Can ETFs make you rich?

The right low-cost exchange traded funds can make you rich with consistent investing over time. ETFs such as a low-cost S&P 500 fund have returned annualized returns around 10%. Therefore, buy and hold investors typically see positive returns when investing for the long term.

Imagine, simplified investing which can make you millions of dollars. You find the right ETFs and contribute every month to retire with $1-2 million dollars or more!

Who doesn’t want to save one million dollars?

Luckily for you, compound interest is your friend when it comes to ETF investing. I’m going to show you how ETFs can make you rich. I’ll even show you what the best strategy is for ETF investing.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Can ETFs make you rich?

Buying low-cost exchange traded funds consistently can make you rich. Investing in an ETF provides easy diversification to reduce investment risk. However, it’s important to understand the goal of the ETF before you invest to minimize investment risk.

It’s important to invest in a low-cost exchange traded fund to minimize investment fees. Expense ratios for ETFs range from 0.03% to well over 1% annually. Therefore, a $100,000 portfolio might see fees ranging from $30 to $1,000 or more each year.

Making matters more complicated, is that fees range widely depending on the fund manager. For example, Vanguard offers a S&P 500 ETF with an expense ratio of 0.03%. Invesco’s S&P 500 expense ratio is 1.29%!

You should also be aware of turnover rates which is how frequently stocks are changed within the fund. A high turnover rate can cost more money in buying and selling fees.

ETFs provide a good level of diversification. You’re gaining access to hundreds of stocks by purchasing one share of an ETF. There are plenty of other stocks, so no worries if a few aren’t performing.

You should also be aware of each ETF’s goal and what the fund is aiming to do. For example, an S&P 500 fund like VOO tracks the performance of the S&P 500. However, SH shorts (bets against) the S&P 500 so you make money when the S&P 500 declines.

In most cases, choosing from the List of Vanguard ETFs is a safer choice. However, consult an investment professional when unsure.

Click to Tweet! Please Share!Click To TweetHow do ETFs make you rich?

Exchange traded funds make you rich through capital gains and dividend reinvestment. Investing consistently over time and taking advantage of compound interest grows wealth. Your portfolio tends to grow in value the longer and more consistent you invest.

Consistency is the key when it comes to investing. The more money you can contribute, the larger your portfolio will grow. Investing at a young age with consistent contributions is the easiest way to build wealth.

At 8% ROI, a $100k investment would become $993k in 30 years. However, starting with $100k and adding $5k per year makes your portfolio $1,464,000 in 30 years.

Over time, the shares of individual stocks within the ETF will grow in price. Price increases are known as capital gains, which is the primary way you’ll make money with ETFs.

Some stocks choose to pay a dividend which is a cash payment. Reinvesting the profit from these dividends will allow your dividends to produce more income.

Compounding interest is the concept that your money begins to make money. A $100k portfolio earns 10% or $10k per year. However, a $1M portfolio earning 10% earns $100k per year. Next year, you’re starting with $1.1M and earning $110k per year at 10%.

The problem is that it’s hard to get your first $100k because it’s primarily savings. A $10k portfolio only earns $1k per year. Therefore, the more money you can put into investing, the easier investing becomes.

What is the best strategy to get rich with ETFs?

Buy and hold investing is the best strategy to get rich with an ETF. Trying to time the market rarely works out and missing a large gain in the market can be costly. The majority of active traders are actually losing money. Therefore, buy and hold investing is the ideal strategy.

J.P. Morgan did a study in which they assumed you missed the best days in the market. Simply missing the 10 best days, your overall return was cut in half!

Imagine, ending up with a $500k portfolio instead of $1M because you tried to time the market. Nobody knows when the market is going to have an amazing day.

Studies have shown the majority of active traders end up losing money. Companies like Robinhood have made it extremely easy for individual investors to trade, commission free. However, the majority of investors aren’t experienced enough to make money.

Some ETFs are actively managed, which means a fund manager tries to beat market performance. These fund managers are seen as the best and brightest, but the majority can’t beat a simple S&P 500 index fund.

So, if a professional fund manager can’t beat a passively managed index fund, why should we try?

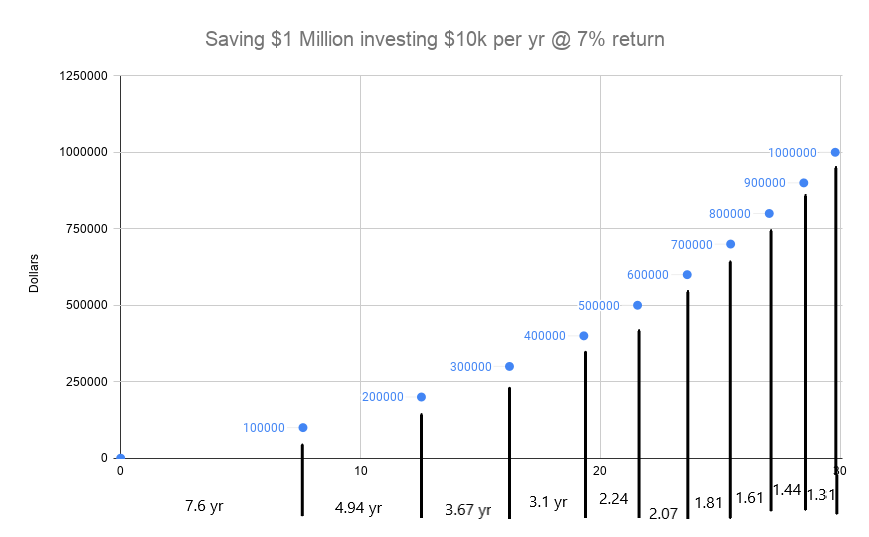

How long does it take to save $1,000,000 using ETFs?

It takes 30 years to save $1,000,000 by investing $10,000 per year with an annual return of 7%. Less time is required to hit one million by investing more money or finding a better rate of return. Therefore, the only thing that matters is your savings rate.

A savings rate is the amount of money you can save and invest from your income. Someone making $50k per year who saves $30k is better off than someone making $100k saving $10k.

Use an investment calculator to help determine your timeline to $1,000,000. Enter in your current savings, expected rate of return, and your investment timeline.

For example, let’s say you’re 30 years old and have $70k invested. Moving forward, you’re going to invest $25k per year into an S&P 500 index fund (average annual return of 10%). By the age of 65, your total investment could be worth $10.1 million.

Now, let’s assume you’re 30 with $70k invested. However, you can only invest $10k per year. At age 65, your total investments are worth $5.4 million.

The key to saving one million dollars is time and amount invested.

Click to Tweet! Please Share!Click To TweetSummary: Can ETFs make you rich?

As you can see, ETFs can make you rich with buy and hold investing. It is important to understand the fees and overall goal of your ETF prior to investing. Overall, ETFs are a good way to diversify your portfolio and build wealth.

Look for ETFs with a low expense ratio. Too many fees can impact your overall returns over your investment timeline. Be aware that a fund may have turnover rates which can cause additional fees.

The best strategy for ETF investing is buying and holding. ETFs are typically not a good idea for short term profit. Most active traders end up losing money, even professionals.

How long it takes you to save $1,000,000 depends on savings rate and rate of return. Find a way to invest more money to reach one million dollars faster.