What are ETF holdings?

ETF holdings refer to the individual stocks held within an exchange traded fund. ETFs consist of multiple stocks and the holdings give investors an idea of asset allocation and diversification. Understanding ETF holdings is important to know where your money is being invested.

Imagine, knowing where your money is going and if you’re investing in good companies like Tesla or Amazon. You can also have peace of mind knowing you’re not too heavily invested in one asset class.

Investing in exchange traded funds doesn’t have to be complicated. However, it’s a good idea to know where your money is going.

Luckily for you, I’m going to show you what ETF holdings are and how to check holdings. I’ll even tell you how to find out how frequently your ETF holdings are changing. Here is everything you need to know about ETF holdings.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

What are ETF holdings?

ETF holdings refer to the number of individual stocks held within the exchange traded fund. The ETF holdings will tell you which stocks are held and the percentage each makes up of the total fund. Understanding the ETF holdings is important to know where your money is being invested.

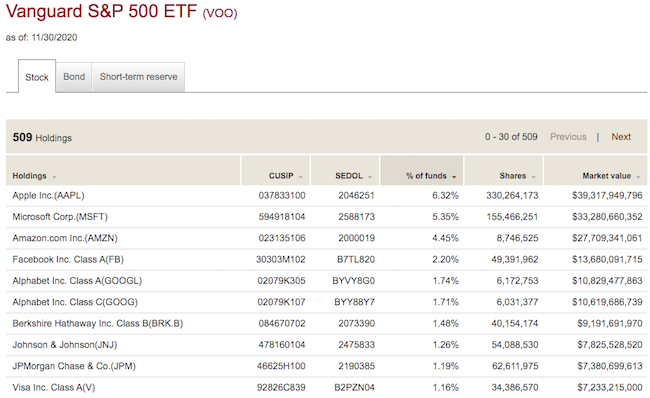

For example, let’s take a look at VOO, the Vanguard S&P 500 ETF. The current price for one share of VOO is around $350.

VOO is weighted by market cap. The total value of a stock’s outstanding shares divided by the total value of all stocks within the fund.

For example, Let’s assume a company with a market value of $10B is held within a fund where all companies’ values added up to $200B. $10B is 5% of $200B, so the company would make up 5% of the ETF’s overall value.

Apple currently makes up 6.32% of VOO. That’s because Apple makes up 6.32% of the total value of all companies combined.

So where does your money go when you’re buying a $350 share of VOO?

| Holding | % of funds

|

Where your $350 investment goes |

| Apple | 6.32% | $22.12 |

| Microsoft | 5.35% | $18.73 |

| Amazon | 4.45% | $15.58 |

| 2.20% | $7.7 | |

| Alphabet Class A | 1.74% | $6.09 |

| Alphabet Class C | 1.71% | $5.99 |

| Berkshire Hathaway | 1.48% | $5.18 |

| Johnson & Johnson | 1.26% | $4.41 |

| JPMorgan Chase & Co. | 1.19% | $4.17 |

| Visa | 1.16% | $4.06 |

| The remaining 499 holdings | 73.14% | $255.99 |

As you can see, over 25% of your investment goes to the top 10 companies. That’s because the top 10 companies make up 25% of the overall market cap.

Click to Tweet! Please Share!Click To TweetWhere can I find ETF holdings?

ETF holdings can be found on the Funds overview page. The fund manager lists all investment information including product summary, holdings, performance and more on the overview page. Alternatively, a Google search for your fund’s holdings will bring up the ETF holdings page.

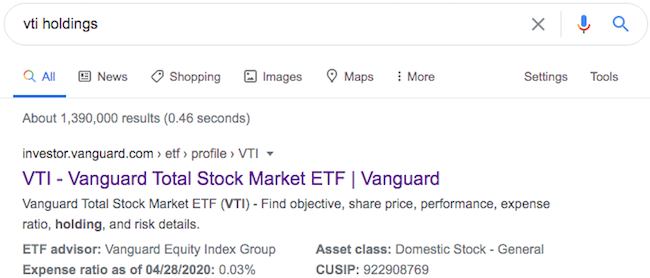

The quickest way to find the holdings for an ETF is with a Google search. For example, search “VTI holdings” for the Vanguard Total Stock Market ETF (VTI) holdings.

The top result brings you to the funds overview page. Scroll down to find the link for “Portfolio Holdings” if you want to find more information than just the top 10 holdings.

Do ETFs change holdings?

ETF holdings do change and actively managed funds change holdings more frequently than passively managed funds. The turnover ratio is the number of stocks that are replaced within the ETF. Consult the funds Prospectus to find information on the turnover ratio.

Actively managed funds change holdings more frequently than passively managed funds. Actively managed funds are constantly bought and sold by fund managers in an attempt to beat market performance.

Typically, actively managed funds are more expensive due to fees from the buying and selling that occurs. Not to mention, the person buying and selling the funds gets a portion.

In general, passively managed funds are your best investment choice. Passively managed funds have lower turnover ratios, less fees, and most perform better than actively managed funds.

When comparing ETFs, look for funds that have lower turnover ratios to avoid extra fees. However, you should also consider the funds expense ratio.

How often do ETFs disclose holdings?

At a minimum, fund managers are required to disclose holdings once per quarter. However, many ETF holdings are disclosed daily or monthly. Most ETF overview pages will tell you the last time the holdings were updated.

Click to Tweet! Please Share!Click To TweetSummary: What are ETF holdings?

As you can see, ETF holdings are the stocks held within an exchange traded fund. Exchange traded funds are a collection of stocks, so holdings disclose the stocks. Holdings will tell you the asset allocation and diversification of an ETF.

You can find ETF holdings on the funds overview page. However, the fastest way to find the holdings is simply Google searching the “the fund holdings.”

ETF holdings are subject to change. Actively managed funds change holdings more frequently than passively managed funds. Consult the Prospectus to find the turnover ratio, which is the number of stocks that are typically replaced.

Holdings are required to be disclosed quarterly, but they are often updated daily or monthly. The fund overview page should disclose the date of the last disclosure.