Hey friends! Being the household monthly budget planner is probably one of the least desired “chores” you could have.

I’m fairly certain you didn’t enjoy math that much when you went to school, why would you have fun with it now?

I sympathize with you, creating a family budget is only somewhat enjoyable when you’re an engi-nerd (engineer). You didn’t go to school to do math for the rest of your life now, did you?

Luckily for you, I am an engineer with a passion for numbers, budgeting, and spreadsheets and I want to help you get your home budget set up, so it’s effective, let’s you save money, and takes as little effort to maintain as possible.

Consider me your monthly budget planner engineer for hire; only my service is free!

This post may include affiliate links that provide a commission when a purchase is made and supports this blog. Thank you for your support!

How to set up a household budget | the budget plan that saves you money

The importance of a personal monthly budget

I can’t begin to stress the importance of effectively tracking your money. Money is meant to be exchanged on a regular basis for goods and services. It flows, like a river, from hand-to-hand or bank account-to-bank account and if you don’t manage it, you’ll never be able to keep it.

Let’s go back to basics. Someone that is an expert at budgeting understands the concept of cash flow.

Cash Flow: The simple equation that massively impacts our budget plan

Your cash flow is the difference between how much money you make each month and how much money you spend. Going back to that evil math class, it can be written:

Cash Flow = Money You Make – Money You Spend

Seems simple right? If you spend more than you make each month, you will end up in debt! Avoid negative cash flow! If you earned $2,000 each month and spent $2,500, you are building debt:

Negative Cash Flow (debt) = $2,000 – $2,500 = -$500

Where is that $500 coming from? Well, your savings account, provided you have money in savings, or the more typical method, piled up on a high-interest credit card.

Now the flip side of the equation, saving money happens when you earn more money than you spend. When you make, say $4,000, and only spend $1,500 each month, money-tastic things begin to happen:

Positive Cash Flow (Savings) = $4,000 – $1,500 = $2,500

You end up saving money each month. This equation is the heart and sole of budgeting. So what’s the problem? Why do we struggle with budgeting so much?

The problems people have with budgeting

Problem #1 – You don’t know how much you spend each month

There are a lot of problems people have when it comes to their cash flow. The main problem is most people aren’t tracking their spending (don’t have a monthly budget).

Think about it. Can you tell me within the next 5 minutes how much money you spent in the last month? Most people have no issue knowing how much money they make on a monthly basis, but budgeting requires us to also know how much we spend each month.

Problem #2 – You haven’t refined your budget enough

Were you able to answer how much money you spent last month? If you could, congratulations, you are ahead of the curve. The second area budgeters fail in is reducing their monthly spending.

Living responsibly on a tight budget is hard work, I mean really hard work. Our expenses consist of needs, wants, and luxuries (I’ll talk more about this later) and you need to cut your expenses on luxuries and focus on your needs first.

Did you know my current budget only lets me spend $20 each month on whatever I want? It isn’t easy, but you have to live within means of your budget. I have other categories (I’ll talk more about categories later) for other entertainment, such as date night – so I’m not solely limited to $20 worth of fun each month.

You will never create a perfect budget on the first attempt. It takes many iterations and usually is adjusted on a month-by-month basis. I’ll talk more about refining your budget later on in the post.

Problem #3 – You aren’t making enough money for the lifestyle you live

I would like to believe that everyone makes enough money to support themselves on one job, but sadly that isn’t the case.

If you want to have positive cash flow then you must get your income to be greater than your expenses. We will talk a lot about reducing your expenses, but if you’re only making $15,000 a year and trying to live in a large city where the lowest rent is $1,000 a month, you’re going to have a hard time without increasing your income.

These are the three main problems when it comes to budgeting. Other problems exist, such as not knowing how to budget effectively (good thing you’re on this post), but this post is already long enough!

Share this article and help others with their budgeting.Click To TweetBudgeting for positive cash flow lets you have money. Money = Leverage.

When you budget for positive cash flow, you are going to be able to see extra money appear in your bank account each month. Money is a powerful tool that lets you have leverage – the ability to let money work for and not against yourself.

Here’s what positive cash flow can do for you:

- Save money – When you save money you can use it for whatever you choose. Take a vacation, buy someone a gift, buy a house, or use it during an emergency.

- Invest money – The true beauty of money is that it can work for you through investments. You can hire someone to manage a stock portfolio for you or invest it in an apartment complex or storage unit which will generate you more money.

- Pay off debt faster – Want to get rid of your car loan or mortgage faster? When you create a surplus of cash through budgeting you have more leverage to pay off your loans faster.

- Do fun things – When you have money, you can do whatever you want. Especially if you’re a billionaire, you can be like batman.

What is your personal preference with creating a monthly budget sheet that suits your family?

There are a lot of different tools to choose from for recording your household budget. The two most common budget tools today are apps and excel, while some people still choose to write down their budget in a notepad.

Personally, I like to track my budget in excel. I’ve included a free budget worksheet download below for your convenience. You may have to adjust it for your needs as everyone’s budget needs are different.

Budget apps

You can find anything in the app stores these days so why would budgeting be any different? I’ve personally never used a budget app before, but I have heard a lot of people say good things about mint.

Mint lets you manage your money through your smartphone or tablet. It has other features, such as letting you pay your bills and track your investments.

Mint isn’t the only app available for budget tracking, it’s just one of the most well-known. If you are set on using an app, make sure the company has a good reputation because there are a lot of scams when it comes to finance.

Handwritten personal budget

I didn’t think this still existed, but some people do prefer to track their expenses by budgeting with a good ole fashion notebook and pencil. This is the perfect way for someone to budget if they want to keep their information safe from hackers!

There is no right or wrong method to track your expenses, but my handwriting is absolutely horrible and I’m a spreadsheet nerd so handwriting is not my preferred style.

Excel budget worksheets

Ah yes, my one true love (… besides my wife and puppies), Excel budget worksheets. While I’ll admit that spreadsheets can be frustrating at times, they can be an excellent budget tool.

Spreadsheets make it easy to copy and paste, track all your financial data, and set up your personal budget. I should mention that the rest of this article will be using excel for creating a budget but the principles are the same regardless.

If you would love to join me in my budget spreadsheet love, here’s where you can join our free budgeting and save money course.

Will you plan your monthly budget for one person’s income or both?

One of the best strategies for creating a positive cash flow budget is to budget for one family members income and save the others. If you are single and working two jobs, or have two sources of income, can you plan your budget based on one income and save the money from the other job?

Budgeting to live on one income isn’t the easiest thing to accomplish. It heavily depends on your living expenses and incomes. A family that earns $150k a year living in a small town would have an easier time living on a single income than a family earning $45k in a large city like New York.

The Pros

I’ve already talked about the benefits of a positive cash flow above and how you can save more money, invest more, pay off debt, and do fun things. Living off of one income allows you to do all those things but also gives you the ability to:

- Meet mini goals – Want to buy new furniture? You’ll have money saved in no time when your other family members income is going towards the things you both want. What mini goals would you want to accomplish with the extra money?

- Be a stay at home parent – While having an additional income is very beneficial, there is something to be said about raising a child with your own values on your own time as a stay at home parent.

In case you haven’t noticed, I’m a huge fan of living on a single income – if you can do it. I largely credit the single income lifestyle in helping my wife and I pay off 40% of our mortgage in 2 years.

The Cons

Living on one income isn’t all that it’s cracked up to be though. It’s incredibly hard to do if you don’t have a high earner in the family. That isn’t to say it’s impossible, it’s just hard.

As with any new budget, it’s going to take some getting used to. My wife and I did struggle the first time we tried to live off of one income. We had to learn to become more frugal and not eat out so much.

Before you commit to anything drastic, such as becoming a stay at home parent, I would highly recommend a trial period for your new budget to ensure that you can still live within your means. The last thing you want to do is quit your job and find out you can’t make ends meet without the second income!

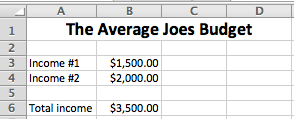

What is your monthly income?

Start your budget planning by writing down your base monthly income, after tax. You can get this information from your pay stub, your HR representative, or use an educated guess based off of your bank statements.

It’s important to estimate a conservative value for income. Don’t include your overtime or any extra pay you receive as you want to budget for your lowest expected income. If you happen to get extra money later on, bonus!

Let’s look at our example characters as they build their budget.

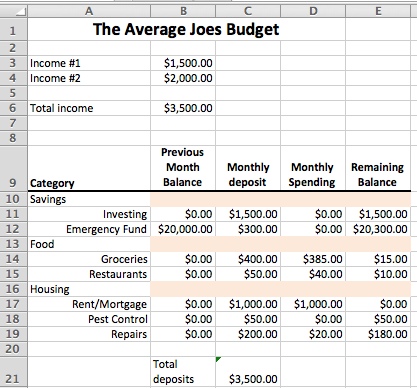

Looks like our example characters make $3,500 between the two of them.

What if I’m paid on commission?

There is nothing wrong with working on commissions, but you will have to work hard to meet your budget needs. Ideally, you have a partner who does bring in a steady income that does not fluctuate much.

I recommend building a budget based on your lowest monthly paycheck that you received in the last year. You can also take last years income and divide by 12 as an estimate, assuming you will make roughly the same amount that you did last year.

Write down your debts

This is the not-so-fun part of budgeting, finding out what the damage is. I won’t be going into too much detail about paying off debt in this blog post, but you need a few key pieces of information to get your budget in order so that you can begin to pay the debts off.

What is the minimum payment on your debt?

You are going to need this information for when we start getting into the nitty-gritty of your budget. Chances are that your debt repayment strategy will not be paying extra on all your loans, but rather, paying the minimums on all but one debt as it’s easier to pay off debt when you knock them out one-by-one rather than all at once.

What is the interest rate on your debt?

It’s a handy piece of information that you should know. High-interest rates prevent you from paying off your debt quickly and this information will help you choose a strategy for paying off your debt.

What is your debt repayment strategy?

I’m not going to go much into details of debt repayment in this post, it is about proper budgeting after all. You should note a few things.

The first being that your primary goal in creating a budget is to build a budget that facilitates as big of positive cash flow as possible. If you can create a large positive cash flow then your debt will melt away.

The second is that there are many debt repayment strategies out there. You should check out our post on the debt snowball. The debt snowball deals with paying off based on dollar amount rather than interest amount which is great for people who need motivation. Others tend to pay off high-interest rate debt first because it’s faster, rather than motivational.

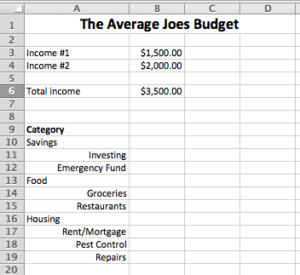

Categorize your monthly expenses

It’s time to make a list of all your expenses. Start with a primary category, such as food and then add a subcategory, such as restaurants or groceries. Here’s an example:

Don’t worry about the dollar amounts at the moment. You should just focus on creating a list of expenses. Don’t try and make your spreadsheet look like a budget worksheet, you can download mine when you’re ready to start budgeting.

Primary categories can include but are not limited too, giving, savings, housing, utilities, food, transportation, personal, clothing and recreation.

Once you have a list off all your expenses, organized into categories and subcategories, you’re ready to learn what makes an effective budget.

Budget tips for an effective budget

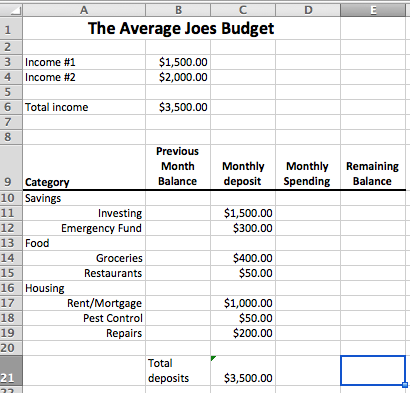

All subcategories have a monthly deposit

This shouldn’t be a major surprise, but each subcategory should have a minimum dollar allocated to it. You might decide to dedicate $400 a month to groceries, $50 for eating out, $1,000 for your rent/mortgage, etc. This is the amount you are promising not to exceed each month!

All of your monthly deposits add up to equal your income

Essentially, every dollar you earn is accounted for and assigned to a category.

Do you see how the monthly deposits add up to $3,500? If you had a really awesome month and made $4,000, you should add that extra $500 into your monthly deposits so the money is accounted for.

Your budget carries over from month to month

Each subcategory is like a separate bank account and the remaining balance should carry over to the next month. For example, if you deposit $400 in groceries for January, but only spend $375, you should start February with $425.

For this example, I’ll assume that the people in the budget example had an even $20,000 in their bank account. Because they are starting their budget for the first time, they need to allocate their $20,000 in the “Previous Month Balance” column. For simplicity, I will put all $20,000 into their emergency fund.

Let’s go over each budgets line item.

- Investing – No money was spent in investing because the people in the example have not set up their investment account yet. February would start with $1,500 and they would deposit an additional $1,500, so March would start with $3,000. If the people in the example did start an investment account in January, $1500 would be in the “Monthly Spending” column and the “Remaining Balance” would zero out indicating the money was transferred to the investment account.

- Emergency Fund – The month of January started with $20,000. $300 was allocated to emergencies in January, but no emergencies happened ($0 spent in emergencies). Therefore, February will start with $20,300.

- Groceries – The month of January started with no money from December but $400 was allocated to groceries. Only $385 was spent, leaving $15 to carry over to February. Because you will deposit $400 in February, your total grocery budget will be $415.

- Restaurants – You spent $40 eating out, leaving $10 to carry over to February. You will have $60 in February to eat out.

- Rent/Mortgage – Rent never changes and you know you will owe $1,000 each month. You deposited $1,000 for January and you wrote a check for $1,000 to pay for your rent. Nothing carries over.

- Pest Control – You are charged $150 every three months for pest control. The next payment isn’t due until March, so you will deposit $50 each month until you are charge $150 in March.

- Repairs – You had a leaky sink that you could fix on your own, but the part cost you $20. You deposited $200 in January, spent $20, you will carry over $180 to February where your total budget for February will be $380.

You don’t have any issues staying within your families budget

Budgeting is hard work. Ideally, the “monthly deposit” should never be exceeded, but it does happen. Here are some tips to recover from a bad financial month if you found yourself spending more money than you budgeted for.

Building a budget will require several adjustments to the “monthly deposit” category. It is very difficult to nail it down, but eventually, you’ll learn how much you spend for each category.

Some people have poor self-control, I know I do when it comes to Taco Bell. Your entire family needs to get on board with your budget and make a commitment to stick to it.

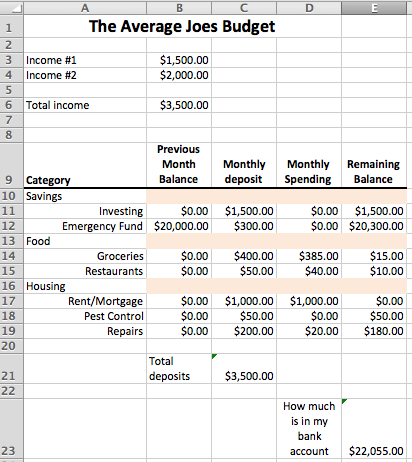

Ideally, you wouldn’t have to log into your bank account

I do recommend logging into your bank account at least once a month, but a good budget should always match up with your bank account.

As you can see in the example, $22,055 is in the bank account. Keep in mind that banks will deposit interest into your account periodically which you should account for as income.

Your turn. Assign dollar values to each category

Remember to make sure that all “monthly deposits” should add up to your base income. Start by giving an honest estimate for what you think you will need for each category. At the end, add it up and see how much money you are over your income. Re-evaluate each category and see what ones you can reduce further.

Prioritize your categories

If you are finding yourself stuck because your income is lower than how much you are depositing in each category, consider prioritizing each category as a need, want, or luxury.

You need to pay rent or you’ll be homeless. You want to eat out 2 times a month for sanity reasons. It’s a luxury to afford a massage each month. Deciding what categories are needs, wants, or luxuries will help you determine what to cut first.

Still struggling? Learn to save money or increase your income

If you are continually stuck because you cannot further reduce your expenses, you have two options. You can learn money-saving tips, such as living frugal or figuring out how to increase your income.

Some people have too many debts to handle on their income, so considering a secondary job until a reasonable budget can be achieved should be a consideration.

What’s next?

Stay motivated

Learning to create a budget isn’t easy. Finances can be tricky, but building a budget is a skill worth having.

Sign up for our free budgeting course

The more you learn about budgeting, the easier it will be. That’s why I created a free budgeting course to help individuals learn the basics of budgeting.

The course is packed full of information that will help you budget and save more money!

Post a comment or question

I would love to hear any comments or questions that you have for me!