Is investing in dividend stocks worth it?

Dividend stock investing has many advantages, such as providing income. The income provided by dividend stocks can supplement or pay for your retirement. However, some dividend paying stocks won’t grow as fast as the S&P 500. Therefore, you could be leaving money on the table depending on your investment strategy.

Imagine, having enough money invested into dividend stocks which pays you a full-time income. You could quit your job at any time and be just fine!

Dividend stocks are an amazing source of passive income.

Luckily for you, I’m going to break down dividend stock investing and give you some considerations. There are many ways to invest in dividends, but are they a good idea or even safe?

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Is investing in dividend stocks a good idea?

Purchasing dividend stocks can be a good idea if you participate in a dividend reinvestment plan (DRIP). Choosing individual stocks can provide a good income, but you may earn more investing in the S&P 500. Investing in a dividend ETF like VYM provides a good balance of dividends and growth.

Click to Tweet! Please Share!Click To TweetWhat are the advantages of dividends?

The primary advantages of dividend stocks are the income payments and dividend increases. With dividend stocks, you are building a source of cash flow. Therefore, you can focus on how much income you make rather than the amount invested.

When you’re investing in growth stocks, most investors are looking to withdraw their investments for retirement. Typically, an investor is looking to withdraw 4% of their investments in retirement.

However, with dividend investing, you don’t actually have to touch the invested capital. You can simply live off the dividends instead. Therefore, your money is free to keep on growing which means your income will continue to grow as well.

You can also build a portfolio with a high dividend yield. With a high yield, you can retire on a full-time income much sooner than a gains portfolio.

For example, a $40k income is a dividend portfolio of $571k at 7% yield. Alternatively, a gains portfolio would require $1M invested at a 4% withdrawal rate.

Some dividend paying companies are constantly increasing their dividend payments. Therefore, year after year, the amount you receive in dividends can increase, giving you a pay raise.

Can you lose money with dividend stocks?

No investment is without risks and dividend stocks are no exception. Dividend stocks can lose value over time or suspend their dividend payments. When investing in dividend stocks, you are often investing for cash flow over capital gains.

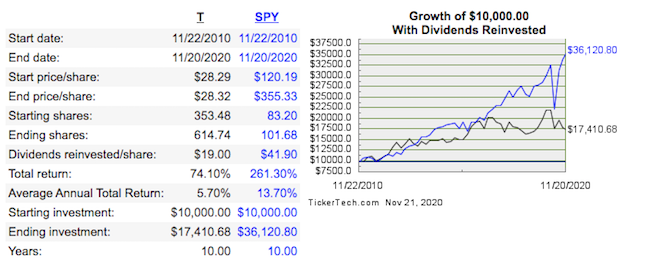

It’s best to invest in dividend stocks which appreciate in price and pay a dividend. For example, AT&T (T) pays a fairly good dividend yield around 7%, but the price has been stagnant since 2003.

Who wouldn’t want a 7% yield? The problem is you would have made more money by simply investing in the S&P 500.

Over the last 10 years, AT&T has an average annual total return of 5.7% with dividends reinvested. The S&P 500 has returned 13.7%, which is more than double. Investing $10k in both would leave you with $36.1k in the S&P 500 and $17.4k in AT&T.

AT&T has been a strong and consistent dividend payer. However, companies with high yields or financial struggles may suspend their dividends. If a dividend is suspended, your cash flow disappears and the stock price may crash.

Therefore, you need to be prepared for dividend cuts as a possibility. What are you going to do if the cash flow stops, but the stock is worth less than you paid for it?

What happens to dividends when the market crashes?

Individual companies may cut or reduce their dividend payments during a stock market crash. Investing too heavily into one company can be detrimental to your income during dividend cuts. Therefore, diversifying your portfolio or buying a dividend ETF can help ensure the longevity of your investments.

Personally, I like dividend exchange traded funds (ETF), like VYM. An exchange traded fund provides substantial diversification so I’m not tied up into one stock. Should one company cut their dividends, I’d hardly notice.

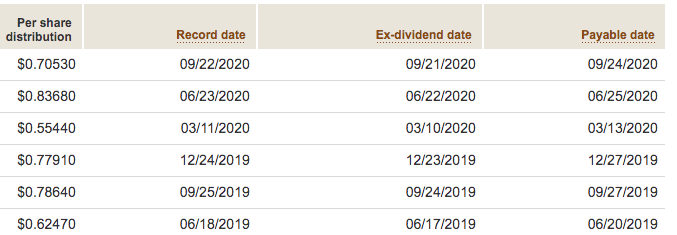

During the Coronavirus, VYM did see a reduced dividend payment which has since rebounded. Dividend payments for VYM were $0.77910 per share the quarter prior to Coronavirus shutdown. The next quarter, when shutdown was initiated, the distributions dropped to $0.55440 per share.

Dividend payments then rebounded the quarter after, paying $0.8368 per share. So yes, there was a slight reduction in income. However, the diverse nature of the fund allowed for normal distributions after one down quarter.

Should you reinvest dividends or take cash?

Reinvest your dividend payments to take advantage of compounding interest. One of the benefits of dividends is that your dividends buy more shares. Your portfolio will continue to grow larger as your dividends buy you more dividend income.

Over time, your dividend reinvestments start to add up. The more money you continue to invest, including dividends, the faster your portfolio grows.

For example, investing $10k into the S&P 500 10 years ago would return $36,120.80 with dividends reinvested. Without reinvesting, your overall return would be $33,036.65. Annualized, the difference is a return of 12.69% per year vs 13.70%.

I recommend leaving the dividends on a reinvestment plan until you’re ready to retire. Once you retire, take the dividend payments and live on them.

Should I invest in growth or dividend stocks?

Investing in both growth and dividend stocks is a good idea. However, do research into each investment and see which has the better potential to earn money. Typically, growth stocks outperform dividend paying stocks, but both should have a place in your portfolio.

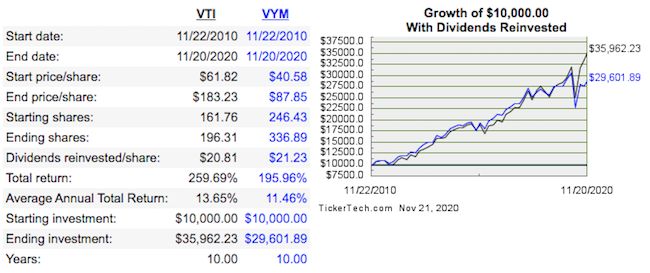

Personally, I prefer to invest in a good mixture of dividend and growth stocks. I am a huge fan of cash flow, but understand that capital gains can build wealth quickly. Therefore, I keep a good mixture of VTI (Total stock market) and VYM (High Dividend Yield) exchange traded funds in my portfolio.

Exchange traded funds are simple and diversified. ETFs are great for long term investors who just want to buy and not think about the stock market.

Using a DRIP calculator, you can compare VTI and VYM over the last 10 years. Both ETFs were performing very similarly until the coronavirus. Typically, dividend paying stocks take a longer time to recover than growth stocks.

As in our previous AT&T vs S&P 500 example, be cautious about leaving money on the table with stocks. High yields may seem attractive, but investing in the S&P 500 was the clear choice.

Why buy stocks that don’t pay dividends?

Some investors choose to not buy stocks that don’t pay a dividend. Companies typically pay a dividend when there isn’t a better growth opportunity. Therefore, some investors speculate they can get better returns buying companies focused on growth.

Click to Tweet! Please Share!Click To TweetSummary: Is investing in dividend stocks worth it?

As you can see, investing in dividend stocks can be worth it. However, in a lot of cases, you would be better off purchasing an S&P 500 index fund. Alternatively, I recommend investing with VYM which pays a good dividend, but also has good growth.

The primary advantage to dividend stock investing is the income. Some companies elect to increase their dividend payments each year. Therefore, your income grows simply by holding the companies.

However, you need to be careful about losing money with dividend stocks. Not all companies are successful. Some companies can cut or reduce dividend payments when times are tough. Therefore, you’ll need a well diversified portfolio to protect against income losses.

Another reason why I like VYM is for market crashes. During Coronavirus, the dividend payment did get reduced, but it rebounded the following quarter.

Always reinvest the dividend payments unless you absolutely need the income. Reinvesting dividends allows you to take advantage of compounding interest. Your money will begin to earn more money, which you are limiting if you take a payment.

Ultimately, it is up to you to invest in dividend or growth stocks. Personally, I stick with Vanguard exchange traded funds which have both growth and dividend potential. My investments continue to grow, but they also pay a dividend. It’s like getting the best of both worlds.

Recommended

Based on this article, we think you’ll enjoy the following:

- Is investing in dividend stocks worth it?

- Do ETFs pay dividends?

- How much do you need to invest to live off dividends?

- How to make money with stocks (the complete guide)

- What time does the US stock market open

- Is investing in dividend stocks worth it?

- Can you get rich from stocks?

- Are penny stocks worth it?

- How much money do you need to invest in stocks?

- Can you make a living trading stocks?

- How much money should I be investing in stocks?

- Can you become a stock market millionaire overnight?

- Is it good to invest in stocks?

- Can you buy stocks with a credit card?