How do you invest $500 for a quick return?

You can make a quick return on $500 by knowing how to pick the right stocks. Generally, you just need to know a few different strategies for finding the right stocks. However, chasing quick returns usually means investing with riskier strategies.

Imagine, turning $500 into $1,000 in a matter of a few days. It may sound like a dream, but it can actually happen.

Most people don’t chase quick returns because they are afraid of risk. Others don’t know anything about the stock market, so they leave their investments to a professional.

Luckily for you, I’m going to show you a few different strategies for turning $500 into $1,000. These strategies can make a lot of money with the right amount of discipline and knowledge.

Remember, just because you can earn a quick return doesn’t mean it will always work out. Take this information with a grain of salt before you invest any of your own money. Only you can decide what is right for you.

This article may contain affiliate links which provide a commission and supports this blog. Thank you for your support!

How do I define a quick return?

For the purposes of this article, a quick return beats the market averages. The S&P 500 has traditionally seen annualized returns around 10%. Therefore, our quick returns will return more than 10% per year.

Understanding Risk: Quick Returns are Risky

You need to understand that chasing quick returns is an easy way to lose a lot of money. Some methods are less risky than others, but they all have inherent risk. Investing in the stock market is risky.

Investing in low cost ETFs or exchange-traded funds is a simple, lower risk strategy. Generally, investors who buy and hold ETFs for the long haul see positive returns. Unfortunately, your returns won’t be much better then the annualized 10%.

ETFs provide a certain level of diversification. You are investing in multiple stocks by purchasing one exchange-trade fund. Therefore, you haven’t lost your entire life savings should one stock perform badly.

However, this usually means some stocks are outperforming while others are underperforming. You get rates of return around 10% when you average it all out .

Now imagine having purchased Amazon as the only stock in your portfolio. Amazon has returned 574% over the last five years for an annualized return of 115%! Amazon has greatly outpaced the market.

Most of us would like to see the level of success Amazon has seen. However, investing in one company is risky. If Amazon’s business is impacted by unforeseen events then so is your investment.

The moral of the story is that you can build wealth quickly if you choose the right stocks. However, building wealth quickly can be an easy way to lose your current wealth.

With this in mind, what are some of the ways you can find quick returns?

Click to Tweet! Please Share!Click To TweetSwing Trading

Swing trading is the practice of buying and holding stocks over the course of a few days to weeks. A swing trader is looking for stocks that are about to increase in price in the near future.

Personally, I love swing trading. Swing trading is something that I can do while working a full-time job. You just have to know which stocks to buy and then be patient as you wait for the profits.

What are some things to look for in a Swing Trade?

There are many different styles of swing trading. Personally, I look for stocks which have been increasing in price over the last 5 to 10 years. While not a guarantee, you are less likely to lose money investing in stocks who have a long history of price increase.

For example, let’s say you bought a stock like Amazon and it falls by 20%. Amazon has a long history of stock price increases. I feel very confident that Amazon would recover, even if I have to hold a stock longer than anticipated.

I also look to invest more into large-cap stocks. A large-cap stock is usually any stock with a market cap over 10 billion dollars. Generally, large-cap stocks are seen as a safer investment than mid or small-cap.

So how do you actually make money with swing trading?

First, you look for a company whose stock price has recently tanked. Next, you look for signs that the stock price is recovering. Once you have confirmation, buy the stock and set a stop loss to prevent unintentional losses.

Ideally, you should see the stock price increasing over the next few weeks. A swing trader usually identifies when they’re going to exit their position.

Let’s take a look at Facebook as an example.

Example – Swing Trading Facebook

Facebook had hit a 52 week high around $218. Unfortunately, Facebook was having some legal issues which caused their stock price to drop. As a swing trader, you should be well aware of when this happens to large companies.

Facebook is a quality stock. For whatever reason, people freak out and sell stock which creates opportunities for you. I have no doubt that Facebook would recover from a significant price drop.

Looking at the picture, Facebook entered a downward trend until it hit a price of $126. Facebook finally broke the downward trend, showing signs of a reversal around $150.

So I truly believe in Facebook and its potential to recover. Personally, I would look to sell right before the previous 52-week High. Therefore, let’s assume I would exit the position at $200.

Facebook did exactly that.

In a matter of six months, Facebook’s price went back to $200. Therefore, I would earn $50 per share or 33% return on investment.

33% return on investment is nearly three times 3 annual stock market return. Therefore, you are three times the stock market annual return in half the time.

IPO Investing

Initial public offering investing is another strategy you can use to generate quick returns. It is not uncommon for stock prices to double, triple, quadruple, or more in only a matter of a few years. Generally, this is because IPOs are rapidly growing with newly invested money.

However, you need to be able to determine which IPOs are worth your money. Companies like Blue Apron did not have a spectacular initial public offering. Initially, Blue Apron had an initial stock price around $165. As of writing this, APRN is worth $6.69 per share.

I don’t know about you, but I don’t want to lose that much money.

Let’s look at the flip side. Shopify had a spectacular initial public offering. The initial price around $25 per share is now worth nearly $1,150. For Shopify, it’s only been five years.

Shopify has returned nearly four thousand percent return on investment. A $10,000 purchase of Shopify stock at initial offering would be worth $455,000 in 5 years.

Usually, I’m never the first person to an IPO investment. Instead, I wait a couple years to determine which direction the stock is going to go.

Shopify was a spectacular stock, no question. The reason Shopify did so well is that it disrupted an industry. Everyone knows what Shopify is and thousands of people were starting to use the software.

Click to Tweet! Please Share!Click To TweetIdentifying Growth Stock Opportunities

Growth stocks are popular among investors because these are the companies who are rapidly growing. However, growth stocks grow at different rates. Some growth stocks may keep up with the market, while others increase stock price by 50%.

Your job is to find which growth stocks are most likely to have the best return. For example, Amazon practically doubled their stock price in 2020.

You need to figure out your system for identifying good quality growth stocks. Once identified, Buy and Hold the stock until you are ready to sell.

I look for multiple things when looking for good growth stocks. First and foremost, is the company a quality company? You are about to invest your money into an actual living company. You do not want to gamble with your money.

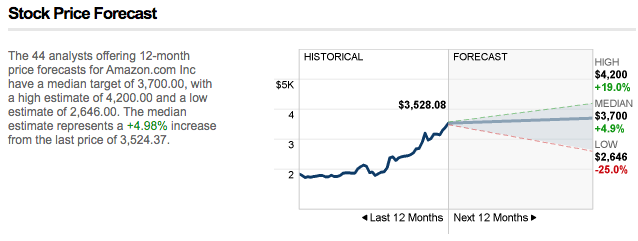

I may also look at the company’s price target. A price target is an analyst’s estimation of where the stock price will be in 12 months.

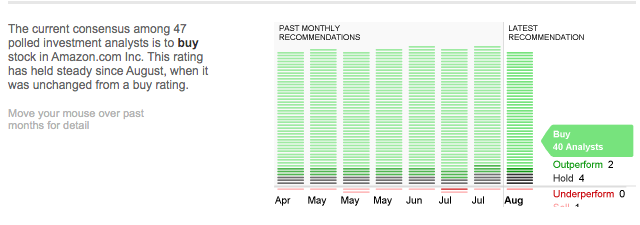

Currently, Amazon has 40 analysts who say Amazon is a buy. Two analysts think Amazon will outperform the Market. Four analysts say to hold the stock while one says to sell.

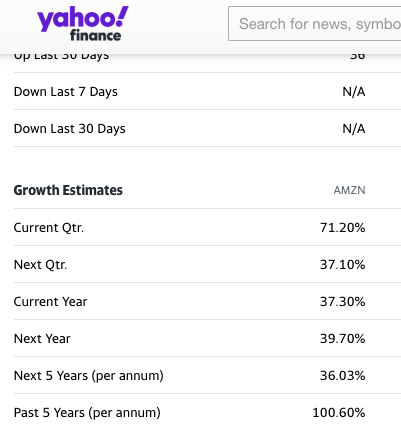

You should also consider the company’s earnings. Earnings are very important when it comes to stock price. Looking at Yahoo finance, I can see that Amazon is expected to have a 36% increase in earnings per annum over the next five years.

Price-to-earnings ratio may also be an indication on which stocks grow quickly. Generally, good things are expected when a company has a high price-to-earnings ratio. Usually, the stock market has a price-to-earnings ratio around 20. Therefore, I usually look to find companies with a PE greater than 20.

Stocks with Recent All-Time highs

Quick returns are also made on companies who have recently hit an all-time high. Some companies will experience significant growth shortly after reaching a new high. Quick returns happen when you buy the stock before the growth happens.

When a stock price has hit an all-time high it is not affected by traders using supports and resistances. Some traders use supports and resistances as an indication of where to buy and sell a stock. At new highs, the stock is free to climb without trader influences.

For example, let’s take a look at AMD. AMD had an all time high around $59.

After reaching $59, the stock had a couple months worth of consolidation. The price didn’t really go up or down much.

Eventually, the stock price did break $59 for the first time. One month later, the stock price was at $90 and still climbing. Therefore, you could have made a 50% return on investment in one month.

There is no way to know how quickly the stock will rise once reaching a new high. Some stocks rise faster than others. Additionally, the stock may not rise at all. Instead, the stock may have made a new high, but then declines.

Therefore, you need to be prepared for the possibility the stock wasn’t ready to climb. Successful traders know how to use a stop loss to help prevent losses.

Click to Tweet! Please Share!Click To TweetSummary: How to invest $500 for a quick return

As you can see, there are many ways to use the stock market for a quick return. Usually, you need to be patient to wait for the right opportunity. Take comfort in the fact that you can outpace the stock market if you are patient and level-headed.

Make no mistake, the stock market is risky. Trying to make a quick return is even riskier than just buying and holding. Remember, you can lose money in the stock market and it should be expected at some point.

I always recommend people start small. Never try risky strategies with anything you can’t afford to lose. Most of us need to experience the stock market firsthand before we put additional money into it.

When you are ready, there are many strategies to flip your first $500.

Strategies for flipping $500 into $1,000

Swing trading is the first strategy which involves buying and holding a stock for a couple days to weeks. Find good quality stocks who are momentarily down. Sell the stock when it recovers.

Initial public offerings can earn significant money. IPOs usually run wild after their offering. Most IPOs will either sink or swim at this point. Your goal is to find the quality companies who are going to grow rapidly.

Growth stocks can also earn you quick returns. There are many factors for determining which growth stocks you should buy. The most important thing to consider is earnings growth. Typically, stock prices increase when the earnings increase.

Lastly, you can earn money by finding stocks which hit an all-time high. Often, stocks will rise anywhere from 10 to 50% after reaching a new high. However, the stock may not be ready to grow.

Remember, you should always look to lock in profits. Know how to set a stop loss. Yes, selling a stock too early is never fun. However, it’s better than losing 50% of your money on the wrong stock.