How would you like to cash your check quickly and without wasting a bunch of money on fees?

I mean, do you really want to waste $50 of your hard earned money? Of course not! You want your money, in cash, quickly without losing it on stupid fees.

Luckily for you, I’m going to show you the best places to cash your check when it’s convenient for you. Today’s article is all about cashing your check without fees.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

The complete list of in-store check cashing locations

Here is a complete list of places you can cash a check instantly. In most cases, you will need to bring your check and a valid ID, such as a drivers license.

| Location | Type | Fees and Limits | Check Cashing Resource |

|---|---|---|---|

| Albertsons | In-Store | Fees vary from store to store. | Local store |

| HEB | In-Store | Fees vary from store to store. | HEB Online |

| Hyvee | In-Store | Call local store for applicable fees and details. | Hyvee Online |

| Kmart | In-Store | Check type and limits

Fees

|

Kmart Online |

| Kroger | In-Store | Fees and limits vary depending on your state. Fees start at $3 with shoppers card.

NOTE: Personal checks, starter checks and third party checks are not accepted. |

Kroger Online |

| Publix | In-Store | Call local store for applicable fees and details. | Publix Online |

| Safeway | In-Store | Limits

Fees

|

Account Now* |

| Stop & Shop | In-Store | Call local store for applicable fees and details. | Stop & Shop Privacy Policy |

| Walmart | In-Store | For pre-printed checks up to and including $1,000: max. $4.00*

For pre-printed checks over $1,000 up to and including $5,000: max. $8.00* |

Walmart Online |

| WinCo | In-Store | Limits

Fees

|

WinCo FAQs |

| Winn Dixie | In-Store | Call local store for applicable fees and details. | Source needed |

* Third party source. Information is unconfirmed.

** Fees are subject to store changes. Check the retailing store for updated information.

Where else can you cash a check near me?

Stores aren’t the only location that you can cash a check. Here are check cashing alternatives that might be more convenient for you.

Can you cash a check at any bank?

Yes, you can cash a check at any bank. Cashing a check is typically free when done at a bank or credit union in which you are a member. Some banks may charge a fee if you are not a member.

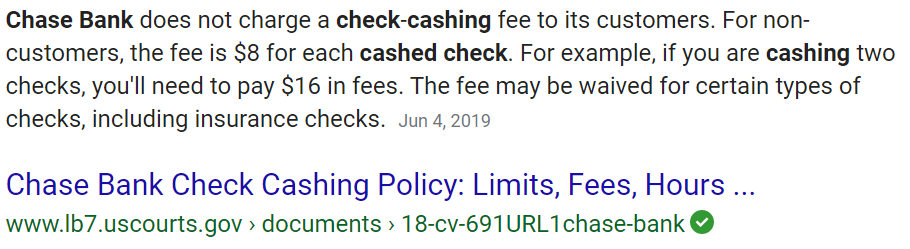

A quick google search shows cashing a check with Chase bank is free for members, but an $8 fee applies for non members.

If you are not a member, consider cashing your check at the issuing bank or credit union. Not sure who the issuing bank is? The issuing bank will be the name listed on the check.

Retail store customer service or cashier

Most retail stores are able to cash checks at the customer service center or cashier. Fees vary from store to store and state to state, so call in advance to confirm.

Click to Tweet. Please Share!Click To TweetGas Stations

Believe it or not, some gas stations will cash a check. You will have better luck with travel center gas stations, but some regular stations still have check cashing services.

Known gas stations with cash checking:

- Pilot Flying J

- Travel Centers of America

- 7 Eleven Transact

Not sure if your nearest gas station will cash your check? Try doing a quick google search to find out more. Calling the gas station is another quick way to see if the service is offered and the fees involved.

As you can see from the picture above, Circle K cashes checks as well. However, you will receive a prepaid debit card instead of cash.

Check cashing store (e.g. Moneytree)

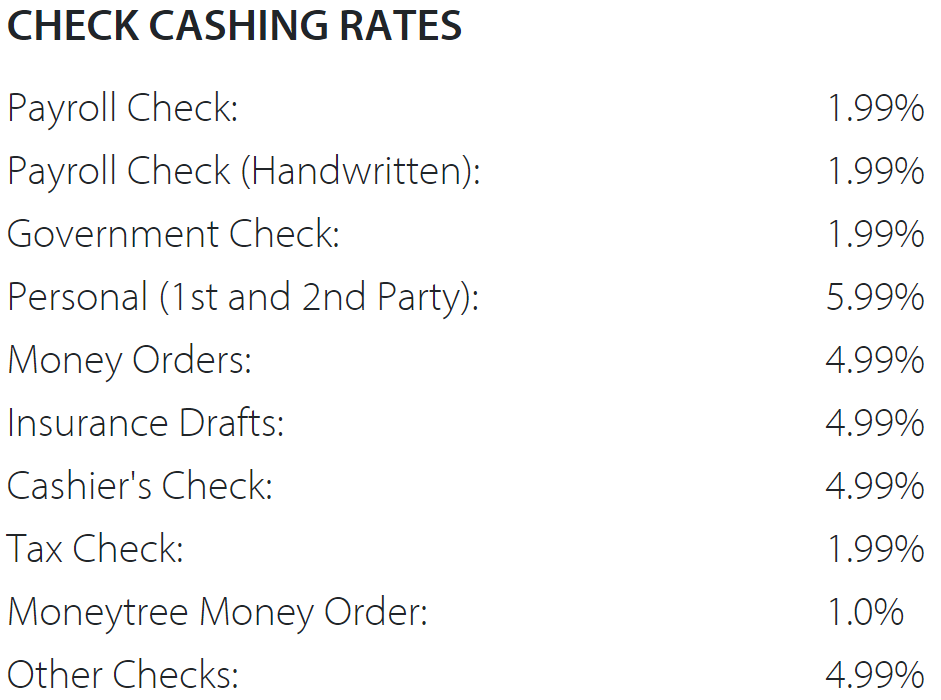

Check cashing stores are the worst places to cash a check. These stores are almost predatory in nature, looking to take advantage of people in need of money quickly.

I’m calling you out Moneytree.

Fees vary from store and state. Most notably, Money Tree cashes checks based on a percentage and not a set fee!

Look at the insanely high fees my local money tree charges to cash any check.

Check cashing fees range from an absurdly high 2-6%!

You would pay $58.70 in fees if someone wrote you a check for $980. Walmart would have only charged you $4 and they’re open 24 hours a day!

All I can say is, please don’t fall for these check cashing store scams.

Can you cash a check at an ATM?

Some ATMs will let you cash a check if they are equipped with a check scanner. Generally, these ATMs are located outside of your bank or credit union. Your bank should list online if they have ATMs which accept check deposits.

Chase bank has numerous ATM locations which allow you to deposit money.

Click to Tweet. Please Share!Click To TweetWhich places cash a check and are open 24 hours?

Most 24 hour grocery stores and some ATMs are available for check cashing. Walmart is generally open 24/7 which makes it an ideal location to cash a check late Saturday or Sunday.

Where can I cash a check online?

PayPal

The PayPal app will let you cash a check. Simply take a picture of your check in the App and send it into PayPal for review. If you need your cash immediately, a fee will apply. If you can wait up to 10 days then no fee will be applied. The money will be deposited into your PayPal Account.

Chase

If you have a Chase account, download the Chase Mobile App. You can deposit a check by selecting “deposit check.” within the app. Funds are generally deposited the next business day. You should mark your check as deposited to avoid confusion.

Ingo Money

The Ingo Money App for iOS and Android is another option for cashing checks on the go. You can deposit your money in your bank, prepaid card or PayPal account, Amazon gift card, pay credit card bills, or pick up cash at MoneyGram locations.

Green Dot

Similar to the other apps, Green Dot is also an App for iOS and Android which allows you to take a photo and deposit your check.

Click to Tweet. Please Share!Click To TweetWhat if I don’t have a bank account?

If you don’t have a bank account, it is still possible to cash a check by endorsing the check to a friend. You’re signing the rights to the check over to your friend who can then cash it at their bank or credit union.

To endorse a check, write “pay to the order of <friend’s name>” on the back of the check and sign.

Here are step by step instructions for endorsing a check.

Is it possible to cash a check without ID?

Check cashing places are required to check your ID before they can cash your check. Some stores, such as WinCo, will require your ID for your first check cashing and may not need it for subsequent cashings.

Summary

We’ve covered a lot about check cashing. Here are the highlights:

- You will generally need your ID for cashing a check.

- The best place to cash your check is at your local bank or credit union. Fees are generally free for members.

- The issuing bank may wave the fee, but call and ask first.

- Most grocery store customer service centers will cash your check for a fee. Kmart was the cheapest for personal checks under $500. Walmart is relatively cheap ($4-8) and open 24/7.

- Some gas stations will cash a check for you.

- Some ATMs with a check scanner will allow you to deposit or cash a check.

- PayPal, Chase, Ingo Money, and Green Dot are all Apps which will allow you to deposit your check with a few photos.

- You can always endorse a check to a friend to cash it for you.

Where’s your favorite place to cash a check? Let me know in the comments below.

Recommended

Based on this article, we think you’ll enjoy the following:

- How to deposit or cash a personal check at an ATM

- Check cashing places near me (Open now and 24 hours a day)

- Cashing third party checks (Everything you need to know)

- Can I deposit a check for someone else?

- How to endorse, deposit, and cash a check for a minor

- How to cash a check without id

- How to write a check to yourself for cash

- Check cashing places open on a Sunday

- How do check cashing places work?

- Can you cash someone else’s check?

- What happens if I cash a bad check?

- Can I cash or deposit an old check?

- How old do you have to be to cash a check

- Best places to cash a check for free