Is $3,000 per month ($36,000 per year) a good salary?

$3,000 per month is not a good salary to live on. $36k per year is below the median household income of $67.5k. After-tax income is estimated at around $2,400, not counting withholdings, deductions, or allowances. The majority of a $36k salary will be consumed by everyday living expenses, making it hard to build wealth.

However, living on $3,000 per month is possible. A careful budgeter and minimalist should do well on $36k per year in the right area.

Luckily for you, I will show you why $36k isn’t considered a good salary. I’ll show you what is considered a good salary and the best places to live for $36k. Ultimately, your strategy should be to raise your income level and start building wealth.

Key takeaways:

- $3,000 a month is $36,000 per year.

- $3,000 a month is not considered a good salary. Most of your salary will be spent on living expenses and easily consumed by inflation. A $36k household income is considered lower income.

- $67.5k is considered the 2020 median household income.

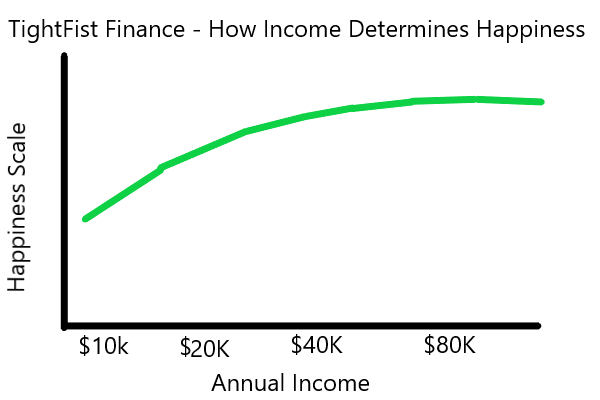

- A $75k salary results in optimal happiness. Salary increases above $75k result in minimal happiness increases. A rise in pay at $36k results in substantial lifestyle improvements but has minimal impact above $75k.

This article may contain affiliate links that pay a commission and support this blog! I appreciate your support!

Is $3,000 per month ($36,000 salary) considered good?

A $36k salary is not considered a good income. According to PEW Research, middle-class income is between $42k and $126k per year. Therefore, a salary of $36k per year leaves you in a lower income class. Additionally, a 36k salary is typically consumed by the high cost of living.

First, $3,000 per month puts you in a low-income bracket. For a single person, you may do fine on $36k per year if you are low-maintenance. However, families of two or more people struggle to keep expenses low.

At $36k, you’re only $6k away from being considered middle class. However, depending on your living cost, even the middle class’s low end can be a struggle.

Recognize that higher-paying jobs are out there that don’t require a degree. Even a bump to $45k per year would significantly increase your income.

The high cost of living is the major concern with earning a $36k salary. Most of your paycheck will probably be consumed by normal expenses, like rent and groceries. Therefore, investing in building wealth or covering a costly emergency can be hard.

$3,000 per month is only around $2,400 without tax withholdings, deductions, and allowances. Contributing to pre-tax deductions like your 401k or employer-sponsored medical programs can further reduce your take-home pay.

For example, contributing $300 to a 401k would reduce your take-home pay. You would reduce take-home pay from $2,465 to $2,201 for a $300 contribution. You can use a paycheck calculator to estimate your paycheck.

Click to Tweet! Please Share!Click To Tweet

What is considered a good salary?

A household income of $67,521 per year is considered median and should be adequate to support a family. Maximum happiness is achieved at $75,000 per year. Studies have found earning more money above $75k results in minimal increases in one’s overall happiness.

The lower your current income, the easier it is to improve your happiness and stress with minimal increases in income. For example, someone making $36k and receiving a raise to $40k would see more joy than $70k to $74k.

So the typical household earner who makes $67.5k is considered reasonably happy. However, the earner still has room for improvement in terms of happiness.

These results come from your ability to live without worrying about a financial emergency. It’s much easier to fix a broken car when you’ve more disposable income at $70k per year. However, a broken-down car can be devastating when living paycheck to paycheck.

Once you’ve reached $75k, promotions don’t buy you more peace of mind. Instead, your disposable income can be used to invest or go on vacation.

Where can I live on $36,000 per year?

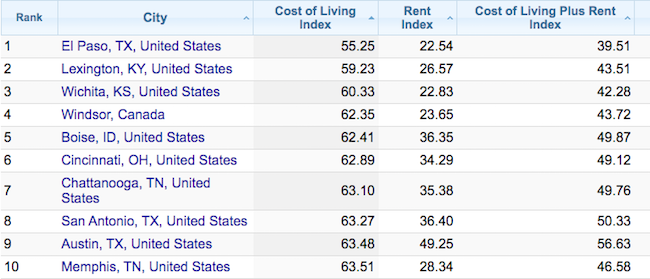

Living on $36k per year is possible, but it’s easier in rural, low-cost living areas. The lower the cost of living, the less expensive it is to live and pay for rent, groceries, gas, etc. El Paso, TX, Lexington, KY, and Wichita, KS are some of the best low-cost living areas.

An easy way to determine a city’s cost of living is to look at the cost of living index. A cost of living index is a numerical representation of how expensive or cheap it is to live in a city. A score of 100 indicates neutral, above 100 is more expensive, and below 100 is inexpensive.

Numbeo has compiled the cost of living indexes for you. Sorting by the cost of living index, you can find the best areas to live on $36,000.

You can find a job that pays $36k or better in any city. Yes, moving may be expensive, but it may save you money in the long run.

Click to Tweet! Please Share!Click To Tweet

Summary: Is $3,000 per month a good salary?

As you can see, living on $3,000 per month isn’t the easiest or happiest salary. You would make around $2,400 in net income, not counting any withholdings or tax benefits. Therefore, any pre-tax deductions, like medical or 401k, would impact your net income substantially.

The primary concern with earning $3,000 per month paying for basic expenses. Your rent, utilities, and other necessities are going to consume your paycheck. Living on $3,000 monthly won’t leave much in your pocket to invest and build wealth.

However, living on $3,000 monthly is easier for a single person. Adding a second person, or even a third, can make living difficult.

A good salary is considered to be $67.5k to be considered average. If you want to maximize happiness earned from income, shoot for $75k per year. Shooting for such a high income can be overwhelming. Instead, focus on gradually increasing your income.

You can easily find a city with a low cost of living if you’re willing to move. Jobs that pay $36k a year are everywhere. Finding a low-cost living area can improve your expenses simply because prices are much lower.