Why is my debit card declined when I have money?

Debit cards can be declined even when you have money. Common reasons to have your debit card payment declined include:

- Your bank noticed suspicious activity

- The card hasn’t been activated or is expired

- The merchant doesn’t accept your card type (e.g., Visa)

- Purchase information was entered incorrectly (e.g., billing address or PIN)

- You’ve reached your spending limit or made too many transactions

- You made a large purchase

- Insufficient funds or the money is in a different account

- Traveling outside your normal area

- Payment processor technical issues

- The card is damaged

- Your account is closed

If your card is declined, wait a few minutes and try the transaction again. Verify you have money in the account and the information was entered correctly. Inspect your card for signs of damage and that the card is not expired. Contact your bank if the problem persists.

I can imagine the frustration and embarrassment of having your debit card declined. Nothing says have a great day like trying to fill up your gas tank, but your card is declined.

No worries though. Fixing your debit card is often very simple.

Luckily for you, I’m going to show you why your debit card may have been declined. I’ll even show you how to get your card reactivated. You’ll be on your way in no time!

Key Takeaways

- There are many reasons why your debit card keeps getting declined. Reasons can involve cardholder or payment processor error.

- Contacting your bank is the fastest way to determine why your card is declined. Your bank can reactivate your card if it was declined for reasons, such as suspicious activity.

- Try the transaction again after your card is declined. Sometimes the payment processor has a card read error or there is a temporary issue with the payment processing network.

- A declined debit card will not impact your credit score. However, over drafting your account may be reported to credit bureaus.

- Contact your bank if your debit card keeps getting declined.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Why is my debit card declined when I have money?

Debit cards are often declined for suspicious activity. You should also verify the right pin was used, money is available, and the card is still active. In some cases, information, like zip code, may not be the same as provided to your bank. Large purchases may also be over a daily spending limit.

Debit cards can be declined by the card issuer for in-store and online purchases.

In-store purchases will often block your debit card if the wrong PIN was used, insufficient funds, or your bank suspected fraud. However, frequent purchases, large purchases, and daily spending limits can also block your card. Contact your bank for more information.

Online purchases will most commonly show a declined debit card for misentering information. Your debit card information entered must match what is on record with the bank and entered correctly. Double check each of the fields are entered without mistake and contact your bank or the merchant if trouble persists.

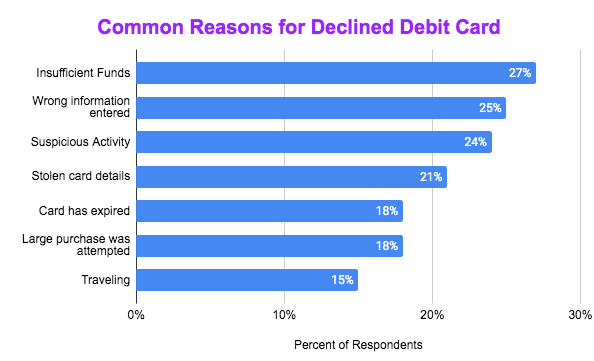

PYMNTS.com surveyed over 3,000 consumers to figure out why individuals have their payment declined.

- 27% of consumer’s cards are declined because of insufficient funds. Roughly 66% of Americans are living paycheck to paycheck, including 49% of those making over 100,000 per year. Increase cost of living expenses contribute to more declines caused by insufficient funds.

- 25% of consumers misenter their card information resulting in a declined card. Misentering card information is common when shopping online. Frequent misentering can result in triggering your bank’s fraud department for suspicious activity.

- 24% of consumers have had their card declined for Suspicious Activity. Suspicious activity is determined by your bank, such as for traveling, attempted fraud, or entering in incorrect payment details.

- 21% of consumers had their payment information stolen. Examples include malicious activity from card skimmers or data breaches.

- 18% of consumers attempted to make a purchase with an expired card. Your payment details will not stay the same between new and old cards. You must get a new card if it is expired as the CVV and expiration date will change.

- 18% of consumers attempted to make a large purchase. Large purchases can trigger your bank to classify the transaction as suspicious or it may result in insufficient funds.

- 15% of consumers made a purchase outside of their normal spending areas. A sudden purchase in Chicago may either be you traveling or fraudulent activity. Therefore, your bank will classify the transaction as Suspicious Activity.

1. Suspicious activity was detected

Your bank or Credit Union has a top-of-the-line fraud detection system. Transactions are constantly being monitored for fraudulent activity. Your debit card may have been declined due to a legitimate or accidental fraud concern.

Suspicious activity is a broad term that can encompass multiple reasons for being declined. Think about suspicious activity as anything outside of your normal spending behaviors.

For example, your bank normally sees your transactions in New York City. Randomly, they see a transaction in California. Someone may have gotten their hands on your information or you are on vacation.

Usually, it is best to let your bank know prior to going on vacation. Doing so will prevent inadvertent fraud detection.

Did you attempt to make any purchases that were out of the ordinary? For example, did you make a large or multiple small purchases?

If so, chances are your account was flagged for suspicious activity. Contact your bank for more details and to unblock your card.

2. Your card hasn’t been activated

New debit cards come with specific instructions on how to activate them. Some banks may require you to call a phone number to activate your debit card. Others simply require you to use your debit card at an ATM.

You will need to activate a new debit card before you can make a purchase. The easiest way to activate the card is to call the number on the back of your debit card. However, you can look for the nearest ATM and check your balance.

Typically, any transaction that requires you to enter in your PIN will activate the card. Once the card is activated, you should be able to make your purchase.

3. Your card is expired

Verify your card has not expired. Your bank should have sent you a new debit card prior to expiration. However, not all banks will get it to you in time. If your debit card is expired, then you will need to contact your bank for a new one.

You can check if your card is expired by looking at the date on the front of your card. The expiration date is typically in the format of MM/YY.

Debit cards that are expired will need to be replaced. Most banks will mail you your new card, but you can visit your local branch. Most banks have the ability to print a new debit card on the spot.

Online purchases may also be declined for entering the wrong expiration date. Typically, this happens to people who are thinking of the current year.

4. The card type (Visa vs. MasterCard) isn’t accepted

Make sure your purchase accepts the type of debit card. Most places will take Visa anywhere, but what if you have a MasterCard debit card? Make sure the merchant is able to accept your debit card.

Merchants will usually display what type of debit card is accepted. Usually, there is a sticker with the payment processor located near the cash register. Alternatively, some apps like Square may display which processors are accepted.

The websites you’re trying to make a purchase through should also display the payment processor logos. Typically, this is found near the card number on the checkout page.

The only way to have a successful transaction is to use a card that is accepted by the merchant. You will need to find an alternate way of paying if your card is not accepted.

5. Bank records don’t match entered information

Banks will often decline debit card purchases which provide different information than what’s on file. For example, making an online purchase to a new address when the bank still has your old address on file.

Again, banks will decline your card to prevent it from being used by unauthorized parties. Trying to make a purchase with different information looks suspicious. Ensure your information is up-to-date with your bank.

Online purchases can be tricky, especially with addresses.

For example, let’s assume you live on Spring View Dr. However, your bank has your address listed as Springview Dr. The payment may be declined because your address does not match what is on file.

You can call your bank to update or verify what information they have on file.

In some cases, you may have to reach out to the online merchant through their contact page. The merchant will be able to tell you which field on the order form is being filled out incorrectly.

6. The entered PIN is wrong or entered too many times

In some cases, your card will be declined if you enter your PIN too many times. Malicious users may try and guess your PIN number. Therefore, some banks limit the number of times you can incorrectly enter your PIN.

Most banks will give you three attempts at entering your PIN correctly. Failure to enter in your PIN may result in a 24 freeze on purchases. You can reset your attempts by calling your bank’s customer service number.

Again, contact your bank if you’re not sure why your debit card was declined. You may even want to consider changing your PIN if you’re struggling to remember.

7. You’ve reached your spending limit

For your protection, some banks place a spending limit on debit cards. Someone with your debit card information can’t go on a major shopping spree.

For example, your bank may specify that you have a $5,000 daily spending limit. You’re in a shopping mood, spending $1,500 in the morning, $2,600 in the afternoon, and $895 in the evening.

In total, you’ve spent $4995. Spending $5.01 more would place you over your spending limit, causing your card to be declined.

You can find your spending limit in your cardholder agreement or by contacting your bank. In some cases, you may be able to increase your daily spending limit.

8. You made too many transactions

A bank may also decline your card for making too many transactions in a short period of time. The frequency of transactions required to make your card decline will vary depending on the card issuer. You should avoid making numerous transactions in a short amount of time.

For example, your debit card might be blocked at a vending machine if you keep attempting to make a purchase. The vending machine card reader might be acting up, causing the transaction to fail. However, your debit card might get blocked for attempting too many transactions.

A debit card blocked for too many transactions should be ready to make purchases again within 24 hours. You can contact your bank and verify your activity to unblock your card faster.

9. A single large purchase was attempted

Attempting to make a single large purchase will often result in your debit card being declined. Random large purchases may appear to your card issuer that someone is using your card without authorization.

Typically, you’ll receive a text message or email asking you to confirm the purchase. Follow the instructions to verify that you are the person attempting the purchase. Once verified, you’ll need to wait up to five minutes before trying the purchase again.

You’ll want to contact your bank if you do not get a text message or email asking to verify the activity. Your bank will be able to unblock the card once you’ve confirmed your identity and the transaction.

Alternatively, your card will most likely be unblocked automatically after 24 hours.

10. You have insufficient funds or money in the wrong account

You may have money in your bank account, but is it in the right account? If you have checked your bank account balance, is your money in checking? Sometimes we mistakenly have more money in savings, but debit cards pull from checking.

Some banks won’t allow you to overdraft your account, withdrawing more money than you actually have. You can check with your bank to see if overdraft protection is enabled. Your bank would most likely decline the transaction if overdraft protection is enabled.

11. You are traveling

Traveling outside your normal area of purchases may result in your debit card being declined. The bank views purchases outside of your normal spending area as suspicious activity. You are more likely to have your debit card blocked when traveling abroad than between states.

Gas station pumps are one of the most common areas where you’ll find your debit card declined. Most commonly, your card will be declined for entering in the wrong zip code. However, you may also be declined for traveling outside your normal area.

Ideally, you’ll notify your bank of your travel plans before departing, especially if traveling abroad. Call the number on the back of your debit card to unblock your card.

Your bank may need to send you a new card if you’re traveling with an expired debit card. Unfortunately, you will not be able to make a purchase with an expired debit card. However, you can make a wire transfer to yourself or exchange money with other travelers.

12. The payment processor is having technical issues

In some cases, the payment processor is having technical issues processing the payment. Typically, this is just a network issue that will only last a few minutes. Alternatively, the system can be down until service is restored.

The best thing to do is try to make the purchase again after a few minutes. Contact your bank if the problem persists, because it might be an issue with your account instead.

13. Your card is damaged

Debit cards are easily worn out and will need to be replaced frequently. Individuals that make a high volume of transactions will need to replace their card more frequently. The most common failure points of a debit card include the chip and the magnetic strip.

Check for excessive wear around the chip and strip. Stop by your local branch and request a new debit card or call them to have them mail you a new one. In some cases, the bank will be able to print you a new debit card on the spot.

Damaged magnetic strips may work when placing a plastic bag over the strip and swiping the card. However, doing so is not a permanent fix and you’ll need to get a replacement card to prevent future issues.

Remember, if you get a new debit card then you will have to activate the card. Typically, there is an ATM outside your bank which you can use to activate the new card. Alternatively, any transaction that requires you to input your PIN will activate the card.

14. A Joint Account owner closed the account or card

In some cases, a joint account owner may have closed your account without talking to you first. Your debit card will not work if the checking account associated with the card is closed. Once closed, the account cannot be reopened and you will need to open a new checking account.

Having a joint account holder close your account is rare, but it does happen. Typically, accounts are closed by a business partner or if you’re going through a bad breakup.

The only way to confirm is to contact your bank who will tell you why your account is closed.

Card Declined Codes

A card declined code is an error code or number which indicates why your card was declined. The code is displayed on the payment terminal after you attempt to make a purchase. The merchant can then use the code to determine what action to take regarding your card.

For example, I attempted to use my debit card to pay for gas but the transaction was declined. The gas station attendant was able to tell me that my debit card had expired by looking at their payment processor.

How do you fix a declined debit card?

Most issues associated with a declined debit card can be fixed by contacting your bank. Your bank will be able to tell you why your card has been declined. Depending on the situation, the bank will ask you account security questions to reactivate your card.

However, the first step you should take is to attempt the purchase again. The payment processor may be having network issues and your payment may go through on the second transaction.

Most of the time, your card was deactivated by fraudulent activity. The bank may want to confirm which purchases you made. You may be reissued another debit card or they may simply block the fraudulent activity.

If your debit card was declined due to insufficient funds then you will need to add money. You can not run your debit card without money in your checking account. However, in some cases you may run your card as credit, but are still responsible for the money.

Make sure you are keeping your personal information up-to-date with the bank. Doing so will ensure your debit card isn’t declined inadvertently.

Always let your bank know before you go traveling. Informing your bank of your travel plans will prevent unexpected debit card declines.

What happens if my card is declined?

Your transaction will fail if your debit card is declined. You will not be able to continue your purchase until a declined debit card is resolved. Contact your bank to resolve your debit card issues or use a credit card in the meantime.

Do you get charged if your debit card is declined?

In most cases, you do not get charged for declined debit cards. Insufficient funds may result in an overdraft fee if your bank allows you to overdraft. However, most banks will protect you from overdraft fees and decline any transactions which would give you a negative balance.

Some banks will not repay money stolen from someone with your card information. Personally, someone stole my debit card information and bought themselves Chick-fil-A. I hope they enjoy the free meal.

My bank did inform me that credit card theft would have been repaid. For some reason, my bank goes to greater lengths to protect fraud with credit cards. Therefore, it is much safer for me to use a credit card than a debit.

Does a declined debit card affect credit score?

A declined debit card does not negatively affect your credit score. However, overdrafting your bank account so it has a negative balance and neglecting payment will be reported to the credit bureaus. Therefore, you only need to worry if you have insufficient funds and you do not have overdraft protection.

Most banks will offer overdraft protection so you cannot make your account balance go negative. You can contact your bank or review your cardholder agreement to determine if you have overdraft protection.

You will need to pay back the overdraft amount if the account does go negative. An overdraft is essentially a small loan the bank gave you in order to honor your payment. Failure to pay back the overdraft can result in more fees, bad credit, and debt collectors.

Why does my debit card keep getting declined for no reason?

Your debit card may keep getting declined due to insufficient funds, payment processor issues, or a damaged card. Ask the merchant for the declined code or contact your bank to determine the root cause.

Insufficient funds

Keep in mind, insufficient funds does not necessarily mean you have no money. The bank may require a minimum deposit and is declining your transaction to prevent you from dropping below the minimum.

For example, you have $25 in your account and want to make a $21 purchase. The bank has a minimum deposit requirement of $5. Therefore, making the purchase would put you $1 below the minimum.

Payment Processor issues or damaged card

Payment processor issues or a damaged card will prevent your payment information from transmitting. Therefore, your payment may show up as declined, even though it’s a card read error.

Try the purchase again after a few minutes.

The merchant may be able to tell you the declined code. In most cases, you’ll have to contact your bank to resolve the issue.

Bank reporting delays

My bank kept declining my card due to a reporting delay and a damaged card.

I attempted to make a purchase at a gas station, but my card’s chip was damaged. My card was immediately blocked.

I called my bank, who unblocked the card and said I was good to go. Purchases worked until the next morning when the fraud department opened up. The fraud department would then open and would see the same transaction at the gas station and block the same transaction again.

In this case, my bank has poor communication between the bank and the fraud department. Once I got a new debit card, everything was good.

Why was my debit card declined then accepted?

Debit cards may be declined on the first transaction attempt, but then be accepted on the second. Typically, declining and then accepting is caused by processing your transaction and not your account. Examples include a card read error or communication between the payment processor’s network timed out.

Can I run my debit card as credit if I have no money?

Check with your bank, but some Merchants may be able to run your debit card as credit. However, you are still responsible for ensuring money is in your account. In some cases, you may be able to run your debit card as credit which can buy you some time.

What is the difference between running a debit card as credit?

Using your debit card as debit requires money to be in your account. Your purchase is tied to money you physically own. Running a debit card as credit will “credit” you the money, so the money is borrowed.

What to do if your debit card is declined but you still got charged?

Your debit card transaction may show as declined, but your online banking shows the same transaction. The transaction is most likely pending which means the funds have not been taken from your account. The pending transaction should be removed within 7 days from your online statement.

However, there may be instances when the pending transaction does go through. In this case, you will need to contact your bank and dispute the charges for services not rendered.

Summary: Why is my debit card declined when I have money?

As you can see, there are many reasons why your debit card can’t be declined. Most commonly, your debit card may have been detected as fraudulent activity. The bank is constantly monitoring for fraudulent activity, but that is not the only reason a card may be declined.

Alternatively, you may have entered information not on file with the bank. Make sure your bank information is up-to-date and that you didn’t fat finger anything.

You should also make sure the vendor accepts your form of payment. Do you have enough money to cover the transaction? Is your card activated or has it expired?

Most activity associated with debit card declined can be resolved by contacting your bank. Your bank will be able to tell you why your debit card was declined. Use a credit card in the meantime if you must.

Most banks will not charge you for a declined debit card. However, you need to be careful that you can’t overdraft. Banks may not cover money lost through fraudulent activity on your debit card.

In some cases, you may be able to run your debit card as credit. A debit transaction relies on money in your checking account. A credit transaction lets you borrow money temporarily.