Is 50k per year good money and can your family live on that much money? Or is a 50k per year salary enough to keep you broke and barely surviving?

$50k per year is an ok amount of money, but rapid inflation and increased housing prices are making $50k hard to live on. It is much easier for a single person to live on $50k, but couples and families are starting to struggle. A $50k household income is considered below average when compared to the 2020 average household income of $67k.

I’m assuming your household makes around $50k per year since you’re visiting this article.

How would you like to live comfortably on that $50k and stress less about money? Can you meet your financial commitments and goals earning $50k per year?

Luckily for you, it is possible to live on that much money. However, today’s article is going to answer the question, “Can I thrive on 50k per year?” Let’s take a look at what earning a $50k salary means for you and your family.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Key Takeaways

- $50k per year is considered a good salary for a single person. However, the average household income was around $67k in 2020, meaning households under $67k have room for improvement.

- Individual couples and families making $50k will spend the majority of their income on necessities.

- Statistically speaking, maximum happiness is achieved around a $75k salary.

- Rapid inflation with minimal income growth is making $50k above poverty, but not enough to live comfortably.

- Purchasing a home on a $50k salary is becoming more unobtainable as housing prices increase.

Is 50k per year good enough money to make you happy?

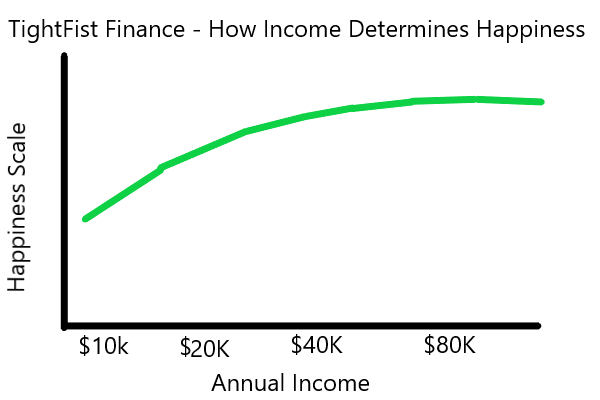

Did you know, money can buy happiness to a point? During a survey of over 450,000 people, maximum happiness is achieved at a yearly income of $75,000.

After $75,000, happiness begins to taper off. Therefore, you cannot expect money to bring you more happiness after earning a $75k salary.

So, how does earning $50k per year affect your happiness? People with a salary of $50k are still considered happy individuals, but have room for improvement. Unhappiness is significantly greater in people earning less than $40k per year.

How much is a 50k salary?

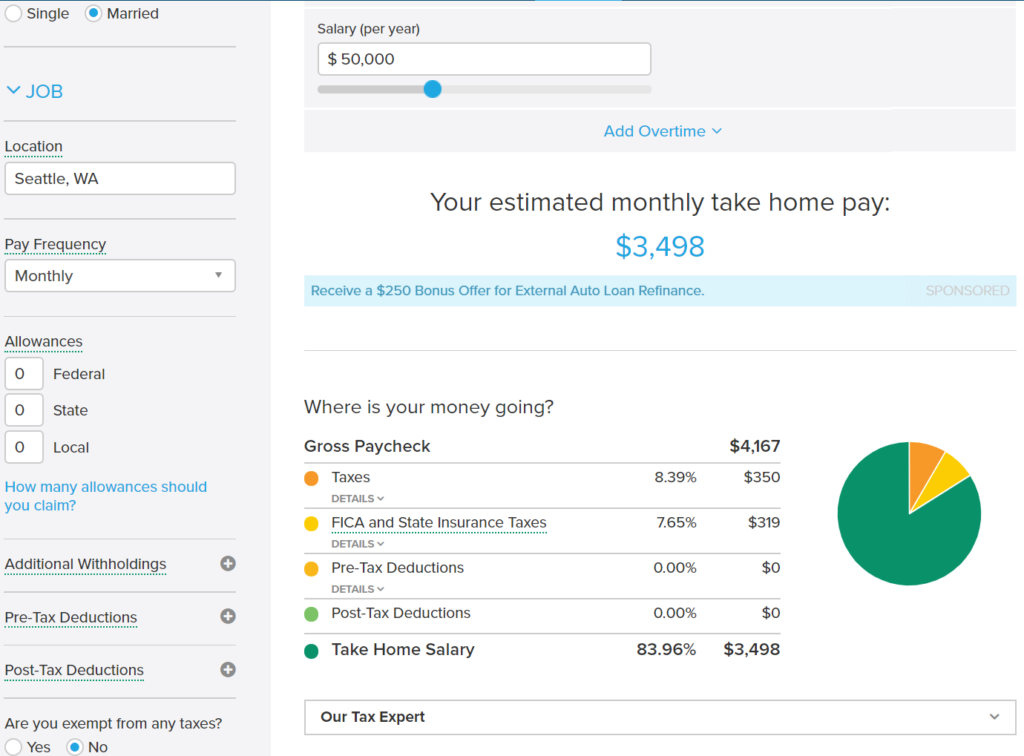

The easiest way to determine your monthly salary is to use a free paycheck calculator. Paycheck calculators are great at helping you determine after tax income.

I recommend using a paycheck calculator because after tax income varies depending on your situation. For example, your relationship status and your Federal, State, or Local allowances determine how much of your $50k salary you can keep.

Here is how much a $50k salary is assuming you’re single claiming zero allowances, withholdings, deductions, live in Washington State, and work a 40 hour work week:

| Frequency | Gross Pay | Net Pay |

|---|---|---|

| Hourly | $24.05 | $18.05 |

| Daily | $192 | $155 |

| Weekly | $962 | $722 |

| Monthly | $4,167 | $3,358 |

| Annually | $50,000 | $40,296 |

Assuming you’re married and aren’t claiming additional withholding’s (e.g. claim zero allowances, pre and post tax deductions), a 50k salary is $3,498 per month.

As you can see, a married person brings home an additional $140 per month in income. There is no one-size fits all answer for estimating your take home pay, because how much you bring home depends on your situation.

Paycheck calculators are great for estimating your income or evaluating how pay raises may change your income.

For example, maybe you want to contribute $300 per month to your 401k. Now your take home pay is $3,234 per month. Notice your take home pay is only reduced by $264. 401k contributions are pre-tax deductions, which means you are saving money on taxes.

Click to Tweet! Please Share!Click To TweetHow much is $50k per year hourly?

Based on a 40-hour workweek, $50k per year is approximately $24.04 an hour. However, it’s common for some employees to work 30 or 35 hours a week as full-time workers. Examples include healthcare workers and some retail positions.

The hourly rate increases when employees earn $50k per year and work 35 hours a week. With a 35-hour workweek, a person makes $27.47 an hour.

Say their workweek only contains 30 hours. The hourly rate goes up to $32.05.

But the opposite happens if a worker is not eligible for overtime and works more than 40 hours weekly.

Say you put in 45 hours weekly on a $50k annual salary. Your hourly rate goes down to $21.34.

Hourly rate decreases are one of the drawbacks to being on salary and exempt from overtime pay.

How much is $50k per year a day?

Before taxes and other deductions, such as health insurance premiums, a 40-hour work week and $50k per year is equivalent to:

| Number of days worked per week | Hours worked per day | Gross daily pay rate |

|---|---|---|

| 4 | 10 | $240.40 |

| 5 | 8 | $192.32 |

| 6 | 6.67 | 160.35 |

| 7 | 5.7 | $137.03 |

The majority of workers receive a monthly or biweekly paycheck. Salaried employees don’t see many variations (if any) in their paychecks. However, hourly employees earning $50k per year may notice some differences. This is due to the number of days in the employer’s pay period.

You can figure out your net daily pay rate if you’re paid biweekly by multiplying your after tax paycheck by 26. Then you can divide that number by (52 x the number of days you work per week).

For example, let’s assume your after tax paycheck is $1,444 which you receive every two weeks. Multiply $1,444 by 26, which results in $37,544 as your net annual income. Assuming you work five days per week (8 hours per day), your net daily income is $144.40 = $37,544 / (5 x 52).

You can also figure out your daily pay rate if you’re paid monthly. Multiply your monthly net pay by 12 to get your annual net income. Then divide your annual net income by (52 x the number of days you work per week).

For example, you’re take home pay is $3,358 per month. Multiplying your monthly take home pay by 12 results in $40,296 annual net income. Assuming you work five days per week (8 hours per day), your daily net income is $155.

How much is $50k per year per week?

Essentially, someone making $50k a year is making $961.54 weekly in gross income. You can calculate this by dividing $50,000 by 52. There are 52 weeks within a year.

Keep in mind that $961.54 is gross pay. Gross pay is not the equivalent of what someone will take home weekly, known as net pay. Net pay will vary depending on federal and state income taxes and individual deductions.

Figuring out your net pay per week is easy if you get paid biweekly. Just take your net pay from a paycheck and divide it by two.

Get paid monthly? Take your net pay and divide it by four.

What is $50k a year monthly?

Earning $50k yearly comes out to a monthly gross pay of $4,166.67. Already earning $50k a year? Figuring out your monthly net pay is as simple as looking at your pay stub.

You can also look at one of your pay stubs for individuals who get paid biweekly. You’ll just need to multiply it by two. But keep in mind that there are some months when you might receive three checks.

This is because 52 weeks a year doesn’t divide evenly into two pay periods a month. So, to get a more accurate calculation, take your biweekly net pay and multiply it by 26. Then divide that result by 12.

Net pay can fluctuate based on changes in payroll taxes at the federal and/or state levels. Increases in benefits and 401(k) deductions can also cut your net pay. For up-to-date and the most accurate figures, use your latest pay stub.

How much is $50k per year after taxes?

Your net pay after taxes will depend on your filing status, pre-tax deductions, and the number of allowances. You can use an online paycheck calculator to determine your estimated net pay. However, $50k per year after taxes for a single person with one allowance is $38,385 annually.

A married person with one allowance will take home $40,490 after taxes with a $50k salary. But say you claim no allowances, which maximizes the amount of taxes taken out. A single person will take home $38,203 a year after taxes.

Someone who’s married with zero allowances will earn $40,126 after taxes. As you can see, there is not too much difference between one allowance and zero.

How does 50k per year compare to the average family?

According to the United States Census Bureau, the average household income was $67,521 in 2020. Therefore, earning a household income of less than $67,521 places you as below average.

Does it matter if a salary of $50k is below average?

Absolutely! Society has to be able to function so that the average family can live. So people earning $67k are doing ok for themselves. However, you really start to flourish when you earn above average income.

As previously mentioned, people earning less than $40k per year are significantly unhappier. Therefore, someone earning $50k is smack dab in the middle of unhappy, financially struggling, and people who are doing ok for themselves.

Click to Tweet! Please Share!Click To TweetIs $50k a year a good salary for a single person?

This all depends on the cost of living in your area and your personal situation. Speaking from experience, $50k a year used to be more than enough for a single person. Nonetheless, it is now more challenging for a single individual to survive on $50k a year.

The rising housing costs and basics like food and utilities make it more difficult to get by. The other half of the equation is a single person pays for everything on one income. They don’t have a partner to help out or divide the bills with.

As a result, many singles take on a second job or side hustle to supplement their main income. With today’s cost of living in most areas, an annual salary of $65 to $75k is more comfortable for singles.

That being said, in areas with below-average cost of living indexes, $50k can be sufficient for one person. The average index for the U.S. is set at 100. Areas with indexes below 100 are more affordable.

Is $50k a year good for a couple?

Given that the average household income was $67,521 in 2020, $50k will be lower than average for a couple. Although it may be possible for a couple to survive on $50k in a low-cost area, they may struggle. For instance, it might be difficult to save for retirement.

That’s because most of a couple’s $50k salary will go toward paying for essentials. There might be little leftover between a rent or mortgage payment, utilities, transportation, and food. Saving is something that’s challenging for most U.S. households earning average pay.

And it’s largely because salaries have not kept up with inflation and worker productivity. When a couple is at or above average household earnings, saving is more feasible.

Is $50k a year good for a family?

Of course, it depends on the size of the family or household and the geographic area’s cost of living. But if a single person or couple finds $50k a year tight, a family will struggle even more.

The 2022 U.S. guidelines establish an annual income of $46,630 as the poverty line for a family of eight. The poverty line for a typical family of four is a yearly income of $27,750. So, a family of four will be well above the poverty level.

However, that doesn’t mean they’ll be able to afford a middle-class lifestyle. In areas like Los Angeles or New York, $50k a year won’t cut it. But in a remote area or a state like Nebraska, $50k might be feasible.

Can you afford a house living on 50k per year?

So, is it possible to afford a house living on 50k per year? Let’s take a look at how much house you can afford.

Affording a house on $50k is a bit of a stretch given today’s average home prices and mortgage costs. The average home price in the U.S. is now $429,000. In many real estate markets, average prices are higher than that.

That puts the average 20% down payment at $85,800 and starting mortgage balance at $343,200. With interest rates on a 30-year mortgage hovering around 5.1%, the monthly payment is around $2,150. Say you’re single and take home $38,385 annually.

That’s around $3,199 a month. So, after your mortgage payment, you have $1,049 leftover for everything else. You still have to pay for insurance, food, utilities, transportation, and general household expenses.

You also have to figure out potential property taxes and home insurance increases. Your principal and interest portion won’t go up, but the entire payment could. As home values increase, taxes and insurance rates increase, leading to escrow shortages.

According to Dave Ramsey, you should target your mortgage payment to be no more than 25 percent of your income. Personally, I think 25 percent is a little on the high side.

When you spend one-quarter of your household income on a house it can be difficult to build wealth. Once you factor the mortgage payment, utilities, groceries, and your normal expenses, the majority of your money is tied up.

You need to start investing as soon as possible to take advantage of compounding interest. It’s hard to save one million dollars when you aren’t investing.

As previously mentioned, a 50k salary is roughly $3,498 per month take home pay, not counting additional expenses. You’ll need to figure out your specific income situation, such as pre and post tax deductions or if you’re paid biweekly.

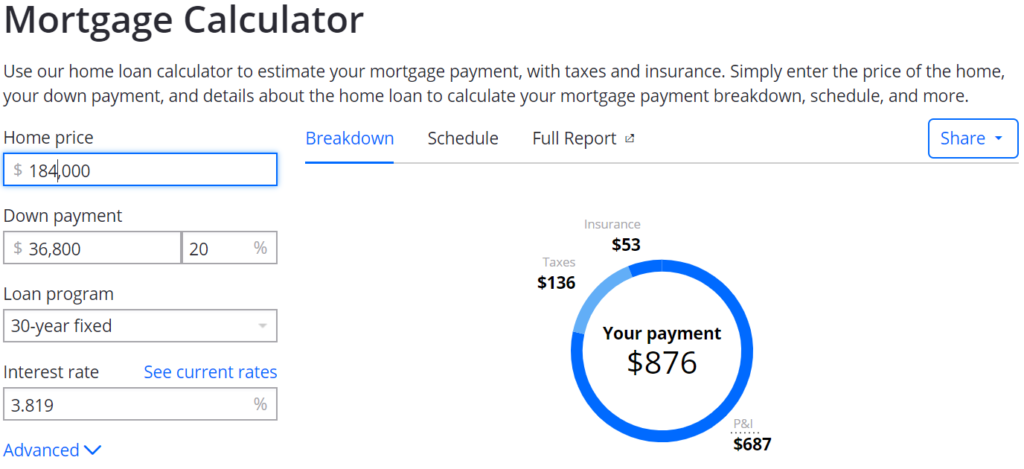

Therefore, Dave Ramsey says you could afford a monthly mortgage payment up to $874.50.

How much house can I afford on a $50k salary

Our best case scenario, you can afford a mortgage payment up to 874.50 per month. For most people, you would want to pay less than $875 per month if you’re making $50k. As always, check the paycheck calculator to determine your after tax income.

Using Zillow’s mortgage calculator, we can see how much house you can afford on a $50k salary.

You could technically afford a $184,000 house assuming a 3.8% interest rate and you pay 20 percent down to avoid personal mortgage insurance. However, you’ll need to keep in mind the cost of home maintenance and other factors.

Depending on where you live, you may or may not be able to find a house within your price range. Typically, people living lower cost areas will have an easier time finding a house they can afford.

Obviously, this is a lot of money and would be stretching your budget thin. Try and find something affordable that works as a starter home.

When you purchase a lower value home, you’ll end up paying less in interest. You can work on building equity in your home until you’re ready to upgrade to a nicer home.

Click to Tweet! Please Share!Click To TweetWhat house can I afford on $50k a year?

Home affordability depends on the following variables:

- Down payment amount

- Interest rates

- Loan terms

- HOA dues

The more you can afford to put down, the more home you can reasonably afford. Lower interest rates on mortgages also make homeownership more affordable.

However, homes governed by HOAs will increase your monthly expenses depending on what the dues cover. Condos usually always have HOA dues, but so can some single-family homes. It can be a good deal when those dues cover exterior maintenance and some utilities.

For example, some HOA dues cover snow removal, lawn care, inside and outside water, and trash. The dues also cover hazard insurance. Others only cover trash and common area maintenance.

So given today’s interest rates and 20% down, you want to stay at a home price of under $300,000. $300k is still considered expensive for a 50k salary. However, a $300k home is significantly greater than the $184,000 previously discussed or 25% of your income.

As you know, in many areas, finding a home for $184,000 or even $300,000 is not practical. That’s why many people are buying homes together and living as roommates.

Sample budget for a $50k salary

Some financial experts recommend a 50/30/20 budget. No more than 50% of your take-home pay should go to necessities. A maximum of 30% should go to wants, and 20% should go toward savings and repaying debt besides a mortgage.

With monthly after-tax pay of $3,199, here’s a sample budget.

- $1,600 for necessities, such as housing and food.

- $960 for wants, such as vacations and entertainment.

- $640 for savings and debt repayment toward credit cards or school loans.

How much should you save if you make $50k a year?

The less debt you have to repay, the more you’ll have to save. Based on the 50/30/20 budget rule, you can save $7,680 a year without having any debt. However, this may not be enough to reach certain financial goals.

You can contribute a maximum of $6,000 yearly to an individual retirement account. But starting at age 50, you can start making catch-up contributions to IRA and 401(k) plans.

It depends on when you started saving, your investment portfolio’s rate of return, and how much you need to retire.

Furthermore, it would be best to build emergency savings with three to six months’ worth of take-home income. On $50k a year, that’s between $9,597 and $19,194. You might want to build up more of a cushion, though.

How to make $50k a year

You can approach making $50k per year in several ways. The most obvious and straightforward way is to find a job that pays $50k a year. This might be more than feasible, depending on your background and the local labor market.

The other approach is to develop more than one stream of income. You can get a traditional job that pays $45,000 a year. Then, you can freelance on the side and earn an additional $5,000 each year to make up the difference.

Some people also rely on investment income or combined earnings. It’s much easier for a couple or household to earn $50k a year than a single. That’s because each individual in a two-person household only has to earn $25k a year to get to $50k.

What jobs pay $50k per year

Jobs requiring and not requiring a degree can pay $50k or more a year. Careers that pay $50k with no degree include:

- HVAC technicians

- Electricians

- Commercial airline pilots

- Insurance agents

- Fast-food managers.

Other viable careers that pay $50k with no degree include:

- Dental hygienists

- Plumbers

- Property managers

- Fitness managers

- Some computer or IT technicians can also earn $50k without a degree. However, many of these careers may require certification or a license.

What to do if you make $50k a year and feel broke

Given the economic pressures of inflation, you may feel broke earning $50k. When this is the case, you can do a few things. You can search for a higher-paying job or take on side work to increase your income.

Another strategy is to downsize and reduce your monthly expenses. This may mean selling a bigger house and renting a smaller apartment or condo. Some people sell a home they’ve been in for a while and pay cash for a smaller house.

Doing this can significantly put more money in your pocket. Although you’ll still pay property taxes and home insurance, you won’t have a mortgage payment. This can save you a thousand or more a month.

Some individuals use a combination of strategies. They work to raise their income and slash what they can from their expenses.

Can you retire on $50k per year?

Yes, it is possible to retire on $50k per year if you watch your spending, start investing early and maintain an aggressive savings strategy. That said, you may have to forego some financial goals in place of retirement. This will be even more applicable if you get a late start on your savings and investment plan.

When you start investing and saving in your 20s, the power of compound interest is on your side. You won’t have to put away as much to have more in your investments by the time you retire. But if you’re starting at 45, you’ll have to save more to end up with less.

When you turn 50, be sure to make catch-up contributions. Also, don’t forget about your employer’s 401(k) plan if there’s a match. This can double your investment and is like getting an income boost or raise.

Where can you retire on $50k a year?

Fortunately, there are still several places you can retire on $50k a year. Go Banking Rates lists 41 cities and towns across the United States. Some of them are:

- Fresno, California

- Las Vegas, Nevada

- Houston, Texas

- Colorado Springs, Colorado

- Detroit, Michigan

- Toledo, Ohio

- El Paso, Texas

- Milwaukee, Wisconsin

- Columbus, Ohio

- Wichita, Kansas

- St. Louis, Missouri

- Oklahoma City, Oklahoma

- Omaha, Nebraska

- Greensboro, North Carolina

- Jacksonville, Florida

- Orlando, Florida

Many of these locations are in the Midwest or the Southeast, where the average cost of living indexes are lower. People may need to consider relocating or give up the idea of retiring in hot spots on $50k a year.

Summary: Is 50k per year good money?

As you can see, a salary of $50k is considered an ok salary. Individuals may be able to live comfortably on a 50k salary, but couples and families will spend the majority of their money on necessities. However, there is ample room for improvement if you want to improve your situation.

The average household income is approximately $67k. Therefore, a salary of $50k is considered below average. People experience greater unhappiness when they have a salary of $40k or less. However, maximum happiness based on income is achieved at $75k.

I highly recommend using a paycheck calculator to determine your estimated take home pay. You can change your allowances, pre and post tax deductions to maximize your families income.

Every family should be budgeting and managing money effectively. Managing your money in a relationship is extremely important when you make $50k per year. Otherwise, it’s really easy to spend the majority of your money.

You may be able to afford a home on a $50k salary. Ideally, you wouldn’t spend more than 25 percent of your monthly income on a home. However, depending on your location, it can be difficult to find a home within your price range.