Is Vanguard REIT (VNQ) a good investment?

Vanguard’s Real Estate Investment Trust ETF (VNQ) is a good income producing investment. VNQ has maintained an approximate 8% annualized return since inception with dividend yields around 4%. Cost of VNQ is low with an expense ratio of 0.12%.

However, Investors need to make an informed decision before investing in VNQ. VNQ only invests in real estate and has underperformed the S&P 500.

Personally, I like VNQ as a portion of my ETF portfolio.

Luckily for you, I’m going to break down the pros and cons of Vanguard’s REIT VNQ. I’ll show you if VNQ is a good investment, it’s dividends, and if it’s recession proof. REITs are a good way to invest in Real Estate without the hassle of owning property!

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

Is Vanguard REIT (VNQ) a good investment?

VNQ is a good investment as part of a well diversified portfolio. The benefits of VNQ investing include 8% annualized returns, 4% dividend yield, and a low expense ratio. However, VNQ underperforms the S&P 500 and only invests in Real Estate.

Vanguard’s REIT has a 10-year annualized return of 8.31% (as of 1/31/21). The dividend yield is typically around 4%, which means you’ll get a nice cash payment or dividend reinvestment.

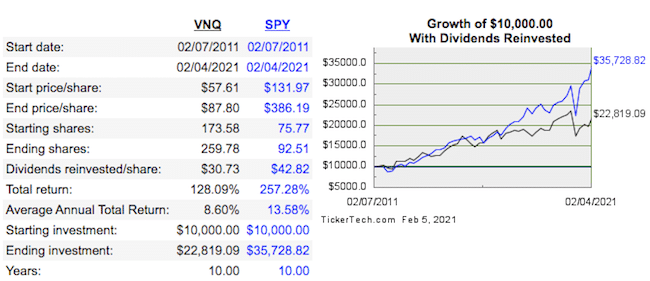

Over the course of 10 years, a $10k investment would be worth $22,819.09 with dividends reinvested.

However, the S&P 500 outperforms VNQ which means you would have made money investing in VOO (Vanguard’s S&P 500 fund).

VOO has had a 13.45% 10-year annualized return. Therefore, a $10k investment in VOO would have been worth $35,728.82, nearly $13k more than VNQ!

VNQ is a sector specific exchange traded fund. In other words, all you’re investing in is Real Estate when you purchase a share of VNQ. Investing in the S&P 500 provides a larger level of diversification by investing in different sectors.

Both VNQ and VOO have low expense ratios. VOO is slightly cheaper, which means you’re getting better returns at a lower-cost than VNQ. However, not all S&P 500 index funds are as cheap as VOO. Some S&P 500 index funds have an expense ratio over 1%!

Personally, I keep a mix of dividend paying ETFs as well as growth funds in my portfolio. I like having a portion of my investments in Real Estate, so I do own some VNQ.

Click to Tweet! Please Share!Click To TweetDoes VNQ pay a dividend?

VNQ pays a quarterly dividend which is typically a 4% dividend yield. The dividend has been consistently paid since inception. You can view the entire VNQ dividend history on the NASDAQ’s website.

Can you lose money in a REIT?

All investments carry risk which includes complete loss of investment. However, VNQ is an ETF which holds multiple REITs. Therefore, investing in VNQ is a good way to diversify your exposure to Real Estate investing.

Typically, when you talk about a REIT you’re talking about a single company. Investing in a single company can be risky because you’re relying on one company’s performance.

However, VNQ is well diversified in Real Estate because it currently holds 176 companies. Should one of those companies go bankrupt, you should be ok because of the other 175 companies.

The top 10 holdings make up nearly 46% of VNQ’s holdings. In other words, the top 10 companies dictate 46% of VNQs performance.

As of 12/31/20, VNQ’s top 10 holdings include:

- Vanguard Real Estate II Index Fund

- American Tower Corp.

- Prologis Inc.

- Crown Castle International Corp

- Equinix Inc.

- Digital Realty Trust Inc.

- Public Storage

- SBA Communications Corp.

- Simon Property Group Inc.

- Welltower Inc.

So while you can lose money investing in REITs, you are less likely to lose money with VNQ. VNQ is more diversified than investing in individual REITs.

Are REITs good during a recession?

REITs are subject to economic events so share prices may dip during recessions. Rent payments are how most REITs generate revenue and recessions make paying rent difficult. Therefore, you should further diversify your assets to protect investments or income during a recession.

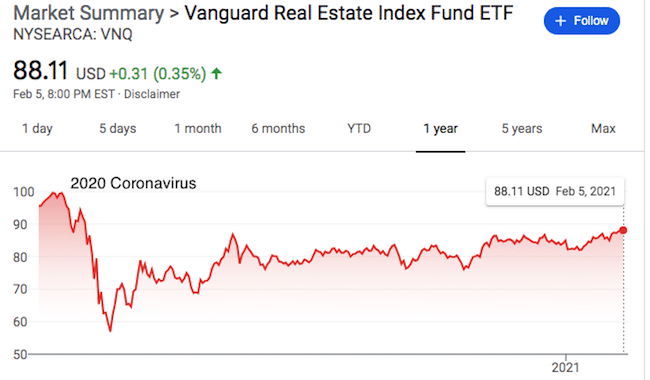

A good example is the 2020 Coronavirus.

The price of VNQ dropped from nearly $100 to $57. Dividend yield for the quarter was down during the crash, but the total dividend payments were up from the prior year. Afterwards, there was a slow recovery.

Crashing during a recession makes logical sense. A lot of people lost their jobs during the first quarter of 2020. If you don’t have a job then you’re probably avoiding paying rent. Without rent, most REITs can’t make their money.

Click to Tweet! Please Share!Click To TweetSummary: Is Vanguard REIT (VNQ) a good investment?

As you can see, the Vanguard REIT (VNQ) is a good investment as a portion of your overall portfolio. Keep in mind, you can find better returns by investing in an S&P 500 index fund like VOO.

Benefits of VNQ investing include low-cost, great dividend, 8% ROI, and easy exposure to Real Estate. The main downside is that S&P 500 index funds, like VOO, are slightly cheaper and perform better. VNQ only exposes you to Real Estate while the S&P 500 can provide better diversification.

VNQ dividends are paid quarterly and are typically around a 4% dividend yield. The fund has had consistent payments since inception.

All investments carry risk, but VNQ is good exposure to Real Estate without selecting individual REITs. Therefore, you have exposure to over 100 real estate stocks which provides diversification in the Real Estate sector. You will still want to diversify outside of Real Estate.

REITs are subject to economic events like recessions. It’s hard for REITs to make money when tenants can’t pay rent.

Personally, I like VNQ and keep it as a portion of my portfolio for exposure to Real Estate. Ultimately, you will need to decide if you want the same exposure and if VNQ meets your investment style.