What are the best income-producing assets to buy with little money?

The best income-producing assets to buy with little money will help increase your cash flow. Dividend stocks, Peer-to-Peer lending, real estate crowdfunding, rental properties, and low-cost businesses are inexpensive assets for income. Each asset can be purchased with small amounts of money but can lead to significant profits.

Imagine investing your first $100 and receiving a cash payment every month. As you continue to invest, the dividends you receive increase over time.

Cash flow is fantastic!

Luckily, I will show you how to build wealth with cash flow. You can start investing for cash flow even if you only have $100. The more money you can invest, the larger your returns can be.

Key Takeaways:

- Cheap assets to buy include dividend stocks, P2P lending, real estate crowdfunding, rental properties, and low-cost businesses.

- Dividend stocks, REITs, P2P lending, and real estate crowdfunding are some of the easiest assets to acquire. Dividend stocks and REITs require a brokerage account (e.g., Robinhood) and can be purchased with a few clicks. P2P lending and real estate crowdfunding require opening an account with the respective business (e.g., Lenders Club or Fundrise).

- Income-generating assets require you to purchase the asset once, and then you’ll get paid for years to come.

This article may contain affiliate links that pay a commission and support this blog. I appreciate your support!

The best income-producing assets to buy with little money

The best income-producing assets are easy to obtain with little money. Each asset provides consistent cash flow, which you can reinvest. Dividend stocks, Real Estate, P2P lending, and certain businesses can produce an income while purchased for a low cost.

No investment is risk-free. Planning your investment strategy according to your risk tolerance would be best.

Learning about each type of investment can help reduce your risk. Most new investors jump into an investment without a complete understanding.

So what are the best income-producing assets?

Click to Tweet! Please Share!Click To Tweet

Dividend Stocks

Dividend stocks are shares of a company that pays a cash payment. The company has no better growth opportunity and has decided to reward investors with dividends. Investors may purchase dividend stocks to increase their income if the dividend is maintained.

A company that pays a dividend will specify the dividend and dividend frequency. For example, a company may establish a $0.50 quarterly dividend. Over one year, you would get $2.00 in cash payments.

The dividend yield is the percentage of dividend payment to share price. For example, a company with a $100 share price that pays $2 a year has a 2% dividend yield.

What makes dividend stocks amazing are the dividend pay increases. Most dividend investors see a dividend increase as a pay raise!

For example, a company might pay a $0.50 quarterly dividend one year and then increase it by 10% or $0.05 the next. So owning 100 shares in the first year would yield $200. After the company grows the dividend payment, you earn $220 per year.

Therefore, dividend investors look for dividend sustainability with a future increase outlook.

Peer-to-Peer Lending

Peer-to-Peer Lending involves lending your money to individuals and businesses who need a loan. The person or company pays back the loan with interest. Essentially, P2P lending is like the bank system, but it allows you to be the lender.

The most significant risk with P2P lending is loan defaults. You’re lending your money to people with the intention they’ll pay back the loan. However, some people may declare bankruptcy or default. You’d lose whatever cash hasn’t been paid back.

However, proper diversification can limit a default’s impact on your cash flow. Typically, with P2P lending, you’re buying a $25 share of a loan, not the whole thing. Buying multiple loans, you would hardly notice if one person defaulted.

P2P lending is a good way of investing money without the stock market. The money isn’t subject to the same fluctuations as stocks but may still be impacted by economic downturns.

You can invest in P2P lending with as little as $25, but it’s recommended you buy 100 different loans. Therefore, the minimum investment is recommended to be $2,500.

To summarize, your cash flow comes from interest paid back on a loan. You should invest a minimum of $2,500 for diversification. P2P lending is an illiquid investment as your money is tied up in a loan.

Real Estate Crowdfunding

Real estate crowdfunding allows you to invest in real estate with minimal investment. You don’t have to purchase the rental property yourself. Essentially, you are giving a company your money to invest in income-producing assets like apartments or single-family homes.

Companies like Fundrise give you the ability to invest in real estate with a $1,000 minimum investment. You can select if you want a portfolio of supplemental income, growth, or a mixture of both.

As of writing this, Fundrise is projecting a 2.9-3.2% dividend yield on its income portfolio. Therefore, every $1,000 you invest would make $30 in income. However, the fund is also projected to grow 5.1-6.4%! Your total returns are between 8.0-9.7%.

Just like P2P lending, your investment is outside the stock market. However, certain economical impacts can affect your investments.

Your investments are tied up in physical real estate projects, which makes them illiquid. The best part about the asset is you own real estate without having to manage properties.

Rental Properties

Real estate is one of the top choices for people looking to generate cash flow. You don’t have to invest with a company. Instead, you can buy real estate on your own, which carries more risk and reward.

Real estate appreciates, pays monthly cash flow, and builds equity. Therefore, you have three powerful methods of building wealth.

Owning your piece of real estate takes a lot of work to manage. You should factor in property management fees to help automate the process.

Generally, your minimum investment is a 20% down payment. Some investors put more or less of their own money into the down payment, but it’s dependent on your risk tolerance.

So how much income does a real estate asset produce? Your income depends on each property. You may find a property that rents for $1,200 and has budgeted $1,000 for expenses. Therefore, you’d generate $200 in free cash flow.

Gumball and Vending Machines

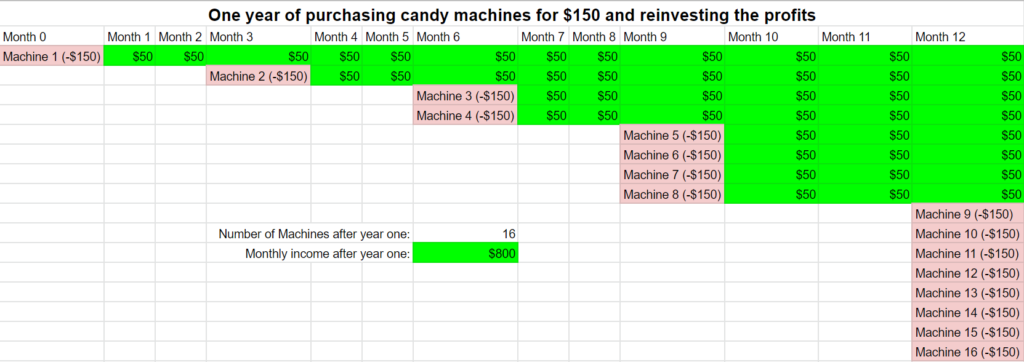

Gumball and vending machines can be a fun investment for cash flow! Gumball machines are cheap to purchase but can make $30-70 per month in cash flow. The hardest part about investing in vending machines is securing good locations.

You can buy a gumball machine on Amazon or eBay for $150. If your machine averages $50 monthly in cash flow, you will pay it off in three months!

Websites

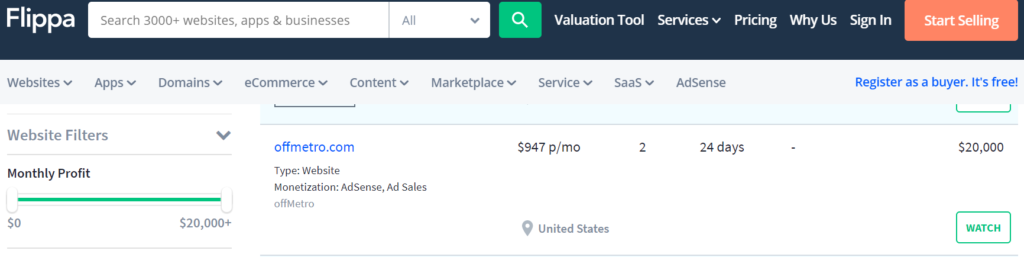

Website investing takes skill but can be a good source of monthly income. Typically, you can see ad revenue of around $15 per thousand pageviews. A website with 100,000 pageviews per month could make $1,500 in cash flow very passively.

However, $15 per thousand pageviews is just an average. Some websites earn $25-$35 per thousand pageviews.

Ad revenue tends to be a small fraction of your income source. You can sell products or courses to supplement your cash flow.

Websites are relatively inexpensive to purchase. Therefore, you can buy an existing profitable website and make up your investment in a short amount of time.

For example, you might find a website selling for $20k, which produces a monthly income of $1,000. Your initial investment would be earned back in 20 months, leaving you with a free cash flow of $1,000 per month.

Digital Products

You can create and sell digital products that generate recurring monthly income. Start with learning specific knowledge, create a product, and learn to sell the product. Fortunately, you can offer an affiliate commission and let others sell the product for you.

For example, let’s say you know a lot about losing weight. You could create an informational product that helps people lose weight. The course sells for $47.

You offer an affiliate program, which gives someone 50% of the sale price for referring business. Therefore, you and your affiliate make $23.50 when a sale is made.

Once your product has been built, you just need to find your affiliates. Eventually, you’ll have enough affiliates to produce consistent income. Your product continues to be an income-producing asset.

Click to Tweet! Please Share!Click To Tweet

Summary: Best income-producing assets to buy with little money

As you can see, there are plenty of income-producing assets to buy with little money. You need to find one asset and focus your efforts on building a passive income stream. As time goes on, your investments continue to build your income.

The best income-producing assets include:

- Dividend stocks – buy a share of a company. The company pays you for being an investor.

- P2P Lending – lend your money to people and businesses. You are paid back in the form of interest.

- Real Estate Crowdfunding – buy real estate by giving your money to companies that purchase real estate. You don’t need the total cost of the property, so you can start with $1,000.

- Real estate – typically involves securing a bank loan to buy properties. Your tenants pay rent, which ideally provides positive cash flow.

- Gumball and Vending Machines – buy gumball vending machines for cheap on eBay or Amazon. Find a location and recoup your investment in a few months.

- Websites – specific skill required, but great income potential for those who take the time to learn. You can buy websites fairly inexpensively.

- Digital Products – Create a product around your specific knowledge. Get affiliates to promote your product. Continue to get sales passively.

You can purchase most of these investments for less than $5,000. However, real wealth is built with the more money you add to your investments.