Hey friend! Looking for tips on how to save money?

You aren’t alone. There are between 1-10 million Google searches every month of individuals and families seeking ways of saving money.

That is a lot of people looking to save money. As a blogger, my mission is to help every reader succeed and find the money-saving plan that works for them.

That’s why today I’m writing what I consider to be the most “ultimate” guide to saving money. This blog post is jam-packed full of tips and will hopefully be your “one stop shop” for money saving tips.

I’ll warn you though; this blog post is long!

Would you do me a favor? If you find yourself finding this post full of valuable tips for saving money, would you share it? Send it to a friend via email or pin it to Pinterest. I can’t help the 1-10 million people each month if they don’t know about this post!

This post contains affiliate links which pay a commission that supports this blog when a purchase is made through the links. Thank you for your support!

How to save money every month tips + money saving ideas

The importance of saving money. Money is leverage!

Have you ever wondered how the rich keep getting richer? It’s because they understand the power of money and how to use it as leverage.

A wealthy person has a substantial income, and they use their earnings to purchase other money making investments, such as apartment complexes. This rental investment might net our rich dude an extra $10,000 per month, for which they could use to pay a mortgage on a second apartment complex.

They are using their money as leverage, having money work for them rather than working hard for money.

Unfortunately for you and me, we aren’t wealthy (yet). Our version of using money as leverage is to use what money we can save until we can make it to the big leagues!

What does leverage look like to you when you save money?

When you can save money, you can use it to your benefit. For us non-rich people who don’t live on a private island, when you save money you can:

- Invest more money for retirement – Saving money each month will let you invest more money in stocks or even purchase rental properties. Investments are one of the best ways to use the money you save because your money is used to make you more money!

- Prepare for the emergencies of life – One of the best save money tips is preparing for life’s emergencies by building an emergency fund or a cash stockpile. You can use this money to protect yourself from going into debt when the car breaks down or if your house floods when you go on vacation.

- Use saved money to pay off debt – When you have extra money each month you can pay off debt. Once the debt is paid off, you can use the extra money that you’re saving each month for additional leverage!

- Send your children to college – Education costs are no joke these days. When you save money, you can send your child to college so they can potentially have a better life.

- Use your money to do the things you enjoy – When you have money saved up, it’s easier not to let life stress you out, and you can pick up a hobby or take a vacation. I don’t know who said it first but the saying “Having money isn’t everything, but not having it is” has some truth to it.

- Accomplish your goals around the house – Saving money lets you buy new furniture or some other random personal goal.

Suggested:

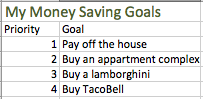

Have a plan for the money you save

If you already know that you need to save money, I’m sure you have an idea of how you are going to use the money you save. However, some people don’t have any idea which means they aren’t effectively using the money they save.

Ask yourself, with the extra money saved, are you going to pay off debt? Build an emergency fund? Invest in a retirement account?

You should always have a goal for your money.

TIP: If you have no idea what to do with the money you save, consider opening a money market account at your local bank. Money markets are kind of like a savings account, but they will earn a slightly higher interest rate. Money markets are a better way to save money than having a money jar in your closet!

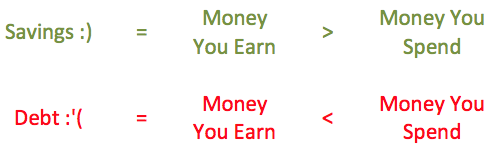

The two principles of saving money

When you are trying to save money, you can either reduce your expenses or increase your income. The goal is to have more money entering your bank account than you have leaving.

Reduce your expenses – I’m going to talk a lot about saving money through reducing your spending in this blog post. Reducing your expenses to save money is usually the first place people start when they need more money, but it’s only part of the solution to healthy personal finances.

Increase your income – I won’t talk much about increasing your income in this blog post. I’ve already talked a lot about increasing your income in this post. I will include a section at the end of this post with some quick tips for generating some extra money.

Both reducing your expenses and increasing your income are essential if you want to save more money. Some individuals or families are fine only reducing their spending. However, if you don’t earn enough money for your cost of living, then you’ll have to consider taking a part-time job, getting a side hustle, or finding other ways to make more money.

The best money saving tip: build an awesome budget!

I cannot stress the importance of having a family budget that you can actually stick to! When I have a budget, I know:

- How much money I make – Could you tell me how much money was deposited in your bank account last month? No? Then you need a budget! You cannot save money if you don’t know how much money enters your bank account.

- Where my money is going – If I dedicate $400 of my salary to groceries, did I manage to spend $400 or less for food? Did I go over or is there any remaining?

- How much money I’m saving – Because your money is dedicated to certain categories, I know how much money I will save before the month ever happens. That’s because every dollar you earn is allocated to an expense like rent, groceries, savings, investing, etc.

- The amount I invest every month – Again, I know how much I’m investing because I dedicate a certain dollar amount each month for it.

- How much money is in my bank account – An effective budget allows me to never have to log into my bank account because I can see how much money is there by looking at the budget.

- How much fun I can have – Responsibilities have to come first! A budget allows me to see how much money I can spend on fun activities while still managing to save money!

An effective budget gives me financial peace of mind. It is your number one tool that you should be using when you want to save money!

Related:

Check out our ultimate guide on how to start a budget

I can’t go into too much depth in this blog post about building an effective budget because this blog post is about saving money and it’s already getting long! Instead, you can click here to check out my post on building a budget that works for your family.

I’ve also created a free budgeting spreadsheet for you to use. In addition, you’ll get my free budget course aimed at helping you build the best budget for your family.

The best tips to save money fast

Below are some of my best money saving tips broken down by category. Feel free to leave any money saving tips that you would love to share with others in the comments at the end of the post. Remember, money shouldn’t be taboo! We need to help others save as much money as possible.

How to save money on your house, mortgage, or rent

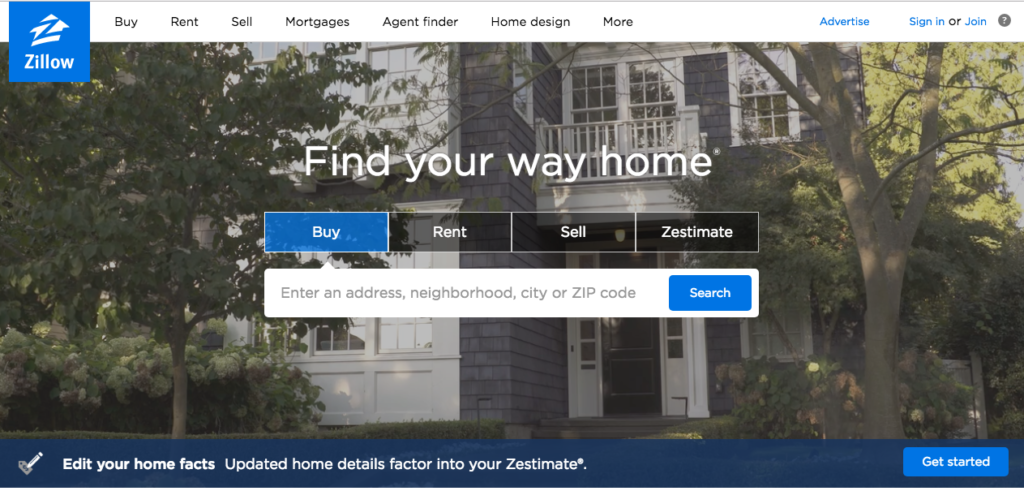

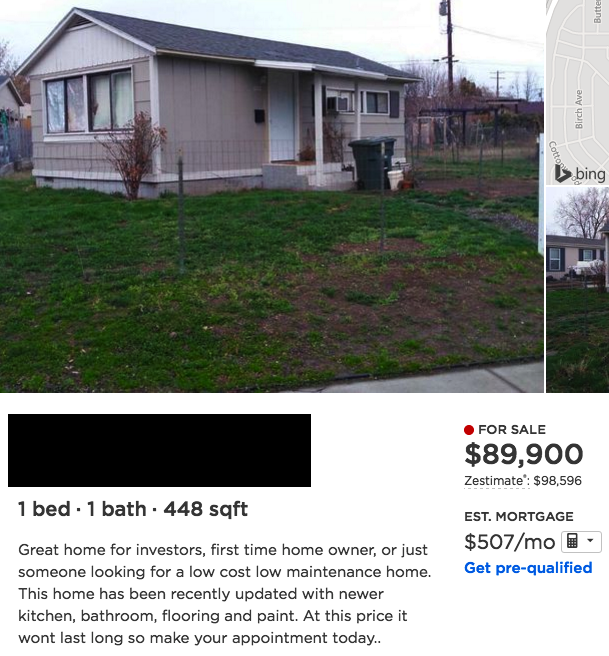

I don’t usually like to recommend people move because moving is a hassle. At the very least you should understand how your housing situation is compared to the market around you. One of the best places to do your research is Zillow.

Enter your city in the box and hit search. Study the surrounding area and get an idea of how much money it costs to rent or the price range of housing. Ideally, you’ll want to stick to as little rent/housing cost as possible to maximize the amount of money you save.

Average rent in my area looks to be around $750 a month and ranges from $650-850$. Sometimes I can find rent as low as $550 or as great as $1,200!

Another way to find out the cost of rent is to do a google search for “your city + average cost of rent + chamber of commerce” Here’s what city shows:

As you can see the average selling price of a house is $219,400 and the average rent is $751. Looks like my Zillow estimate and the chamber of commerce estimate is pretty close!

What does this tell me?

If I make less than $64,124 it’s going to be hard to save money. It isn’t impossible, but usually, the economy of your city is going to be able to support slightly under the average. Can you find a way to be better than the average? You will absolutely thrive if you can be above average in “average household income.”

I don’t want to rent in my area for more than $750 or I’m overpaying. The sad part is, when I first left my parent’s house I was paying $850 in rent for a 2 bedroom, 2 bath duplex. I could have been saving $100 each month by just choosing a better place to rent!

If I’m buying a house for the first time, it should be below $219,400. My research on Zillow shows me that the cheapest house I could find was $80,000. Zillow also showed me with their mortgage estimator that I could be in a house cheaper than I could rent!

Save money by buying a house when the opportunity presents itself

Now obviously this house looks like it could use some TLC and the house is small, but let’s use this as an example. There are other larger homes in the area that could still save you money if you decided to purchase rather than rent.

The mortgage estimate is only $507 for a 15-year loan and other miscellaneous assumptions. I would jump on this if I were a bachelor because I would only have to pay $507 a month, cheaper than the $750 in rent and I could save the difference of $243 for repairs and maintenance.

The main point: you don’t know if you’re overpaying for rent/mortgage unless you do your research. I would highly recommend researching your housing situation and evaluate money saving opportunities as housing tends to be one of the major expenses that we can reduce.

Related:

Save money by understanding the cost of living in your area

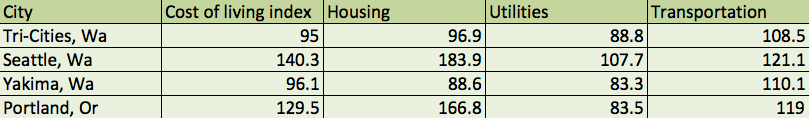

Have you ever heard of the cost of living index? No? It’s a number that tells you how expensive it is to live in a city. Anything below 100 has an inexpensive cost of living while anything above 100 is expensive!

Let’s look at some of the cities around me. You can find your cost of living index by doing a google search for “cost of living index in your city.” Make sure you choose a good source and that the site where the information came from.

Tri-Cities and Yakima both have a great cost of living index. It’s going to be easy to save money in both of those cities because the cost of living is low! Transportation costs are high all around but you will save money on housing and utilities.

I would hate to live in Seattle and Portland because the cost of living is expensive! Portland has cheap utilities but is horrible in housing and transportation.

Most people want to live in a large city because it gives them a lot of entertainment opportunities but it’s hard to get ahead on your finances if you live there because major cities have a huge cost of living.

There are a lot of people that can make a living in a large city work, but if you are looking to save a lot of money, consider moving to a less populated area.

Save money by offering your services to your landlord

Your landlord does not want to mow their rental properties lawn. Most landlords hire it out anyways. You live right next to the lawn that needs to be mowed! Ask your landlord to work off your rent rather than pay your rent!

They might knock off $100 on the rent if you mow the lawn so they don’t have to. Look to find ways that you can add value to your landlord and offer to help them in exchange for reduced rent.

Evaluate if a duplex makes sense to purchase

If you don’t mind being a landlord yourself, you might be able to afford a duplex and rent out the other side. You might save money on your mortgage because someone else is helping you pay it off.

Begin by checking Zillow and comparing the estimated mortgage to what you’re currently paying in rent. I may write a blog post later on finding and renting properties for profit, so make sure you subscribe to find out when that happens!

Once the property is paid off, you’ll have a source of passive income that you can use to help purchase a nicer house. Once you’re in a house, you can rent out the side you were living in and have a steady income.

Find a mortgage term that works for you

I must say I was a little unhappy the first time my wife and I were pre-approved for a home loan. According to the bank, my wife and I had the financial capacity to buy a small private island and hire workers to farm the vineyard for the winery that comes with the island.

Let me make this clear, we do not have the financial capacity to pay for these things! The bank was approving us for way more than we could realistically afford because they make money on us being in debt to them.

Think small and modest when choosing a house for the first time. Don’t borrow more than you can reasonably afford, pay off the small house first, and then consider buying a larger house if the need or want arises.

The longer you borrow money from a lender the more you will pay in interest. Your payments will be smaller but you’ll pay for a longer time. This isn’t a bad thing if the average rent in your town is $750 and a 30-year mortgage has you paying a house off at $767 per month.

The shorter the loan term the less interest you’ll have to pay, but you’ll have to pay more each month. Just make sure that you can afford the monthly payments.

How to save money on children and baby expenses

I won’t go into a ton of detail on how to save money on children and baby expenses because I did write an article on this topic that you can read here. Tips to consider for saving money on your children include:

- Breastfeed

- Make your own baby food

- Coupons, coupons, and more coupons!

- Cloth diapers

- Exchange babysitting services with another couple or ask your parents to watch them

- Find deals on craigslist

- Make your own baby wipes

- Look for alternatives to expensive baby brand items

- Use old shirts as bibs

- Have as many baby showers as possible for different groups of friends such as church or work

There are a lot of ways to save money on having a baby, but the biggest tip would be to not follow the hype. Companies advertise and want to convince you that they have the perfect solutions. Just remember that people have been having babies for a long time and we didn’t always have such fancy products!

How to save money in the kitchen and on groceries

I’m so excited to write about saving money in the kitchen and on groceries because it’s one of the biggest areas that people can save money. It’s also one of the hardest areas for people to save money on because everyone tends to love their food!

How much money should you spend on groceries?

There is no right or wrong answer when it comes to spending money on food. Everyone’s situation is different but you don’t want to spend half your paycheck on food!

If you have taken our free budgeting course or read our budgeting blog post, you should have an idea of how much you are currently spending on food each month.

Dave Ramsey, financial expert, recommends that you spend 5-15% of your take-home pay on groceries. Again, these are general guidelines because someone making $100k a month doesn’t need to spend $5k on groceries, while someone that makes $1k a month may need to spend more.

I find myself spending around 10-12% of my take-home pay on food each month. I agree that Dave’s estimates are a good target for most families to shoot for, but it shouldn’t cause you stress if you can’t meet the 15%.

Find out where you fall in the percentage and then use some of these tips to save money.

Related:

Save money by learning the art of batch cooking

I love to save money through batch cooking, making large meals that you can save for leftovers. It’s one of the best ways to save money on groceries.

Most people are afraid of batch cooking because they hate leftovers, but if you find the right recipes you’ll have no problem eating them again and again.

How can you get started saving money with batch cooking?

Start by deciding what tools you want to use. I love to use a combination of pressure cookers, slow cookers, and large cooking pots. These are three great options for anyone looking to save money.

Recommended slow cooker. (See it on Amazon)

My favorite tool is probably my wife’s instant pot (pressure cooker). I was a bit nervous letting her buy one because of all the horror stories about pressure cookers exploding, but it’s worked out well for us. I would guess it probably helps us save about $100 on groceries each month.

You can even buy a ton of pressure cooking accessories! I love the accessories because they make cooking more enjoyable, so I use my Instant Pot more frequently.

Cookbooks are also something you’ll want to pick up because they are full of great ideas to try!

Experiment with different recipes and save the ones you could eat over and over again. Stick with batch cooking and you’ll start to notice how easy it is to save money on groceries.

Related:

Save money by freezing your batched food

One of the biggest mistakes people make when switching to batch cooking is that they don’t switch it up often enough!

We aren’t robots. We need flavor variety in our life’s. Experiment often and write your families rating of the meal on the pages of the recipe in your cookbook.

When my wife and I experiment, we rate the meal and then place one more dinner’s worth in the refrigerator to eat later in the week and then freeze the rest to eat later down the road.

Pro money saving tip: Use a vacuum sealer to keep your meals fresher for longer. It makes saving the meals quick, easy, and in the right portion sizes to pull out of the freezer later. It’s one of our favorite tips for saving money in our kitchen!

If you haven’t guessed by now, you’ll need a deep freezer to store all of your meals. So worth it if you can find one for cheap!

My favorite part about batch cooking is that any time my wife and I look like we might exceed our grocery budget we can pull out meals that we’ve already cooked, keeping us in our budget each month!

Batch cooking + vacuum sealer + deep freezing is the ultimate way to save money in the kitchen!

Save money by buying what you need and not what you want

I’m sure you’ve heard of this money saving tip before so I’ll keep it short. If you need to save money on groceries, stop buying the things you don’t need like soda, alcohol, chips, and ice cream.

Most of the frivolous groceries people buy aren’t good for them. I use to buy soda often until I started developing panic attacks. I stopped buying soda, the panic attacks stopped, and I started saving money from not buying it.

Yes, it’s hard to drink nothing but water, but you do get used to it.

Save money by joining Blue Apron

For some families, it may make sense to order meals through Blue Apron. They send a box of food and a recipe to make with the items in your box.

The plans are reasonably priced as well, about $10 a serving. It’s a good way to experiment with cooking, save money, and spend less time grocery shopping/meal planning.

Other quick tips to help you save money every month on groceries and in the kitchen

Your kitchen is the perfect place to start saving money, that is if you can get the rest of your family on board. Here are some other quick tips to help you save money in the kitchen:

- Save money by eating less meat – I love eating meat, but it’s expensive. Most Americans make meat the main focus of every meal. Luckily, I saved money by marrying a vegetarian! (sigh..)

- Don’t shop hungry – Nothing says “take my money” like rampaging through the grocery store like Godzilla when you’re hungry. We’ve all over purchased because we shopped when we were hungry.

- Have a small garden – Gardening can be peaceful if you have the right personality for it and it’s an excellent way to save money every month on the produce that you would normally buy.

- Keep herbs on your window seal – Some herbs tend to grow back really fast and don’t take up a lot of space which makes them perfect for your window seal.

- Save money by Canning – Canning will keep your food fresh for long periods of time. Fresh peaches year round anyone? Some farms let you pick your own fruit for a fraction of the price that you would find at the store. Pick lots and can it!

- Shop generic brands – Consider the brands you’re buying. You can usually find other less popular brands for cheaper and the product is comparable.

You might be interested in reading my article, frugal foods for the kitchen if you are interested in saving money on groceries by shopping more frugal.

How to save money on eating out

I have a food weakness. I love good tasting food and I always have a craving to eat out which makes it hard to save money, especially after a long day at work.

Luckily, I batch cook as previously discussed. Batch cooking helps keep a variety of meals in the house that are quick to reheat and reduces the chance that we will eat out.

Tips to save money on eating out

- Throw a potluck party – Invite your friends over for a potluck. At the end, divide the remaining meals up so that everyone takes home some of each meal. It’s a great way to build your food storage up quickly!

- Eat half the meal – When you eat out, consider eating half the meal and saving the other half for tomorrow’s lunch.

- Eat a snack before you go – Having a little snack before you go out to eat will help you choose smaller, cheaper options.

- Save money by skipping alcohol and soda – These beverages are heavily marked up when you have them at restaurants.

- Find a deal website – We have a local deal website that occasionally offers deals like “$20 of food and drink for only $10.” Find deal websites for your area and eat out according to the deals you can find.

- Ask for gift cards – During Christmas time or for your birthday, ask people to give you gift cards for your favorite restaurants.

- Order Appetizers – Having an appetizer as the main course lets you have delicious food for less money.

- Split meals – share a meal instead of getting your own. My wife and I would always over eat at one of our favorite restaurants so we decided to split. Now we pay $15 instead of $30!

It’s ok to eat out when you’re trying to save money every month. Just make sure that you stay within your budget, otherwise, you defeat the purpose of saving money!

Tell me you're ready to save more moneyClick To TweetHow to save money on household expenses and shopping

Buying things for your house can start to get expensive fast. Different stores have different prices and I hate playing the “this item is cheaper at store A, but this is cheaper at store B” game.

My wife and I registered at bed, bath, and beyond for our wedding and soon realized that everything in the store was way overpriced, even with the 20% coupon they send out.

We would buy an item, head to Costco or TJ Maxx and find the same item for way less, like $20 or more less! Needless to say, we went right back and returned the items to bed, bath, and beyond.

We did this like three or four times before we just had to suck it up and spent the gift cards on something. My wife and I still cringe at the fact that we overpaid, but we couldn’t get rid of the gift cards to save our lives.

Here’s my strategy for not getting ripped off.

Save money by shopping online

Amazon is our go-to for shopping. Doesn’t matter if it’s household items or a new set of headphones. It’s just cheaper on Amazon and with Prime membership, you get free shipping on Prime items.

First, start your online shopping by going to Ebates. Ebates lets you earn cash back on your online purchases and they work with over 2,000 stores! Select your store and hit shop now, it will take you to the website’s home page. Today, I’ll be shopping on Amazon.

I also use Honey to help me find the best deals on Amazon. If you aren’t aware, Amazon lets other merchants sell on their website, so item prices will vary depending on who sells it. Honey finds the lowest price for me.

From the picture above, Honey saved me $24.22 on something I was going to buy anyways. Combine that with shopping through Ebates and I’m getting a much better deal than what I would find in a store.

The sad reality is that shopping at a local store is more expensive than shopping online. Even at our local Walmart, the prices are more expensive in store than if I would have shopped at Walmarts website.

Other tips to save money on household and shopping expenses

Unfortunately, you can’t do all of your shopping online. Here are a few of my other favorite money saving tips to consider:

- Make your own cleaning supplies – The house has to get cleaned, but that doesn’t mean you need to pay a ton for cleaning supplies.

- Sleep on it! – Never buy a big purchase, like a house or car, on the spot. Sleep on it and make sure it’s the right decision to make. You might decide to skip the item and save some money!

- Shop second hand and thrift shops – I like to poke my head into a thrift shop every now and then to see what I can find. Sometimes you can find a great deal on something that you were looking to get at full price.

- Save money by repairing clothing – Instead of buying new clothes, can you learn to repair them. Hole in your socks? Did the button fall off your pants? Strap on your backpack break loose from the seam? Can you fix it?

- Save money buying in bulk and build a stockpile – I love Costco because buying in bulk does save money. However, I don’t just go buy a giant pack of toothpaste, I wait for it to go on sale at Costco before I buy it.

- Have your partner cut your hair – I love this money saving tip! I bought a $40 haircut kit and have had my wife cut my hair for the last three years. At $15 a haircut once a month, that means I’ve saved roughly $500.

I’m always on the lookout for ways I can save money at home every month!

Tell me you're ready to save money!Click To TweetHow to save money on Utilities, Bills, and Car Expenses

Isn’t adulthood fun? We get to pay bills and own cars that we can drive to work! Here’s how you can minimize the expenses of being an adult when it comes to your utilities, bills, and car expenses.

How to save money every month on Utilities

The top electric expenses are:

- Heating

- Cooling

- Water Heating

Heating makes up about 1/3 of your total electric bill! Maybe you’ll think twice about reaching for the thermostat?

Quick tips for reducing your heating bill include wearing a sweatshirt, get a programmable thermostat, and service your furnace.

How to save money on your bills

One of the best tactics that I’ve found to reduce your monthly bills is to negotiate the price with customer service.

For example, I really do not like how much I pay each month for internet service. I said, “I’m looking to save money and your service is a little too expensive for me compared to some of your competitors. Is there anything you could do for me otherwise I may have to cancel my service.”

They don’t want to lose business and offered me $5 off my monthly bill for a year. I didn’t actually want to cancel because unfortunately, they are the fastest in town.

However, this 5-minute phone call saved me $60 over the course of a year so I’ll take it!

How to save money on your gas bill

I use the gas buddy app to make sure that I find the cheapest gas around. Usually, it’s the Costco near me but it never hurts to look to make sure that I’m saving money on gas.

You can also go to gas buddy’s website and search by city, zip code, or location to find out the gas prices near you.

Other ways to help you save money every month

Now for all the little tidbits and tips that help you save money every month. They may not seem all that important, but they do add up.

How to save money on medical expenses

Medical expenses are costly and most can be avoided. Quick tips to help you save money on Medical include:

- Eat healthily – Healthy bodies don’t need to be in the hospital!

- Avoid gym memberships – They are costly and you are charged to use them regardless of whether you use them or not. Learn bodyweight fitness, go for walks, or buy a program like P90X.

- Take breaks at work – Prolonged sitting is bad for you and can put you in the hospital. Take a break from sitting every 20 minutes if you can. At the very least, a break every hour for at least 10 minutes where you stand and walk around.

How to save money on entertainment

We will always need some form of entertainment in our life’s, but entertainment doesn’t have to be expensive.

Quick tips to help you save money on entertainment include:

- Invite friends over – This is much cheaper than a night out on the town.

- Play video games – Video games are probably one of the best cost per hour forms of entertainment.

- Check your community calendar for events

- Use the library – you can save a lot of money by borrowing a book rather than buying it. The library usually has the newest releases so you don’t have to buy the book.

- Switch to Netflix – Way cheaper than owning cable. I would have to pay an extra $50 to add cable to my current plan but Netflix is about $10.

Quick cash boosters to add to your savings

Looking to build an emergency fund or just need to make money fast to add to your savings? Here are a few ideas:

- Sell your stuff on craigslist – Most people have at least $1,000 of stuff they don’t use anymore laying around.

- Have a yard sale – Pick a good location to have your yard sale at and advertise it on craigslist. Most yard sale enthusiasts use craigslist to plan our their yard sale adventure.

- Flip Clothes/Flea Market Flipping – Clothes go for fairly cheap at yard sales and flea markets but can sell well on eBay.

- AirBnB, Lyft, Uber – If you have a spare room then you can rent it out on AirBnB. If you have some free time and a car then you can give people rides using Lyft and Uber.

What’s next?

Use the extra money that you save as planned. Don’t save up $1,000 and spend it on a new TV if you originally planned on using the money to help pay off your mortgage!

Make sure your household budget is in order

You can read my blog post about budgeting here. Remember, the first part of saving money effectively is having a budget that you can stick too!

Take my free money saving course

I’ve built a course to help people save money and I’m giving it away for free. This course is for anyone that wants to learn to save more money and live a life with fewer worries about money.

Share, comment, or leave a question

As I mentioned in the introduction, 1-10 million people are searching every month to find help on how to save money. Can you help me reach them by sharing? Share on Facebook, Twitter, Pinterest or whatever the newest and fanciest social media site is. I would appreciate it!

If you want to say hi or anything, feel free to leave a comment or question below. I’ll try my best to get to them.