Did you know investing in exchange trade funds (ETFs) are a great way to build wealth, even if you’re a beginner?

Investing is the key to meeting your financial goals, like retiring early or saving one million dollars. ETF investing can help you meet your money goals in a safe, diversified manner.

Imagine, investing enough money that you could quit your job. Yep, ETF investing can help with that too!

You just need to know where to start.

Luckily for you, Today I’m going to tell you everything you need to know about investing in exchange trade funds. At the end of this article, you should have a good knowledge of what an ETF is and how it can help you build wealth.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support.

What is an Exchange Trade Fund?

Exchange trade funds are a collection of stocks offered at one low price. By owning one share of an ETF, you own hundreds or thousands of stocks hand picked by the fund manager. Owning an ETF provides greater diversification and makes it easier for investors as they don’t have to choose individual stocks.

Each exchange trade fund has an overall goal, so it’s important to understand what the goal of the ETF is before investing. For example, VYM is the Vanguard high dividend yield fund and attempts to provide investors with dividend income. VNQ is the Vanguard Real Estate Investment Trust fund which is a collection of real estate funds.

Every ETF has a fund manager, who is responsible for hand picking the stocks, maintaining diversification, and/or keeping the fund on track relative to it’s goal. As you can guess, fund managers don’t work for free and you’ll have to pay a management fee. Some ETFs are passively managed because they are tracking an index, which don’t actively choose stocks.

Generally, the fee is anywhere from 0.07 to 1 percent of invested assets per year. Therefore, it’s important to choose well performing funds with low-fees to minimize your costs.

Click to Tweet! Please Share!Click To TweetExchange Trade fund examples

Now that you have a better understanding of exchange trade funds, let’s take a look at some popular options. Personally, I stick with a select few of the Vanguard ETFs because they are low cost and perform well.

| ETF Name | Ticker Symbol | Fund Goal | Current Fee* | Benefit |

|---|---|---|---|---|

| SPDR S&P 500 Trust | SPY | This fund mimics the S&P 500, a collection of the top 500 companies. | 0.095% | One share of S&P 500 costs $2,700! SPY only costs $272. Diversification by owning 500 of the best companies. Pays dividends. |

| Vanguard Total Stock Market | VTI | This fund tracks the overall stock market. | 0.03% | Diversification by owning over 3,500 stocks with one fund. Pays dividends. Extremely low fee. |

| Vanguard Total Bond | BND | Tracks US bond market returns. | 0.035% | Low cost, low risk, and low reward. Invest in a variety of bonds. |

| Vanguard High Dividend Yield | VYM | Tracks investments that produce a high dividend yield. | 0.06% | Dividend income. Diversification by owning nearly 400 stocks. |

*Dollar amounts and fees are subject to change. Always check prior to purchasing.

The funds listed above are just a few of the many different style of ETFs. My personal favorites are VTI, VNQ, VYM, VOT, and VBK.

Are ETFs safer than stocks?

Generally, ETFs are a good investment and are considered safer than investing in stocks.

Exchange trade funds provide a good level of diversification by holding multiple stocks. If one companies stock tanks, you still have many well performing stocks. However, ETFs, like any investment, aren’t full-proof.

The 2020 Coronavirus is a great learning example for ETF performance. In 2020, the stock market tanked with fears of a global pandemic.

Because of the global pandemic, your stock portfolio would take a hit regardless of investing in ETFs or individual stocks. As you can see from the image, the stock market has had down moments but has recovered. Generally, people who lose money are those who sold at the bottom and then the market recovered.

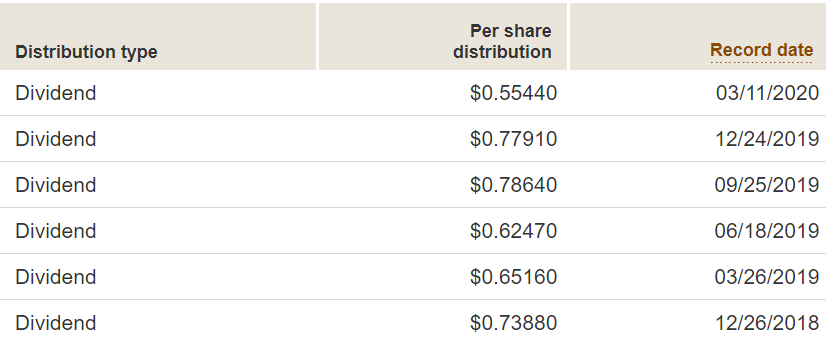

Dividend income also took a hit during the 2020 pandemic.

VYM averaged a quarterly dividend payment of $0.71612 the previous five declarations prior to the 2020 crash. During the crash, dividend payments were only $0.55440 per share! The decrease represents approximately 23% of dividend income loss for the first quarter.

To put that in perspective, someone living off dividend income of $4,167 per month ($50k per year) would have three months of earning about $3,200.

I still recommend investing in ETFs, but you need to be aware of stock market crashes and dividend cuts. Plan for them accordingly when you’re planning your retirement. Invest for the long haul, not the short term.

How do ETFs make money?

We’ve already discussed that a fund manager makes money on ETFs by charging a management fee. So how do you make money with exchange trade funds?

There are two primary ways for you to make money when investing, capital gains and dividends.

Capital gains or losses results when the value of your ETF changes. Investors buying and selling the individual stocks and ETFs can cause the share price to increase or decrease. As companies continue to make or lose money, the share price should change accordingly.

Dividend payments are paid to investors when no growth opportunities are available for the company. Therefore, you are paid a dividend as your share of the companies profit.

Click to Tweet! Please Share!Click To TweetWhat are the disadvantages of ETFs?

Personally, I believe the benefits of ETF investing out way the cons. However, here’s what you need to know about the disadvantages of exchange trade funds.

- High Fees – Some index funds will have high fees which can get in the way of your compounding growth. Do your best to look for low cost index funds.

- Sector specific ETFs limit diversification – Some funds are sector specific (e.g. Real Estate, Technology, Precious Metal, Energy, etc.). Technology sounds great now, but what if there’s another tech bubble burst?

- Low Liquidity – Just like stocks, some ETFs may have a low volume of trades. So what does that mean? When you try and sell your shares you may have to wait if there isn’t anyone to purchase. Try and stick to the larger funds, like Vanguard and you won’t have many issues.

Are ETFs good for beginners?

Absolutely, beginners should consider investing in exchange trade funds. Picking your own stocks can be risky and most beginners lose money on individual stocks when they haven’t learned the market. Again, you should know what your investing in and not invest based on other peoples opinion.

How do I invest in Exchange Trade Funds?

So how do you actually buy an exchange trade fund? You’ve learned a lot about ETF basics, but how do you purchase shares?

I remember graduating from college, getting a job, earning money, and having absolutely no clue how to invest money. No one teaches you how to invest your money. It’s a skill that you have to learn yourself.

Luckily, I’ll share with you what you need to know. Here’s the breakdown on investing your money.

Open a brokerage account

A brokerage account is the link between you and the stock market. Unfortunately, you can’t invest your money without a licensed stock broker.

Personally, I have three brokerage accounts that I use.

- Robinhood – The easiest brokerage account that I’ve found. It’s aimed at beginners with a super simple to use app interface. You can purchase stock with a few swipes of your fingers. Personally, I use Robinhood for swing trading.

- Vanguard – One of the best brokerage accounts that offer a variety of low cost exchange trade funds. I use Vanguard to invest my extra money that is over my bank account maximum. Basically, I keep about $8,000 in my checking account at all times. Any money earned above $8k is transferred to Vanguard.

- TD Ameritrade – I love the Think or Swim platform by TD Ameritrade. In my opinion, it is the best and free charting software on the market. I use Think or Swim to plan my trades and monitor the market.

You don’t have to open three brokerage accounts. You only need one to get started investing. Take time to browse brokers and find one that works best for you.

Don’t want to be alone? Consider finding a brick and mortar business like Edward Jones. You can walk in, talk to someone, and create a personalized plan for investing.

Research exchange trade funds

Next, you’ll want to research exchange trade funds and determine what funds you’ll want to invest in. I recommend starting with the list of Vanguard ETFs.

Generally, you want to look for exchange trade funds which have been increasing in value over the last 10 years. Past performance isn’t a guarantee of future performance, but it’s a good rule of thumb.

You’ll also want to consider the ETF management fee. If two funds are similar, but the first charges a 1 percent fee and the other a 0.07 percent, the 0.07 may be more desirable.

However, you need to know what the different types of available ETFs. Having a good understanding will help you choose the index funds relevant to your situation.

Understanding different types of exchange trade funds

The first thing you need to know is if the exchange trade fund is international or domestic. Domestic ETFs are United States companies while international invests in other countries.

Large, mid, and small-cap funds all refer to the size of the companies held within the fund. Large companies are generally more stable, but aren’t necessarily growth oriented. Small-cap funds are about up and coming companies and may be more volatile.

Furthermore, funds can be broken down between growth, value, and blend. Growth stocks are expected to grow while value stocks are stocks that may be under-priced. Blends are a combination that hold both growth and value stocks.

Dividend funds are aimed at providing an income to investors. Some investors choose dividend funds because they pay an income during good and bad markets.

Target retirement funds grow in conservatism over time. You may start out investing in your 20s with a 100 percent stock portfolio. As you near retirement, your fund will automatically have more bonds than stocks.

Bond funds are primarily made up of bonds for added conservatism. Bond funds can help protect your money during an economic downturn.

Sector specific only invests in one type of asset. For example, one fund might invest only in real estate or technology.

Click to Tweet! Please Share!Click To TweetDetermine your portfolio balance

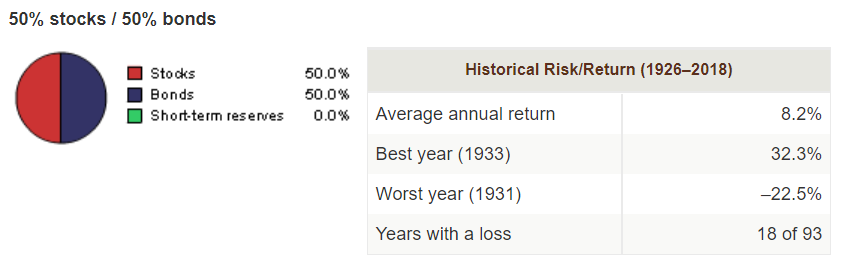

What percentage of bonds vs stocks do you want your portfolio to hold? Portfolios with 100% stocks have performed better than portfolios containing both stocks and bonds. However, portfolios containing only stocks are more susceptible to market volatility.

Per the Vanguard Portfolio Analysis, a 50-50 split has an average annual return of 8.2%. However, 100% stocks has an average annual return of 10.1%.

Buy shares of your Exchange Trade Funds

Purchasing a share of an exchange trade fund is the same process as buying a share of stock. If you’ve never purchased stock before, here’s how.

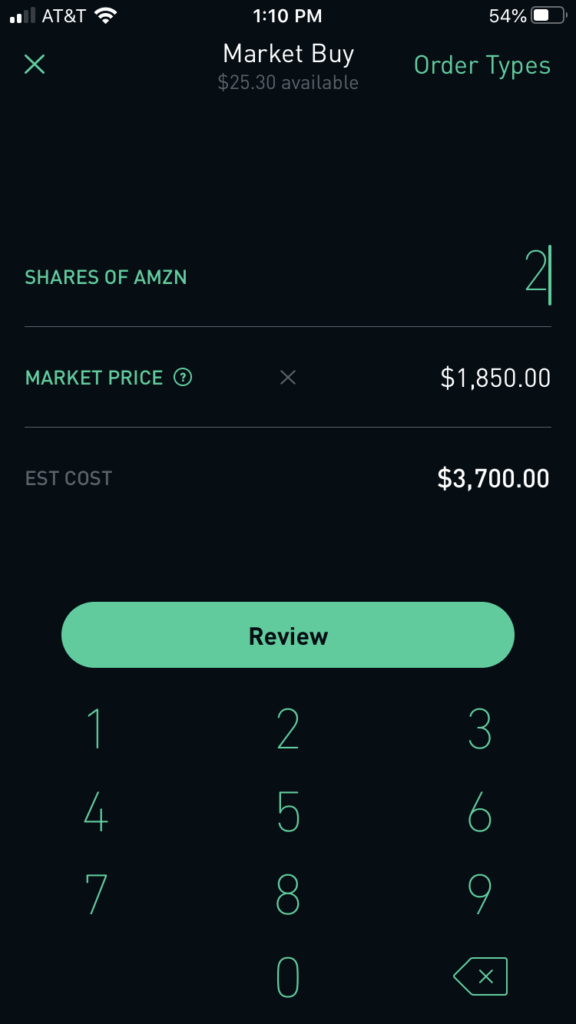

First, log in to your brokerage account. I will assume most of you chose Robinhood, because it’s the easiest brokerage account for a beginner to learn.

Open up Robinhood and search for the ETF or stock you want to purchase. Select the ETF or stock and you’ll see the current price per share, which you should take note.

At the bottom right hand corner, select the “Buy button.” You’ll see in the upper right hand corner, there is an option to select order types. The most generic order type is Market Order, but other order types exist for advanced traders.

Enter in the number of shares you want to purchase.

Verify the Available Balance can cover the purchase. Robinhood will stop you if you cannot cover the full price of the stock.

Review your order and swipe up to confirm! Congratulations, you’ve purchased your first ETF or stock.

Click to Tweet! Please Share!Click To TweetSummary: How to invest in exchange trade funds

Exchange trade funds are a collection of stocks offered at one low price. It’s an easy and generally safe way to invest and diversify your portfolio. However, you are still investing in assets like stocks which means you may be subject to market volatility.

The fund manager makes a yearly commission for managing the ETF holdings, stocks within the ETF. Generally, this fee is anywhere from 0.07 to 1%. Investing in low cost index funds is important to reduce the impact to your portfolio.

You make money with ETFs in two different way, dividends and capital gains. Dividends are cash payments paid to shareholders in excess of companies profits. Capital gains or losses results from a change in value of the companies share price.

In order to purchase your ETF, you’ll need a brokerage account and to know what ETFs you want to invest in. Identify how aggressive you want to be and identify your portfolio balance accordingly. Finally, purchase your exchange trade fund through your brokerage account.

That’s it!

Questions or comments? Let me know in the comments below!