College can be a fun time in your life, but for many, it can be difficult to pay for college on your own.

The cost of a college education is rising, but it is still possible, with proper planning, to leave college debt free.

There are three types of students. The first type has college paid for and can be found partying or wasting money. The second type of college student will leave with some college debt, but still had fun partying.

Finally, the third type of student has no college financial support to start with and leaves college debt free. This type of student is rare, but they understand the value of hard work and starting off their life debt free. The third student leaves college without having to repay financial aid or student loans.

I want you to be like the third student. College is a tempting place to spend money. However, you can leave college debt free with some careful planning and hard work.

Today’s article is all about finding out how to pay for college on your own with no money and leave debt free!

This post may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

How to pay for college on your own with no money and leave debt free

How much does it cost to go to college?

So how much does it really cost to go to college? According to Collegedata.com, the 2017-2018 average yearly cost of college is $25,290 for in-state college.

That’s an outstanding $101k for a four-year degree!

I guarantee most people are leaving with college debt because their parent’s couldn’t help financially. You might even have bad credit which can make borrowing money for a college degree even more complicated.

Now that’s not to say you can’t go to college for much less. Half the cost was estimated to be housing-related expenses. So living close to home can save you a huge amount of money.

Assuming you have no other expenses, you’ll need to find a way to generate $25k a year to cover college.

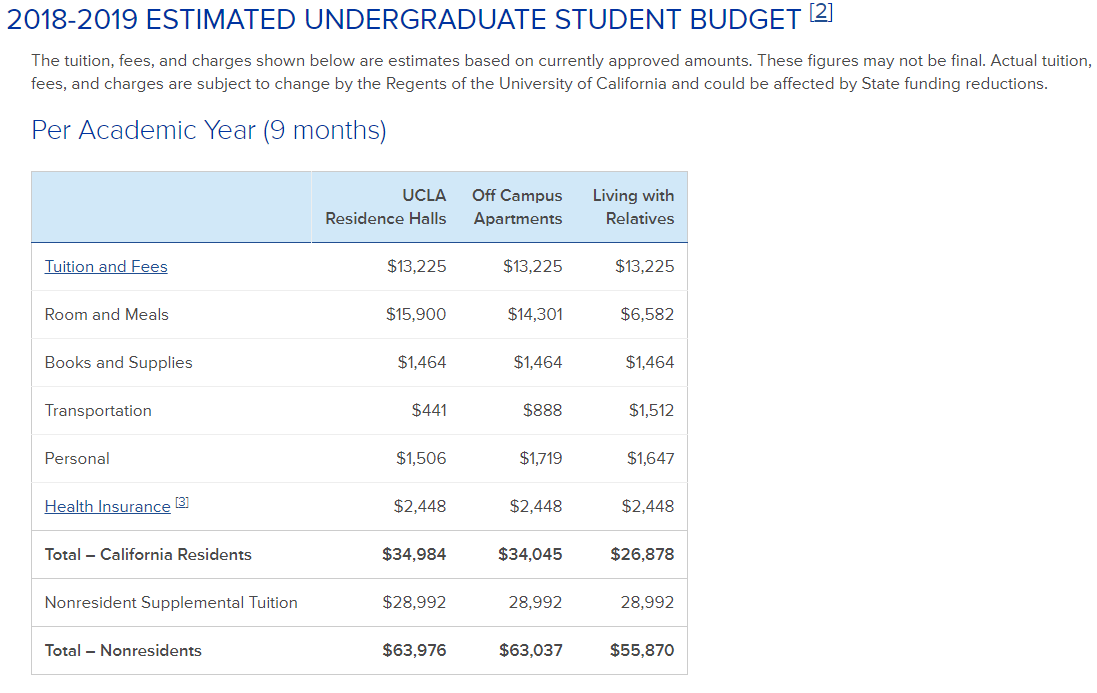

Example: Estimating the cost of college to attend UCLA

If you already know which college you’ll be attending, do a Google search for “cost of admissions + your college.” This will give you a more accurate breakdown of what it will cost to attend your specific college.

In our case, let’s look at how much money we would need to attend UCLA. Doing a google search for “Cost of admissions UCLA” the admission boards website was the first result. They’ve put together a handy budget to help first time students understand the cost of college.

You can see UCLA estimates the cost of one year for a California Resident to be nearly $35,000! Room and Meals are the biggest estimated expense, but you can see it’s much cheaper to live with your relatives.

Tuition and Fees is pretty much non-negotiable. You’ll need to find a way to pay roughly $13k a year for tuition. The best thing you can do to reduce tuition cost is constantly looking and applying for scholarships.

Books and supplies are a smaller portion of college costs, but still noticeable! Most college students save money by buying books online, getting the international edition, or borrowing books from friends previously enrolled.

Go through the listed fees and see which are applicable to your situation. Create a yearly savings goal based on your estimated cost.

Related:

Deciding on the right college to keep costs down

As you can see from the linked article above, nearly half of your estimated college expenses come from living. Ideally, you’ll be able to live at home while attending school to keep cost down.

Living with your parents is probably one of the best ways to save money on college expenses. In most cases, your rent and food are free so you can focus on school.

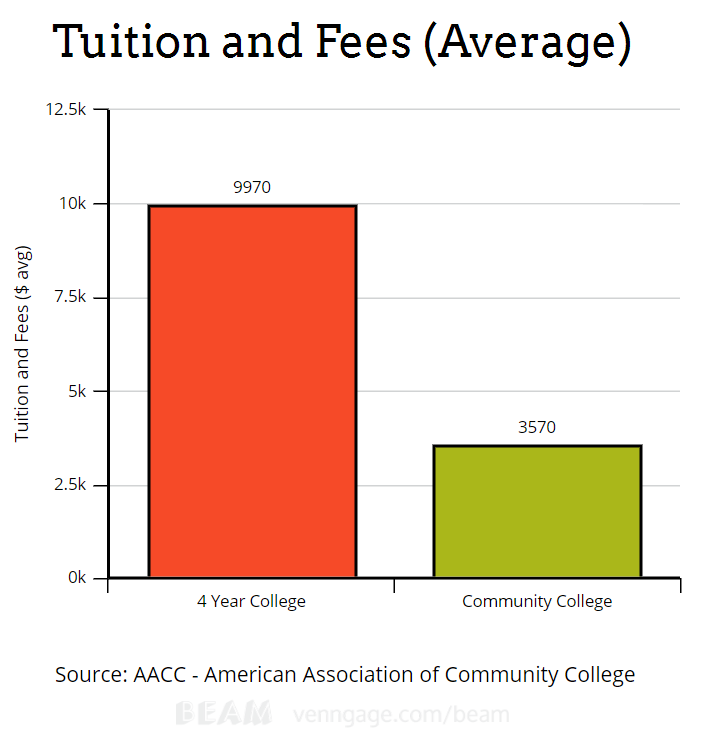

Choosing to go to a community college is usually a lot cheaper than attending a large university. Even going to a 2-year community college to get basic classes finished will significantly cut the cost of your education.

According to the American Association of Community Colleges, the average annual tuition and fees are only $3,570 at community colleges. Going to community college is an astounding 64% cheaper than a four year university!

Be selective with the college you choose and compare tuition rates. Billionaire Mark Cuban decided to attend a college with the best business program for the lowest cost.

At the end of the day, we are going to school for an education. It’s important to keep that in mind when choosing a school. It’s tempting to go to a known party school, but is partying worth the extra tuition costs?

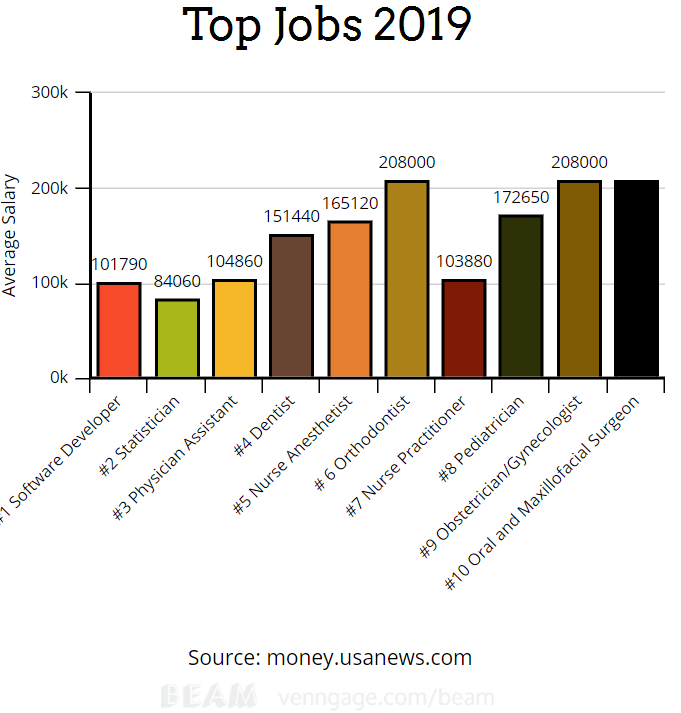

Choose a degree in a well-paying field and stick with it

I would like to be able to say that following your dreams is the most important part of going to college, but it isn’t.

You may want to go to school to follow your passion, but if you can’t find a job or earn enough money then life gets rough. It’s much easier to have a return on investment if your job pays you $50k out of school, rather than $30k.

You can get jobs that pay $30k out of high school, so why pay $101k for a degree that pays $30k per year?

USA news found the Top 100 best jobs in 2019. The list was dominated by healthcare professions, but there are plenty of other career choices to inspire you. Here’s a chart with the top 10 career choices and their salary:

There are much cheaper college alternatives if you are truly set about learning your passions and following your dreams.

Online websites, such as Udemy, will let you take courses for much less than going to school. I strongly recommend self education for your passions and paying for college when it makes sense for your future.

Some companies will even be willing to hire you without a degree if you show promise. Someone who’s really good and self taught at graphic design could get a job as a graphic designer.

When you have enough experience, people tend to stop looking at degrees. That is, unless it’s super critical to the job, like engineering.

If you do go to college, be set on your degree. You’ll pay more money and waste valuable time if you flip flop on your choice.

Build a budget

Budgeting is going to be your secret weapon for leaving college debt free. With proper budgeting, you’ll know if you’re on track to leaving school debt free or behind schedule.

Building a budget isn’t easy or fun, but I’ve designed a free course to help you get going on the right track. The course is full of budgeting and money saving advice so that you can live a happy financial life.

Work while you go to school

You will have to work while going to school if you want to leave college debt free.

Working a part-time job during college is a good way to earn extra money. The best jobs you can do earn tips, such as pizza delivery or bartending. If your college is big on drinking, a good bartender can earn a lot of money in tips.

Estimate the cost of your college. How much money will you need and how long do you have to come up with the money? Someone who starts looking for cash their freshman year will have four years to come up with an estimated $101,000, if you want to leave loan free.

If you worked year round, you would have to work an average of 48.5 hours each week at $10 an hour. However, you would only need to work an average 24 hours if you started earning money your freshman year of high school.

Always do your best to have an internship or well-paying job lined up for the summer time. Landing a well-paying job is key for paying off the large cost of college.

Ideally, you would have a summer job start the day after school let’s out. You don’t want to waste a month of your summer trying to find a good paying job.

If you did manage to find a good paying job, see about the possibility of returning the next year.

Click to TweetClick To TweetFind and apply for college scholarships and grants regularly

You may already feel overwhelmed with graduating high school, finding a college, picking a degree, building a budget, and finding a job. However, you need to add one more thing to your list, finding and applying for scholarships and grants.

Scholarships are free money that you can use to pay for college. If you’re lucky, you can find enough scholarships to pay for most of your schooling.

The majority of Federal Aid money comes from Pell Grants, followed by federal work study, subsidized direct loans, and unsubsidized direct loans.

Start by asking your college’s finance department if they have any scholarship leads. Try to avoid taking out student loans. If you have to take out student loans, make sure you don’t have to pay interest on them until after you graduate.

Do a Google search often for college scholarships. Some scholarships are degree specific which means not as many people are applying for them.

You should check for new scholarships once a week. Your strategy should be to apply for as many scholarships as possible!

Related:

- Save more money at home! Here’s how.

- How to start investing for retirement!

- Ever hear of Dave Ramsey? No? Then you must read this!

Side hustle

College has a way of bringing out our inner entrepreneur. Look for ways to profit in your college town and then make it happen!

One person I met made a living on recycling beer cans. Fridays and Saturdays were notorious partying days at my college. This guy came around the next day and collected as many beer cans as he could find and took them to be recycled for cash.

Another business would cook hot dogs for drunk people on Fridays and Saturdays. There was always a line down the road and drunk people didn’t mind waiting in line for their hot dog.

College is full of young people being wasteful of their money. Start brainstorming how you might make money at your college.

Summary

To summarize, there are a few things you can do to pay for college on your own. It won’t be easy, but if you maintain a good work ethic, you can pay for college before you leave. You should:

- Decide on a specific college. Try to go close to home, consider community college, and think what school offers the best program for the lowest cost.

- Find out how much it will cost you to go to that college. The 2017-2018 average is 25k per year, but half of that was in housing expenses.

- Choose a degree that can get you a higher salary. Stick with your degree to avoid wasting time and money.

- Build a budget to manage your money well so that you save enough money each month to pay for school.

- Work while you go to college so that you can earn money to pay for school. During school think jobs that pay in tips, such as bartending or pizza delivery. Always try and have a well-paying summer job lined up.

- Apply for college scholarships and grants on a regular basis.

- Side hustle! Identify what people crazy college kids will spend their money on and profit from it.

Don’t forget to sign up for the free course on budgeting and saving money. You’ll learn how to budget and save money effectively so that you can pay for college on your own.