Are you ready to start buying cash flow assets to replace your income?

Cash flow investments are some of the best assets to build wealth. Imagine, having a an income generating machine that makes you money while you sleep.

With enough time, energy, and investments, you could replace your income and quit your 9-5 job with cash flow.

Luckily for you, I’m going to show you the best income generating assets that revolve around cash flow. Buy these assets in your 20’s or as a teenager and you shouldn’t have a problem retiring early.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Dividend Paying Stocks

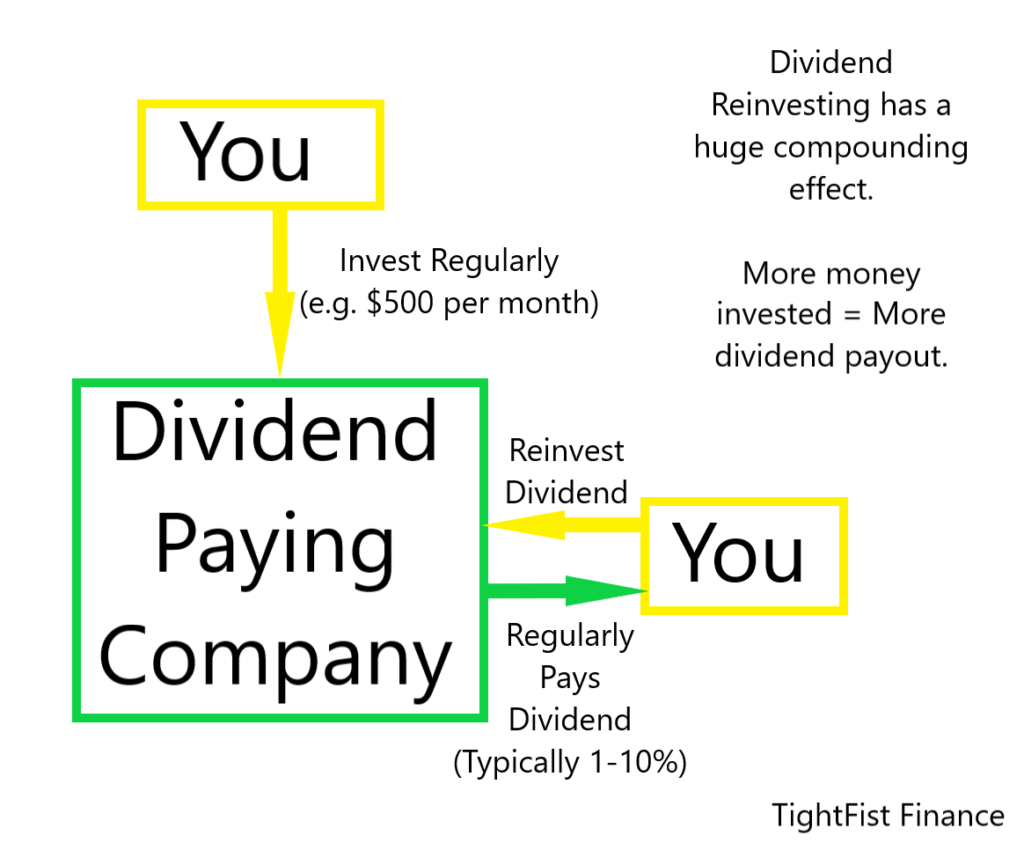

Dividend paying stocks are one of the easiest ways to generate cash flow. Simply purchase a share of a dividend paying stock and the company will pay you time and time again.

Companies pay dividends to shareholders when there’s no growth opportunity for the money. So you’re paid just for owning the stock!

Continuing to reinvest your profits will lead to a snowball effect, where your income grows larger and larger over time.

Maybe you’ve got $100,000 at a 7 percent dividend yield. Not accounting for capital gains or losses, your investments would pay you $7,000 in one year. Reinvesting your profits would give you a portfolio of $107k and pay you $7,500 in dividends the next year!

How should you reinvest your profits. Should you find a new stock or invest in the same ones?

The best thing to do is reevaluate the stock market and find the best opportunity. Generally, this is the worst performing stock on your watchlist. Your goal is to constantly purchase quality stocks with good yield that are momentarily down on their luck.

Click to Tweet! Please Share!Click To TweetReal Estate Investment Trusts (REITs)

Real estate investment trusts are similar to stocks, but the company is involved in real estate. Investing in a REIT is basically like investing in real estate without having all the upfront cash.

You purchase REITs the exact same way you would buy stock. Again, you’ll need a brokerage account, like Robinhood, to purchase a REIT.

Personally, I like ($VNQ) which is the Vanguard Real Estate index fund. It’s a collection of REITs for added diversification and is currently paying a 4% dividend yield!

Real Estate Crowdfunding

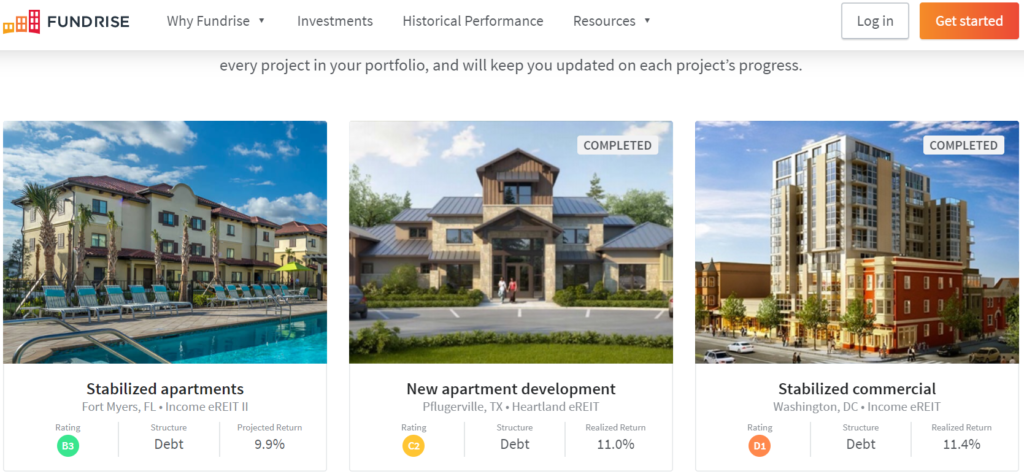

Crowdfunding is another way to purchase real estate with as little as $100. Companies like FundRise allow you to invest your money into real world real estate projects.

You don’t have to manage properties or deal with tenants. FundRise handles everything for you, so all you need to do is check your bank account.

Maybe you only have $1,000 to invest and that’s ok! FundRise takes your money and the money of others until they have enough to purchase property. Income from the properties is then distributed to the investors according to how much they invested.

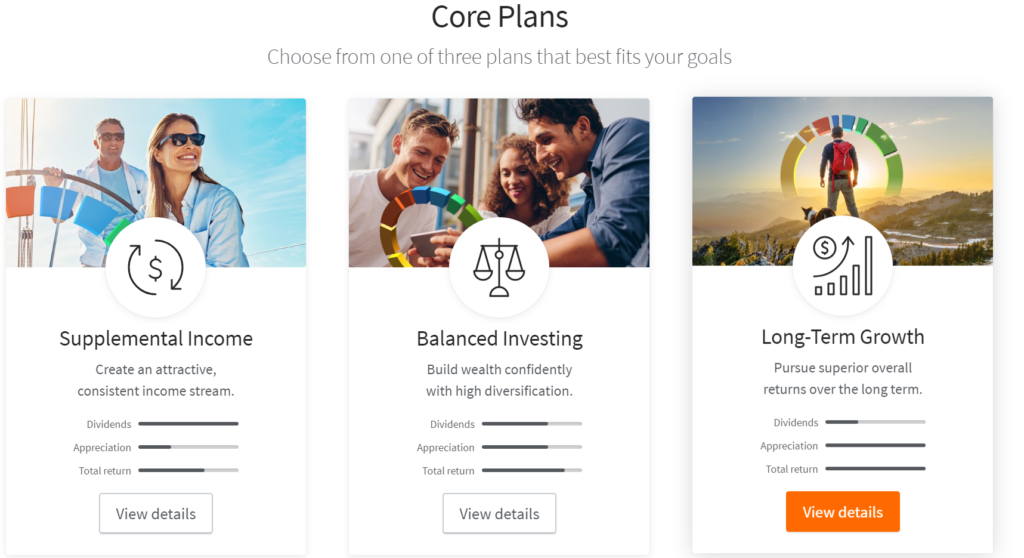

FundRise has three different core plans depending on your investment style. If you’re interested in obtaining cash flow assets, stick with the supplemental income plan which distributes more dividends than the other plans.

Rental Properties

Rental properties can be one of the top cash flow assets, but they can be risky if not done right. The best part about real estate is that you can use someone else’s money to make yourself wealthy.

Once you determine if a property is profitable, you can apply for a bank loan to purchase the home. Now you’re responsible for finding tenants, making repairs, and making sure the mortgage gets paid.

You can either hire a property manager to handle this for you or start an AirBnB. Good property management companies can take the stress away from owning a rental property. However, the more profitable course is to start an AirBnB.

My buddy does airBnB and he’s making a small fortune on his duplex. He lives in one side but rents out the other. His best month was over twice what he could rent the property.

AirBnB does require some effort to keep the place clean, wash sheets, and keep up with the property. However, most of these tasks can be hired out at some point.

You may not think AirBnB is worth it but people really are staying in them. From soccer tournaments, conferences, work travel, etc, people are using them. If people are renting then you could be profiting.

Click to Tweet! Please Share!Click To TweetCandy Machines

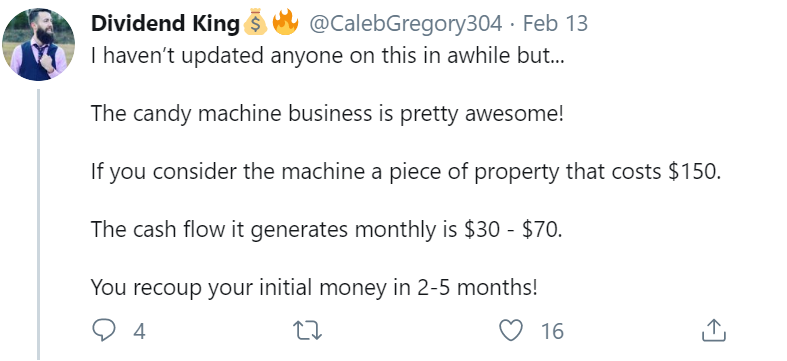

Candy machines are an easy business to start and have the potential to replace your income. Caleb from Dividend Kings says he makes $30-$70 per candy machine.

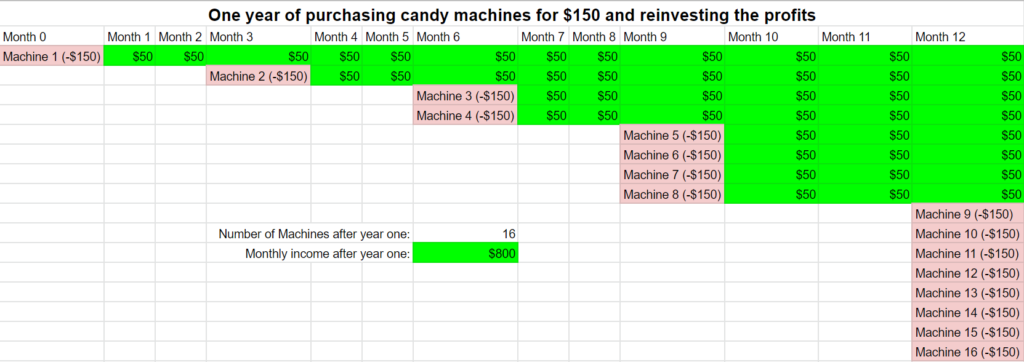

The machines only cost $150, so it’s a low cost business to start. Now, assuming you earn $50 per machine, what would your cash flow look like after one year?

If you started with one machine, you would have a cash flow business that generated approximately $800 per month in one year! Now funnel that money into REITs and Dividend stocks and you’ve got a passive income generating machine!

The hardest part of a candy machine business is securing the location. However, if done right, you’ll have a valuable cash flow asset that will continue to generate income.

Income producing websites

Income producing websites can provide an amazing cash flow if you know what you’re doing. There are two ways you can own a website. You can either purchase a website already making money or create one from scratch.

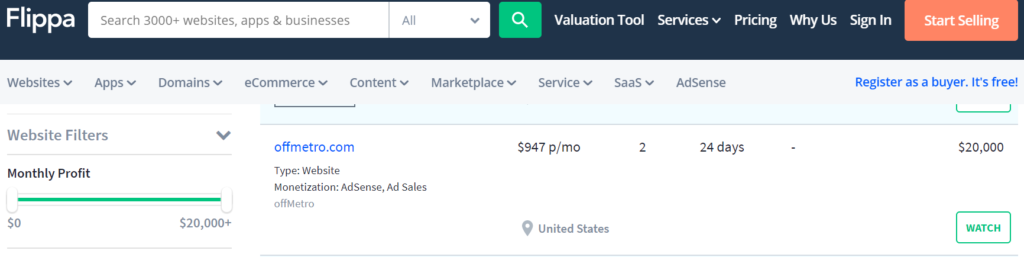

You can purchase a website on Flippa, a marketplace for buying and selling websites.

In the picture above, a website is being sold on Flippa for $20k. Yes, that’s a lot of money, but the website is earning nearly $1k per month in revenue! You would be earning 60% annual return on investment (ROI) and have the website paid for in less than 2 years!

That website will continue to pay you $1k per month with minor upkeep. At this rate, you would only need five websites to earn $5k per month or $60k per year!

Owning a website takes some knowledge, so I highly recommend building a website first to gain experience. You would also want to see if website ownership is something you’re interested in.

Website ownership is one of my favorite cash flow assets. There’s no greater feeling than waking up in the morning, grabbing your smartphone, and seeing the money you’ve earned overnight.

Peer to Peer lending

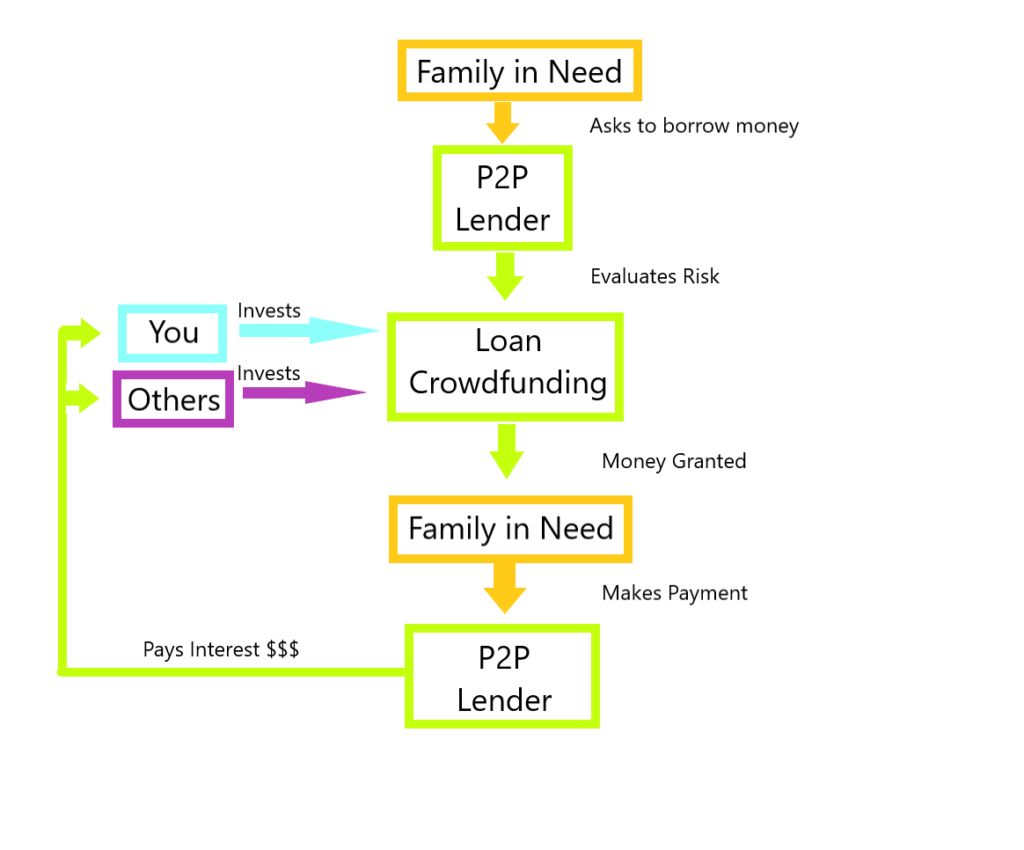

Another cash flow asset you can invest in is Peer to Peer lending. As an investor, you give money to families looking to buy their first home, refinance credit card debt, or with a personal loan.

You can get started with as little as $25 on P2P lending websites like Lending Club. However, it’s recommended investing a minimum of $2,500 in at least 100 different loans. People diversified in over 100 different loans tend to turn profit more than those who aren’t.

Click to Tweet! Please Share!Click To TweetSummary: Cash Flow Assets for Income Generation

There are so many cash flow assets at your disposal, but these are the best ways to put your money to work. You’re not going to generate much cash flow keeping your money in a money market, savings accounts, or certificate of deposits.

Most cash flow assets require an investment of either time or money. Dividend stocks, REITs, and Real Estate Crowdfunding are easy income generators which involve investing your money.

You can invest in single or multi-family real estate if you’re willing to take risks. Financing allows you to use the banks money to generate a real estate business, which can be managed by property managers.

Candy machines are simple, yet effective, cash flow assets. If you can secure locations, your candy machines will pay for themselves in about three months.

Purchasing or creating income producing websites is one of my favorite ways to generate income. You can purchase websites on Flippa and generate better than stock market returns.

Peer to Peer lending is another option for generating cash flow. P2P lending essentially lets you and others be the bank by crowdfunding your money. Your money is then invested into families in need.

So what’s your favorite way to create cash flow? Let me know in the comments below.