So what are the best assets which appreciate over time?

Stocks, ETFs, REITs, peer-to-peer lending, real estate, and cryptocurrency are appreciating assets. When correctly managed, investing your money into these assets will cause an increase in monetary value. Less volatile assets include bonds and CDs.

Imagine, buying an asset now and being able to sell it or twice your investment down the road. Some Investments appreciate incredibly fast, like Shopify stock which increased 3000% in 5 years.

Keep in mind, not every asset has such results.

The important thing is that you start investing now. Learn to identify appreciating assets and let your money do the heavy lifting.

Luckily for you, I’m going to show you some of the best appreciating assets over time. All Investments have risk, but these Investments can work to your advantage. Wise investing coupled with patients can lead to profit potential.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

What are assets that appreciate in value?

An asset that appreciates in value is anything you can buy which is worth more later. Homes, cars, stocks, and even trading cards can be appreciating assets. However, not everything appreciates and you must be careful of depreciation, or loss in value.

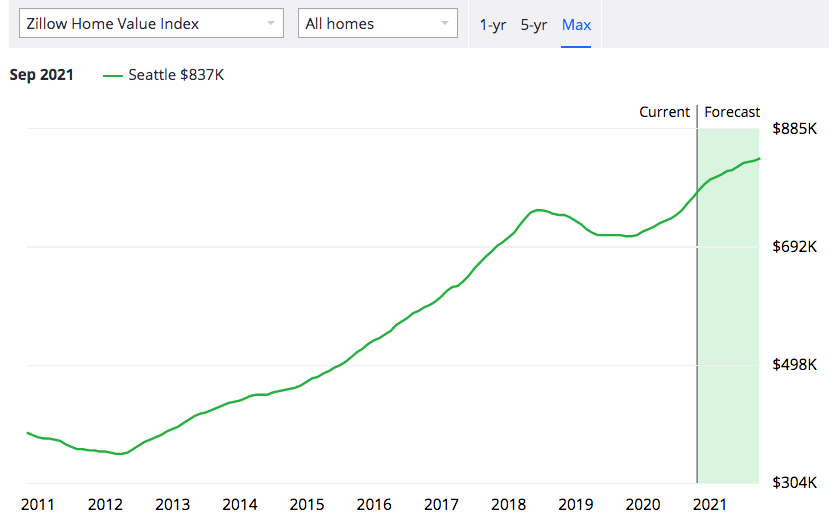

For example, most people that buy a home would expect that home to appreciate in value. According to Zillow, the average home price in start investing now. At the start of 2020, home values were estimated to be $721,000.

Your home was an asset. In this example, the home practically doubled in value. Therefore, it was an asset which appreciated in value.

However, it is important to understand not all items will appreciate in value. Seattle is a growing area which drives the price up. Certain market conditions can lead to a decline in value or depreciation.

Housing bubbles are the perfect example of how you can lose money on a house. Your community may see a boom in growth of housing prices and new builds. Eventually, demand for new housing stops, which leaves your community with a surplus of houses.

You may have bought a house when prices were on the rise. However, when the bubble collapses more houses are available without buyers for them. With less demand, the value of your house decreases because of supply and demand.

Click to Tweet! Please Share!Click To TweetWhat assets appreciate in value over time?

Stocks, ETFs, REITs, peer-to-peer lending, real estate, and cryptocurrency can be appreciating assets. Choosing the right asset can lead to an increase in value over time. Each asset needs to be evaluated for profitability, but all assets carry risk.

Stocks

Stocks are one of the most common assets people turn to for appreciation. Specifically, growth stocks and initial public offerings offer the best appreciation. However, each of these assets can be risky.

Generally, individual stocks are not well diversified. As a result, you really win when a stock wins, but lose when a stock loses.

For example, Shopify was one of the best examples of an individual stock which appreciated. From its initial public offering, Shopify grew over 3,000% in only five years. A $10,000 investment would have been worth $370,000 in five years.

Amazon is another example of a stock which keeps on growing. Year-over-year, Amazon’s stock price keeps increasing.

However, for every stock that wins, there are plenty of losers. Since Blue Aprons IPO, the stock has continued to depreciate. The stock went public for a share price around $140, but it’s worth only $6 today.

Exchange Traded Funds

Exchange traded funds are one of my personal favorites for appreciating assets. ETFs are a collection of individual stocks provided by a brokerage. Look to buy ETFs that have a long history of increasing in value.

Vanguard has a list of exchange-traded funds they offer as a brokerage. From Vanguard’s website, you can see a performance history of each ETF. For example, the total stock market fund VTI has a 10-year annualized history 13.5 percent return on investment.

ETFs don’t always provide the highest return-on-investment. However, ETFs are great for long-term ‘buy and hold’ investors.

The major benefit to purchasing ETFs is their simplicity. You can continue to purchase an exchange traded fund which is well diversified. Generally, over time, this asset will appreciate.

Most investors would be okay with an ETF that tracks the S&P 500. Historically, the S&P 500 appreciates around 10% for annualized returns.

Real Estate Investment Trusts

Real Estate Investment Trust or REITs are like ETFs, but focus on real estate. Owning a REIT is a good way to generate cash flow as they generally pay a dividend. Your investment is backed by physical real estate like apartments, multi-family homes, and office buildings.

REITs are traded just like stocks on the stock market. You can even buy them through your brokerage account, like Robinhood. As a result, they are also volatile just like the stock market.

However, one of the main benefits to REITs is their dividend. For example, VYM is the Vanguard real estate fund which usually pays a 4% dividend.

You could take that dividend as a cash payment. However, you should consider a dividend reinvestment plan or DRIP. Reinvesting your dividends will buy more shares which lead to more dividend payments.

Therefore, your cash flow is constantly appreciating. Your investment capital may also appreciate with the price of the REIT.

Peer to Peer Lending Notes

Peer-to-peer lending is another form of investing. However, you are investing in people and small businesses. You are the bank when it comes to peer-to-peer lending.

Investing in peer-to-peer lending is kind of like dividend stock investing. You purchase a fraction of someone’s loan and it gets paid back over time with interest.

The more loans you start out with the more interest that is paid back. as you get more interest paid back you can buy more loans. The amount of money you have invested begins to snowball, increasing your invested money over time.

Peer-to-peer lending is done outside of the stock market. Therefore, your investments are not subject to regular stock market fluctuations. However, you are still subject to loan defaults.

You should expect a certain percentage for your loans to default. However, Lending Club has stated that investors with over 100 notes typically see positive returns.

As always, the key to successful investing is diversification. Just as you would buy multiple stocks, purchase different loans to diversify your P2P portfolio.

Real Estate

Real estate has always been popular among investors for its ability to cash flow and appreciate. When done right, real estate will pay you every month while the asset increases in value. Unfortunately, the lure of real estate has caused many people to make bad choices for Investments.

Zillow estimates home appreciation in the US of 5.8% in 2020. Moving forward into 2021, appreciation is forecasted to be 7%.

As I mentioned earlier, buying in the right Market can be very profitable. An investment in the Seattle real estate market in 2012 would have doubled in value by 2020.

Buying rental property is an amazing source of income. Your tenants are paying rent for a place to live or a place to work. The goal with real estate is to have your tenants pay enough rent to cover your expenses. Ideally, you’ll walk away with extra money each month as well.

Real estate also attracts many investors because of the low cost for entry. You can take out a loan to buy rental properties. You are still responsible for paying the loan, but you are investing someone else’s money.

Most people fail at real estate for a couple reasons. Either they don’t estimate future expenses properly or they try to take too much profit.

A lot of people don’t get the math right for estimating cash flow. They buy a property without estimating cost for repairs or vacancies. You need to have a game plan for incidents and a good budget in place. Do not forget the emergency fund!

Other people try to take a profit before the home is paid off. When something arises, they don’t have the money to pay for it because they’ve already spent it.

Cryptocurrency

Cryptocurrency has not been around for a very long time, but is showing signs of long-term appreciation. Bitcoin is one of the most popular cryptocurrencies for poor alternative investors. As Bitcoin grows in popularity and becomes mainstream the price should increase.

Over the last five years, Bitcoin has appreciated 4500%!

Companies like PayPal are looking to incorporate cryptocurrency as part of regular payments. Widespread use will only drive the price of cryptocurrency higher.

Trading Cards

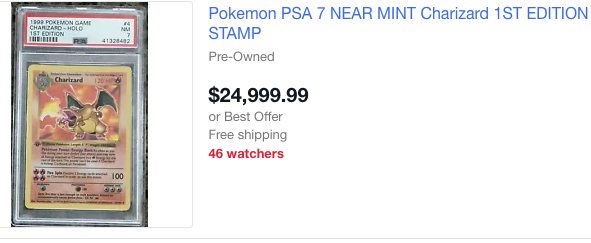

You would be surprised, but the right trading cards can be an asset which appreciates over time. Your pokemon, sports, and other fan favorites can be more valuable as supply decreases. Nostalgia and other factors may drive the price up!

Check out this Charizard card which is now listed on EBay for $25,000!

There is no way this trading card was selling for $25k back in 1999. Sadly, many of these cards are sold for pennies at yard sales because people don’t know the value.

Who knew a card that you could find in a $5 booster pack would be worth $25,000?

What is the best thing to buy as an investment?

The best investments to buy are stocks and real estate. Stocks and real estate can rapidly appreciate in value and even provide income opportunities. Stocks are ideal for investors who have limited time, while real estate can be more hands on.

Click to Tweet! Please Share!Click To TweetSummary: Assets which appreciate over time

As you can see, there are many assets which appreciate over time. Real estate and stocks have the best growth potential. Alternative investments include trading cards, REITs, ETFs, cryptocurrency, and P2P lending.

All investments carry risk. Make sure you understand the factors which cause your asset to appreciate or depreciate. Never invest in anything you don’t understand.