What is a good salary to make to live comfortably? Does it matter if you’re single, married, or have a family of four?

The ideal salary which all households should strive for is $75,000. Singles and couples should strive to earn double their monthly expenses while saving 20% of their income. A family of four will need to aim for four times monthly expenses while saving 20% of income.

Imagine making enough money to live comfortably. You no longer have to live paycheck to paycheck. Your family might even take a vacation once in a while.

How could your life change if you weren’t so stressed about money?

Luckily for you, I’m going to talk about what a good salary to make is for you to live comfortably. I hope you can use this information to better your situation or feel more relaxed about your income.

Key Takeaways

- A $75k salary is considered a good salary to live comfortably. A Princeton survey shows that optimal happiness is achieved at a salary of $75k, and pay increases over $75k result in minimal happiness gains.

- A good salary for singles and couples is to earn double their monthly expenses while saving 20% of their income.

- A good monthly income for a family of four is considered four times your monthly expenses while saving 20% of your income.

- Your salary increases should be between 5-10%. Pay raises under 5% risk not keeping up with inflation.

This article may contain affiliate links that pay a commission and support this blog. I appreciate your support.

What is a good salary to make to live comfortably?

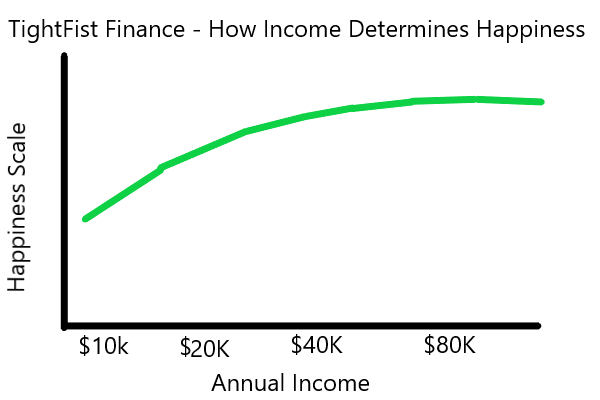

A Princeton survey of over 450,000 people set out to find out if money does buy happiness. Not surprisingly, the answer is yes, money can buy happiness. However, money can only buy happiness to a point.

The survey found that happiness increases significantly up to a household income of $75,000. After $75,000, happiness begins to taper off.

According to the United States Census Bureau, the median 2020 household income was $67,521. Therefore, most Americans can still increase happiness by increasing their income.

The results of the survey are based on household income. Therefore, it doesn’t matter if you are single, married, or have a family of four. If you make $75,000 or greater, you have achieved optimal happiness through income.

Interestingly, people making less than $1,000 per month have more problems than those making over $3,000. Low-income people experience less happiness on the weekends, frequent headaches, asthma, divorce, and are more likely to be alone.

That being said, $75,000 would still be more beneficial to a single person than a family of four.

Click to Tweet! Please Share!Click To Tweet

Double your expenses is a good salary for a single person

Most financial advisors recommend that a single person aim to earn at least double their monthly expenses.

Of course, most people plan their monthly expenses around their salaries, so this advice doesn’t exactly help. Instead, it’s better to consider your regional cost of living and personal expectations to gauge what’s regarded as a high salary for a single person right out of college.

Many single people find it easier to save and budget since they don’t have to plan for others’ wants and needs.

For example, a single person living in rural Nebraska may be able to survive on $100 a week since they’re less likely to spend on special occasions. On the other hand, a couple may spend that same amount in just a few days at a restaurant or event.

Likewise, a single person living in New York City may struggle to spend less than $300 a week simply due to the higher price of food and transportation within the city. Then, with the added rent price, it would be difficult to survive on a salary of less than $3,500 a month, and, even then, they wouldn’t be living comfortably.

Therefore, it’s essential to gauge the living wage. To do so, researchers at the Massachusetts Institute of Technology have developed a calculator that accurately measures regional data and generates estimates by location.

For example, a single person living in California should aim to earn at least $3,500 a month, whereas someone in Kansas could live comfortably on just $2,600.

These estimates only account for basic expenses, though.

To qualify for a “good” salary, you should save roughly 20% of your monthly income.

So, a single person living in Middle America should earn around $3,250 a month, and someone living in California or New York should earn roughly $4,500 a month if we calculate savings into the equation.

Double your expenses is a good salary for a couple

A couple may have different joint expenses than a single person, but the same basic principles apply.

A good salary for a couple is at least double their monthly expenses, with the addition of a 20% savings goal. Therefore, a couple that spends $3,000 a month should aim to earn $7,000 a month between the two of them.

Of course, this is just a general guideline, and every couple has unique circumstances.

A married couple with no children may have different expenses than a couple with one child. Likewise, a couple who owns a home will have different expenses than those who rent an apartment.

To get a better understanding of what a good salary is for a couple, consider the following factors:

- Number of children

- Homeownership

- Location

- Lifestyle

- Debt

These factors will play a role in the couple’s overall monthly expenses and, as a result, their desired salary.

To give a more specific answer, a couple with no children who rents an apartment in a small town in the Midwest may only need to earn $5,000 a month to live comfortably. On the other hand, a couple with a child who owns a home in a major metropolitan city may need to earn closer to $10,000 a month.

Four times expenses is a comfortable salary for a family of four

A family of four has more mouths to feed, so their monthly expenses will be higher than a single person or couple.

A comfortable salary for a family of four is at least four times their monthly expenses, with the addition of a 20% savings goal. Therefore, a family of four that spends $5,000 a month should aim to earn $22,000 a month.

Again, this is just a general guideline, and every family has unique circumstances.

A family with two working parents may have different expenses than a family with one working parent. Likewise, a family with two young children may have different expenses than a family with two teenagers on the verge of enrolling in university.

However, to give a more specific answer, a family of four with two working parents and two young children living in a small town in the Midwest should aim to earn around $10,000. In contrast, the ideal income for a family of 4 in New York, with only one working parent, could be as much as $30,000 a month.

So what job makes the most money a month?

So now you know $75k promotes living comfortably and happily. How do you find a job or degree that makes you the most monthly money to increase your happiness?

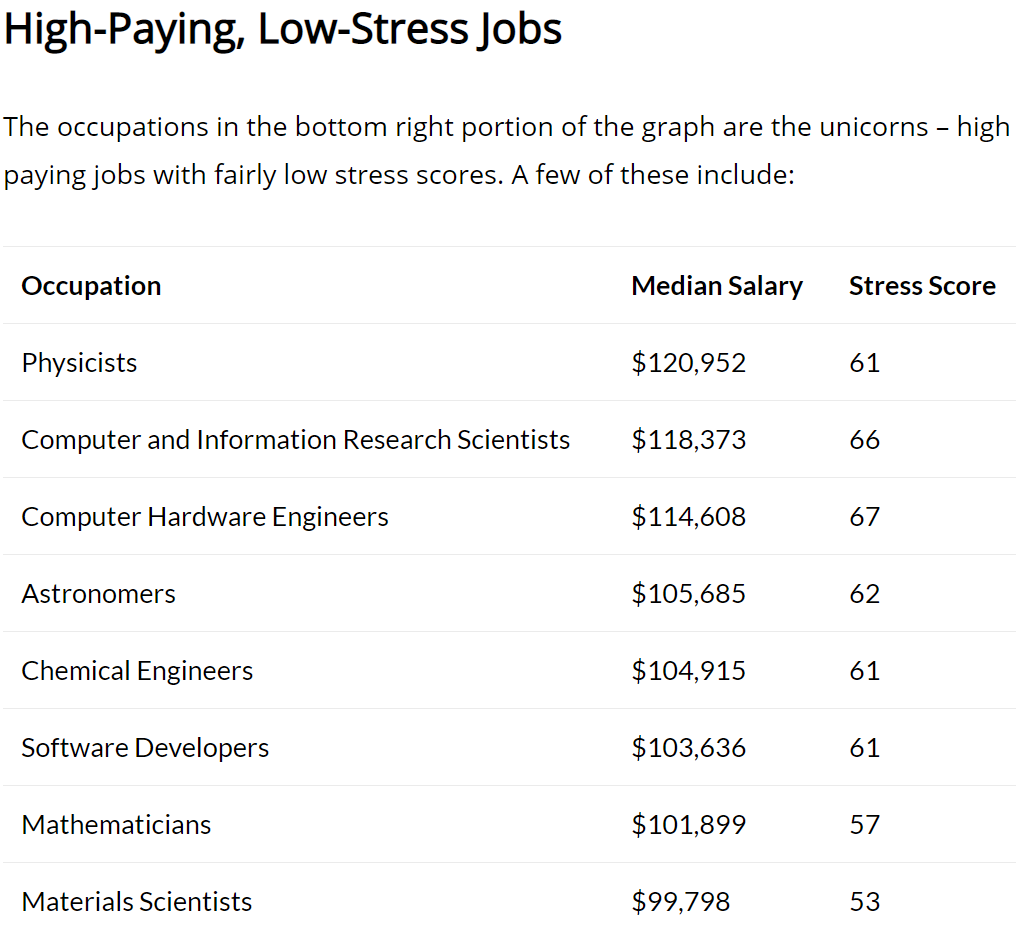

FourPillarFreedom wrote an awesome post about which degree pays the most with the least amount of stress to answer this. The article includes an interactive chart that shows you the job salaries compared to stress levels.

According to the article, the highest paying and least stressful jobs were in the STEM fields.

Although, don’t feel obligated to put yourself through college for a STEM degree. There are plenty of other high-paying, low-stress jobs available.

What salary should I be making at my age?

There’s understandably a positive correlation between age and salary. As we grow older, earn a higher education, and gain vital work experience, our earning potentials increase. The U.S. Bureau of Labor Statistics tracks median monthly income based on various demographic factors, including age.

To learn whether your stack up against your peers, check the data below:

| Age Range | Average Median Monthly Income | Men | Women |

| 16 to 19 | $2,220 | $2,380 | $2,004 |

| 20 to 24 | $2,532 | $2,624 | $2,452 |

| 25 to 34 | $3,712 | $3,844 | $3,544 |

| 35 to 44 | $4,476 | $4,968 | $3,872 |

| 45 to 54 | $4,536 | $5,116 | $3,940 |

| 55 to 64 | $4,520 | $4,984 | $3,892 |

| 65+ | $3,956 | $4,564 | $3,264 |

Salary is only one factor in wealth building. People focus entirely too much on salary. However, earning a good salary doesn’t always make you more successful.

Yes, I would much rather earn a high-paying salary. Having a higher paying salary makes it easier to build wealth.

However, most people earning a high-paying salary aren’t using their extra income effectively. Consider two different people.

The first person earns $100k per year but only saves $10k. This person’s savings rate (amount saved vs. made) is only 10%! The second person earns $60k per year but can save $20k. The second person has a savings rate of 33 percent!

When it comes to investing and building long-term wealth, the second person earning $60k will be better off. Most high-income earners are spending their salaries instead of increasing their net worth.

Therefore, net worth is a better measurement of success. Use your income effectively to build your net worth.

Click to Tweet! Please Share!Click To Tweet

So what is the formula for net worth?

Net worth is the difference between your assets and your liabilities. Assets are worth money and have the potential to increase in value. Liabilities cost you money and can decrease in value over time.

Therefore, net worth is defined as:

Net Worth = Assets – Liabilities

Purchasing a quality stock is an example of an asset. I might buy Amazon stock and sell it later for twice what I purchased. Because the share price increased, owning the stock was an asset that made me money.

Owning a car can be a liability. Purchasing a new car might seem like a good idea, but it begins to lose value once you drive it off the lot. The car will continue to lose value over time.

You can use a net worth calculator to help you determine your net worth. Simply enter the value of your assets and liabilities, and the calculator will determine your net worth.

What should my net worth be?

According to the Millionaire Next Door, you should follow a specific formula to determine if you’re considered wealthy.

The formula is:

Net worth minimum = (Your Age x Your Gross income)/10

You are considered wealthy if your net worth exceeds the number calculated. You are not considered wealthy if your net worth is lower than the calculated number.

For example, a 42-year-old makes $63,000 annually and has a net worth of $200,000. According to the formula, his net worth minimum is $264,600 [=(42 x $63,000)/10]. Unfortunately, his net worth lags by $64,600, and he is behind on building wealth.

The formula considers your age and income, which makes it applicable to your current situation. Your net worth minimum will change with every year and each pay increase.

Click to Tweet! Please Share!Click To Tweet

5-10% is a good salary increase

A good salary increase varies depending on your current salary and the cost of living in your area. However, most people consider a 5-10% raise above average.

For example, if you’re making $50,000 a year and receive a 5% raise, your new salary would be $52,500. Likewise, your new salary would be $110,000 if you received a 10% raise on a $100,000 salary.

It’s in your best interest to request a raise if you haven’t been offered a pay-scale increase over the last few years.

Also, anything below the 3-5% bracket may put you at a disadvantage. As inflation continues to rise, the cost of living also increases.

In other words, you are making less money than you were the year before if you don’t receive a salary increase that keeps up with inflation. Within the last year alone, inflation has skyrocketed by 9.1%, pricing many middle-class Americans out of their pay brackets.

Unfortunately, it’s unlikely that your boss will agree to a sudden 9% raise on such short notice.

The Federal Reserve has implemented several regulatory measures to bring inflation back under control, but the last time it rose to such extremes, it took more than two years to lower the rate. This also came at the cost of millions of jobs. It’s unlikely that this will happen again but be aware that your next raise may not be as beneficial as you think.

How to Find a Higher Paying Job

Getting a job straight out of school (whether high school or university) is a lot harder than it used to be. With the economy in constant flux, it’s no wonder that so many graduates are having difficulty finding employment.

Luckily, you can do a few things to increase your odds of landing a high-paying job straight out of school.

1. Start networking as soon as possible

One of the best things you can do to increase your chances of finding a high-paying job is to start networking as soon as possible. Get involved with as many professional organizations as possible and attend as many networking events.

The more people you know, the more likely you are to hear about job openings in which you might be interested.

2. Get experience in your field

Employers are much more likely to hire someone with experience in the field they’re applying for. If you can, try to get an internship or volunteer in your field of interest. This will not only allow you to gain valuable experience but also help you make important contacts within the industry.

3. Consider pursuing a higher degree

While it may take longer and cost more money, pursuing a higher degree can increase your chances of finding a high-paying job after graduating. A master’s degree or doctorate will make you much more attractive to potential employers.

Alternatively, consider enrolling in a trade school to learn a high-wage technical skill, such as electrical work, plumbing, or construction management.

4. Be willing to relocate

You may need to relocate to a better job market if you’re serious about finding a high-paying job. Some areas of the country are simply better for job seekers, such as more urbanized regions with greater investment. Research to find out which cities or states have the best job markets.

5. Stay positive

It’s important to keep a positive attitude throughout your job search. Remember that it may take some time to find the perfect job, but it will eventually happen if you keep at it. Even if you’re rejected at first, staying in contact with potential employers and marketing your skills can help to position your application ahead of the competition.

Summary: What is a good salary to make to live comfortably? (Single, Married, or Family of 4)

As you can see, your household income should be $75k or greater to be content and live comfortably. However, most Americans are only earning an average income of $63k.

Therefore, one of the biggest things you can do to increase your happiness is to increase your income. Most of the highest-paying jobs with the lowest stress levels are in STEM. However, there are plenty of acceptable jobs outside of the STEM fields.

A good salary is not enough to be considered successful or wealthy. It would be best if you focused on your savings rate (e.g., how much of your income you save). Invest your money in dividend-paying stocks or exchange traded funds.

It’s difficult to say what salary you should earn at your age. Earning a good salary doesn’t mean you’ll live comfortably or have enough money for retirement.

Tracking your net worth can be a valuable tool in determining your progress towards wealth accumulation. Wealth accumulation takes a great deal of personal money management.

According to the Millionaire Next Door, you are considered wealthy if your net worth is greater than your age times gross income, all divided by 10.