How would you like to make a lot of money with stocks, fast? I’m talking about serious cash you could earn from your cell phone through the stock market.

Yes, it is possible and yes, people are doing it every single day!

You just need to know how the stock market works and the right strategy.

Luckily for you, I’m going to show you an easy way to make money with stocks. The exact same strategy I used to earn 30% return on investment (ROI) in only 7 months this year.

How would you like to earn 4% on your money every month? Let’s dive into the basics.

This post may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

What is a stock?

A stock is a security you can purchase as a share of ownership in a company. You become part owner in the company when you purchase a share of stock. Generally, investors purchase shares in a company they believe will increase in value or pay dividends.

Related:

Why do companies sell shares of a company?

Large companies require a huge amount of capital (money) to make even more money. Companies look for investors to obtain this extra money. The company then uses the money to make more money while the investor earns money as the company grows.

Click to Tweet. Please Share!Click To TweetWhat is share price?

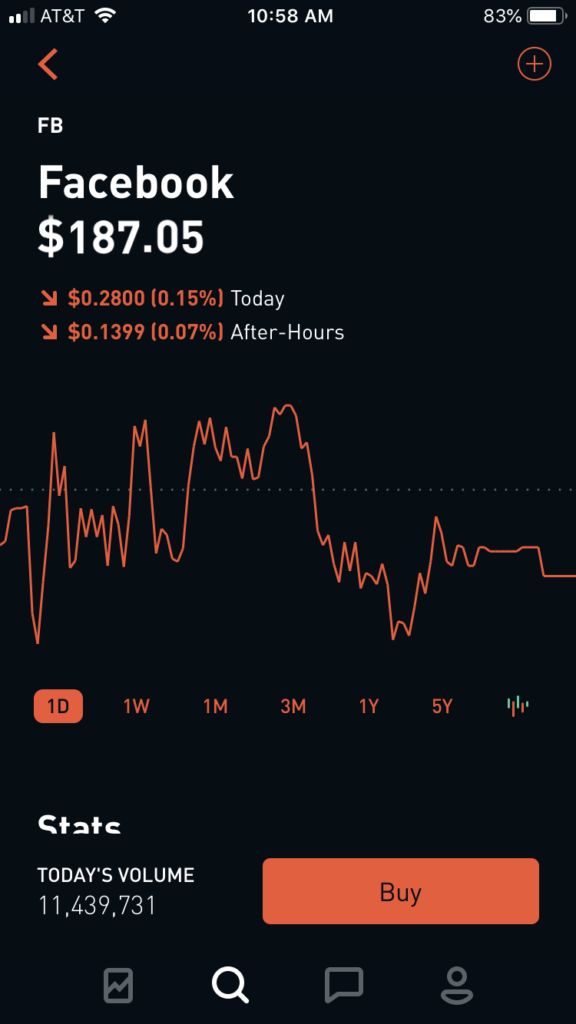

Share price is how much it costs to purchase one share of a specific companies stock. In the picture below, Facebook is currently trading for $187.05 per share. So I would need $187.05 to purchase one share of Facebook or $374.10 for two shares.

You will need a stock broker (like Robinhood) to purchase a share of stock. A stock broker lets you buy and sell stocks, manages your money, and prepares tax documents.

Why you should manage your own stock portfolio

You can earn more money by managing your own stock portfolio than if you went with a full service stock broker.

Stock brokers like J.P. Morgan don’t actively manage your money. Generally, the put your money into a collection of stocks or exchange trade funds (ETFs) estimated to increase in value. The average value increases roughly 7-12% per year.

Stock brokers don’t make many changes to your portfolio, it just sits through the market ups and downs. Even worse, stock brokers charge you fees to basically do nothing with your money.

A passive approach to stocks generates average returns.

From the intro, I mentioned my small stock portfolio that I manage has generated 30% ROI in 7 months, roughly 4% return per month. I’m sorry, but I’d rather take my 48% per year of investment gains than getting charged by an “expert” for 7-12%.

Your own stock portfolio can generate the same investment gains in one year as a broker does in four.

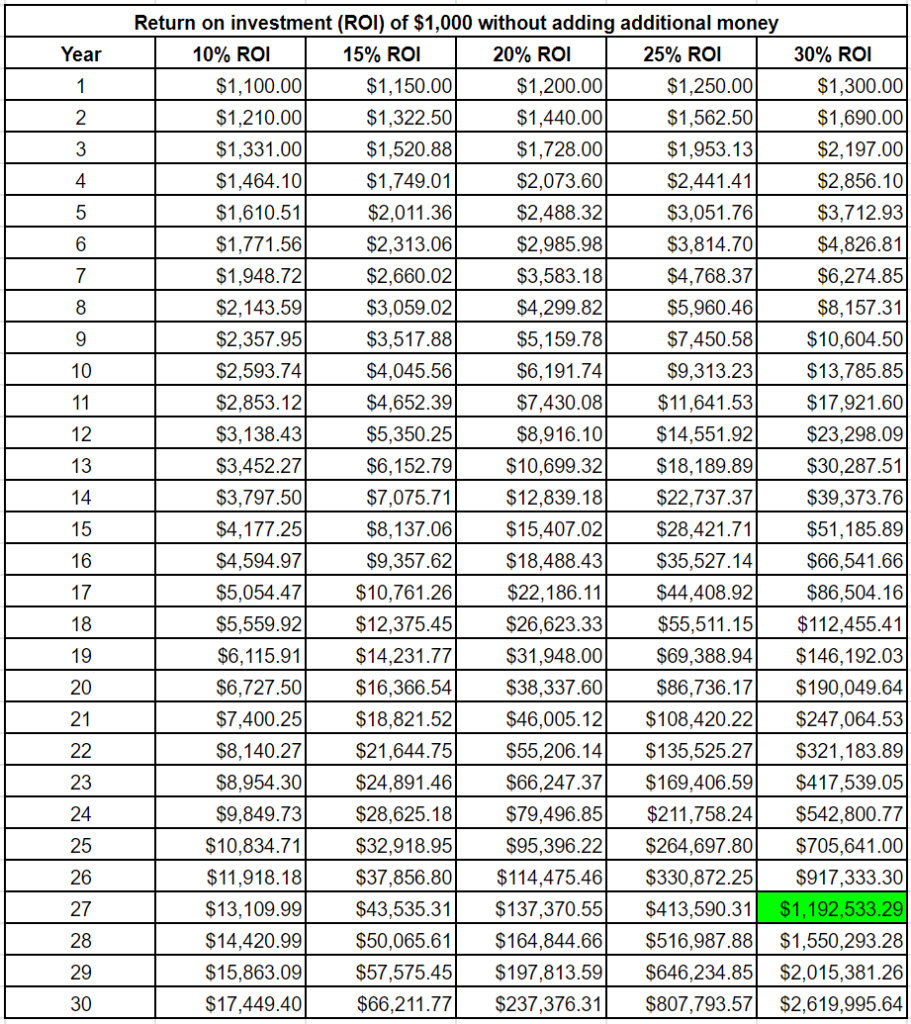

Just look at this chart! It shows a best case scenario for investing only $1,000.

A broker will only keep you in the 10% ROI column, generating $17.5k in 30 years. However, if you learn stocks and generate 30% ROI per year, that same $1,000 is worth $2.6 million!

Keep in mind, managing your own stock portfolio can be risky, especially if you’re new. I recommend starting small and continuing to use a stock broker for the majority of your retirement investments.

Click to Tweet. Please Share!Click To TweetHow do you make money with stocks?

There are two primary ways you can make money with stocks, capital gains and dividends.

Capital Gains

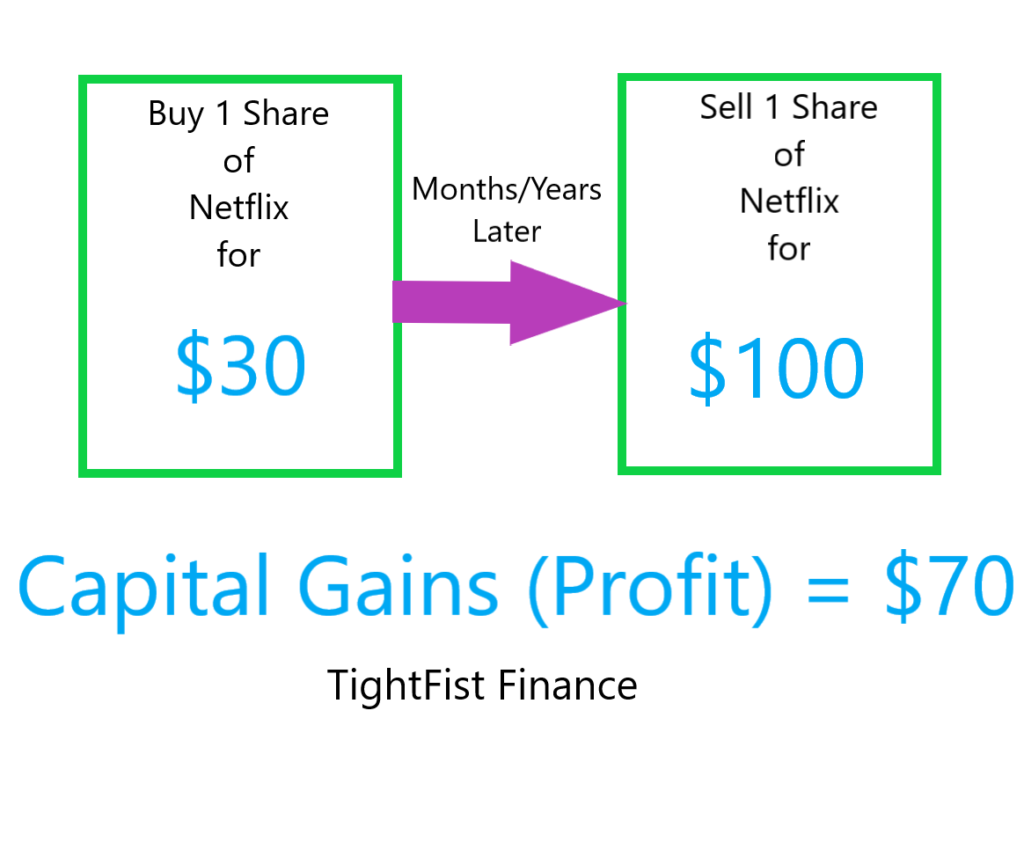

Capital Gains is the change in value of a stock price. You earn money when the stock price increases and lose money during a decline.

Let’s say you purchased a share of Amazon Stock when it was $30 and you sell it for it’s current price $1,792. You’ve earned $1,762 in capital gains because the stock is now worth more.

The price of the stock changes daily during stock market hours. Stock traders take advantage of the volatility, earning money when they buy low and then sell high.

However, there is a right and a wrong way to buy low and sell high.

The key to making money with capital gains is finding a stock that should increase in value. Most people make the mistake of purchasing a stock declining in value because they think they are getting a good deal.

Click to Tweet. Please Share!Click To TweetDividend Payments

Dividends are profits paid to shareholders over a course of time. Not every stock pays a dividend whereas every stock loses or increases in value.

Let’s say you purchased one share of AT&T for $34.97 with a quarterly dividend of $0.51. If you held AT&T for one year, you would be paid $2.04 in dividends which would offer a 5.83% return on investment.

Keep in mind the value of the stock will increase or decrease. So if at the end of the year, you sold AT&T for $40, you earned $5.03 in capital gains and $2.04 in dividends. You would earn $7.07 in total profit or 20.2% return on investment.

Dividends can be paid monthly (M, 12 times per year), quarterly (Q, 4 times per year) or annually (A, 1 time per year). The company, in this case AT&T, is responsible for determining dividend payment frequency.

Many investors love dividends because it provides them with cash flow, regardless of market performance.

Click to Tweet. Please Share!Click To TweetManaging stock market risk

As we previously discussed, managing your own stock market portfolio can be risky. Generally, the stock market is the most risky to new beginners without any experience.

When you start as a new trader, you’re going to lose money and make mistakes. Learn from those mistakes quickly and remember, practice makes perfect. You can make fewer mistakes by finding a mentor or someone who’s been successful with trading stocks.

1. Start Small

When I started trading stocks, I started with $150 and proceeded to lose 50% of it before I actually learned how to make money with stocks.

Oh darn, $75 down the drain.

Losing the $75 was better than any course I could have ever purchased. I learned what advice I could trust and which to avoid. Now I could read stock charts more accurately and predict how the stocks would perform.

Through losing money, I learned about stock trends, why penny stocks are dangerous, stock bankruptcy, and finally, how to make money with stocks.

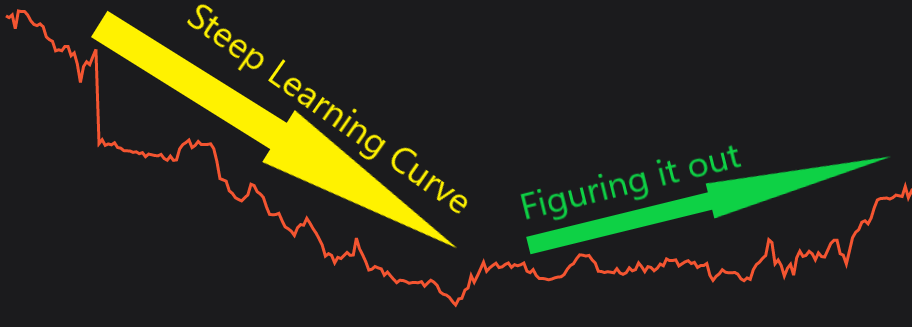

As you can see, learning how to make money with stocks had a steep learning curve. The first six months were full of downs, and several bump ups which got me excited until it continued downward.

It takes time to learn the ins and outs of the stock market. Don’t be stupid and throw $10,000 into it immediately. Remember, it’s easier to part with $75 than $5,000. You can always add more once you get the hang of trading stocks.

2. Only invest in what you understand

One of my biggest mistakes was investing in stocks without understanding stock market basics. I did zero research and made several mistakes because of it.

After experiencing my first penny stock bankruptcy, I started doing research on buying and selling stocks.

I learned how to read stock charts and understand what factors indicate a stock that might rise versus shooting in the dark. It’s one thing to take someone else’s opinion on the best stock, but it’s another to evaluate the stock for yourself and form your own opinion.

Click to Tweet. Please Share!Click To Tweet3. Lead with your head, not your heart

You’re going to lose money if you trade stocks based on emotion. Emotional people tend to have a harder time successfully trading stocks. The best thing you can do is learn to read stock chart patterns and determine for yourself if the stock is worth a purchase.

4. Diversify your portfolio

Putting your money into one stock is extremely risky. Starting out, I would invest in multiple stocks. Investing in multiple stocks helps keep you calm when one stock starts losing value, but your others are increasing in value.

Have a plan for your profits. Most swing traders will only trade with a set amount, say $50,000. Any profits earned are then transferred into less risky moves such as exchange trade funds or dividend stocks.

Click to Tweet. Please Share!Click To Tweet5. Choose higher cost per share stocks

Buying a stock worth $100 is generally better than buying a $5 stock. Why? Higher price generally indicates a higher quality stock.

A.K.A, you’re getting what you pay for!

Most inexperienced buyers would prefer to buy 20 shares of $5 stock because they feel they are getting more for their money. However, earning 10% on a single share of a $100 stock or 20 shares of $5 stock is still $10.

I’ve tried both ways and generally always lost money on stocks under $20. One of my stock buying criteria is looking for stocks valued $50 or higher.

6. Avoid IPOs

Initial public offerings (IPO) can be a good way to make money, if you know what you’re doing. I mean look at Shopify.

In about 4 years, Shopify went from about $30 to peaking at $409.61! That’s an amazing 13.7 times the initial price! So yeah, you could have turned a $10,000 investment in Shopify into $137,000 in 4 years!

However, Shopify’s experience is extremely rare and most IPOs aren’t successful. There is a right and wrong way to buy IPOs, but that will have to be for a different article.

7. Patience!

Finding the right swing trade takes time and even more time for the stock price to rise. Don’t expect to earn 40% return on investment a month. Yes, people can do it, but no most people don’t. Patience is a virtue when it comes to trading stocks.

Click to Tweet. Please Share!Click To TweetDay Trading vs. Swing Trading vs. Momentum Trading

There are three different styles of trading, Day, Swing, and Momentum. Personally, I prefer Swing Trading because I feel it’s the easiest and works with my busy schedule.

Day Trading

Day traders buy and sell a stock within a day, taking advantage of small market movements. This style of trading is considered highly risky, although it can be highly profitable.

Unfortunately, day traders are subject to the Pattern Day Trader (PDT) rule. The PDT rule requires day traders, who make 4 day trades in a 5 day period, to maintain $25,000 in their brokerage account.

Swing Trading

Swing traders buy and sell stocks over a multiple days or months. Generally, swing traders buy when a specific stock takes a dive and then sell when the stock recovers. Again, this is my favorite style of trading!

Momentum Trading

Momentum traders find stocks which are aggressively rising and buy to ride the momentum. Like day trading, this is risky because you’re assuming the trend will continue.

Click to Tweet. Please Share!Click To TweetWhat is Dividend stock investing?

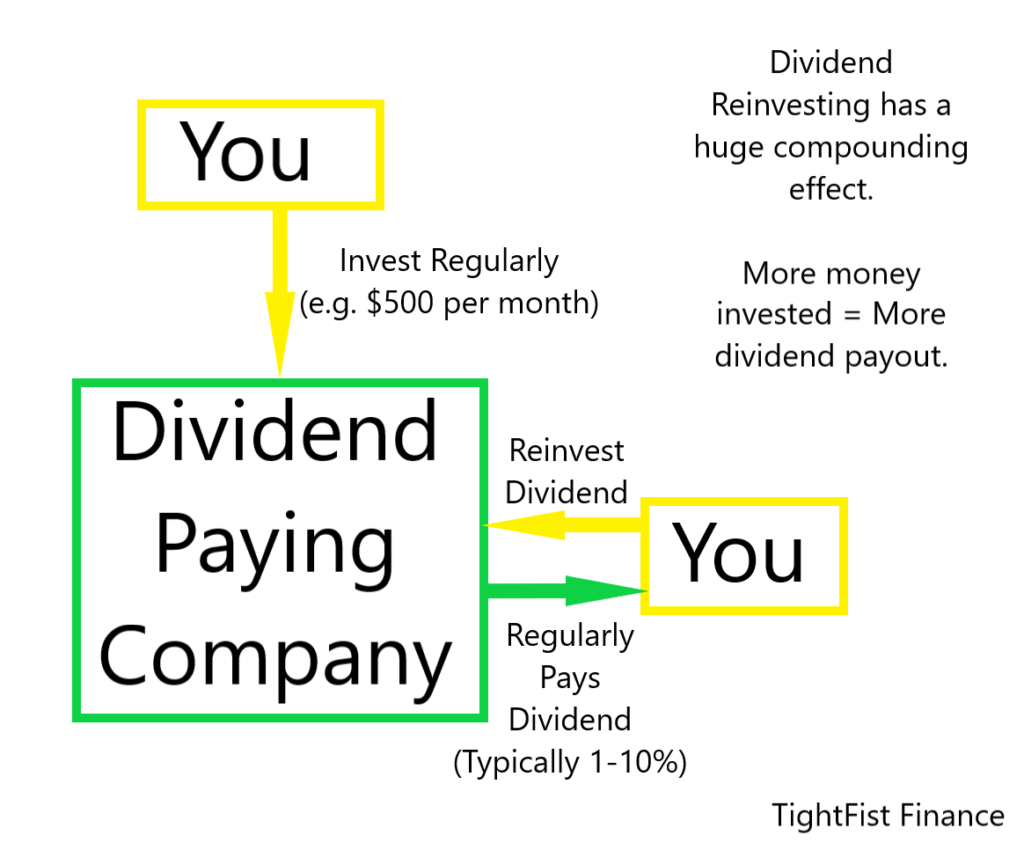

Dividend investing is a powerful way to generate passive income. The more money you can invest into dividend paying stocks, the more dividend payout you receive.

The trick is to continually invest your dividend payments back into the company. Compounding interest has an exponential curve, which basically means it takes more money up front but gets easier the more money you feed into the dividend machine!

You can even retire on dividend payouts if you build a large enough portfolio.

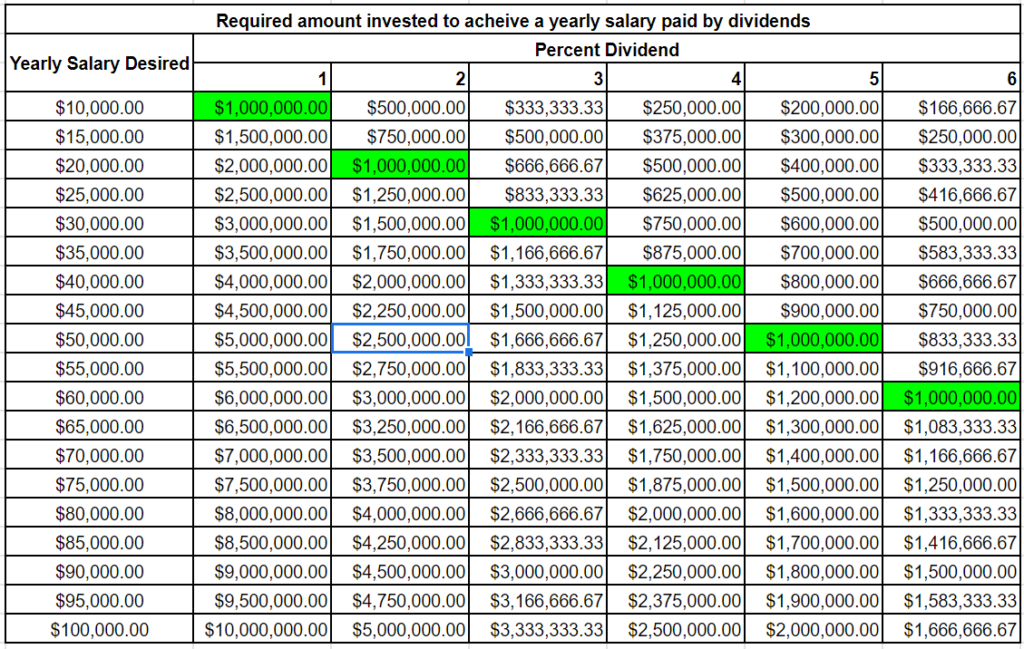

As you can see from the chart above, money invested and dividend yield are important factors in building your dividend portfolio. $1,000,000 at one percent dividend only pays a yearly salary of $10,000, but $60,000 at six percent.

Interested in Dividend reinvest planning? Check out dripinvesting.org, a free resource for people to learn more on effective dividend investing strategies.

Click to Tweet. Please Share!Click To TweetHow to read Japanese candlestick patterns

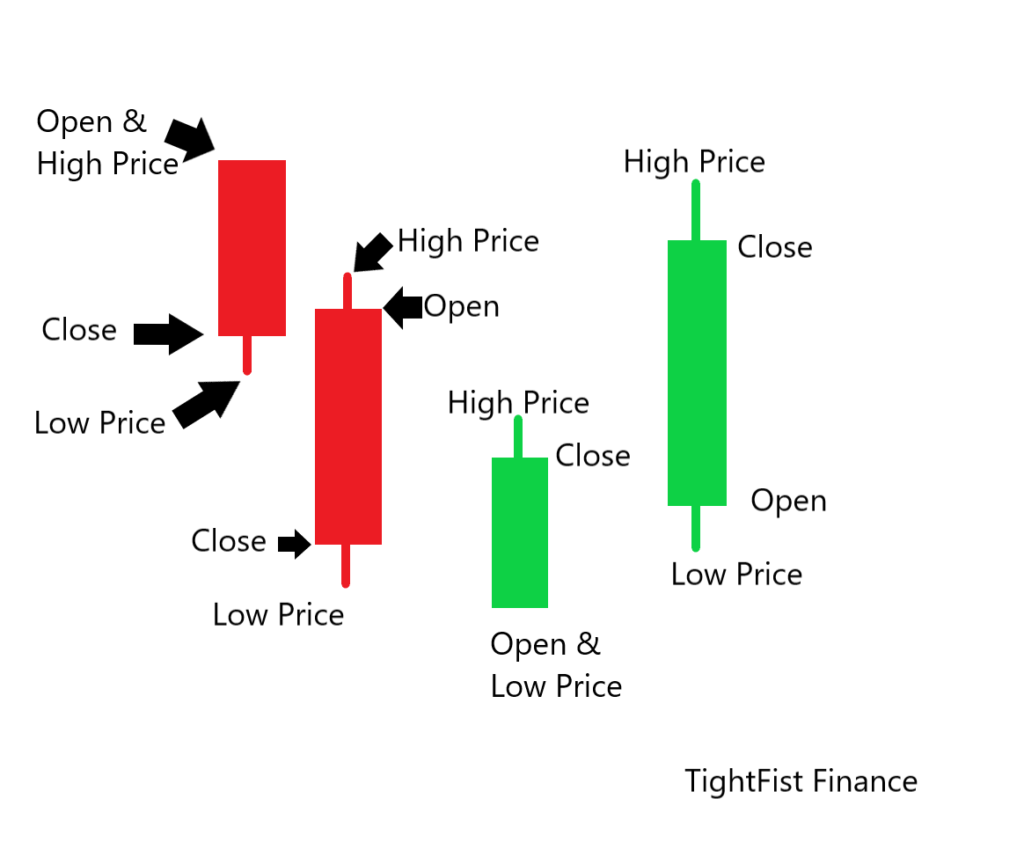

One of the most basic skills you’ll need to know is how to read the Japanese candlestick patterns. While confusing at first, it will become second nature after a little practice.

Red denotes a loss on the day, while green means a gain or profit. From the chart above, the terminology is as follows:

- Open – The price of the stock at the time the stock market opened.

- Close – The price of the stock at the time the stock market closed.

- Low Price – The lowest price the stock reached during the day.

- High Price – The highest price the stock reached during the day.

Basic stock market terminology to know

You will need to know a few basic terms if you want to start making money with stocks. In my experience with swing trading, these are important words to know.

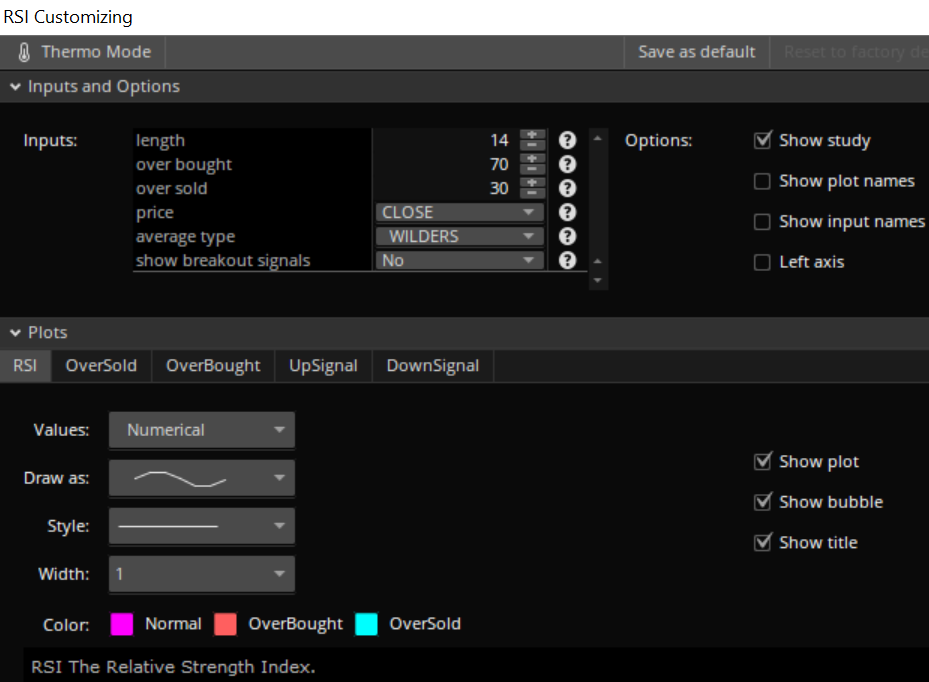

Relative Strength Index (RSI)

Relative strength index is a measure of an individual stocks recent price change indicating if the stock has been overbought or oversold. Average range is from 30 (oversold) to 70 (overbought).

Typically, a large selloff might drop the stock under 30 RSI, indicating the stock has been oversold. Dropping below 30 might indicate the stock price will rise in the near future as the stock recovers from overselling.

Conversely, a stock might be overbought when the RSI is over 70. Overbuying is a sign the stock price might drop in the near future to recover from overbuying.

Click to Tweet. Please Share!Click To TweetSupport and Resistance

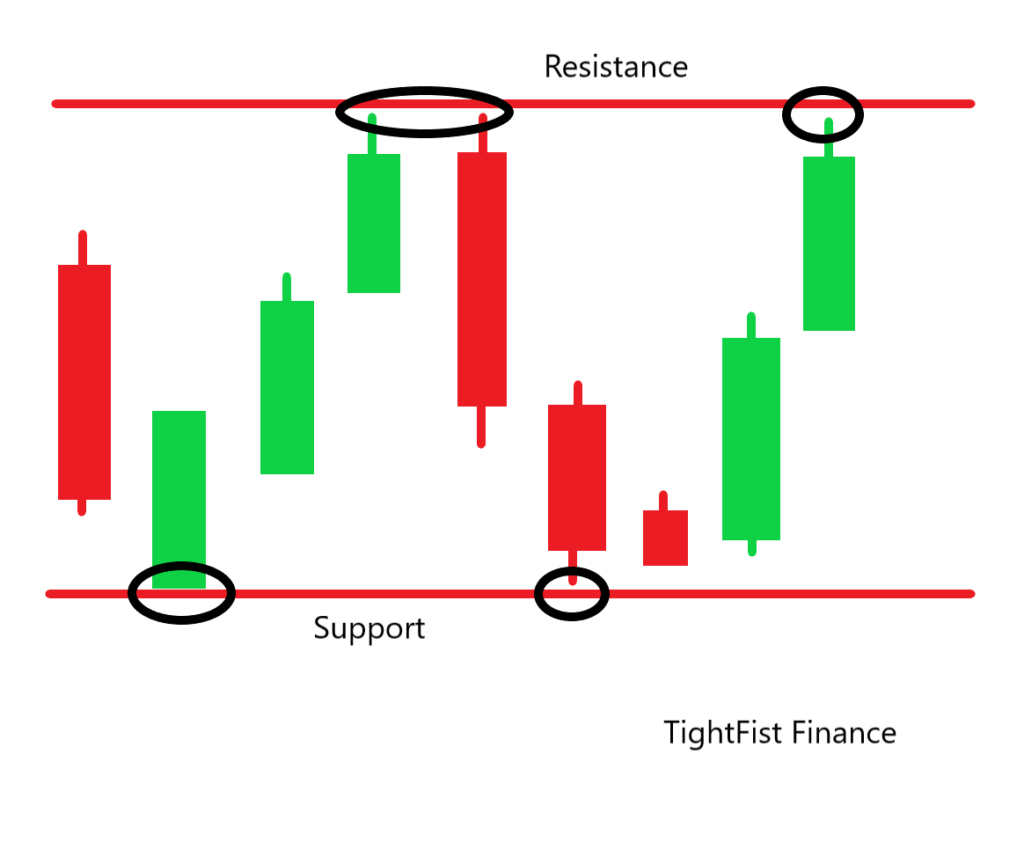

Supports and Resistances are imaginary lines where stock prices tend to bounce. Old supports can become resistances and old resistances can become supports. Be careful, just because a price has previously bounced at a support doesn’t mean it will again.

Exponential Moving Average (EMA) and Simple Moving Average (SMA)

The exponential moving average (EMA) and simple moving average (SMA) are both moving averages of the stocks price. The EMA is a short time frame average, while the SMA is a longer time weighted average.

Why is this important? When the EMA is above the SMA, generally the stock is earning money. While the SMA is above the EMA, the stock is generally losing money.

Also, The EMA and SMA can act as supports and resistances to each other. See the chart below, in yellow are times when the EMA (blue line) and the SMA (green line) acted as supports or resistances.

As you can see, the stock earned money when the EMA was above the SMA. A swing trader will take advantage of times when the EMA crosses the SMA for short term gains. Swing traders also look for times when the SMA acts as a support as an ideal buying time.

Click to Tweet. Please Share!Click To TweetWatchlist

Your watchlist is one of the most critical aspects to making money with stocks. A watchlist is a list of stocks that you want to closely monitor. You can create multiple watchlists for different purposes, (i.e. Vanguard ETFs, Dividend Stocks, Stocks over $100, etc.)

You need to know how to chose stocks that will actually make you money and add them to your watchlist. I’ll cover more about choosing stocks for your watchlist later.

Brokerage

Your brokerage is the company that you can buy and sell stocks through. For example, Robinhood is a brokerage firm where you can make free stock trades.

Robinhood is perfect for beginners because other brokerage firms make you pay a fee for each trade. I’m sorry, but when you’re just starting out with $100 you can’t afford to pay $10 per trade. Best of all, you can download the Robinhood App and make trades from your phone.

Click to Tweet. Please Share!Click To TweetSetting up your brokerage accounts

There are two brokerage accounts I highly recommend you set up.

- Robinhood – Robinhood will be your starting brokerage account to buy and sell stocks. It’s perfect for beginners because it has free trades. It’s not the fastest brokerage in the world, so don’t try to day trade with it.

- TD Ameritrade Think or Swim – The think or swim platform is my favorite platform for researching and analyzing stock charts. It will take some getting used to, but it’s well worth the effort.

Most brokerage accounts will require your income, place of work with address, Social Security Number (for tax purposes), etc. While this may seem daunting, most brokerage accounts only take about 15 minutes to set up.

For both Robinhood and TD Ameritrade, I trust that you’ll be able to follow the on screen instructions for setting up your account. Robinhood is pretty straight forward because it’s built for beginners.

However, TD Ameritrade Think or Swim will require some setup.

Click to Tweet. Please Share!Click To TweetTD Ameritrade Think or Swim Setup

Personally, I find the Think or Swim mobile app more user friendly than the desktop version. However, once you get it set up and play around you’ll start getting the hang of it. Remember, Google is your friend if you have questions!

The first thing you’ll need to do is log into your Think or Swim.

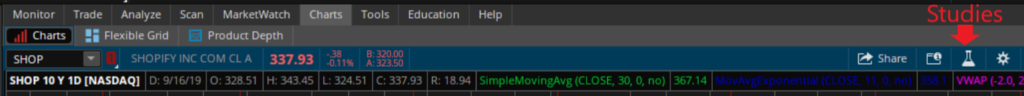

Go to Charts and find the beaker icon (studies). Studies add helpful tools to the charts.

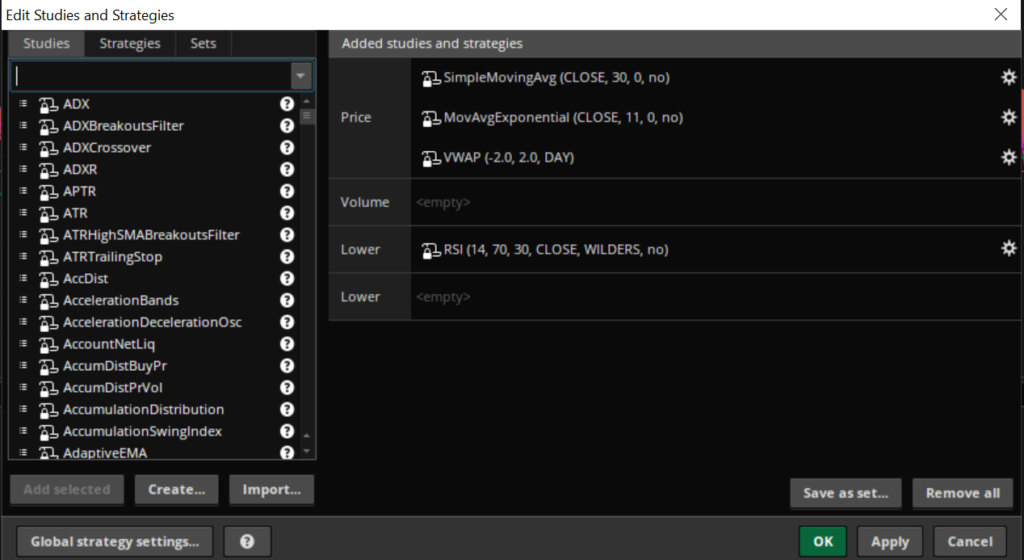

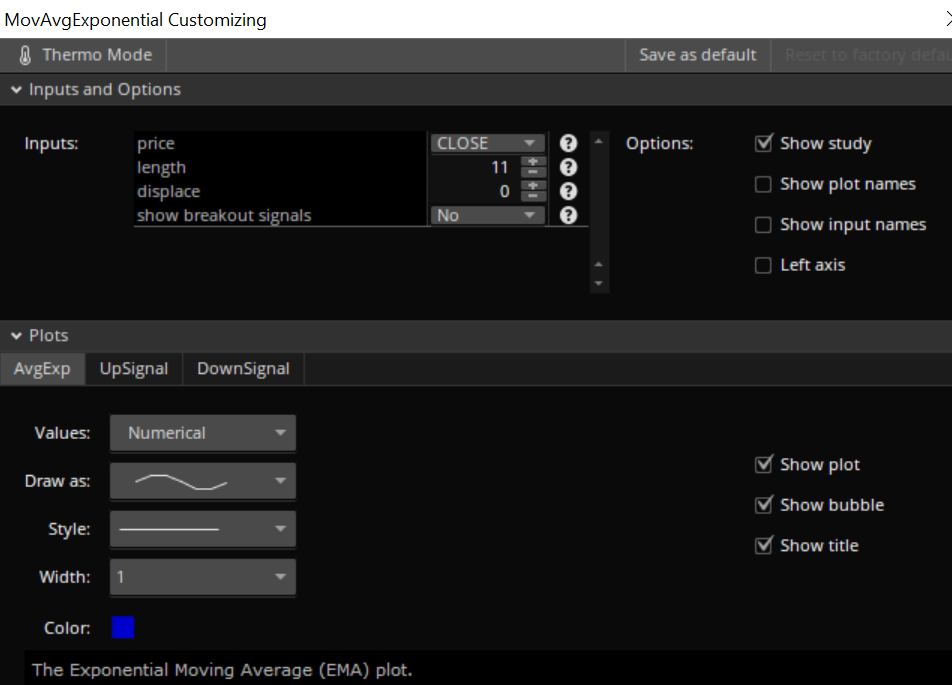

A box for adding studies will pop up. Here are the studies I have added to my Think or Swim. I recommend you add SimpleMovingAvg, MovingAvgExponential, and RSI.

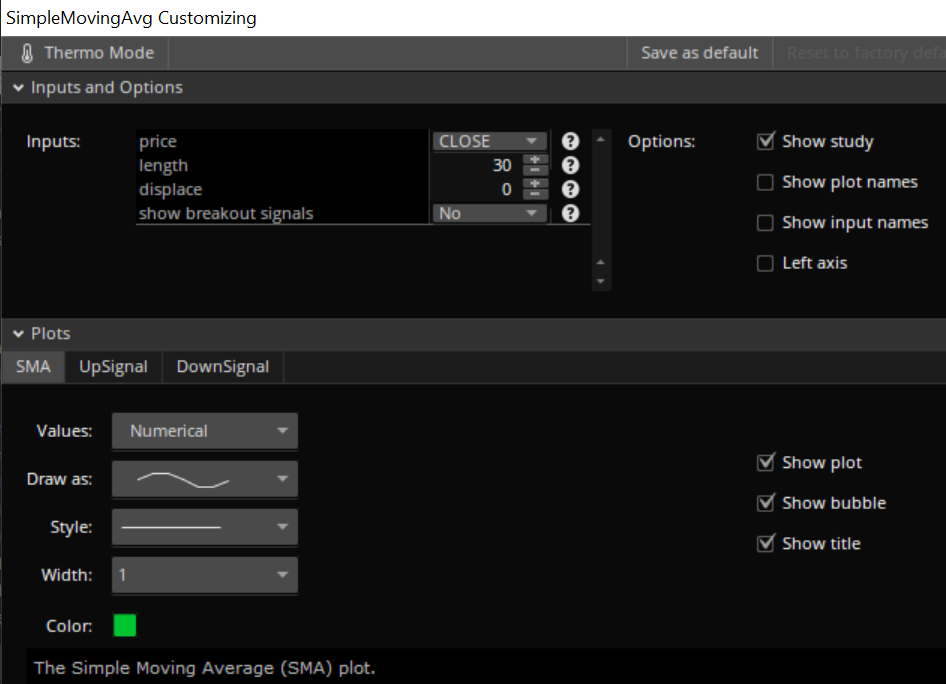

Click the Cogwheel next to each study to edit the settings. Here is how I have my studies set up:

Studies are one of the most important parts of setting up your Think or Swim platform. Again, this software takes some getting used too so watch a few YouTube videos. I recommend starting with the App on your phone because it’s more user friendly.

Setting up your watchlists

Now for the most important part of making money with stocks, setting up your watchlist!

Your watchlist can make or break your ability to make money with stocks. So how do you find stocks that will actually make you money?

Here is what I look for when choosing stocks for a watchlist.

Click to Tweet. Please Share!Click To TweetWhat stocks should you add to your watchlist?

Ideally, you know a little something about the company. I know that Target is a retail business, how retail works, they’re financially doing well, and they are remaining competitive.

Knowing a company isn’t a hard rule. However, every company added to your watchlist should be earning money.

What does that look like?

Just look at the 10 year chart for a company. Check out Amazon’s stock:

See how over the years Amazon’s stock price has continually increased? While not a guarantee, stocks that have continued to grow will continue to grow because they know how to make money!

Now that you know the pattern to look for, is the companies stock price over $30? Remember, you get what you pay for and you’re not going to make any money trading cheap stocks. Higher priced stocks tend to be more stable than lower priced.

Finding a Quality Swing Trade

The first thing you should ask yourself is, “what direction has this stock gone in the last 10 years?” Facebook has been growing over the last 10 years, check!

What about the price? The stock is over $30, check!

As you can see, the stock peaked at $218.62 but crashed. Why? I don’t really care why (most of the time). In this case, Facebook was struggling with Privacy issues.

This massive crash caused a massive sell off, creating a buying opportunity for swing traders. Facebook is still a money generating machine, meaning the direction is still up!

Let’s take a closer look at the stock crash and sell off.

As you can see, Facebook’s stock fell about $93 before recovering! Facebook isn’t about to shut it’s doors. Overall, the stock’s direction is increasing which makes it an ideal purchase.

Once a reverse in stock price direction is confirmed, the stock price is about $150. So what happened next?

From January to July, Facebook’s stock price increased $50. This means you generated 33.3% return on investment in 6 months! An average of 5.55% return on investment per month!

The stock market averages about 7-12% return per year! As you can see, swing trading your own investments can generate higher profits than investing in ETFs or with a stock broker.

Click to Tweet. Please Share!Click To TweetWhat’s your favorite way to make money with stocks? Let me know in the comments below.

If you liked this article, please share!

Recommended

Based on this article, we think you’ll enjoy the following:

- What time does the US stock market open

- Is investing in dividend stocks worth it?

- Can you get rich from stocks?

- Are penny stocks worth it?

- How to buy Disney stock for a child

- How much money do you need to invest in stocks?

- Can you make a living trading stocks?

- How much money should I be investing in stocks?

- Can you become a stock market millionaire overnight?

- Is it good to invest in stocks?

- Can you buy stocks with a credit card?