Where is the best check cashing place near me?

Check cashing places near you include banks, credit unions, ATMs, Grocery and retail store customer service centers, cash advance stores, and gas station Travel Centers. Each location offers a convenient source for cashing checks, but fees vary depending on location.

You don’t need to worry if the bank is closed and you need to cash a check. Banks are usually the ideal location to cash a check, but that’s not always an option.

It’s your money, so you deserve access to your money!

Luckily, I will show you the best check cashing places near me so you can cash a check 24/7. With this guide, I hope to make your check cashing the most seamless and hassle-free experience.

Key Takeaways:

- Check cashing near me open now includes grocery stores like Walmart, Winco Foods, and Kroger affiliate stores, automated telling machines, gas station travel centers like Pilot, and cash advance stores like PLS 24/7 financial services.

- Banks and credit unions are the best places to cash your checks because they’re low-cost and often free for members.

- Check cashing places open on a Sunday include Walmart, Kroger, PLS 24/7 financial services, Pilot, and ATMs.

- Banks will often offer mobile banking apps where you can direct deposit a check through the app. You can also download Ingo Money App, PayPal, or Venmo from Google Play or Apple App Store and cash a check via the apps.

This article may contain affiliate links that pay a commission and supports this blog. I appreciate your support!

Check cashing places near me

Several places near you can cash a check and are open 24/7. Unfortunately, only some locations are open all day every day, but options are available.

The best check cashing places include:

- Local Banks

- Credit Unions

- Mobile Deposit and Check Cashing Apps

- Your Bank’s Mobile Banking App

- PayPal Check Cashing

- Venmo Check Cashing

- Ingo Money

- ATM check cashing

- Grocery and Retail Customer Service Desks

- Walmart

- Kroger

- Winco Foods

- Cash Advance Stores

- MoneyTree

- PLS 24/7 Financial Services

- Speedy Cash

- Money Mart Financial Services Group

- Ace Cash Express

- Gas Station Travel Centers

- Pilot Flying J

- Travel Centers of America

- Western Union Check Into Cash Kiosk

- MoneyGram

Banks and Credit Unions should be your first stop for cashing a check. Unfortunately, banks don’t always have the best hours. Other options for check cashing include ATMs, Grocery and retail customer service centers, cash advance stores, and gas stations.

When check cashing, you need to be aware of fees. If you’re not careful, the service fees can take a large portion of your check.

While there is no shortage of places you can quickly cash a check after banks are closed, each business will have its own rules and caveats, such as:

- Every business will require a government-issued ID

- Some will only cash certain types of checks

- Each company will have different surcharges

- Some will have limits on how big of a check they can cash.

Check each business’s rules before trying to cash your check. Even the largest chains can have hours, rules, and surcharges that will vary.

Click to Tweet! Please Share!Click To TweetBank or Credit Unions

Your bank or local Credit Union is the best place to cash a check. Typically, most banks offer their members free check cashing. If you don’t have a bank account, you can cash the check at the issuing bank for a fee or endorse the check to someone with a bank account.

Consider opening a bank account if you don’t have one. Bank accounts are free to open. Typically, opening an account requires:

- A photo ID, such as a driver’s license

- Social security number

- Date of birth

- A physical address

- A minimum deposit.

You can cash unlimited checks once you’ve opened a bank account.

In-Person

It would be best to start cashing checks at your local bank or Credit Union. Check cashing is usually a service that is offered for free to members.

Mobile Banking Apps

Most member FDIC banks will offer check-cashing services via a mobile app for convenience.

For example, First Century Bank offers the Ingo Money app which allows you to cash a check from your smartphone. The money is then deposited in your bank, to a prepaid card, or PayPal account and allows you to buy Amazon gift cards, pay bills, or pick up cash at MoneyGram store locations.

Endorse the check for cashing

The next best option is to endorse the check to someone you trust with a bank account. Your friend can then cash the check and return the money. With this method, you’ll avoid extra fees but rely on a friend.

To endorse the check:

- Write “Pay to the order of” and your friends name

- Sign the back of the check

Your friend is now the owner of the check. They can now cash it at their bank and give you the money.

Cashing the check at the issuing bank

Alternatively, you can cash a check at the issuing bank. However, the bank may charge a fee if you don’t have an account.

Here is a table for convenience of common bank fees for non-customers. Note: Fees are subject to change, and you’ll need a photo ID.

| Bank or Credit Union | Check Cashing Fee (non-customer) | Notes |

| Bank of America | Under $50, Free | Requires a full-service financial center if you don’t have an account. |

| Chase Bank | $8 per check | Read the full agreement |

| Wells Fargo | $7.50 | None |

Need help finding your bank? Check here for a complete list.

Automated Teller Machines

Most banks will allow you to deposit or cash a personal check using an automated teller machine. Consult the bank for foreign or cashier’s checks. A bank account is required with the bank to cash a check at an ATM.

A bank account is required because you must insert your debit or bank card into the ATM. Once you have inserted your card, follow the on-screen instructions for check cashing.

Use your bank’s ATM locator to find the nearest ATM. Verify that your bank allows check cashing at ATMs before making a special trip.

Grocery and Retail Store Customer Service Centers

Grocery and retail stores offer check cashing at the customer service center. Fees will vary depending on the grocery store or retailer. Stores like Walmart can be open 24/7 and offer check cashing solutions.

Grocery and retail stores are one of the most convenient places to cash a check. You will most likely be at one of these stores to do your grocery shopping anyways. However, you will have to pay a fee to take advantage of the service and convenience.

Walmart

Walmart is one of the most convenient places to cash your check because they are so widespread, with over 4,700 locations, so it should be easy to find one near you. Even better, many Walmart stores are either open late or 24 hours.

What Kind Of Checks Does Walmart Cash?

You will need an ID to cash your check at Walmart, so remember it! Walmart offers check cashing with fees up to $4 for checks up to $1,000. Checks over $1,000 are subject to a maximum $8 fee.

Walmart is one of the best businesses to cash checks because they will accept just about any type. These may differ depending on your region. They include but aren’t limited to:

- Payroll

- Government (Including stimulus)

- Cashiers

- Tax returns

- Money orders

- 401k & retirement checks

- Insurance settlements

- Two-party checks (up to 200$)

Kroger And Its Affiliate Stores

Kroger is a conglomerate that owns a bevy of grocery stores in 31 states, including:

- City Market

- Fred Meyer

- Pay Less

- King Soopers

- Baker’s

- Smith’s

- Dillons

- Ralphs

- Gerbes

- QFC

- Fry’s

Next to Walmart, you would be hard-pressed not to find a Kroger-owned grocery store in your area.

What Types Of Checks Does Kroger Accept?

Kroger won’t cash as many types of checks as Walmart, but they will still accept:

- Payroll checks

- Business checks

- Insurance settlements

- Government checks (including tax refunds)

You should note that Kroger will not accept personal checks. You can still pay for your groceries with a personal check, but they will not cash a personal check for you, unfortunately.

Do I Need an ID To Cash A Check At Kroger?

You must have a valid, government-issued ID to cash a check at Kroger. Any Kroger affiliates will not cash your check without identification.

Acceptable forms of ID include:

- State ID

- Drivers License

- Military ID

- United States passport (other countries won’t suffice)

On top of having the correct identification, you will need to know your social security number. You don’t need the actual social security card, but you will need to know your number for the paperwork you fill out.

Winco Foods

Winco will cash payroll checks up to $1,000. The fees include $5 for up to $500 and $10 for amounts over $500 and up to $1,000. Winco requires a valid ID and must be able to verify your employment before offering payroll check cashing services.

Cash Advance Stores

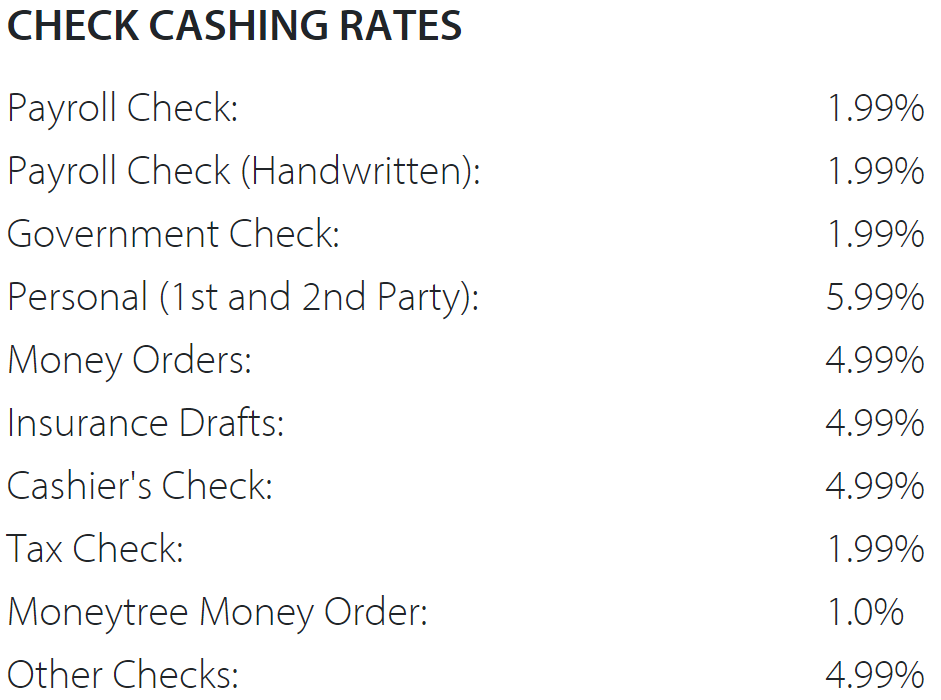

Cash advance stores, like Money Tree, are another option for cashing checks. The advantage of cash advance stores is they are typically open late. However, most cash advance stores charge large fees for check cashing.

They usually offer multiple services such as:

- Check cashing

- Payday loans

- Registration loans

- Title loans

- Installment loans

These loans come with high-interest rates, so it’s better to stick with the check cashing option.

In most cases, it would be better to cash your check at Walmart. Cash advance stores make most of their money from large fees and payday loan interest rates. Not only is Walmart usually open 24/7, but the fees are cheaper.

For example, a cash advance store near me offers check cashing of personal checks for a fee of 5.99%. A check for $200 would cost me $12 at this cash advance store. However, cashing that same check at Walmart costs up to $4.

As you can see, you are being charged three times the amount for the same check. Again, most fees can be avoided by having a bank account. However, if cashing your check at a bank is not an option, you should only pay what you have to.

Check cashing stores tend to deal with customers who may have had credit difficulties in the past and are not accepted at most financial institutions. Each new customer will most likely need to go through an application process to verify their needs are legitimate and not of fraudulent intent.

PLS 24/7

One of the most popular check cashing businesses is PLS 24/7 check cashing. They are located in 12 states and are open 24 hours a day and seven days a week.

It doesn’t get much more convenient than this, plus they cash a bunch of different checks and offer low rates.

Where Is PLS 24/7 Located?

Lucky for you, PLS is located on both coasts and almost everywhere in between. You should strongly consider using their services if you live in one of the states it operates in.

Currently, PLS operates in:

- Arizona

- California

- Illinois

- Indiana

- Kentucky

- Massachusetts

- New York

- North Carolina

- Ohio

- Oklahoma

- Texas

- Wisconsin

They are located in so many states because they can cash many different types of checks for a very nominal surcharge, including personal checks, which is rare with check-cashing businesses.

What Services Does PLS 24/7 Offer?

PLS offers some of the lowest rates for check cashing, with rates starting at $1 + 1% of the check’s total amount. They can cash many different types of checks, including:

- Government checks (including stimulus checks and tax refunds)

- Payroll checks

- Business checks

- Personal checks

- Checks from other states

It’s not hard to see why PLS 24/7 is so popular in the check-cashing game.

Speedy Cash

Speedy Cash operates as a Credit Access Business and provides the following services:

- Installment loans

- Payday loans

- Fast cash loans

- Line of credit

- Online loans

- Short-term loans

- Title Loans

- Funding times

- Cash advance loans

- Loans by phone

- Payday advances

You can also cash a check at Speedy Cash, even without a bank account. You’ll need to bring the check and a valid identification. Once you go to the nearest check cashing store, they’ll verify the check, who wrote it, the amount, and charge a minimum $2 fee.

Money Mart®

With Money Mart Financial Services Group, you can download the mobile check cashing app via Google Play or the Apple App Store. Just like the other cash advance stores, they cash the following checks:

- Payroll

- Government

- Small business

- Personal

- Insurance checks

- Money orders

You can also stop by any of there physical locations for other services such as loans, Western Union money transfers, and money orders.

Ace Cash Express

Another option is Ace Cash Express. Each local branch can cash the following checks:

- Payroll

- Personal

- Business

- Income tax refund checks

- Government checks

- Insurance settlement checks

- Money orders

Gas Station Travel Centers

Certain gas stations and gas station Travel Centers can cash checks. The easiest way to find out which gas stations cash checks is to do a quick Google search. Some gas stations will instead load your check onto a prepaid debit card.

Pilot Flying J and Travel Centers of America are the most popular gas stations that cash checks.

Money Transmitter Services

Money transfer services are not considered banks, but they can transfer money. Examples of money transmitters include:

- Walmart’s MoneyGram International Inc.

- Western Union Financial Services

- PayPal

- Venmo

In fact, some of these money services will let you direct deposit a check using their mobile app.

Ingo Money App and MoneyGram

MoneyGram will cash paychecks, government checks, and any tax refund check. Check cashing fees include $3 for checks under $1,000 and $5 for checks between $1,000 and $5,000.

But what if you don’t see your type of check?

Consider downloading the Ingo Money App. The Ingo Money App allows you to cash personal checks, paychecks, and business checks from your smartphone. You can then transfer the check amount to various places, including your bank or getting cash at MoneyGram.

Western Union Check Into Cash Kiosk

Western Union provides multiple kiosks around grocery and convenient stores which you can use to cash your check. The fees are typically under 5% of the check amount.

If Western Union sounds like it meets your financial needs, consider checking out Fiscal Tiger’s guide to cashing checks at Western Union. The guide covers everything you need to know about cashing checks at Western Union, such as type of checks, fees, and service hours.

PayPal

Downloading and using the PayPal smartphone app is one of the easiest ways to mobile deposit your cash. To cash a check from the app:

- Go to cash a check in the wallet

- Take a picture of both sides of the check

- Select Next

From here, you’ll be given the option for Instant Deposit or a Standard Deposit. The Instant Deposit charges a $5 minimum fee and will give you access to your money instantly. Selecting Standard Deposit is free, but you can expect your money to be available within 10 business days.

Venmo

Similar to PayPal, you can also use Venmo to cash your check. Assuming your account is setup, cash a check through Venmo app by:

- Go to “Me” tab

- Select “Manage Balance”

- Select “Cash a Check”

- Enter the Check Amount

- Take pictures of both sides of the check

- Select “Next”

As with PayPal, you’ll be asked if you want the Instant Deposit or Standard. Again, Instant Deposit charges a fee, but is instant while Standard is free but you’ll have to wait 10 days for access to your money.

Click to Tweet! Please Share!Click To TweetSummary: Check cashing places near me (Open now and 24 hr per day)

As you can see, many 24-hour check cashing places. Your bank or Credit Union is the best and cheapest place to cash a check. However, only some can open a bank account, so you might have to pay some fees.

If you’re not in a hurry consider a mobile check deposit. Most banks offer a mobile banking app, or you can download the Ingo Money App, PayPal, or Venmo. These apps allow you to take a picture of both sides of the check and direct deposit into your account.

The next best option is to endorse your check to a friend with a bank account. They can cash the check for you without fees. Some banks may even allow you to cash a check at an ATM, up to the maximum ATM withdrawals limit.

Your next best option is to cash a check at a grocery or retail service center. For example, Walmart is open 24/7 and charges minimal fees compared to everywhere else.

You can cash a check at certain gas stations and Travel Centers if you travel. You can ask the cashier or do a quick Google search to find out which gas stations cash checks.

Cash advance stores are the last places you should try and cash a check. Most cash advance stores charge a large fee for their services. You can almost always find a cheaper place to cash a check.

Recommended

Based on this article, we think you’ll enjoy the following:

-

- How to write a check to yourself for cash

- How to get a cancelled check

- Cashing third party checks (Everything you need to know)

- Can I deposit a check for someone else?

- How to endorse, deposit, and cash a check for a minor

- How to cash a check without id

- Check cashing places open on a Sunday

- How do check cashing places work?

- Can you cash someone else’s check?

- What happens if I cash a bad check?

- Can I cash or deposit an old check?

- How old do you have to be to cash a check

- Best places to cash a check for free