How can you get cash back from Amazon purchases?

To receive cash back on your purchases at Amazon, use cash back credit cards, discounted gift cards, and cash back websites. As a company, Amazon doesn’t give cash back. Instead, you can adjust how you make the purchase to receive a cash back discount.

Imagine, being able to receive cash back whenever you make a purchase on Amazon. Alternatively, you can build airline miles or other credit card rewards.

Luckily for you, I’m going to show you the best strategies for receiving cash back on Amazon. The same strategies will work at other retailers, saving you money in the long run.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

How do I get cash back from Amazon purchases?

Three ways to get cash back from Amazon include cash back credit cards, discounted gift cards, and cash back websites. How much cash back you receive depends on how many of these strategies you use. Alternatively, results vary depending on which cards and websites you use.

Click to Tweet! Please Share!Click To TweetUse cash back credit cards

Cash back credit cards are no new secret. You make a purchase and receive cash back for that purchase. However, did you know there are credit cards designed specifically for Amazon purchases?

For example, the Amazon Prime Rewards Signature Visa offers a 3% cash back on all Amazon and whole foods purchases. However, connect your Amazon Prime account to your card and you’ll earn up to 5% cash back!

The Prime Rewards card will also allow you to earn points on eligible purchases. These points may be redeemed for cash or used on further purchases. After signing up, you’ll receive a $60 Amazon gift card which is basically free money.

Alternatively, the Discover it Card provides a 5% cash back when shopping on Amazon. However, the 5% cash back on Amazon is only for the last quarter of the year (Oct.-Dec.). You’re limited to $1,500 in purchases for the 5% back.

You don’t have to use these credit cards for cash back at Amazon. Any cash back credit cards can be good for shopping on Amazon. Nerdwallet put together a list of the best cash back credit cards which you can use for inspiration.

Buy discounted Amazon gift cards

You can use your cash back credit card to purchase discounted Amazon gift cards. People sell their unwanted gift cards at a discounted price, just to cash out. Luckily for you, you can buy discounted gift cards to further your cash back.

Gift Card Granny and CardPool are some of the best websites for buying discounted gift cards. However, Amazon is a fairly popular retailer so finding a discount gift card may be difficult.

Use Rakuten, a cash back website

Rakuten is a cash back website. Visit Rakuten prior to shopping at your favorite retailers to earn cash back on your purchases. Rakuten earns a commission for referring business and they give some of that cash back to you.

Rakuten works for over 2,500 retailers. Once you’ve signed up, visit Rakuten and search for the store you want to shop at. Click the shop now button to be taken to the retailers website and make your purchase.

Typical cash back ranges between 1 and 11 percent, depending on the store. For example, eBay gives 1% cash back while Macy’s is at 6%.

Unfortunately, the amount of cash back will vary over time. You might see Macy’s giving 6% cash back today, but come back a month later and it’s now 3%.

As you can see, the best cash back strategy is to use a cash back credit card to buy a discounted gift card. Use your gift card to make a purchase through Rakuten for extra cash back.

Is the Amazon Prime Rewards Visa worth it?

The Amazon Prime Rewards Visa is handy if you shop frequently at Amazon with a Prime membership. Additional benefits include 2% back at restaurants, gas stations, and drug stores. The Prime Visa also gives 1% back on all other purchases.

Amazon’s goal for this card is to keep you shopping on Amazon. Why would you go anywhere else if you can get a 5% discount? The rewards points are easily spent on, you guessed it, Amazon.

So if you shop at Amazon and have a Prime membership, this could be a good card for you. You may also like the card for the 2% cash back at restaurants, gas stations, and drug stores. The card isn’t so good if you don’t have a Prime membership or want to get sucked into Amazon.

Click to Tweet! Please Share!Click To TweetHow else can I save money on Amazon?

You can save money on Amazon by shopping Warehouse deals and using price history tools. The less picky and more patient you are, the more you can save on Amazon.

Warehouse deals are for items in used condition. Most of the items have been returned or refurbished, but they still work. Therefore, you can buy these items at a significant discount.

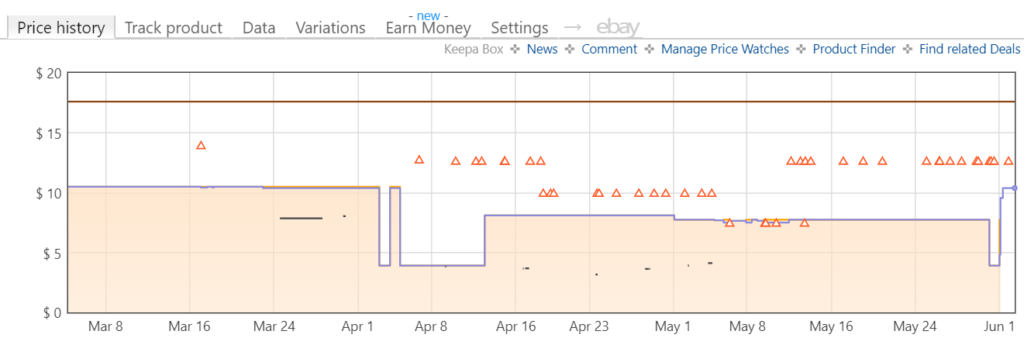

Price history tools monitor the price of Amazon items and alert you with price drops. Keepa is one tool which monitors prices on Amazon. See the history of an item and set an alert to be notified for your desired purchase price.

You’ll get an email if the price drops. I got notified when my coffee maker dropped below a certain price!

Summary: How to get cash back from Amazon purchases

As you can see, there are many ways to get cash back on Amazon purchases. Unfortunately, most of the methods aren’t actually through Amazon. Instead, you need to be a little more creative to get a discount.

Your main strategy is to use a cash back credit card. Amazon Prime Rewards Visa and Discover it are some of the top cards for Amazon shopping. Any cash back card can be used to buy a discounted gift card. Then, use Rakuten as a cash back website.

You can earn more cash back by shopping Amazon Warehouse deals or price history tools. Warehouse items can’t be sold as new, but they still work. A price history tool can notify you when an item drops below a set price.