So you want to know how to buy Amazon stock?

I can’t blame you for wanting to jump on one of the fastest growing stocks around. 10 years ago, Amazon was priced around $134 per share and is now at approximately $1,870!

That’s a whopping 14 times your investment!

Just think if you would have invested $10,000 in AMZN 10 years ago. You would have approximately $140,000!

So today, I’m going to show you exactly how to purchase a share of Amazon stock, even if you’ve never bought stock in your life. I’ll also show you a few different tips to help you decide if purchasing Amazon, or any other stock, is a potential buy.

This post may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

What is a share of a stock?

Companies issue shares of stock in order to raise money to reinvest into their company. Growing a large scale business takes a lot of money, so companies borrow it from investors.

Shares and share prices are set corresponding to a companies value and how many shares are to be issued. When an investor purchases a share, they are purchasing a share of ownership in that company.

Because the investor is now part owner, regardless of owning one share or millions, the investor earns or loses money with the company. Should the value of the company increase, the share prices will raise. Companies that lose money will also cause the share prices to decrease, causing investors to lose money.

Can you buy shares of Amazon?

Yes, Amazon is a publicly traded company so you may purchase shares. You will need to work through a stock broker if you would like to purchase shares of Amazon.

What are fractional shares?

Some brokerages offer the ability to purchase shares in fractions, also known as fractional shares. You wouldn’t own a full share, but a portion of one share. Fractional shares are not common among brokers, but some offer it as a benefit to their investors.

Personally, I highly recommend using fractional shares to your advantages.

Example for purchasing fractional shares:

Let’s say Amazon is currently trading for $1,850 per share, but you only have $500 to invest. Most brokers wouldn’t let you buy any shares of Amazon because you don’t have enough money to cover a full share.

Your brokerage is really cool and sells stock in fractional shares. You can now purchase a portion of Amazon stock for $500. Since Amazon is trading at $1,850, you can purchase 27% [=($500/$1,850)*100] of one share.

What are the benefits of purchasing fractional shares?

There are several benefits for purchasing fractional shares. The first benefit is that it allows you to purchase quality stocks that you previously couldn’t afford.

Higher priced stocks tend to be a higher quality stock. The price of the stock tends to reflect the value of the company, meaning higher priced makes more money.

If you can afford a portion of the stock then you still receive the benefit or growth from ownership. If Amazon stock grows 25 percent this year then your fractional share of $500 will also grow by 25 percent.

The second benefit is that fractional shares allow you to have greater portfolio diversification. Diversification is key to ensure that you don’t put all your cash into a poor performing stock. The last thing anyone wants is to invest into a company who goes bankrupt in a year.

With fractional shares, you could split your $500 investment into five, 10, 20, or more stocks. You might put $100 into Amazon (AMZN), $200 into Tesla (TSLA), and $200 into Johnson and Johnson (JNJ).

Click to Tweet. Please Share!Click To TweetShould you purchase Amazon stock?

Amazon is a company that is constantly innovating and trying to change the shape of retail as we know it. Does that mean Amazon is a good stock to buy?

Let’s take a look at a few different factors you should consider before you make an Amazon stock purchase.

Do company research

Step #1 – Find Amazon’s balance sheet and income statement on NASDAQ

A balance sheet is a summary of a companies financials. Amazon is required to publish their financial information to be a publicly traded company.

Do a Google search for “Amazon balance sheet” and you’ll see numerous results for Amazon’s balance sheet and income statement.

Step #2 – Review Net Income and Earnings Per Share

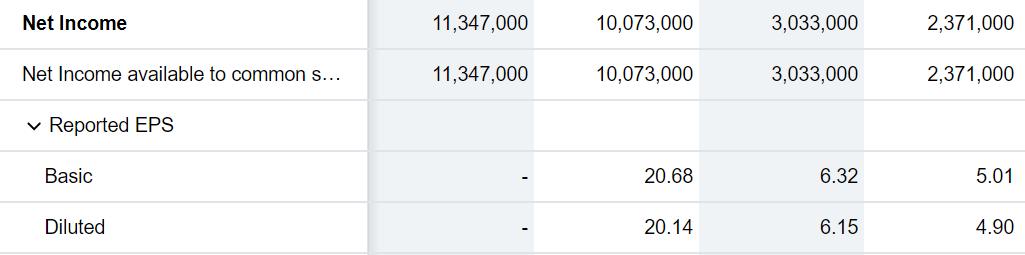

From the income statement, we can see that Amazon’s net income has grown from 2,371,000 in 2016 to 10,073,000.

An increase in the companies net earnings mean that the company is earning more money year over year. This is a favorable indicator that the company may continue to grow in the future.

You’ll also want to find EPS or Earnings Per Share. Earnings per share is an indicator that let’s you know how much money a company is earning in relation to outstanding shares.

So if a company earned $10 million, but had 1 million shares then the EPS would be $10 per share. This is a good indicator of profitability incase of share inflation.

Sure, a company can earn $10 million one year with 1 million shares. But what if they earned $13 million the next year with 1.5 million shares the next year. You just went from $10 EPS to $8.67 EPS because the company added more shares and isn’t anymore profitable.

See how the EPS has increased from 5.01 to 20.68? Amazon is growing rapidly in terms of earnings.

Click to Tweet. Please Share!Click To TweetStep #3 – What are price targets?

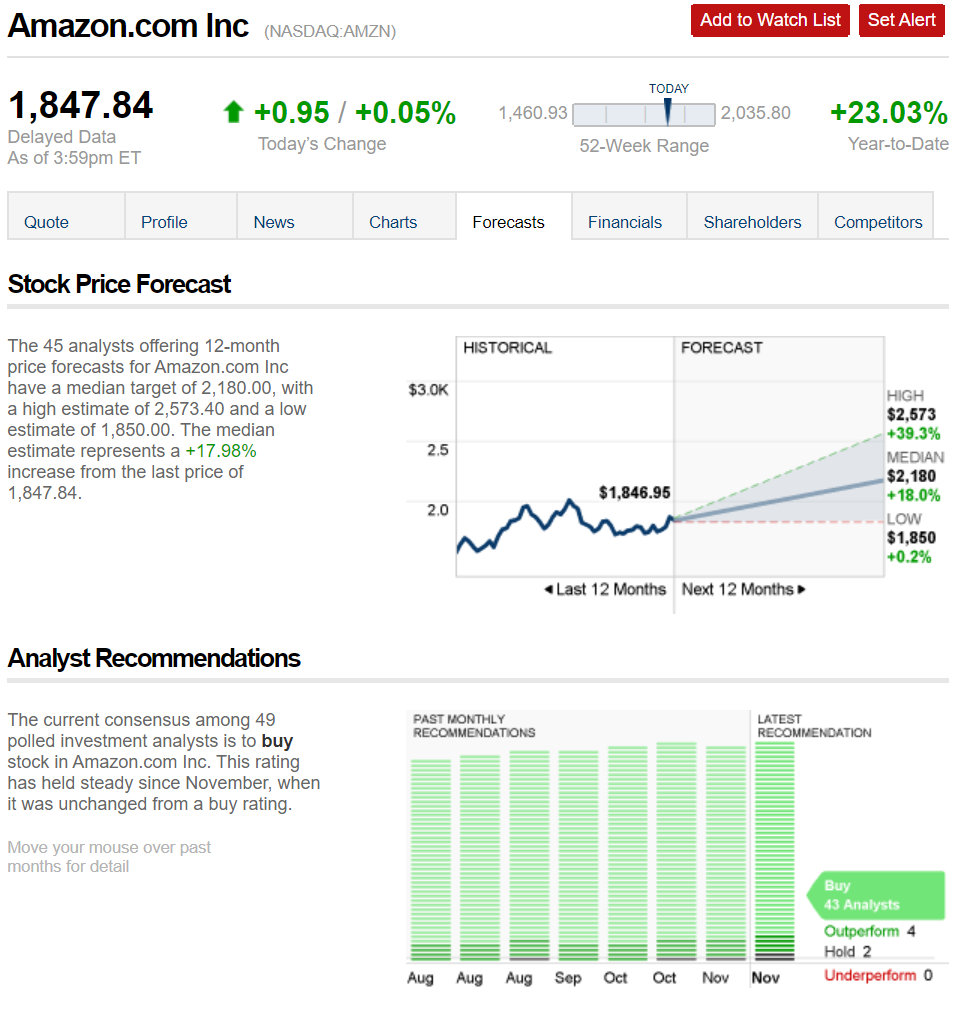

Price targets are estimated stock prices by expert stock analysts. Each price target is estimated to occur within 12 months.

Doing a quick google search for “Amazon Price Target” brings up CNN’s price target page.

According to 45 different Analysts, Amazon is predicted to go from $1,847.84 per share to anywhere between $1,850 to $2,573 in the next 12 months! 43 Analysts recommend buying the stock with 4 analysts saying Amazon will outperform it’s peers.

Price Targets are a great way to confirm and get reassurance that others see value in the stock as well.

What’s my opinion of AMZN?

Remember, don’t purchase stocks based on other peoples opinions. Never invest in anything you don’t understand.

From my research above, I believe Amazon, at this time, is a buy.

Amazon is consistently achieving higher net income, higher earnings per share, and other analysts see value in the stock. Over the last 10 years the price has continued to climb higher and higher. All these factors point me in the direction that the stock will continue to earn money.

How do you purchase shares of Amazon stock?

Step #1 – Open a brokerage account

What is a brokerage account?

A brokerage account is an agreement between you the investor and a licensed brokerage firm. The licensed brokerage firm has access to buying and selling stocks, but unlicensed individuals like yourself do not.

Therefore, opening a brokerage account allows you to have access to the stock market through the brokerage firm. If you place a purchase order for Amazon, the brokerage will execute the order for you.

Simply stated, opening an account with a brokerage firm is the only way for you to access the stock market.

Most brokerages will charge a fee for their involvement in either making trades or managing assets on your behalf. However, other brokerages like Robinhood have zero commission stock trade fees. In other words, Robinhood doesn’t charge you for buying or selling stocks!

Vanguard is an example of one of my favorite brokerage firms. Any extra money I earn is usually sent to my Vanguard account so I can invest in low cost exchange trade funds or ETFs.

Vanguard is my recommendation for anyone looking to save for retirement. Their ETFs are some of the lowest fees I’ve seen. Most Vanguard ETFs charge between 0.03-0.12% of managed assets, whereas other brokerages charge you between 0.85-1%!

What are my brokerage account options?

There are several brokerage options, each with their own fee structure. It’s important to do your own research and determine a brokerage that will work for you. Some of the more common brokerage firms include:

Click to Tweet. Please Share!Click To TweetWhat brokerage accounts do I use and why?

I use Vanguard, Robinhood, and TD Ameritrade for completely different reasons. Here’s how I use each of these brokerages to my advantage.

- Vanguard – I use Vanguard as my investment account outside of my 401k. At the end of each month, any money in my bank account over $8,000 is transferred to my Vanguard account and invested in low cost ETFs. ETFs I invest in include VTI (Total Stock Market), VYM (High dividend yield), VOT (Mid Cap Growth), VNQ (Real Estate), and VBK (Small Cap Growth).

- TD Ameritrade – I don’t actually invest money with TD Ameritrade. However, I do love TD Ameritrades free tools, such as the Think or Swim Platform. I use Think or Swim to research individual stock trades for swing trading. Using the Think or Swim platform has a learning curve but it has been one of the best research tools I’ve found.

- Robinhood – I invest a small amount of money with Robinhood to make frequent stock trades. Robinhood does not charge a fee for buying or selling stock which makes it ideal for short term investments, like swing trading.

As you can see, I have one brokerage account for long term investments, one for research, and one for short term investing. I’m crazy about investing so opening brokerages is kind of a hobby for me. You don’t need to open more than one if you don’t want to!

If you’re just going to be making stock purchases, like Amazon, then I would recommend Robinhood for no fee buying or selling. Robinhood is perfect if you are purchasing stocks with the intention of buying and holding, because it’s free from fees. Other brokerages may charge you a fee for buying or selling.

Robinhood has even announced they will be supporting the purchase of fractional shares. I’ve signed up for the waiting list and it may be available by the time you’re reading this!

The one downside to Robinhood is that it isn’t great for researching stock purchases. Hence, why I have a TD Ameritrade account. However, you’ll need to develop your own method for researching stock picks.

Step #2 – Open Robinhood and search AMZN

Open up Robinhood and search for “AMZN” or “Amazon.”

You’ll see the current price for Amazon stock, which you should take note.

Step #3 – Buy Amazon Stock

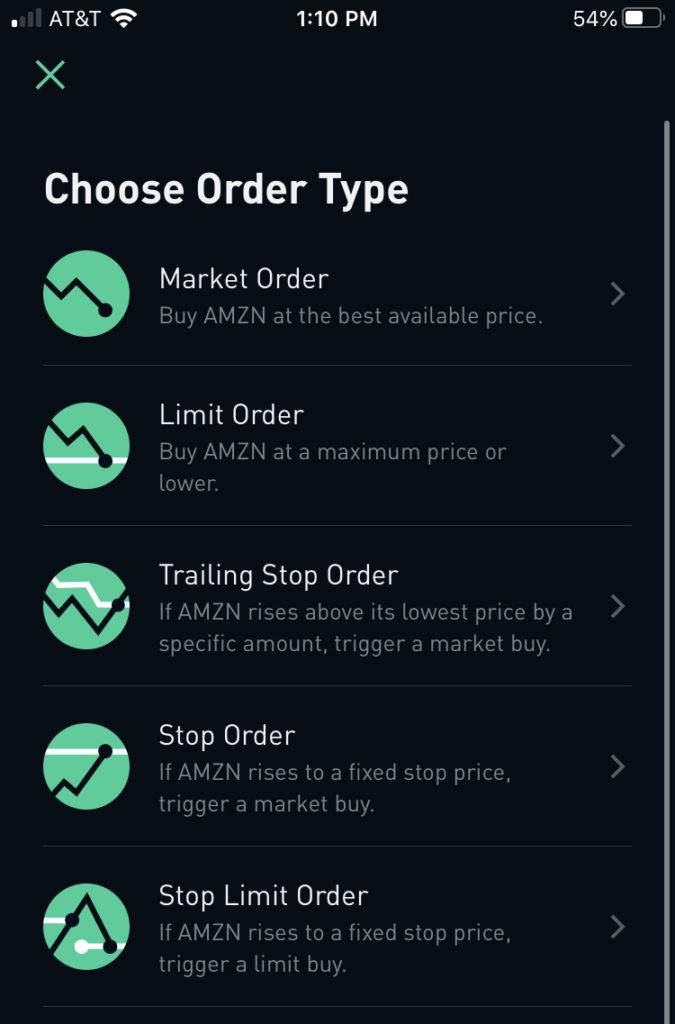

At the bottom right hand corner, select the “Buy button.” You’ll see in the upper right hand corner, there is an option to select order types. The most generic order type is Market Order, but other order types exist for advanced traders.

Let’s take a look at the different order types.

Understanding Order Types

- Market Order – Purchase stock at the next best available price. Example, Amazon is currently trading at $1,850 and you place a market order. You place a market order at the next available price, which could be slightly higher or lower than $1,850.

- Limit Order – Purchase stock at a certain price or lower. Example, Amazon is trading at $1,850, but you think the stock price will drop to $1,840 before it continues to rise. You place a limit order for $1,840. You will purchase Amazon only if the price drops below $1,840 at whatever the current price becomes. If you placed the limit order for $1,860, it would be essentially the same as a market order because the current price of $1,850 is below the order price of $1,860.

- Trailing Stop Order – Amazon’s price has been declining and you want to purchase Amazon when the price is $10 above it’s lowest price. Amazon goes from $1,850 to $1,830, then $1,832, then $1,820, then $1,833 which then triggers your trailing stop order.

- Stop Order – Performs a market order once a higher price is reached. Example, Amazon is trading at $1,850 but you’re not sure if it will continue to rise or drop soon. You place a Stop order for $1,860. You will only purchase the stock when the price reaches $1,860 or higher.

- Stop Limit Order – Once the stock reaches a higher price, you purchase the stock at a certain price or lower. Example, Amazon is currently trading at $1,850 and you’re not sure if the stock will drop. You only have $1,860 to trade. You place a stop limit order so that if Amazon’s price reaches $1,858, you buy Amazon stock for $1,860 or lower. Unfortunately, you may miss your purchase opportunity if the stock price blows past your $1,860 before an order can execute.

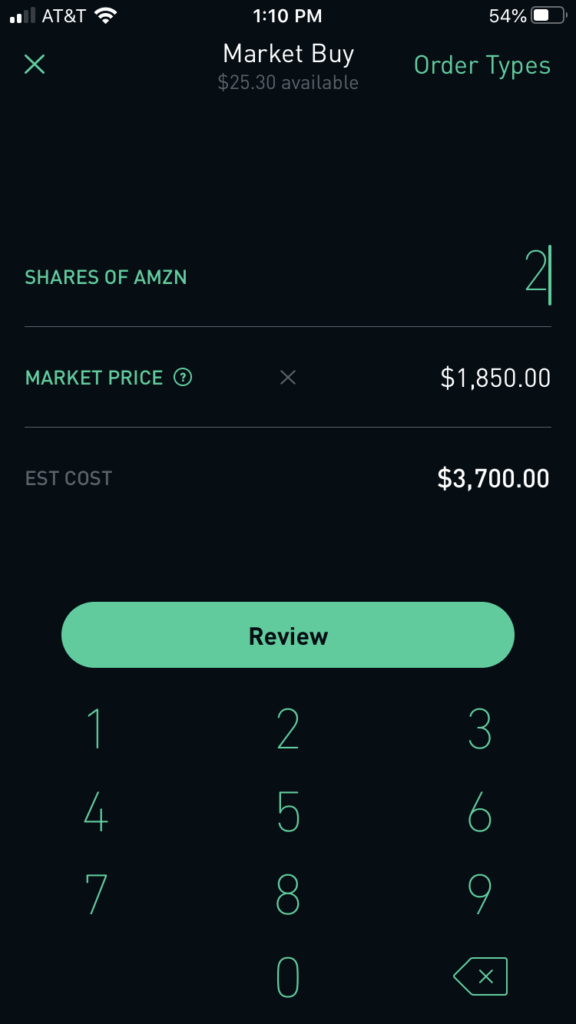

Purchasing Amazon Stock with Market Order

Enter in the number of shares you want to purchase. Remember to stay diversified and ensure you aren’t solely invested into one stock.

Verify the Available Balance can cover the purchase. Robinhood will stop you if you cannot cover the full price of the stock.

Review your order and swipe up to confirm! Congratulations, you’ve purchased your first Amazon stock.

Tips for successful stock purchases

While finding individual stocks can be very rewarding, they can also be risky. Here are some tips to keep you a bit safer while investing in the stock market.

- Stocks are a long term investment. Constantly trading stocks can be a risky if you don’t know what you’re doing. Finding good quality companies and investing for the long term is the safest way to earn money in stocks.

- Research is important! For every quality company, there are 100 more losing their shirts. Do proper research to find stocks that are actually worth investing in.

- Find stocks with a 10 year history of stock price increase. You need to understand that past performance doesn’t guarantee future results. However, stocks that have been on the rise for the last 10 years, *generally* continue to rise.

- Dollar cost averaging. Purchasing the same stocks in regular intervals takes advantage of dollar cost averaging. While the stock rises your purchases average out overtime. Sometimes you buy high and others you buy low, but it averages out.

- Learn the basics of stock market investing. Learning about stock market investing is critical if you’re going to be doing your own investment management.

- Consider purchasing ETFs. Exchange trade funds are a collection of individual stocks wrapped up into one stock. The benefit is that you get higher diversification for a lower price. For example, VYM is Vanguards High Dividend Yield ETF which contains over 400 dividend paying stocks. It would cost thousands of dollars to purchase each stock individually, but VYM is currently available for under $100!

- Hire a financial advisor. If you are absolutely at a loss, consider hiring a financial advisor to manage your money.

Summary: How to buy Amazon stock

Amazon is a company that is highly sought after. It’s currently a recommended buy by over 43 different Analysts. However, you should always perform your own independent stock research.

You’ll need a brokerage account in order to purchase Amazon stock. I highly recommend Robinhood for people just getting into the stock market. Vanguard is my other highly recommended brokerage where I have access to low fee exchange trade funds, which greatly diversifies my portfolio.

There are several different order types, but Market Order is the most common. Essentially, a market order executes as close to the current price as possible.

Always diversify your portfolio, learn the stock market basics, and hire a financial advisor when unsure. Practice safe stock market practices!