So you want to know how long it will take you to save $1 million dollars?

Imagine, having one million or more dollars in an investment account. Nothing sounds greater than checking your brokerage account to see $1,000,000.

For some, having that much money would be enough to retire on! Would you retire with $1 million in the bank?

One million is a lofty goal, but it is achievable with the right plan. Luckily for you, I’m going to show you exactly how much money you need to save in order to reach $1 million.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Two factors that affect saving $1 million dollars

Only two things matter when you’re trying to grow your net worth, savings rate and rate of return. Both are very important to understand and both greatly affect how quickly you can save one million dollars.

Savings rate is all about how much money you earn vs save. The goal of building wealth is to save the most amount of money. Let’s face it, retirement is a numbers game and whoever saves the most will retire first.

Someone who earns $100,000, but only saves $10,000 per year is worse off than the guy earning $50,000 who can save $25,000 per year. The $50,000 per year earner can save and invest more money. Therefore, he would reach $1 million before the person wasting their $100k salary.

Rate of return is how much money your investments earn you each year. Someone who earns a 7 percent rate of return on $100,000 will earn $7,000 in one year.

The stock market has an average rate of return around 10 percent. For most of us, we will be turning to the stock market to help us grow our money faster through compounding interest.

Click to Tweet! Please Share!Click To TweetYour first $100,000 is the hardest

Compounding interest is the concept that our returns will start to make us more money as time goes on. Essentially, the rich get richer because of compounding interest.

As you get more money invested, your investments begin to do more of the heavy lifting. Eventually, your investments will earn you more money than what you contribute. Interest earned on $1 million is way more than you earn with only $10,000 invested.

Assuming 10 percent rate of return, your $10,000 investment would earn you $1,000. While that may sound nice it isn’t going to make you a millionaire anytime soon. You are essentially saving your first $100,000 which is where things start to pick up.

Now, you’ve finally hit $100,000 in investments. That same 10 percent is now earning you $10,000 per year! Next, you’ll be earning $20,000, $30,000 and so on at each of the $100,000 increments.

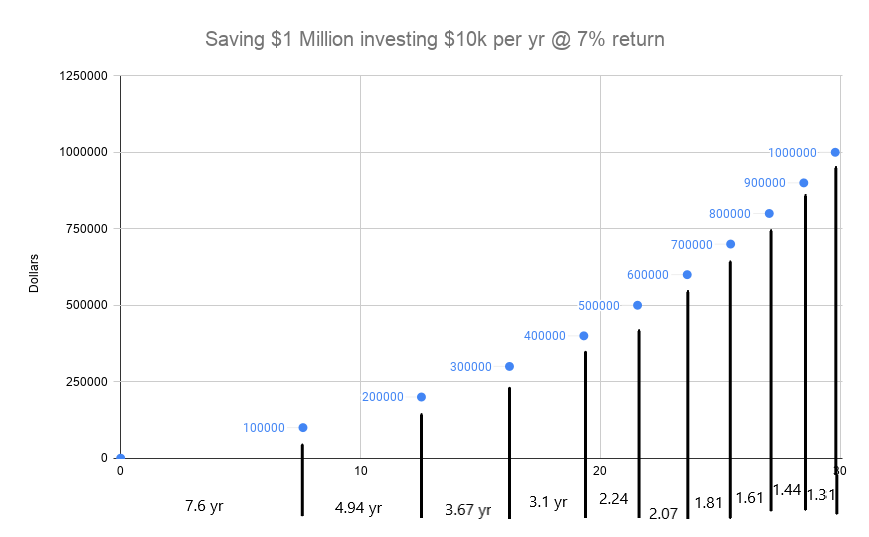

Now, let’s assume you invest $10,000 per year and earn 7% return.

It takes 7.6 years to save your first $100,000! You’ll save your next $100,000 2.6 years quicker, leaving you with $200k.

Overall, it takes 30 years for you to save $1,000,000. What’s interesting is that saving your first $300k takes nearly half of the time at just over 16 years! The other $700k is built over the next 14 years thanks to compounding interest. The more money you have invested the less work you have to do to build wealth.

How much interest would you earn on one million dollars? Can I live off the Interest?

As previously mentioned, leaving your money in the stock market has generally returned 10 percent every year. Therefore, conservatively assume you would earn anywhere from 6-10 percent return on investment.

Six to 10 percent would generate you an average investment return between 60k and 100k per year from a one million dollar portfolio.

Most people plan to live on the 4 percent withdrawal rule. Basically, the 4 percent rule says you can withdraw 4 percent of your invested balance and have a high likelihood you will not run out of money over 30 years.

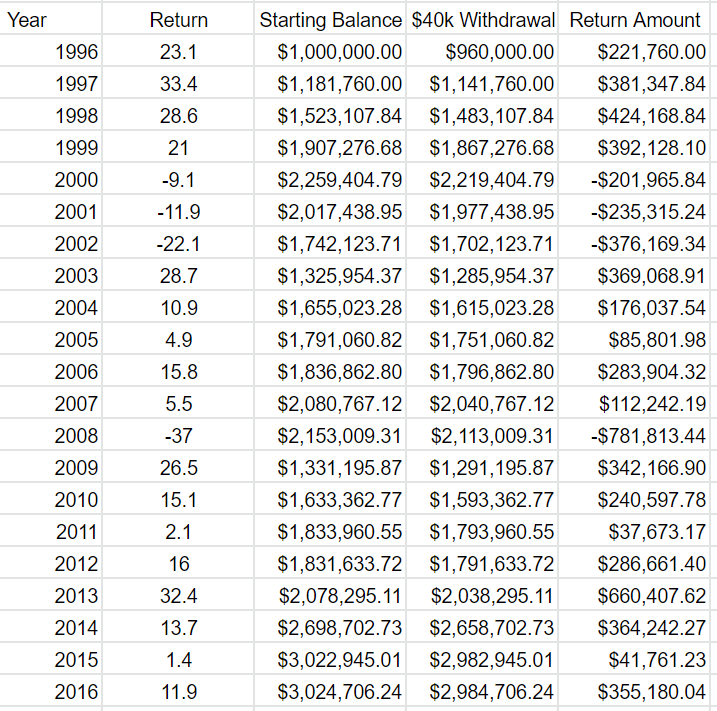

Let’s take a look at how your $1 million portfolio would have performed over 20 years of stock market returns.

Making some general assumptions, your $1 million portfolio would have grown to $3M from 1996 to 2016, only withdrawing $40,000 each year. You would still need to adjust for inflation and would most likely increase your $40k withdrawal.

The best thing you can do for yourself is use an investment withdrawal calculator. This will help you understand if you have enough money to live off of in retirement.

Click to Tweet! Please Share!Click To TweetHow long does it actually take to save $1 million dollars

As we talked about earlier, the only thing stopping you from reaching $1 million is your savings rate and your rate of return.

In order to control your rate of return, you will need to select your investment choices carefully. For most of us, we choose to invest in the stock market or about 10 percent return. However, other people have made more through Real Estate or other means.

The best thing you can control is how much money you save every year or your savings rate. You can cut expenses, but eventually you will need to focus on growing your income.

So how long does it take to save $1 million in 5, 10, 15, 20, or 30 years? Let’s take a look:

| Yearly Investment Contributions | 5 Percent ROI | 7 Percent ROI | 10 Percent ROI | 12 Percent ROI |

|---|---|---|---|---|

| $10,000 | 36 Years | 30 Years | 24 Years | 22 Years |

| $15,000 | 29 Years | 25 Years | 20 Years | 18 Years |

| $20,000 | 25 Years | 22 Years | 18 Years | 16 Years |

| $25,000 | 22 Years | 19 Years | 16 Years | 15 Years |

| $30,000 | 20 Years | 17 Years | 15 Years | 13 Years |

| $35,000 | 18 Years | 16 Years | 14 Years | 12 Years |

| $40,000 | 16 Years | 14 Years | 13 Years | 12 Years |

Note that the years are rounded to the nearest year and assumes you have nothing currently invested. You can always use an investment calculator to estimate a savings goal closer to your situation.

Click to Tweet! Please Share!Click To TweetHow can I start investing towards my $1 million dollars?

To start saving for your $1 million there are a few steps you need to take.

- Budget and cut expenses

- Open a Brokerage Account

- Invest Money

- Grow Your Income

Start by creating a budget if you haven’t already. You need to cut away excessive spending so that you have more money to invest.

Next, you’ll need to open a brokerage account, like Robinhood. A brokerage account is the middleman between you and the stock market. If you want to buy a stock, then you need to place an order through your brokerage account.

Investing your money is the next step, but it’s one of the hardest for people to do. Most people struggle to save for the future and money burns a hole in their pocket. Set up automatic deposits to help save money automatically.

Finally, you need to focus on growing your income any way you can. Growing your income is the fastest way to reach retirement. Imagine being able to save $10,000 on a $50k salary. Now, if you got a promotion or a new job that paid $60k, you’d be able to save $20k per year!

Summary: How long does it take to save $1 million dollars?

The only two things that matter when it comes to saving $1 million is your savings rate and rate of return. Savings rate is how much you earn compared to how much you save. Rate of return is how much your investments grow year over year.

It would take you about 30 years of investing $10k at a 7 percent return on investment to have $1 million. Most people need to focus on growing their income so they can invest more. Growing your income and investing more will help you reach the $1 million mark faster.

Saving your first $100,000 will be the hardest. Saving your first $100k is all about how much money you can save because you don’t earn much in interest on your money. Eventually, your investments start to earn more money than you put in every year!

Technically, you can live off the interest of $1,000,000. However, you will have to consider your unique situation. Can you live off of 4% or less withdrawal rate? Can you handle a recession?

To start saving for your $1 million there are a few steps you need to take.

- Budget and cut expenses

- Open a Brokerage Account

- Invest Money

- Grow Your Income

Your money is an asset if used correctly. Keep investing and you’ll be a millionaire before you know it!