Can being frugal make you rich or do you become wealthy doing something else?

How would you like to know how to use your frugal nature to actually become wealthy? What if you could become a millionaire by choosing the right level of frugality for your personality.

Imagine what you could do with one million dollars in the bank?

Some of you might retire early or take a well deserved vacation. Personally, I think I would buy a few of my favorite dividend paying stocks to increase my cash flow.

Regardless, living frugally can help you become rich. However, being frugal is only one piece of the picture. Luckily for you, I’m going to show you what it takes to become rich, even if your frugal or not.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Can being frugal make you rich?

As I mentioned, being frugal is only one piece of the picture. In order to become rich, you need to focus on your savings rate. So what is savings rate exactly?

Savings rate is all about how much money you earn vs save. The goal of building wealth is to save the most amount of money. Let’s face it, retirement is a numbers game and whoever saves the most will retire first.

Someone who earns $100,000, but only saves $10,000 per year is worse off than the guy earning $50,000 who can save $25,000 per year. The $50,000 per year earner can save and invest more money. Therefore, he would reach $1 million before the person wasting their $100k salary.

But that money needs to be invested into something that provides a good return on investment. The stock market has an average rate of return around 10 percent.

For most of us, we will be turning to the stock market to help us grow our money faster through compounding interest.

Click to Tweet! Please Share!Click To TweetOk, so how does being frugal help you become rich?

As I mentioned, you need to focus on your savings rate and invest as much of your income as possible. Your income is either spent on liabilities or assets. Generally, your daily expenses are considered liabilities.

Daily expenses include things like paying rent, groceries, a new car, etc. Expenses and liabilities don’t benefit your situation much. However, assets can improve your net worth.

Purchasing a good stock is a good example of an asset that can help you generate wealth.

Someone who is extremely frugal minimizes their expenses. When you minimize your expenses, you have more money to invest. However, it’s crucial that you invest the excess cash rather than make the mistake of lifestyle inflation.

Consider your typical middle-class family. The middle-class rarely breaks into the upper-class because their expenses match their income. They aren’t using their incomes to invest more money, because they buy more stuff.

Basically, the middle-class are living paycheck to paycheck. When they get a pay raise, the increase goes towards lifestyle inflation.

What does it mean to live frugally?

So what does it mean to live frugally? Frugal living involves living a low cost lifestyle. You are choosing to minimize your expenses in order to save money.

Living frugally means something different to each person. For some, it means growing as much produce at home and turning off the light when leaving the room. For others, living frugally means living in a small house and foregoing impulse purchases.

Look at your situation, are there areas of your life that could be wasting money?

Click to Tweet! Please Share!Click To TweetWhy being frugal is important

Frugality is important because it helps you control your spending. In today’s society, it’s really easy to overspend which can keep you poor.

It’s really easy to spend money without a budget or proper money management. Spending a few extra dollars per day can be the difference between saving money and losing it. Impulse purchases can be one of the worst financial decisions you make.

For example, someone who spends an extra $20 per day is really spending an extra $600 per month. Investing $600 per month from the time you’re 30 to 65 could be worth $1,000,000!

Trust me, $20 per day is nothing! Spending an extra $20 could be purchasing coffee, Uber rides, lunch, or excessive shopping.

Are millionaires frugal?

Not all millionaires are frugal, but most understand the concept of being frugal. However, it’s important to distinguish between the two types of millionaires.

The book, The Millionaire Next Door, talks about two types of millionaires, self-made and those who inherited their wealth. Self-made millionaires had the tendency of being frugal and being married to someone even more frugal. However, those that inherited their wealth are spending their way out of their millions.

Why the difference?

Self-made millionaires understand what it takes to build wealth. They make money, spend less than they earn, and invest the difference. However, millionaires who inherited their wealth never learned to be frugal and manage money. Instead, inherited wealth was rapidly blown on luxuries.

Therefore, millionaires who are frugal stand a better chance of keeping their wealth.

Click to Tweet! Please Share!Click To TweetSo where do millionaires put their money?

As I’ve mentioned, millionaires are great at investing. The more money you have invested, the harder your money works for you.

For example, someone who has $100,000 in invested assets might earn $10,000 at a 10 percent ROI. Now, someone with $1,000,000 would earn $100,000 at the same 10 percent return.

Millionaires understand the concept of compounding interest. Compounding interest basically means your investment returns start to earn returns, making investment growth exponential!

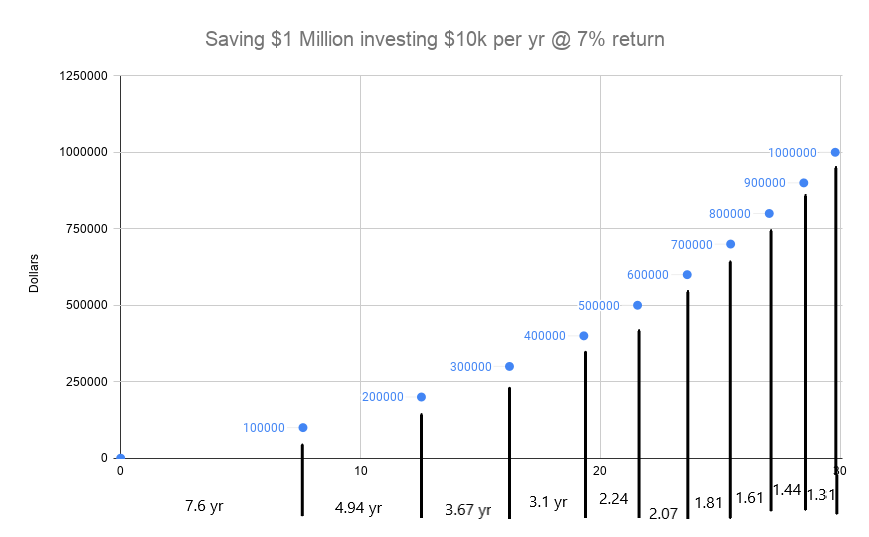

In English, as you keep investing you’ll earn more and more money with less effort. Check out the picture above. In this example, it takes you 7.6 years to save your first $100k! To save $200k, it only takes about 5 years.

Amazingly, earning $100k from 900K to $1,000,000 only takes 1.31 years!

It’s hard and nearly impossible to save one million dollars. Investing can significantly increase your progress. Being frugal allows you to save and therefore, invest more money.

At what point are you considered a millionaire?

You are considered a millionaire when your net worth is at or surpasses $1,000,000. Net worth is the sum of all your assets minus all your debt.

For example, let’s assume you have $100,000 in cash or investments, $50k left on your mortgage, and $10k of debt remaining on your car. Assuming no other assets or liabilities, your net worth would be $40k.

You can also use a net worth calculator to help you determine your net worth.

Most people assume your typical millionaire has $1,000,000 in the bank. However, the majority of millionaires don’t have that much liquid assets. Usually, it looks like the equity of your home, investment and savings accounts, and other assets that total one million or more.

Click to Tweet! Please Share!Click To TweetCan you be too frugal?

In my opinion, there is no such thing as being too frugal. However, a lot of people say being frugal is a bad thing. So, can you be too frugal? Is being frugal a bad thing?

Is being frugal a bad thing?

Most people associate being frugal as a bad thing, but their confusing frugality with being cheap. As a friend of mine would say, “being cheap isn’t sexy.”

So what is the difference between being cheap and being frugal?

Being frugal is all about reducing your expenses to save money for things you really want. You have a goal for your money and you are prioritizing your money.

Personally, I work towards being frugal so that I can purchase stocks for early retirement. I am prioritizing my freedom over material goods.

Being cheap is about spending less because you don’t really care. You’re spending less money for a less than spectacular product for the sake of getting the job done.

Click to Tweet! Please Share!Click To TweetSummary: Can being frugal make you rich?

As you can see, being frugal alone cannot make you rich. However, being frugal is part of an overall strategy that can make you rich.

In order to become wealthy, you need to focus on your savings rate. Savings rate is all about how much money you earn versus how much you spend. Your goal is to focus on the gap between income and expenses.

You can become frugal to limit your expenses. However, you can only limit your expenses so far. Eventually, you will need to focus on growing your income if you want to increase your savings rate.

Investing your money is the true path to wealth. The more money you invest, the faster compounding interest takes effect. Compounding interest is the concept that your investment returns start to generate returns.

Most self-made millionaires understand the benefit of compounding interest. Therefore, most self-made millionaires have frugal tendencies to help them build their investments.

Millionaires who inherited their wealth may struggle to keep their wealth. Generally, inherited wealth never learned proper money management or the art of being frugal. Therefore, inherited wealth is more likely to spend their millions than self-made millionaires.

You are considered a millionaire once your net worth is equal to or exceeds one million dollars. Net worth is the difference between your assets and liabilities. You do not have to have one million dollars in cash to be considered a millionaire.

You cannot be too frugal, but you can be too cheap. Frugal focuses on saving money for a purpose while being cheap focuses on spending less.