How would you like to find and buy dividend stocks for income?

Imagine, finding and purchasing something that will continually pay you year after year just for owning it! Dividend stocks are one of the best sources of passive income because they pay well and are super low maintenance.

That’s the beauty of dividend stocks. With every purchase you increase your passive cash flow.

But how do you know which stock to purchase? How do you know which stocks will be a winner and which to avoid?

Luckily for you, I’m showing you a great strategy to find winning stocks and help sort out the losers. Keep in mind, nothing is a sure thing and you should keep a diversified portfolio.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support.

Finding and buying dividend paying stocks

So what is a dividend paying stock?

Companies are in business to do one thing, make money. Out of these earnings, a company may decide to pay a portion back to the investors which is called a dividend.

A company pays a dividend to shareholders out of their earnings typically when there is no better growth opportunity for the money.

Let’s take a look at AT&T:

The current price is $34.97 per share and a 5.83% yield. So over one year, AT&T will pay you a total of $2.04 in quarterly payments of $0.51. Not bad for simply owning a share with your unused money!

So how do you go about finding quality dividend stocks to purchase?

Most new investors purchase stocks based on yield alone, which is wrong.

I understand. I would like a stock with a yield of 10%, but yield alone does not guarantee a quality stock. Often, high yield can be a sign of a company in trouble.

Let’s take a look at a better way to evaluate dividend stocks.

1. Find dividend stocks that appreciate

The first thing you should do is create a watchlist of dividend stocks that appreciate. A watch list is a list of stocks you have an interest in and most brokerages, like Robinhood, allow you to create a watch list.

Stocks will either appreciate, increase in price over time, or depreciate, decrease in price over time. Find stocks that have increased in price over the last 10 years that also pay dividends. Add them to your watchlist.

Using a stock screener

There are many different ways to find stocks that have appreciated over the years. Using a stock screener can help narrow the search.

Stocks that have appreciated are floating higher in price. Quality stocks tend to be a higher price and garbage stocks are generally a few dollars.

Using the stock screener, set the price range you are willing to buy. I might want to find stocks that are anywhere from $80 to $150 to invest in.

Select screen to see a list of stocks that meet the price criteria. As you can see, there are currently 269 stocks between $80 and $150 per share.

Next use Google or a brokerage like TD Ameritrade Think or Swim to see if the stock has:

- A dividend

- Been increasing in value over the last 10 years.

Add any stock that meets these criteria to your watchlist.

Looking through dividend ETFs

A really easy place to find dividend stocks currently within dividend exchange trade funds (ETFs). Each ETF is a collection of dividend paying stocks that you can get for a lower price.

Vanguard VYM is one of my favorite dividend ETFs and you can see VYM holdings on Vanguard’s website.

You can easily scroll through each ETFs holdings and evaluate which stocks are appreciating and they all pay dividends. Add the ones which are appreciating to your watchlist.

Click to Tweet! Please Share!Click To TweetDividend reinvestment plan list

Dripinvesting.org maintains a complete list of dividend stocks for you to evaluate. This list is a goldmine for dividend investors looking to find quality dividend stocks.

Remember, past performance does not guarantee future success. However, it’s generally a good indication.

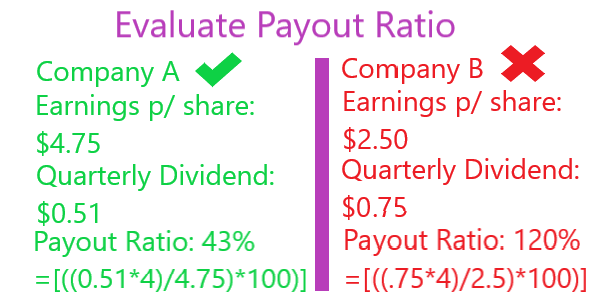

2. Evaluate payout ratio

You need to know if purchasing a specific dividend stock is sustainable for dividend income. Looking at a companies payout ratio helps you understand if a company can afford to pay you a dividend.

If the annual dividend is greater than the companies earning per share (EPS) then the dividend isn’t sustainable. It’s because the company is paying shareholders more than they’re earning.

Dividend payments are not sustainable if a company had an earnings per share of $0.50 but an annual dividend of $0.75. The company owes you $0.25 more than they earned.

Let’s look at AT&T who had an EPS of $2.35 and pays $2.04 annually [=$0.51 dividend x 4 quarterly payments]. The payout ratio would be 0.87 or 87%.

So AT&T currently has a sustainable dividend. They earn enough money per share to cover the dividend payment. Anything with a payout ratio of 1 or greater is not advised.

Click to Tweet! Please Share!Click To Tweet3. Find a good price to earnings

Price to earnings is an indicator of a companies current value. It is the price divided by its EPS.

A low price to earnings indicates that the company may be a good buy. The stock is trading at a price close to what it’s earning. Conversely, a high earnings per share may indicate the stock is overvalued.

Undervalued stocks may end up increasing in price once their value catches up. Dividend investing includes looking for discounted or great value stocks, which the P/E ratio helps you determine. It’s like shopping the discount section at your favorite store.

For AT&T, the price to earnings (PE) is 14.88 or $34.97/$2.35. If company B had a PE of 55, AT&T might be the better deal because it’s considered undervalued compared to company B. AT&T is currently trading at a closer price to what it earns.

The Stock Market currently has a price to earnings around 25. Any stocks under a P/E ratio of 25 are currently underperforming the market and may be worth considering.

4. Check dividend history

Dividend history is the history of a company paying it’s dividend. You want to ensure the company has paid consistent dividends over time, without dividend cuts. The longer a company has paid dividends, the more confident you can be the company will continue to do so in the future. However, remember, past performance of a company is no indication that a company will continue to perform in the future.

Ideally, you are looking for a company who increases their dividend every year. Dividend growth means you continue to get pay raises every year without having to do anything.

For example, you buy 100 shares of a company trading at $100. The company currently pays a quarterly dividend of $0.25 per share or $1 annually. Therefore, your $10,000 is now generating you $100 in dividends every year.

The next year, the company decides to hike their dividend by 16%. Each share now pay you $1.16 annually. Therefore, your same shares are now paying you $116 in dividends every year.

You can check a company’s dividend history by using a website like the NASDAQ.

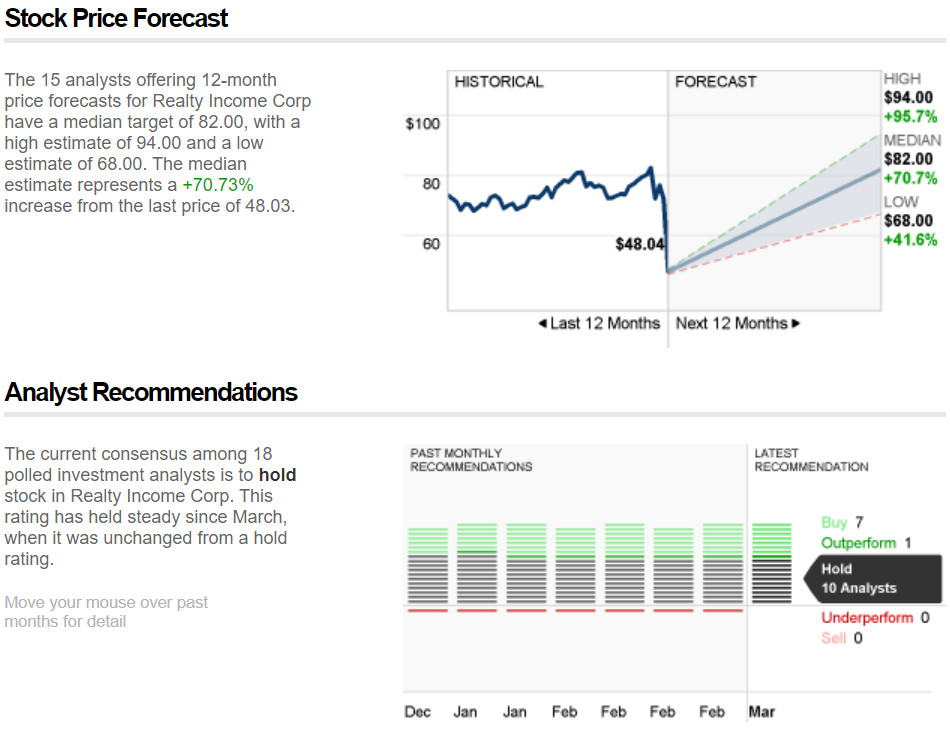

5. Read news

One of the best ways to reassure yourself of the stock is to read the news. Generally, doing a quick Google search is enough to find out if the company is a good buy.

You can even find websites like CNN Money which has stock analyst ratings for buy, sell, or hold. The Motley Fool and Seeking Alpha are other good websites for finding stock news.

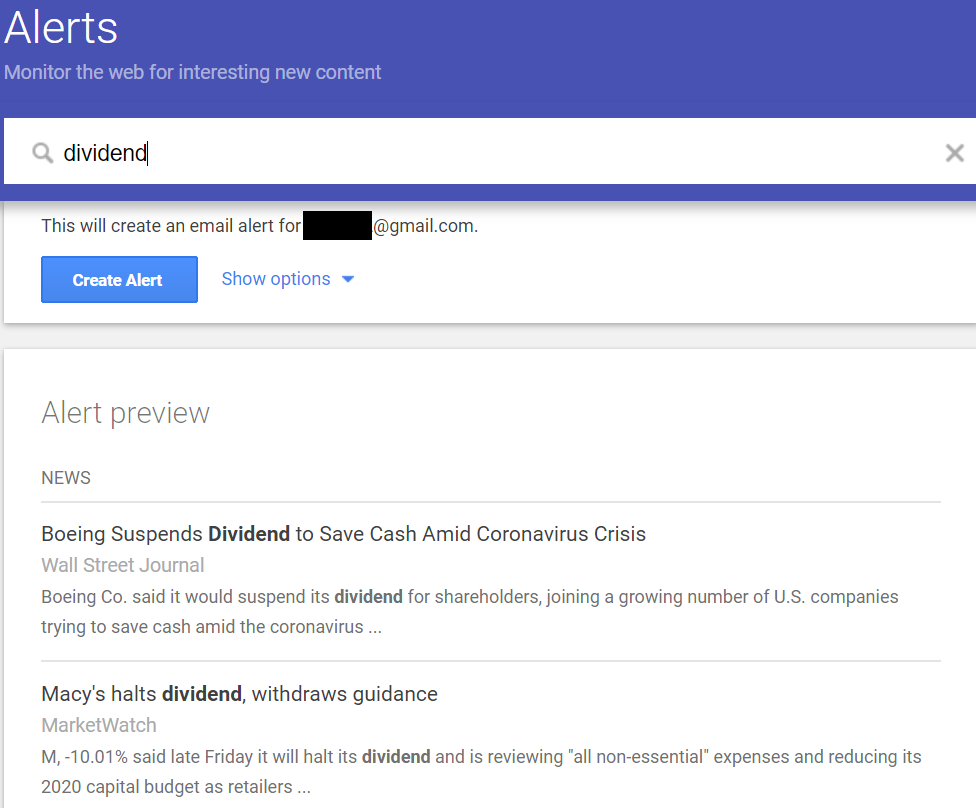

You can even set a Google alert for specific terms. Setting a Google alert for “Dividend” will send you a daily email with new articles containing the word Dividend.

Look for companies offering dividend increases. A dividend increase is a sign that a company is doing well and rewarding the investors.

However, never invest in anything you don’t understand. Just because a news article says you should invest in something doesn’t make it true. Always make an educated decision on a stock before purchasing.

Articles should disclose if they have any relation to the company they are recommending. Disclosures are important so an author doesn’t buy a stock and then try to influence the market.

Click to Tweet! Please Share!Click To Tweet6. Purchase stock

Once you’ve decided on a dividend stock you’ll need to purchase it. You’ll need a brokerage account through a company like Robinhood.

Purchasing a stock is super easy with Robinhood. Simply search for the stock you want to purchase, select buy, enter in share quantity, and swipe to buy.

Understanding Order Types

- Market Order – Purchase stock at the next best available price. Example, Amazon is currently trading at $1,850 and you place a market order. You place a market order at the next available price, which could be slightly higher or lower than $1,850.

- Limit Order – Purchase stock at a certain price or lower. Example, Amazon is trading at $1,850, but you think the stock price will drop to $1,840 before it continues to rise. You place a limit order for $1,840. You will purchase Amazon only if the price drops below $1,840 at whatever the current price becomes. If you placed the limit order for $1,860, it would be essentially the same as a market order because the current price of $1,850 is below the order price of $1,860.

- Trailing Stop Order – Amazon’s price has been declining and you want to purchase Amazon when the price is $10 above it’s lowest price. Amazon goes from $1,850 to $1,830, then $1,832, then $1,820, then $1,833 which then triggers your trailing stop order.

- Stop Order – Performs a market order once a higher price is reached. Example, Amazon is trading at $1,850 but you’re not sure if it will continue to rise or drop soon. You place a Stop order for $1,860. You will only purchase the stock when the price reaches $1,860 or higher.

- Stop Limit Order – Once the stock reaches a higher price, you purchase the stock at a certain price or lower. Example, Amazon is currently trading at $1,850 and you’re not sure if the stock will drop. You only have $1,860 to trade. You place a stop limit order so that if Amazon’s price reaches $1,858, you buy Amazon stock for $1,860 or lower. Unfortunately, you may miss your purchase opportunity if the stock price blows past your $1,860 before an order can execute.

Creating a brokerage account is free, easy, and only takes a fee minutes.

Click to Tweet! Please Share!Click To Tweet7. Reinvest the profits

Reinvesting your profits is what’s really going to amplify your ability to make money while you sleep. Building wealth breaks down into three easy steps:

- Make money.

- Use that money to make more money.

- Repeat.

The more money invested the faster you’ll see more significant investment returns. Compounding interest is a wonderful thing!

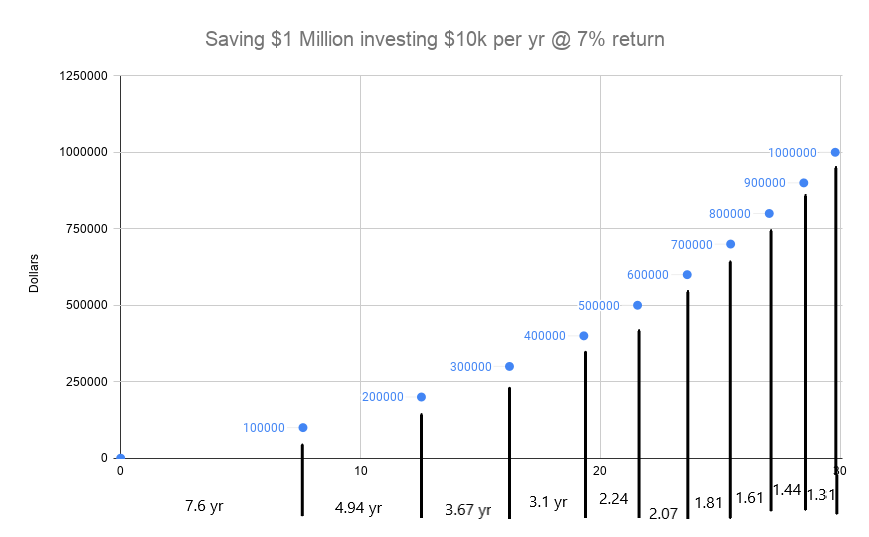

In the above example, investing your first $300,000 takes just as long as investing from $300k to $1M. Both take about 15-16 years, but having more money allows your investments to do the heavy lifting.

Consider someone who earns 10% on $100,000 each year. In one year they would have $110,000. In total, it would take that person just over 7 years to reach $200,000 with no additional investment.

Now someone who has $1,000,000 invested would earn $100,000 in one year at a 10% return.

How to maximize dividend returns on reinvestments

You’re building an impressive dividend portfolio and starting to see frequent dividend payments. How should you reinvest your profits. Should you find a new stock or invest in the same ones?

The best thing to do is reevaluate the stock market and find the best opportunity. Generally, this is the worst performing stock on your watchlist.

Your goal is to constantly purchase quality stocks with good yield that are momentarily down on their luck. Use the methods described here to find the best possible return on investment.

Example: Finding a Dividend stock

Let’s evaluate 3M ($MMM). Following dividend investors on Twitter got me interested in checking out this particular stock.

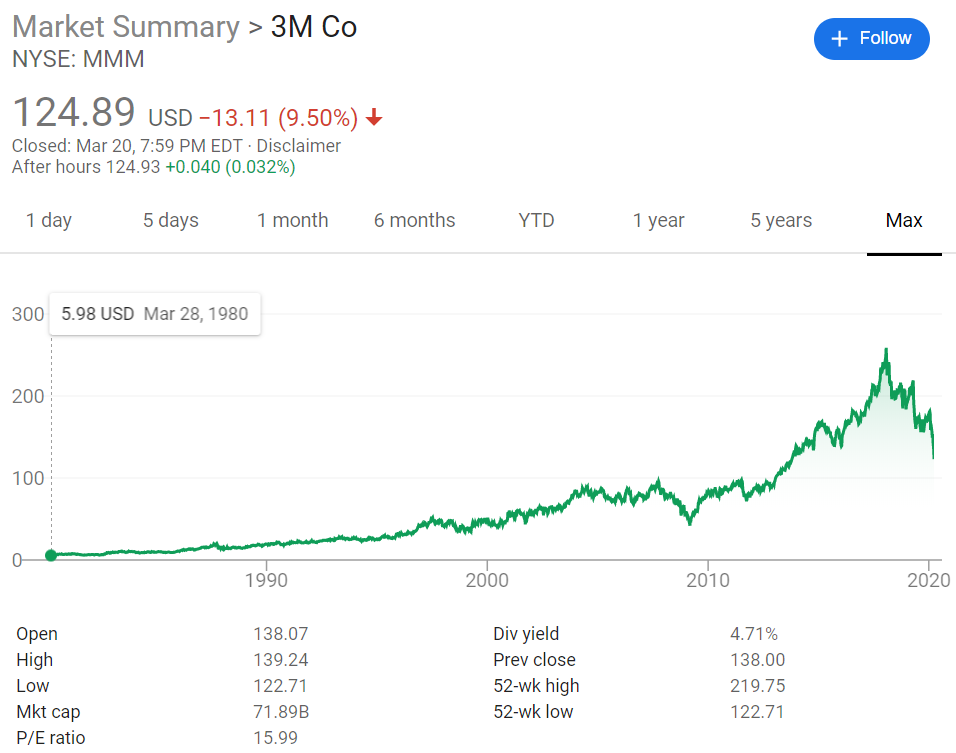

3M has been raising in value over the last 10 years. The current price (2020) is $124.89 and it had a high price around $260 in January of 2018. 10 years ago the price was $80.

So, in the last year the price of 3M has 1.5x the original price and at its best was 3.25x the original $80 price. Now we have confirmation that 3M is appreciating and meets our first criteria. See the nice growth over time?

Dividend yield is nearly 5%, which is a fairly good yield!

Now, can 3M actually afford to pay me that dividend?

Current earnings are $7.81 per share with quarterly dividends of $1.47 or $5.88 annually. The payout ratio is about 75%[=(5.88/7.81)*100] which is ok. 3M is earning more than they are paying so that’s good.

So how does 3M compare to the market? The price to earnings ratio is 15.99 which is lower than the S&P 500 of 25. Therefore, 3M is looking undervalued.

3M has also continued to pay dividends consistently for at least 10 years. Not only have they been consistent, but the dividend has significantly increased over time as well.

As of now, 3M has met my criteria for buying dividend stocks for income. What do others think?

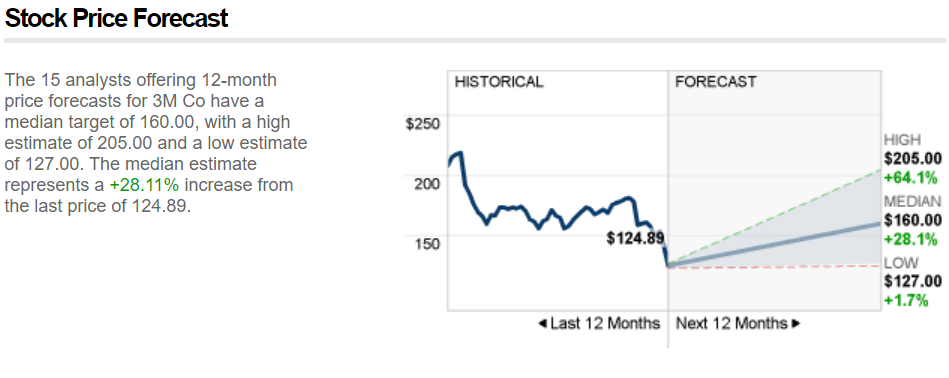

According to CNN, analysts estimate the price will increase over the next 12 months. It is expected that 3M will be anywhere from $127 to $205, which is higher than what I’m buying it at.

All these signs tell me that 3M may be a good stock to purchase right now.

Summary: How to find and buy dividend stocks for income

As you can see, finding a quality dividend stock is way more than looking at dividend yield. You want to find a stock that will continue to pay you and rise in value over time. Dividends are amazing because they pay you for doing absolutely nothing!

The first step is to create a watchlist of dividend paying stocks that appreciate over the last 10 years. You can use a stock screener, see dividend ETF holdings, or use dripinvesting.org to find dividend stocks.

Next, use the payout ratio to see if a company can actually pay their dividends.

Try and find companies with a price to earnings ratio less than the stock market. Generally, a lower price to earnings means the company is undervalued. Don’t invest in a company with negative price to earnings.

Finally, see what other analysts think about the stock. Is the price expected to increase in the next 12 months?

Recommended

Based on this article, we think you’ll enjoy the following:

- Is investing in dividend stocks worth it?

- Do ETFs pay dividends?

- How much do you need to invest to live off dividends?

- How to make money with stocks (the complete guide)

- What time does the US stock market open

- Can you get rich from stocks?

- Are penny stocks worth it?

- How to buy Disney stock for a child

- How much money do you need to invest in stocks?

- Can you make a living trading stocks?

- How much money should I be investing in stocks?

- Can you become a stock market millionaire overnight?

- Is it good to invest in stocks?

- Can you buy stocks with a credit card?