What are the best investments for a 10% return on investment or better?

The best investments include:

- Index funds

- Dividend stocks

- Real estate

- Websites

- Flipping products

- Paying off high-interest debt

- Stock options

- Starting your own business

- Investing in farmland

- Fine art

- Foreign currency investments

- Cryptocurrency

- Peer to Peer Lending

- Initial Public Offerings

- Tax Liens

- Vending machine

Each of these investments are proven to be able to hit 10% ROI or better. However, all investments are not guaranteed to achieve a 10 percent return on investment.

Imagine, investing enough money that your returns made more money than your day job. Maybe you only make $50k per year, but your dividends are paying you $60k.

Investing is always slow in the beginning. However, due to the power of compound interest, your investments can build wealth for you.

Luckily for you, I’m going to show you some of the best investments for 10% ROI. Make smart choices and you can hit 10% or better!

Key Takeaways:

- There are many investment options which can produce a 10 percent return on investment. You can invest in the stock market, real estate, websites, land, art, cryptocurrency, and starting your own business.

- A 10 percent investment return is realistic and is around the annualized return of the S&P 500.

- You can get a 10% return on investment by investing consistently for the long-term, investing in different assets, and buying quality assets on sale.

This article may contain affiliate links that pay the commission and support this blog. Thank you for your support!

The best investments for a 10 percent ROI

Some of the best investments for a 10% return on investment include:

- Index funds

- Dividend stocks

- Real estate

- Websites

- Flipping products

- Paying off high-interest debt

- Stock options

- Starting your own business

- Investing in farmland

- Fine art

- Foreign currency investments

- Cryptocurrency

- Peer-to-Peer Lending

- Initial Public Offerings

- Tax Liens

- Vending machine

Any of these Investments should be able to get you a 10% return on investment or better. You just need to pick an investment style or mix of assets you’re interested in and understand.

Let’s take a look at each investment in more detail.

Index fund investing

As previously mentioned, Index Fund investing is one of the most simplistic ways to reach a 10% ROI. Most beginner investors will choose Index Fund investing because it’s easy and the traditional route.

Most people like Index Fund investing because you can pick a few index funds and set your Investments on autopilot.

Most new investors should consider themselves an S&P 500 Index Fund.

For example, Vanguard offers VOO, which tracks the performance of the S&P 500. VOO has had a 13.7% annualized return over the last ten years and is typically seen as a safer investment.

Knowing how to invest your money into index funds can build wealth over time.

How to invest in your first index fund

Investing in index funds breaks down into a few simple steps:

- Open a brokerage account and transfer funds

- Determine your index funds

- Purchase the securities

Opening a brokerage account

You will need a brokerage account before you can buy your first Index Fund.

A brokerage account is the link between you and the stock market. You log into your brokerage account and transfer money from your bank to the brokerage money market. You can then use your money to purchase individual securities within a brokerage account.

Some of the most popular brokerage accounts include:

- Vanguard

- Fidelity

- Charles Schwab

- TD Ameritrade

- Robinhood

Signing up for your brokerage account only takes a few minutes. You will have to have information on hand to open up your brokerage account, such as:

- Name, birth date, and social security number

- Contact information (Phone number, Address, email, etc.)

- Employment information

- A form of identification

Determining your index funds

When looking at index funds to invest in, consider the following:

- Past performance – Not a predictor of future performance, but a good start.

- Expense ratio (e.g., fees)

- Your investment goals and how the fund matches

- Asset type and sector

You can browse Vanguard’s list of ETFs and invest in ETFs with good performance history.

You should also determine if you like growth stocks or dividend payments.

I’m a huge fan of receiving dividend payments, but I understand the benefit of having growth stocks. Therefore I tailor my portfolio to be about 50% dividend and 50% growth funds.

Look at each fund’s expense ratio. The expense ratio is how much you will pay for holding the fund. A higher expense ratio means you’ll pay more money in fees.

The strategy used by most beginning Index Fund investors is to figure out your core group of index funds. Your core group of index funds is what you will continue to invest in for the long term, making up your portfolio.

For example, some of my favorite index funds or ETFs to invest in include:

- VTI – Vanguard Total Stock Market Index Fund ETF

- VNQ – Vanguard Real Estate Index Fund ETF

- VYM – Vanguard High Dividend Yield ETF

- VOT – Vanguard Mid-Cap Growth Index Fund ETF

- VBK – Vanguard Small-Cap Growth Index Fund ETF

- QYLG – Global X Nasdaq 100 Covered Call & Growth ETF

- JEPI – JPMorgan Equity Premium Income ETF

You can always make adjustments as time goes on. However, it’s essential to have a core group of diversified exchange-traded funds that you can invest in consistently.

Purchasing your index funds

The best time to buy your favorite index funds is when the assets go on sale.

For example, Let’s assume you’re invested in VNQ, and the price drops by 30%. Most people make a mistake and think this is the time to sell. However, now is the best time to buy because you can buy more shares at a lower price.

Buying your index funds when they’re on sale is especially good when investing in dividends.

For example, let’s assume Johnny and Sally both have $10,000 to invest. They both want to purchase company XYZ, currently trading at $100 and paying a $4 annual dividend.

Johnny spends $10,000 to buy XYZ at $100 per share. Johnny now owns 100 shares, which will pay him $4 in dividends yearly.

Sally sees XYZ drop to $70 per share and then buys 142 shares for $9,940. Sally now earns $568 every year in dividends.

Sally earns more dividend income because she bought the company at a better price.

Stock trading

Trading stocks is not considered an investment. However, there are a lot of people who make good money by trading stocks. Keep in mind that trading stocks is a risky practice, and many people lose money when trading.

Swing trading is one of my favorite ways to trade stocks. Swing trading involves buying stocks when they’re at a discount and holding for a few days to months for the stock to recover.

For example, a stock may be trading at $100 and fall to $70. You purchase the stock at $70, wait for recovery, and sell your shares at $80. You pocket $10 in profit per share, which is a 14% return on investment.

One of my favorite places to start swing trading stocks is by looking for a bullish MACD crossover.

A bullish MACD crossover indicates that the share price moving average is starting to trend upwards. However, there is no guarantee the stock will increase in price, and the MACD is only one indicator swing traders use.

Stockcharts.com has a predefined scan that helps you find bullish MACD crossovers.

From this report, I will sift through and see if there are any companies I’m familiar with. If I find a company I like (e.g., Costco, Amazon, Apple, etc.), I will pull up the stock chart and see if it’s worth trading.

From the chart, I consider the following:

- Is the Relative Strength Index low?

- Has there been stock price consolidation?

- Has the company’s share price been increasing in the long term?

- Would I own the company, even if I wasn’t trading it?

- Is the share price currently trading at a discount?

If the answers to the questions above are ‘yes,’ then I’ll consider trading the stock if the price crosses above the simple moving average.

I’ll consider selling if:

- The RSI is high

- At resistances

- The price crosses below the simple moving average.

Dividend stock investing

Dividend stocks can have a good rate of return because they can appreciate and pay dividends. Therefore, if your dividend stock appreciates 9% but pays a 3% dividend, your total return is 12%.

As previously mentioned, I like to buy dividend stocks on sale. When a company is on sale, you earn more money in dividend payments.

So to monitor my potential dividend stock investments, I create a watchlist.

A watchlist lists companies you’re trying to keep an eye on. You can list stocks for any investment style, like your favorite stocks to trade options on.

You can create a watchlist and brokerage accounts like TD Ameritrade and Robinhood. You can also make a watch list on Google stocks or Yahoo finance.

One of the best resources around for beginning dividend investors is dripinvesting.org. Dripinvesting.org has a list of dividend champions (25+ years of dividend increases) and contenders, which is updated monthly.

Companies that have increased their dividends for 25 years or more are considered more reliable for dividend income. They have a history of consistent payments.

I add these companies to my watchlist, but consider the following before I buy:

- Has the company’s share price been increasing over time?

- Do they have ten years’ worth of consistent dividend payments?

- Does the dividend payment increase every year?

- Is the company’s payout ratio 100% or less?

- Does the company have little to no debt?

- Would I own this company for the long term?

Real estate investing

Real estate can provide an amazing return for investors willing to take risks. Most millionaires were made through real estate because you can borrow money you don’t have. Therefore, you can get a fantastic return on investment by finding the right real estate deal.

Different ways to invest in real estate include:

- Buying physical Real Estate

- Real Estate Crowdfunding

- Real Estate Investment Trusts

Physical Real Estate Investments

Let’s assume you will buy a piece of Real Estate for $200,000. You can finance this deal through your bank while paying a 20% down payment.

Let’s assume you were renting this place for $1,200 per month. After all planned expenses, your investment has a cash flow of $200 per month. Remember, this $200 is not going towards costs, so you can reinvest it if it makes sense.

In one year, your $200 per month is $2,400. Because you only paid 20% down, your investment return is now 12% [=$2,400/$20,000)*100].

However, the value of your home may also appreciate. According to Zillow, the estimated home value across the United States will increase by 7% in 2021. Therefore, your return on investment is now at 19%.

But wait, there’s more! The renter also pays off the mortgage, building equity into your investment.

The amount of equity will depend on your loan and how much of the home is paid off. Let’s assume you are getting $100 in equity per month. Another 6% return on investment is added due to equity, coming to a total of 25%.

Every real estate situation is different. You can invest in traditional real estate, have a property manager, or rent the property on Airbnb. Alternative Investments include Real Estate Investment Trusts (REITs) and real estate crowdfunding.

Real Estate Crowdfunding

Real estate crowdfunding is when a company allows individuals to invest with their company in real estate deals. The company is pulling money together and giving you some of the returns.

Some of the best places to participate in real estate crowdfunding include:

- Fundrise

- RealtyMogul

- Yieldstreet

- EquityMultiple

- CrowdStreet

- Modiv

Real Estate Investment Trusts

Real estate investment trusts (REITs) are real estate companies that invest in real estate. You can purchase ownership in these real estate companies and receive a dividend payment for your ownership. Real Estate Investment Trust trade like normal stocks on the stock market.

You will need a brokerage account to purchase a real estate investment trust. For example, Robinhood is a brokerage account where you can buy a Real Estate Investment Trust.

Some of the largest REITs include:

- Prologis (PLD)

- American Tower (AMT)

- Crown Castle (CCI)

- Public Storage (PSA)

- Equinix (EQIX)

- Simon Property Group (SPG)

- Welltower (WELL)

- Digital Realty (DLR)

- Realty Income (O)

- AvalonBay Communities (AVB)

Buying profitable websites

Buying websites is a fantastic source of income if you know how to run them. Every single day people are selling websites that are already profitable. Luckily for you, websites have a low maintenance cost and high-profit potential.

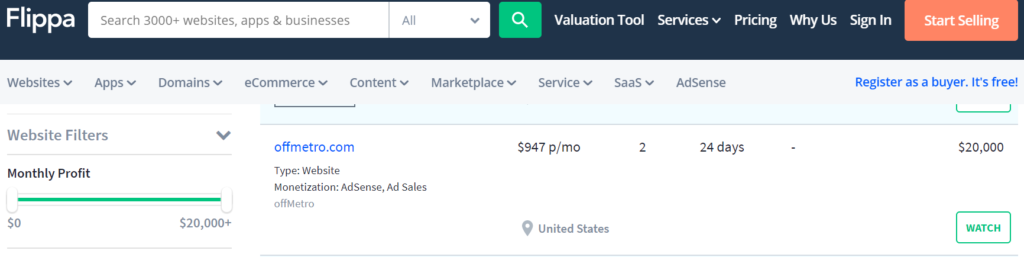

Browsing Flippa, I found a website for sale with an asking price of $20,000. This website is already making $1,000 per month.

Buying this website as is would generate $12,000 per year. Therefore, you would have an excellent return on investment at 60%!

Best of all, websites are generally easy to maintain. Therefore, this website can generate $12,000 annually with minimal effort. Talk about passive income!

Flipping products for profit

Most rich people understand that working a day job does not make you rich. Selling products and investing well can make you rich. Luckily, you don’t even have to go far to find products you can sell.

Yep, you don’t even have to make a product. You just need to find the right product to put in the right marketplace.

Imagine going to your favorite stores and raiding the clearance rack. You can sometimes find amazing deals 40, 50, and even 90% off!

You can then sell these items on Amazon, eBay, Mercari, Poshmark, and many more sites! Thousands of people are doing this every day. The process is called Retail Arbitrage.

But does Retail Arbitrage work?

Absolutely! However, you will need to work to find items, list them, and ship them out promptly.

For example, I once found dog treats selling at Grocery Outlet for $1.99 per pack. I then sold these treats on Amazon for around $3. Amazon took their cut, which put my overall cost close to $2.50.

I would earn around $0.50 or 25% return on investment for every pack sold. I know what you’re thinking; who cares about 50 cents?

I did! There was no way I could keep the Amazon store stocked with these treats. It didn’t matter that the profit margin was only $0.50 when the product flew off the shelves.

Paying off high-interest debt

A high-interest loan or debt is a negative return on investment. Simply paying off any debt with a high-interest rate gives you a fantastic return.

For example, owning a credit card with an 18% interest rate. You are losing money every month that you pay interest on this debt. Make it a priority to pay it off ASAP!

Click to Tweet! Please Share!Click To Tweet

Start Your Own Business

Nowadays, anyone can start their own business and grow it into a thriving success. Starting a business will take a significant initial investment of time– and, likely, some capital. However, with enough dedication, a start-up business can soon rise off the ground and make a 10% return or higher.

Some of the easiest businesses to start could be:

- Pet, house, or babysitting

- Being a delivery driver

- Lawn mowing or landscaping

- Residential cleaning

- Virtual assistant service

- Affiliate marketing, if you already have a website or strong social media presence

To make your 10%, you’ll need to have enough profit.

Profits in a business are sales minus expenses, which means you’ll need to sell more goods or services than what you’re paying in bills.

By focusing on cutting your costs and increasing your sales, you can make your way into the 10% mark after some time.

Most businesses don’t reach profitability until after their first year running. Amazon, for example, consistently cost money during its first few years in the 1990s and is now a $1.3 trillion company.

The moral? Maintain your patience and keep the course.

Invest in Farmland

Most people don’t think of farmland when considering investments, but this could be a real estate landmine if you do it right.

With a steady increase in population, the world has a rapidly-growing need for increased food production. Many farmers choose to rent farmland instead of buying their own.

You’ll have constant cash flow and someone else cultivating your land or using it for pasture.

If you have some land you can’t cultivate, you can:

- Host billboards or cell towers

- You may also want to set up solar panels on your farmland if your municipality permits.

Apart from paying rent or hosting, you’ll also see the value of your farmland appreciate.

The best way to make 10% through this investment is by finding the best deal on the land. To do this, you’ll need first to choose an area to focus on.

Analyze farmland in the area by size and rental prices. Look for one selling at less than the average cost per acre.

If you’d rather not be a landlord or landowner, you may want to invest in farmland REITs instead. Farmland REITs are trusts that purchase and manage farmland and sell parts of their trust as a form of stock.

Invest in Art

Art is one of the oldest investing methods, and it provides a safety net for your portfolio since it tends to hold its value when the economy dips. This makes art an excellent hedge against inflation.

Investing in art can be done through traditional pieces by well-known artists or, more recently, through non-fungible tokens (NFTs).

NFTs, in layman’s terms, is a form of digital art. Some NFTs have increased to more than 100 times their original value in as little as a year.

Choosing the right art pieces will take some research and a bit of luck. First, choose a niche such as fine arts or NFTs. Then, find a reputable source or platform to purchase the type of art you’re looking for.

Fine art sells through official galleries or auctions, and NFTs will be sold through online marketplaces, requiring you to fund an online wallet for purchase.

The trick to making money on art is to buy it low and hold it as its price rises. The rarer the piece, the more profit you can make off of it in the future.

Foreign Currency Investment

Foreign currency investment is when you buy money from one country while selling another. This strategy works best when you purchase currencies from several countries, balancing your portfolio against macroeconomic fluctuations.

Although we don’t tend to talk about it day to day, the value of money rises and falls, much like stocks. If you purchase a foreign currency and it begins to rise against the dollar, you’re experiencing appreciation, much like other investments.

After you sell this currency for dollars, you’ll have made a profit.

To participate in foreign currency investment, you’ll need to buy and sell currencies through a foreign exchange market called Forex. Because this market is international, it’s open for trading 24/7, Monday through Friday.

To begin, you’ll need to choose a currency that you believe will increase in value. Be sure to analyze significant events in that country, including:

- Government elections

- Agreements with other countries

- Any civilian unrest

Then, purchase currency from that company through an online forex platform and wait. Once the currency rises to a value that meets your profit goals – hopefully, 10% or higher – you can sell it for dollars and earn your income.

Cryptocurrency

Cryptocurrency is one of the most volatile assets on the market, but this means a considerable risk for the opportunity of huge rewards. You don’t have to know much about crypto to know that many people have become almost-overnight millionaires through this type of trading.

Cryptocurrency is digital money. Instead of having a currency from each country, these cryptos are created independently to avoid government interference.

To keep it simple, you can view them similarly to forex trading or speculative stock trading.

It’s harder to estimate when or how a cryptocurrency will rise in value. Bitcoin, the most famous crypto, was worth only $1 in 2011 and is currently valued at over $19,000 per coin. You can research the blockchain and plans for each cryptocurrency to speculate its appreciation, but a lot of it is guesswork.

If you’re open to some risk and are attracted by the enormous potential reward, you can open up an account on an online crypto trading platform like Coinbase or Binance. Connect your bank account to fund your trading account and purchase the cryptocurrency you’re interested in.

If it increases in value by 10% or more – something that can easily happen overnight with cryptos – you sell your coins and cash in.

Peer-to-Peer Lending

Consider peer-to-peer lending if you have put away a decent sum of money and want to make more off of it than your bank’s measly interest payment. P2P lending is what it sounds like; you lend your money to a peer, and they pay you back with interest.

Instead of having an acquaintance or other person go to a bank or loan officer, they can come to you. You set up your interest rate and repayment options and see who is interested.

Then, you put together a legal agreement for your loan, and you can check the borrower’s credit score before confirming the loan. A government guarantee doesn’t protect your loan, but you can include some liens or collateral clauses to protect your investment further.

Most peer-to-peer lending interest rates are more than 10%. This means you’ll immediately be making money without much legwork.

Initial Public Offerings

Often, a private company will decide to “go public” by making its shares available for anyone to buy. The initial public offering (IPO) is the first set of available shares.

Companies must meet specific requirements to go public, and some IPO dates are looked forwards to months or even years in advance.

Not all IPOs are suitable investments.

It’s essential to check the company’s performance history, including its revenue during the years before going public. If you find a company that has been growing steadily, it is likely a good IPO investment.

To invest in an IPO, you’ll need an account through an online brokerage or a physical broker to purchase the new stock. Stay aware of IPO dates and changes within the company before it goes public.

Once you have the stock, you can hold it indefinitely or sell it as soon as you’ve gained 10% or more in appreciation.

Tax Liens

In 28 states, if you don’t pay state taxes on your property, the local municipality has the right to seize the property as an asset. Some states will sell the tax lien certificates in auctions if the property remains delinquent. The bidders bid a price and an interest rate they want to be paid back.

The winning bid for the certificate doesn’t automatically get the property, but they purchase the right to get the property if it is foreclosed on. If the owner decides to pay back the taxes, the bidder is repaid, plus they receive the interest they determined during the auction.

This investment could easily make you more than 10% interest if the homeowner decides to repay their debt. If not, you may have made more than 100 times your investment if the home forecloses and becomes your property.

Vending Machines

Purchasing vending machines as an investment requires a bit of start-up capital, but with $1,000-$2,000, you can be on your way to great passive income.

Consider what kind of vending machine you want to purchase and where to place it. You’ll need an agreement with the property owner.

Then, consider purchasing a used vending machine to get the most bang for your buck. Stock it with wholesale-purchased items and monitor your sales.

The average vending machine earns over $120 per month, easily making it one of the best investments for a 10 percent return on investment.

What is a realistic rate of return on investment?

10% return on investment is a very realistic return on investment. Generally, the S&P 500 has returned an annualized return of 10%. However, when planning for retirement it may be wise to estimate 7 or 8 percent for conservatism. Investments outside of the stock market (e.g. Real Estate) may lead to even higher returns.

However, you can get better rates of return by managing your own investments. Ideally, you would start small because learning investment strategies take time. You want to learn what you can while minimizing risk.

You may be able to get higher returns on investment depending on your investment strategy. For example, real estate builds equity, provides cash flow, and appreciates in value over time. Therefore, a real estate investment may provide a higher rate of return.

How do you get a 10% return on investment?

You can get a 10% return on investment by:

- Investing consistently for the long-term

- Investing in different assets

- Buying assets when they’re on sale

Let’s take a look at each step in more detail.

Invest consistently for the long term

A 10% return on investment is achieved by investing consistently for the long term. Most Investments will have up and down years, but long-term investments typically balance out. Therefore, it is crucial to keep a long-term outlook on your Investments.

Most historical returns on investments are stated in annualized returns. Essentially, it is a statement that the past timeframe averages out to a certain return on investment.

For example, let’s say an investment has the following yearly returns:

Year 1 – 10%

Year 2 – 20%

Year 3 – 3%

Year 4 – 7%

Year 5 – 12%

The five-year annualized return would be 10.4%, or the average return over the five years. You should not expect to get a 10% return each year. Instead, know that the typical return averages out to 10% over the time frame.

The longer you play the investing game, the more even keel your investment returns will be. Look to invest for the long-term and add money to your investments regularly.

Invest in different assets

Different assets and asset classes have up and down cycles. Investing in different asset classes helps ensure your portfolio isn’t hammered all at once during a down cycle.

For example, during Covid-19, the stock market was hit hard, especially for stocks like airlines. However, physical real estate had remarkable year-over-year growth.

Having a rental property could have helped your overall portfolio continue to grow, even though stocks weren’t doing so well.

I’ll diversify my stock portfolio, splitting between dividend stocks and ETFs vs. Growth.

During some periods, growth performs while dividends are down. Other times, dividend stocks are up while growth lags.

Buy assets when they’re on sale

As an investor, you should always seek quality assets for as cheap as possible.

Most people want to jump into cryptocurrency or whatever the media and their friends are talking about. They might see Bitcoin ‘going to the moon,’ but the best time to buy Bitcoin was before liftoff occurred.

Most individual investors buy at the top because that’s when people talk about it.

Instead, look for the assets nobody is talking about. Good companies will typically rebound.

As previously mentioned, I own some of the following:

- VTI: Vanguard Total Stock Market Index Fund ETF

- VNQ: Vanguard Real Estate Index Fund ETF

- VYM: Vanguard High Dividend Yield ETF

- VOT: Vanguard Mid-Cap Growth Index Fund ETF

- VBK: Vanguard Small-Cap Growth Index Fund ETF

- QYLG: Global X Nasdaq 100 Covered Call & Growth ETF

- JEPI: JPMorgan Equity Premium Income ETF

Growth ETFs include VTI, VBK, and VOT. If growth stocks are down, I’m probably buying one of these three ETFs.

Alternatively, I’m probably buying VNQ, VYM, QYLG, or JEPI as my favorite dividend ETFs if dividends are down.

Click to Tweet! Please Share!Click To Tweet

Is 10 percent a good return on investment?

Ten percent is considered a good return on investment for individual investors. However, many other assets can outperform or underperform a 10% ROI. Unless you actively manage your investments, aiming for a 10% ROI is a good goal.

Generally, most investors focus on a 10% return on investment because of the S&P 500. The S&P 500 is an index that tracks the top 500 companies in the US. Historically, the S&P 500 has an annualized return of 10%.

So when focusing on a 10% investment, we are focusing on beating the market average. Most people don’t even try to beat the market average. Instead, most investors will happily take a 10% ROI to invest in a safe index like the S&P 500.

However, an experienced investor can beat the market average. You can do better than a 10% return on investment.

So why aren’t more people trying to get a better return?

Most individuals lack the knowledge and effort to manage their Investments. Choosing a simple S&P 500 index fund is easy and requires little thought. Most people know that a boring index fund will grow over time without effort on their part.

Summary: The best investments for a 10 percent ROI

As you can see, there are many ways to get a 10% return on investment or better. The most common include index funds, dividend stocks, real estate, websites, and flipping products for profit. However, paying off high-interest debt can be the best return on investment.

The best investments include:

- Index funds

- Dividend stocks

- Real estate

- Websites

- Flipping products

- Paying off high-interest debt

- Stock options

- Starting your own business

- Investing in farmland

- Fine art

- Foreign currency investments

- Cryptocurrency

- Peer to Peer Lending

- Initial Public Offerings

- Tax Liens

- Vending machine

Realistically, most investors see a return on investment of around 10%. However, your investment returns will depend on your investment strategy.

Real estate has been the chosen vehicle to wealth for many millionaires. You can invest with other people’s money while earning cash flow, equity, and appreciation. However, real estate can take a lot of time and effort.