If you’re on this article, you’re probably wondering, “How do I stop being broke?”

To stop being broke, you need to plan your income and expenses and stop wasting money. Every dollar needs to be accounted for so you have money to pay off your debts. You need to focus on growing your income, so that you can use money as a tool to build wealth.

Life can seem bleak and depressing if you have no money.

Breaking the poverty cycle is possible, no matter your situation. You just need to know the steps towards financial freedom.

Luckily for you, I’m going to show you what to do if your tired of struggling financially. You should be able to go from broke to financially woke if you take consistent action towards each of these steps.

This article may contain affiliate links which pay a commission and support this blog. Thank you for your support!

How do I stop being broke?

To stop being broke, you need to start managing your finances. Start by tracking your income and expenses, paying off debt, and growing your income. Money is the number one tool you have to build wealth and should not be wasted.

Building wealth is a simple concept, but it’s hard to execute. Often, people are broke because they either don’t make a lot of money or spend too much of it.

1. Evaluate your income

One of the biggest reasons people are broke is income. It doesn’t matter how frugal you are if you don’t make enough money. Do you make enough money to live comfortably?

At a minimum, you should try and earn an average income for your city. Earning a below average income is a bad sign that you might struggle financially. Your city should be set up that the average income earners do ok for themselves.

Life becomes easier with the more money you make. Emergencies hurt less if you make enough money to cover them. You can afford certain luxuries with a high income.

If you don’t earn an average income right now, that’s ok. It’s something to shoot for. Right now, you need to focus on what you are earning and making a plan to stop being broke.

2. Create a budget

Budgeting is the one thing which will help you stop being broke. A budget tracks every dollar earned and every dollar leaving. Without a budget, you are doomed to living a broke lifestyle.

Even high earners need a budget. Spending money is too easy. A budget provides you with the guidelines you need to stop wasteful spending while working towards your financial goals.

Starting a budget is the best thing you can do for your finances. The bottom line is, without one, you’re not going to stop being broke.

3. Set aside money for small emergencies

Emergencies happen, it’s a fact of life. I wish I could tell you that your car is never going to break down. I wish I could tell you your kids are never going to get sick. Unfortunately, it’s a part of life.

So why do we not plan for something we know is going to happen?

You need to set aside money for emergencies. If you’re just getting started figuring out your finances, then you need an emergency fund with at least $1,000. Build your emergency fund to three to six months expenses once you’ve paid off your debt.

Click to Tweet! Please Share!Click To Tweet4. Pay down debt

Having debt is what keeps most families from building wealth. It’s really hard to get ahead in life when you owe people money.

For most people, it’s easy to get into debt. Car payments, student loans, and mortgage payments are all common traps. These debt payments are designed to keep you in poverty.

Debt isn’t always bad if you know how to use it. Wealthy people use debt to make themselves richer. For example, a rich person might use debt to purchase a rental property. A rental property income pays for the mortgage and maybe a little extra cash.

How can I pay off my debt when broke?

You can pay off your debt when broke by starting a budget. Focus on growing the gap between income and expenses. Use any and all extra money to pay down your debt.

Escaping debt doesn’t come easy. Often, it takes a lot of hard work and extra hours. For some, it means picking up a second job.

You can pay your debt of per the debt snowball or avalanche methods. The debt snowball involves paying off your debts in order from smaller amounts to larger. The avalanche method involves paying off the highest interest rate first.

So which is the best way to pay off debt? If you want to pay off debt fast then you should go with the avalanche method. The debt snowball provides a few quick wins, but is slower. Use the debt snowball if you need emotional support.

5. Invest your money

You can’t save your way to one million dollars unless you make an extremely high income. Investing is the way anyone can build wealth. If you want to stop being broke then you’re going to have to start investing.

Investing works because of compounding interest. Simply stated, compounding interest means your dollars invested start to make you money over time. It’s easier to make money with the more money you have invested.

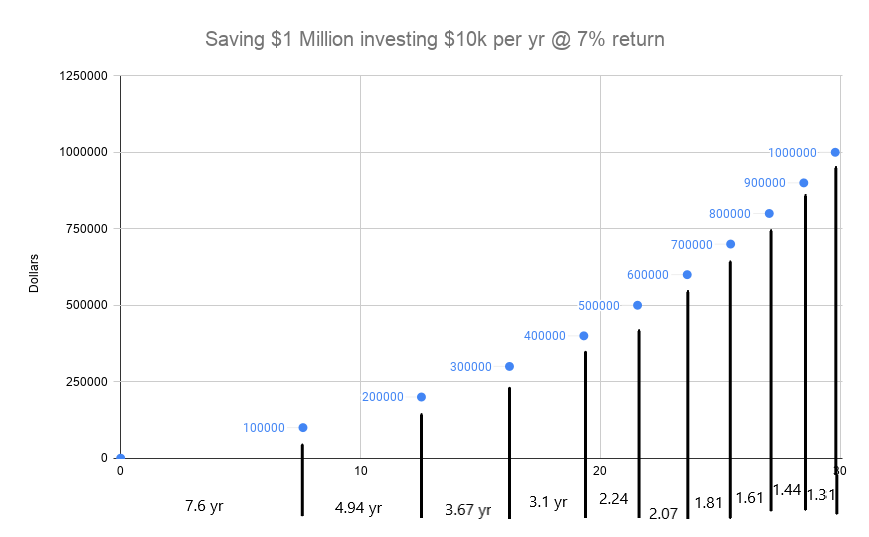

In the example below, it takes 7.6 years to save your first $100,000. Keeping the same savings rate, it would only take you 1.31 years to go from $900k to your first million.

You’re only investing $10k per year, but your investments are making you more money.

You’ll need a brokerage account, like Robinhood, to start investing. I recommend investing in low-cost exchange trade funds for beginners. Exchange trade funds are a collection of stocks which help diversify your portfolio.

Investing is the best way to build wealth. You will need to start investing at some point in your finances.

6. Grow your income

Growing your income is another important part of breaking the poverty cycle. Wealthy people are always looking for a way to increase their income. Usually, growing your income is done through increasing earned income or buying income producing assets.

When was the last time you got a substantial pay raise? Are you looking for higher paying jobs on a regular basis? Are you actively trying to build a side hustle?

You may not have a well-paying job. However, that doesn’t mean there aren’t higher paying jobs out there. Yes, jobs exist even if you don’t think you have the skillset.

If you’re tired of being broke and living paycheck to paycheck, then you need to follow the money.

You may need to take a less exciting job that pays more. It sucks to work a job you don’t like, but it sucks more to keep being broke.

Click to Tweet! Please Share!Click To TweetHow much money is considered broke?

You might be surprised, but being broke isn’t a dollar amount, it’s a lifestyle. The choices you make on a daily basis will determine if you are building or losing wealth. Someone who is considered broke spends just as much, if not more, than they make.

Why am I so broke all the time?

Someone who is broke all the time usually makes a few financial mistakes. Generally, a broke person doesn’t track their money, doesn’t make enough, and buys items they really can’t afford.

If you don’t track your money then you have no idea how much money you’re spending. Spending money is easy to do. You need a plan for your money or you’ll never have any.

Making enough income is a large problem. Most people don’t have high paying jobs or never look for anything beyond minimum wage. Ideally, you should be looking for new and higher paying opportunities once per year.

You might fall for purchasing certain middle class traps which keep you broke. Examples include buying cars, boats, RVs, and larger homes. Middle class traps are common for people who make a decent income. You don’t really build wealth, but you make just enough to fall into a lower class.

Some people earn great incomes, but are still considered broke. Consider a Doctor who makes $200,000 per year. Often, people have lifestyle inflation where they buy stuff that keeps them poor.

Stop buying stuff that is keeping you poor! Gary Vee has a message for people buying stuff. (Warning. Strong Language.)

How can I never be broke again?

Managing your money is the best way to never be broke again. Keep investing and working towards growing your income. Avoid any debt that isn’t going to pay you for holding it.

Building wealth takes time and hard work. Very rarely does anyone make a lot of money without doing anything. However, if you understand the concept of working hard, saving money, and growing your income then you’ll be ok.

Click to Tweet! Please Share!Click To TweetSummary: How to stop being broke

To stop being broke, you need to plan your income and expenses and stop wasting money. Every dollar needs to be accounted for so you have money to pay off your debts. You need to focus on growing your income, so that you can use money as a tool to build wealth.

You should strive to reach an income that is at least average for your city. Create a budget and set money aside for emergencies. If you have debt, set aside at least $1,000 for emergencies.

Pay off your debt by focusing on the gap between income and expenses. Use the debt avalanche for quick debt payoff or the snowball method for emotional support.

Invest your money to start building wealth and break free of the poverty cycle. Low-cost exchange trade funds are simple ways to invest for beginners. Always be looking for ways to increase your income, so that you can invest more.

Being broke isn’t a dollar amount. Rather, lifestyle choices greatly determine if someone lives paycheck to paycheck. You will be broke all the time if you don’t track your money, make enough, or buy useless stuff.

Managing your money is the best way to never be broke again. Keep investing and working towards growing your income. Avoid any debt that isn’t going to pay you for holding it.