How do you become wealthy in five years?

To become wealthy in five years takes careful planning. Start by creating a budget to track expenses while keeping expenses low. Raise your income both in and outside of work to make more money. Aim to invest a minimum 40% of your gross income to become wealthy in five years.

Imagine, having more money than the majority of your peers in a matter of five years. Wouldn’t it be nice to have a stockpile of cash?

With careful planning, you can build wealth quickly.

Luckily for you, I’m going to show you how to become wealthy in five years. I’ll even show you how much money you need to invest to become a millionaire in five years. With enough work, you’ll be on your way to early retirement.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

How to become wealthy in five years

In order to become wealthy, you must focus on growing the gap between your income and expenses. Invest as much money as possible without giving in to lifestyle inflation. Aim to invest a minimum 40% of your gross income for rapid wealth building.

Create a budget

Wealthy individuals will almost always have a budget to track their expenses. A budget allows you to identify areas where you’re overspending. Individuals who don’t track their expenses end up spending the bulk of their income.

Everyone has different methods of budgeting. It’s important for you to find a method that works for you.

Personally, I’m a fan of tracking every cent earned and spent. I’ve got a spreadsheet which shows me how much money I’m spending on groceries, eating out, gas, and everything else. Obviously, this is a time intensive method, but my budget keeps track of my expenses very well.

Other individuals might invest or save a chunk of their money. Whenever their paycheck is deposited, it’s automatically separated, saved, and invested. These individuals focus on saving first, then spending the rest as they please.

Whatever your method, you need to be hitting your savings goal every month. You need something in place to track your spending habits.

Keep your expenses low

Money is your leverage for building wealth. The more money you have, the more you can invest to make more money. Therefore, you need to reduce your expenses as much as possible.

Think of all the money wasters in your life. Are you spending too much money on subscriptions, hobbies, eating out? Use your budget to identify wasteful spending and eliminate it.

Personally, I’ve got a weakness for eating out. My budget keeps me in line and points out when I’ve eaten out too much.

However, you can only cut expenses so far. At the end of the day, you’re still going to need to eat and live somewhere. The goal is to reduce your wasteful spending to save as much as possible.

Grow your income at work

You need to be doing everything in your power to make more money at work. Ask for a promotion, take on extra work, or switch jobs. Income is your number one tool for building wealth.

Budgeting and keeping your expenses low is playing defense. In order to win any game, you have to play offense in order to score. The only way you’re going to score in wealth building is boosting your income.

Your current employer is only going to pay you so much money. You’re probably well overdue for a pay raise or promotion. Talk to your boss and see what you can do to earn more money.

However, you can earn more money by simply switching jobs. Companies these days would rather hire new employees for a higher salary than pay their existing ones more.

I’ve even met someone who got a 50% pay raise by switching companies!

Extra money isn’t going to fall into your lap. You’ve got to go get more money if you want it.

Create income sources outside of work

If you want to be wealthy in five years, then you will need to supplement your income outside of your 9-5. Ideally, you are working on building a side hustle that can generate a steady cash flow.

Remember, your goal is to increase the gap between income and expenses. Your boss might give you a 5% raise at most. However, creating your own side hustle has unlimited upside.

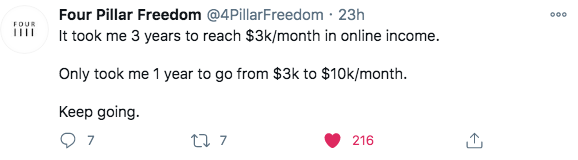

For example, you could start a blog. While blogs usually don’t see any profit in the first year, they have huge income potential. At the end of the second year, you could be making $5,000 per month passively.

Who wouldn’t want to make a side income that’s making them $60k per year? For a lot of people, $60k per year is more than they make at their 9-5.

Find a side hustle that pays you for producing results instead of hours in a chair. You’ll find that your results have a compounding effect.

For example, Zack from FourPillarFreedom built a $3,000 per month online business in three years. In another year, that same business was making $10k per month.

Invest the majority of your income

You have to get your money to make money if you’re going to be wealthy. You’ve spent the last steps creating a gap between expenses and income. Now, you need to use that surplus of cash to invest into income producing assets.

You need to find a way to invest at least 40% of your gross annual income every year. If you really want to be wealthy, you’ll find a way to invest even more.

However, it’s not that easy to simply invest 40% of your gross annual income. Let’s assume you make $60k per year. You’re going to have to find a way to invest at least $24k per year!

Why is that so hard?

- At current Federal tax levels, $8990 is going Federal tax. Good luck if you live in a state with Income Tax.

- You’re investing $24k per year.

- You now have $27,010 to live on for the year or $2,250.83 per month. That’s $2,250 per month for health insurance, groceries, rent, entertainment, transportation, utilities, and the list goes on.

Even still, use an investment calculator to find the future value of your investments. Your $24k per year is worth $155k in five years at a 10% return on investment.

$155k isn’t anything to scoff at. Having a large income and doing everything in your power to increase your income is going to help. Let’s assume you built a $40k per year side hustle, making your total income $100k.

At 40k per year invested, your portfolio would now be worth $258k in five years.

The main point? The more money you can invest the easier building wealth becomes.

Click to Tweet! Please Share!Click To TweetHow long does it take to become wealthy?

You can become financially independent in as little as two years. However, at 10% return on investment it takes 24 years contributing $10,000 per year to become a millionaire. A contribution of $25k per year requires 16 years and a $40k contribution takes 13 years.

Ultimately, becoming wealthy depends on your definition of wealthy.

For example, a blogger can build a website to a full-time income in 2-3 years. They would be financially independent because the cash flow from the blog pays for their lifestyle.

Most individuals would define ‘wealthy’ as becoming a millionaire. So here’s how much time it would take to save $1,000,000 depending on your contribution and rate of return.

| Yearly Investment Contributions | 5 Percent ROI | 7 Percent ROI | 10 Percent ROI | 12 Percent ROI |

| $10,000 | 36 Years | 30 Years | 24 Years | 22 Years |

| $15,000 | 29 Years | 25 Years | 20 Years | 18 Years |

| $20,000 | 25 Years | 22 Years | 18 Years | 16 Years |

| $25,000 | 22 Years | 19 Years | 16 Years | 15 Years |

| $30,000 | 20 Years | 17 Years | 15 Years | 13 Years |

| $35,000 | 18 Years | 16 Years | 14 Years | 12 Years |

| $40,000 | 16 Years | 14 Years | 13 Years | 12 Years |

The two biggest factors for building wealth is your savings rate and your rate of return. Some people may have better returns investing in real estate. However, investing in real estate usually takes more effort.

Either way, you’ll be way ahead of your peers if you can invest 40% of your gross income.

How much do I need to invest to be a millionaire in five years?

Investing $13k per month at a 10% return on investment would make you a millionaire in five years. Investing large sums of money is required if you want to build wealth quickly. Therefore, you can either build wealth quickly with a large investment or slowly with minimal investing.

Click to Tweet! Please Share!Click To TweetSummary: How to become wealthy in five years

As you can see, becoming wealthy is about controlling your finances. You need to reduce expenses, budget, grow your income in and outside of work, and invest the majority of your income. Ideally, you’ll find a way to invest a minimum of 40% of your income.

Becoming wealthy depends on your definition of wealthy. You can be financially independent by creating enough cash flow to cover your living expenses. Alternatively, you can keep investing until you’ve reached enough money to call yourself wealthy.

Becoming wealthy breaks down to investing as much as possible at the highest possible return on investment. The larger your portfolio, the faster your wealth will build.