How much money can you make with peer-to-peer lending?

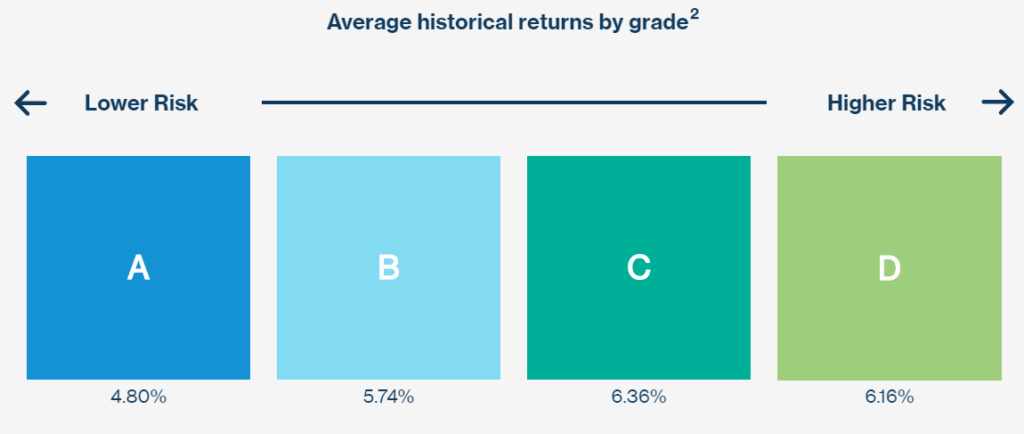

Peer-to-peer lending return on investment ranges from 4% to 7% annually. Some investors report yields over 10%, but are investing in riskier loans. Therefore, an investor with a well-diversified portfolio may make between 4% and 7% return on investment.

Imagine, making money without investing in the stock market. Instead, you lend your money to people in need and earn money by letting people use your unused money.

Simply stated, you are just like the big-name banks.

You can now earn money by investing in people’s mortgages or credit card refinancing. Peer-to-peer lending websites make investing extremely easy and automated.

Luckily for you, I’m going to show you exactly how much you can make with peer-to-peer lending. Remember, investing always carries risk and it is important to understand those risks before investing.

Key Takeaways

- Most Peer-to-Peer investors earn 5% annually on average. Investment returns typically range between 4 and 7%.

- You can start investing in P2P lending with as little as $25. However, most investors see positive returns with 100 notes or $2,500 invested.

- You can lose money with P2P lending. P2P lending has higher default rates and low liquidity.

- Lending Club and Prosper are the most popular companies for P2P investors.

This article may contain affiliate links which pays the commission and supports this blog. Thank you for your support!

How much money can you make with peer to peer lending?

Annualized returns for peer-to-peer lending range for 4 to 7%. Many factors go into your estimated year over year earnings. Investors who take on longer term and higher risk loans stand to gain a higher return on investment.

Peer to Peer lending returns are expected to be anywhere from 4-7 percent. Lending Club historical returns are between 4-7 percent while Prosper averages 5.3 percent.

Money Under 30 confirms average returns of 5 percent after investing $20,000 with Lending Club.

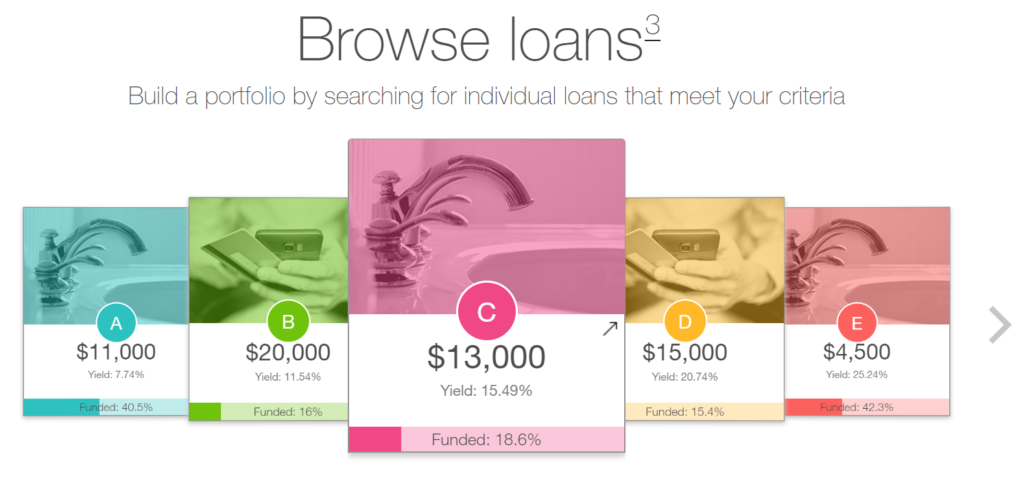

However, one of the benefits to peer to peer investing is that you can select the loans you want to invest in. Creating a investment gradient across multiple risk levels (e.g. A, B, C, and D), you can create a higher return on investment.

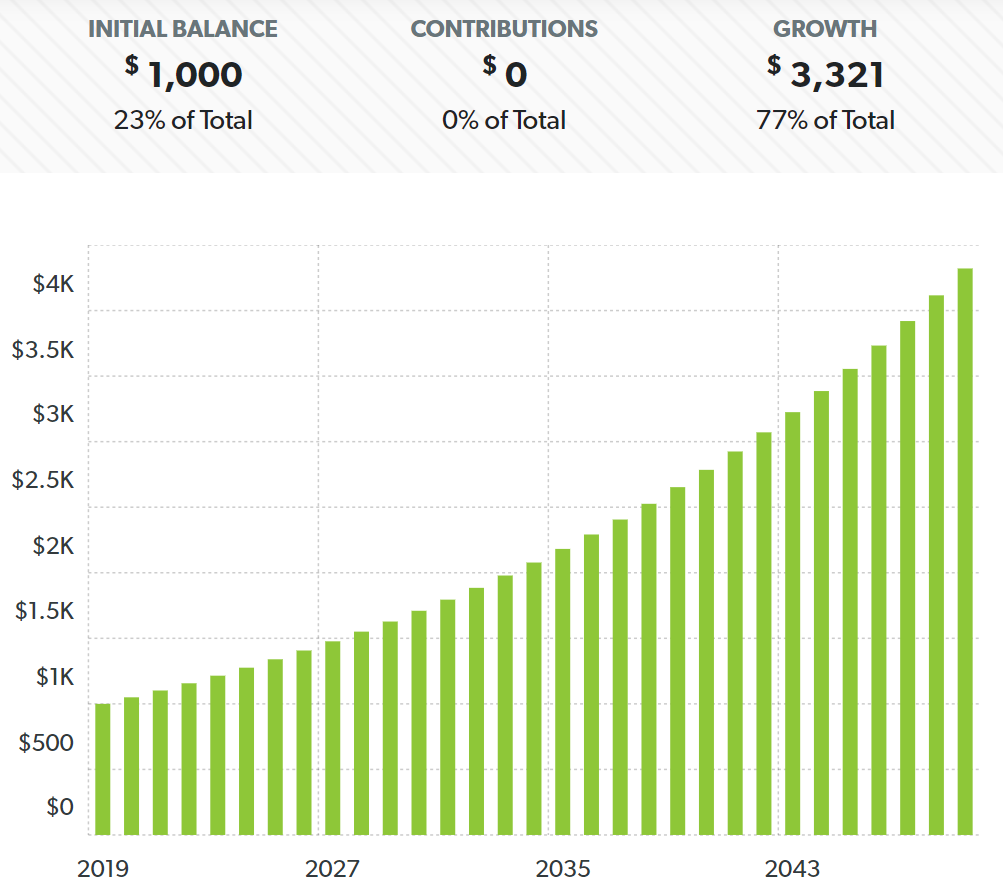

So what does 5% return on investment look like? According to Dave Ramsey’s retirement and investment calculator, A $1,000 investment grows to $3,341 over 30 years!

With peer-to-peer lending, you are purchasing fractions of a loan called notes. You can buy a note for as little as $25. Investors who purchase more than 100 notes tend to see positive returns.

Investors can also purchase notes with a 3 or 5 year term. In other words, the loan is anticipated to be paid back in 3 or 5 years. Investors who purchase 5 year term loans tend to have a higher return on investment.

Notes are usually assigned a letter such as A, B, or C. A notes are generally seen as less risk less reward. The further away you get from A, the higher risk and higher return you can receive.

As you can see, you can generally earn more money with peer-to-peer lending with higher risk. The riskier you play it, the better your chances of seeing a double-digit return. Alternatively, the safer you play it, the last return you should expect.

Click to Tweet! Please Share!Click To TweetSo how do you profit with Peer to Peer investing?

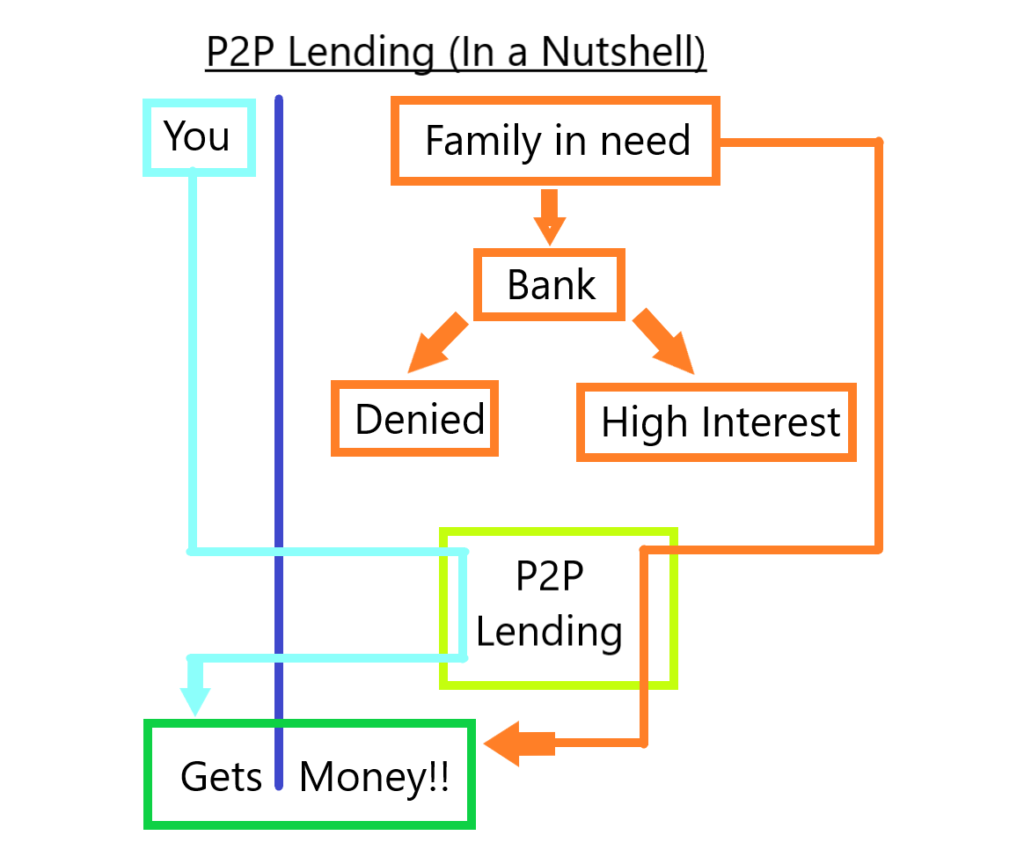

So how do you actually profit through investing with a Peer to Peer network? The process is similar to how banks earn their money, only in this case, you’re the bank!

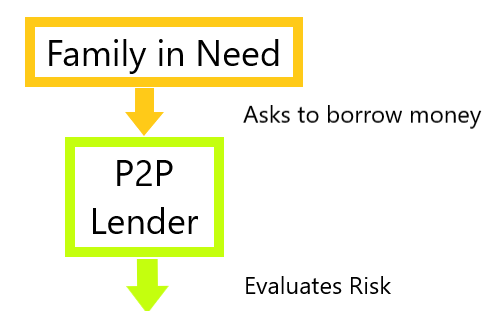

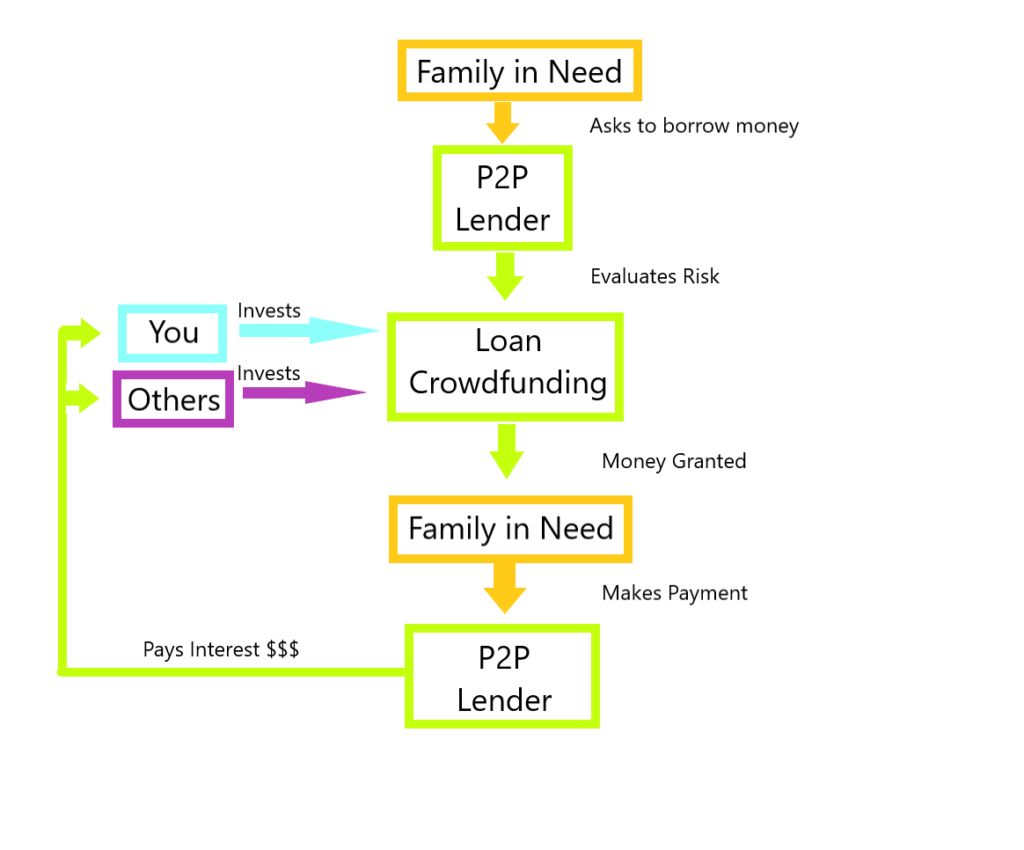

It starts with a family wanting to borrow money who approaches a Peer to Peer company. The P2P lender begins a risk evaluation. The risk evaluation considers the families current debt, income, expenses, amount to be borrowed, credit score, loan term, and the purpose of the loan.

The Peer to Peer company assigns the loan a risk score, typically in alphabetical form. Lending Club uses a risk A through D, A being less risky and D being most likely to default.

Next, the P2P network begins a loan crowdfunding period where investors invest capital (money) into each loan. Each investor purchases a portion of the loan until the loan is fully funded.

Once the loan has been funded, the family receives the money and makes monthly payments to the P2P lender. The P2P lender then deposits your earned interest (for investing your money), back into your account with each payment.

It’s that simple. As an investor, all you need to worry about is choosing loans that meet your risk criteria. Once your money is invested, your money and interest is paid back over the life of the loan.

How much money do you need to start P2P investing?

The first thing you should understand before investing in Peer to Peer lending is the note system. A note is simply a fraction of a loan that you can own.

Most notes are sold in $25 increments. So for a $1,000 loan there would be 40 notes available ($1,000 / $25). So technically, you only need $25 to get started investing!

But wait! Before you start checking your couch cushions for cash, there’s more.

Notes allow you to own a small fraction of a loan, so that you can spread your money across multiple loans easier.

Notes are also broken up into letter grades, such as Lending Club’s A through D system. A notes are less risky and less rewarding, while D notes are more risky with more potential reward.

These notes are further broken down with a 1 through 5 numbering system. Therefore, A1 notes are less risky than A5 notes.

Lending Club also mentions that 99% of investors that own 100 notes or more see a positive return on investment. Diversification is key when it comes to peer to peer investing.

Therefore, it’s recommended that you start with a minimum of $2,500 and diversify your note portfolio.

So what is Peer to Peer lending?

As I’m sure you’re aware, life takes money and people are always looking to borrow money. You might need a loan for a mortgage or to consolidate student loan debt. Maybe your family is looking to do a major home improvement, but are a little short on cash.

We need to borrow money and the most traditional way to borrow is through a bank.

However, some people would rather not borrow money from a financial institution. Other people have bad credit which makes the loan interest unbearable!

Peer to Peer lending is the solution that helps every day investors earn money while helping families in need.

I can invest my extra money in a family looking to buy their first home. This family may have bad credit due to extensive student loans. Either way, we both win as the family can purchase their home while I earn interest on my unused money.

Is peer to peer lending safe?

Peer-to-peer lending should be considered a risky investment. All investing caries risks and peer-to-peer lending is no different. With peer-to-peer lending you are subject to loan defaults. Your capital is also invested in a hard to liquidate asset.

Peer-to-peer lending has not been around for a very long time. Therefore, it is untested in the long run. We do not know how certain economic hardships may affect your peer-to-peer lending investment.

For example, we can look at the S&P 500 which has a long history of increasing in value over time. We have seen time and time again how these stocks recover after a crash. Most recently, we have seen how the S&P 500 recovered after the Coronavirus.

What are the risks of P2P lending?

The primary risk of peer-to-peer lending includes loan defaults and low liquidity. As an investor, you should expect borrowers to default on their loans. You should also not expect to gain your money back until loan maturity.

For a well-diversified portfolio, default rates may be around 5%. Therefore, you should expect 5% of your Investments to simply vanish.

However, this shouldn’t be a problem if you are experiencing a positive return on investment. Remember, Lending Club states that investors with more than 100 notes generally see a positive return.

Default rates are more problematic when you don’t have a well-diversified portfolio. Even worse is when an investor put all their money into one loan. You could lose your entire investment should the borrower default.

Your Investments in peer-to-peer lending are not very liquid. You cannot simply cash out your investment when you feel like it. Your money has been sent to a borrower who has made a purchase and is paying you back.

As a rule of thumb, you should never invest money that you will need in the short-term. If you buy a 5-year note then you should expect your money back in 5 years.

Additionally, your investment is not FDIC insured. Therefore, if your peer-to-peer lender fails then your investment may be lost.

Can you lose money?

You can lose money through peer-to-peer lending. Loan defaults are the most common way for investors to lose money in peer-to-peer lending. Should your peer-to-peer lender go under then you could lose your entire investment.

If you do decide to invest in peer-to-peer lending then plan on defaults. You should always be focused on diversifying your portfolio.

Having a peer-to-peer lender go out of business is an extreme example, but possible. You are putting all of your money with one company. Doing so lacks diversification.

When you invest in the stock market, you might purchase exchange-traded funds. These ETFs are made up of multiple companies. Should one of the companies go out of business then your investment isn’t entirely lost.

Is it worth investing in Peer to Peer lending?

Peer-to-peer lending can be a good way of diversifying your Investment Portfolio. You can invest with peer-to-peer lending as a stock market alternative, but I wouldn’t solely invest in P2P lending.

For example, you could have a portion of your portfolio invested in stocks, real estate crowdfunding, and peer-to-peer lending. Diversifying your investment options is never a bad thing.

The S&P 500 has a very long history of returning annualized returns around 10%. Some may argue that it would just be better to invest in an S&P 500 Index Fund.

Personally, I would start small but invest in a minimum of 100 different notes. Doing so would allow me to test the waters and get a feel for peer-to-peer Lending. You could then see what your rate of return is and compare it to the stock market.

Ultimately, you have to decide for yourself if peer-to-peer lending is worth it. Does it matter to you that you can’t immediately liquidate your position? How much money are you really comfortable investing into one company that is not backed by FDIC insurance?

What are the best Peer to Peer lending sites?

There are two well known companies for Peer to Peer lending, Lending Club and Prosper. So which P2P lender is the best for investing?

Both Prosper and Lending Club are very similar Peer to Peer lenders. Prosper and Lending Club use a Note system, let borrowers borrow around $40,000, and have loan terms of 36 and 60 months.

Similarly, both lenders average an annual return of about 5 percent. Doesn’t sound like much of a difference, does it?

However, there is one small, but very important, factor that separates Prosper vs. Lending Club. Loan default rates are significantly different between the two lenders.

What does it mean to default on a loan? Loan defaulting means a family or individual failed to pay their loan, claiming they cannot pay it off.

What does loan defaulting mean for the investor? When someone defaults on a loan, the investor will be unable to regain their money invested. Unfortunately, the borrower took the money and is refusing to pay it back.

Lending club has significantly worse default rates than Prosper. Therefore, Prosper is the safer option for Peer to Peer investing.

According to Forbes, Prosper default rates range approximately 1.5 to 17 percent compared to Lending Clubs 6 to 33 percent.

Summary: How much money can you make with peer to peer lending?

As you can see, historically the return on investment for peer-to-peer lending is between 4 and 7%. The S&P 500 has an annualized return of around 10%. Peer-to-peer lending gives you the option to diversify your portfolio outside of the stock market.

Peer-to-peer Lending comes with its own set of risks. Investors have seen loan default rates around 5%, which is part of the normal process of P2P lending. Your Investments are not liquid so you can’t cash them out.

A more extreme risk is that P2P lending websites are not FDIC insured. To make matters worse, you are investing your money with one company. Therefore, your investment lacks diversification and you can lose your investment if the company fails.

When investing in peer-to-peer lending, it is wise to diversify your holdings. Per Lending Club, investors with over 100 notes generally see positive returns.

Only you can decide if P2P lending is worth it. Personally, I can see using peer-to-peer lending as part of my portfolio, but not all of it. You can also diversify your portfolio with real estate crowdfunding and stocks.

You can start investing in peer-to-peer Lending through the Lending Club and Prosper. Both websites have their own set of requirements for investors. I think you will be happy with either of these companies.