I know the feeling of being broke, tired, and frustrated.

You wake up every morning, go to work, and come home tired every single day. Your paycheck comes and you get a little more room to breath.

The problem? You’re making only enough to get you through the month. You’re broke and don’t know how to save any money.

You want to start moving forward with your finances, rather than surviving.

Your situation can be improved!

Today’s article is all about changing your financial situation. Don’t forget to sign up for our free budget and save money course.

This post may contain affiliate links which pay a commission and supports this blog. Thank you for your support!

Evaluate your income situation

Remember that old college saying, “C’s get degrees?” The saying means an average C student will still pass and get the same degree as an A student.

As a college student, I was ecstatic to get C’s in some of my courses. Why? Because I passed after a long hard fight and wouldn’t have to retake the course. I was moving forward with my degree and not paying to do the same work over again.

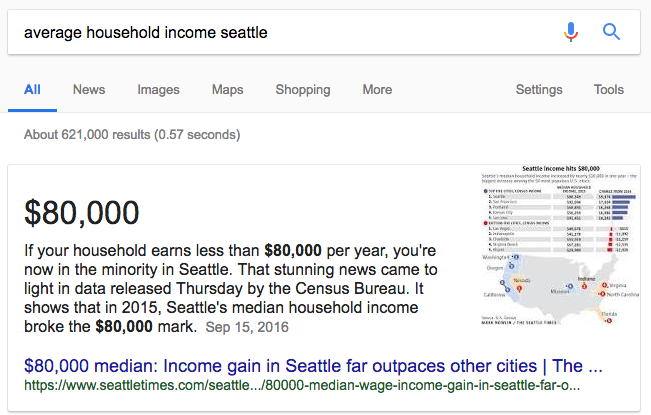

The same is true with your income. Are you making enough money to be considered average compared to the other people in your city?

Someone who makes their average cities household income *should* be able to do alright financially. An average income earner should be able to move forward in their life financially and not backwards!

Related:

How do you evaluate your income?

The first step is to write down your yearly income. I consider your income to be the base number before taxes or any overtime worked. You know, the number they give you when they say, “We offer you $40k a year to come slave away for us and never see your family again.”

Once you’ve written down the number you’ve signed your life away for your income, it’s time to Google search. Google “your cities name” + “average household income.”

Is your income lower than your cities average household income? If the answer was yes, you need to figure out a way to at least become average. The best thing you can do is start searching for another job right away!

Story time! How one simple act resulted in a huge income gain!

Alright, ladies and gentlemen, it’s story time. Today’s story is posted with permission from a friend of mine who shared their income story with me.

My friend graduated from college with a degree in engineering. Unfortunately, the economy was slow at the time so there wasn’t a lot of job opportunities available. One company made an offer, but it was super low.

My friend didn’t want to take the job, but no one was hiring and their family said it would be good experience. Hesitantly, they took the job despite the companies refusal to negotiate salary.

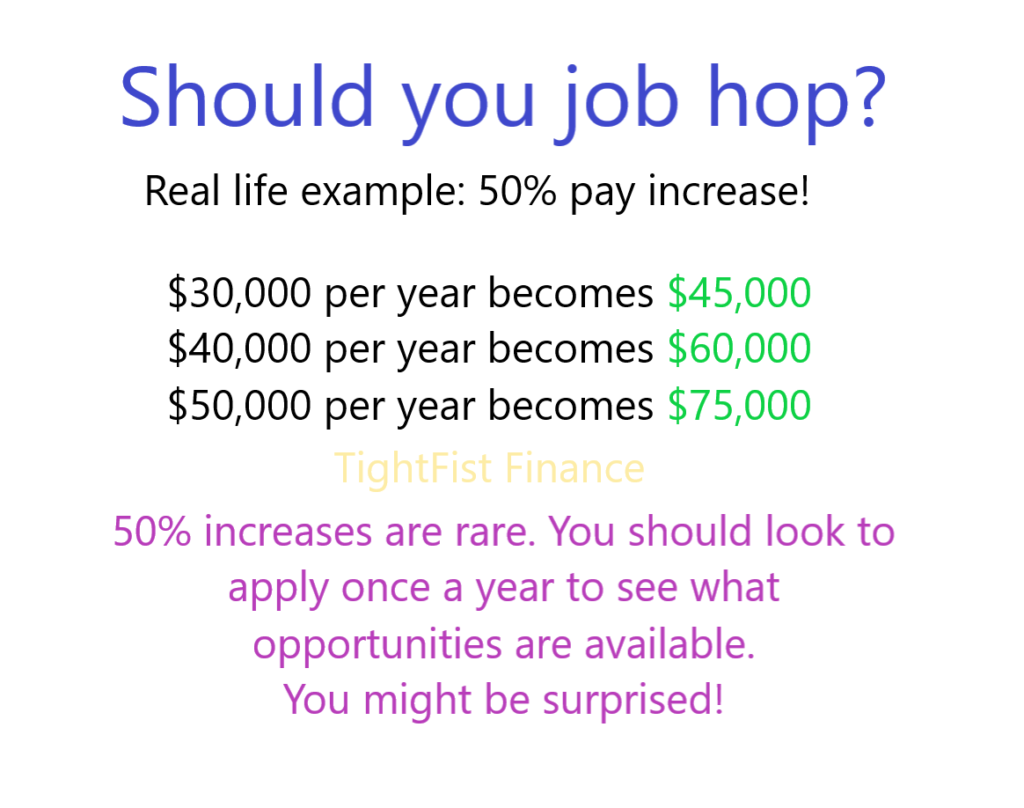

Not wanting to work at a company that didn’t value their employees, my friend kept an eye on the job market. Eight months later, they found a new position that offered a 50% pay increase with way better benefits.

As you can see, they went from being broke to doing much better financially. Could you imagine making an extra half of what you’re making now? If you made $40,000, you would now be making $60,000 overnight! You could save $1,000,000 way faster with that much money!

Stop being worried if employers frown upon job hoppers. Employers are not looking out for your best interest and might give you a 5% yearly increase, at best.

Related:

You are worth more than what you’re making now

Companies are always looking for someone that can come in and be a rockstar. A new company will gladly give you a significantly better offer to work for them.

Sadly, your company already has you and only rewards you with a small pay increase from year to year. Jumping companies is a significant strategy to boost your income.

Always be on the lookout for better job opportunities. Job hopping used to be considered a bad thing, but it isn’t so anymore. It’s time to get over the “job hopping is bad” stereotype.

30 years ago, you used to be able to work for a company and receive a pension. Pensions are almost non-existent anymore. To top it off, companies aren’t paying their employee’s decent wages. Job hopping is your new strategy for earning a decent income.

Your city plays a big part on your ability to save money

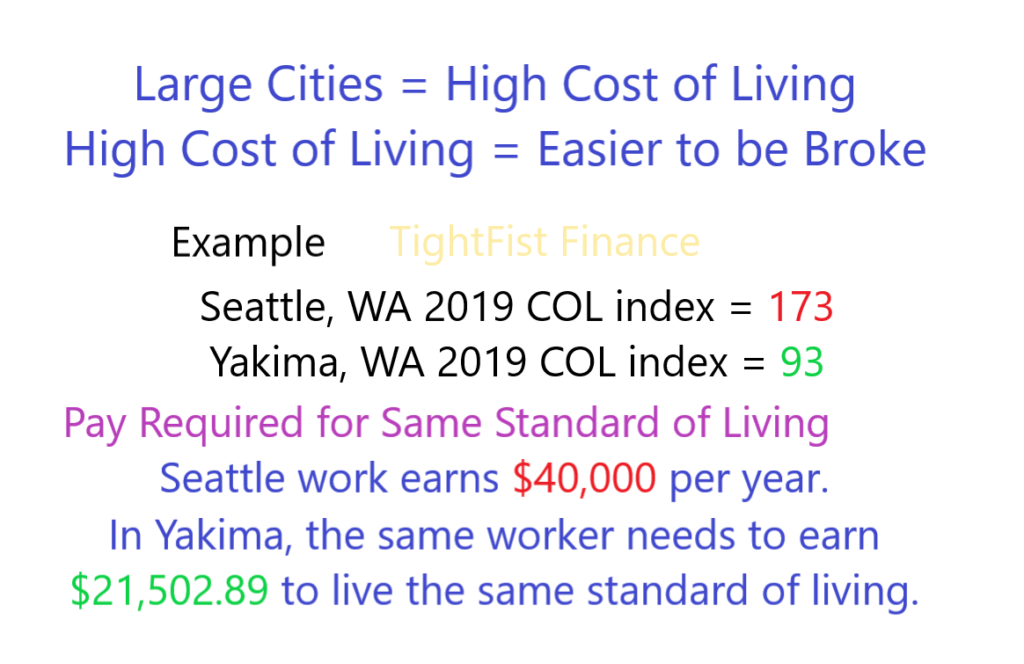

In general, people who live in larger cities are going to have more difficulty saving money. That’s because the cost of living is typically higher in larger cities.

Cost of living is measured by the cost of living index. The index is a number that helps easily identify how expensive an area is to live. 100 is considered average, over 100 is considered a more costly area, and under 100 is considered fairly inexpensive.

You’ll notice that I previously stated you want to earn at least an average income. Earning an average income is a good thing, but will be more helpful in a low cost of living area. Someone who earns average will do better in an area with a cost of living of 97 over an area of 105.

Are you broke, but living in a big city? Chances are you might do better off moving away from a large area, like Seattle or New York.

Related:

- How to save money when you’re shopping online!

- Make a budget that works with this detailed guide.

- The easiest budget you’ll ever see.

Create a household budget

Have you ever walked into a grocery store without a list or menu plan? I have and it was disastrous! Making matters even worse, I was super hungry.

I came out with a cart full of groceries and a massive grocery bill. Sadly, I still didn’t know what to eat all week even after buying all those groceries. I was unprepared without a plan which was a costly mistake that left me dissatisfied the remainder of the week.

Your families finances without a budget are no different than my poorly planned grocery trip. Without a budget, you’ll fill your home with meaningless or consumable items while spending a lot of money. You’ll overspend, leaving you unsatisfied with your finances and potentially leaving you without anything for retirement.

Creating a budget is the best thing you can do to keep track of your finances. It is your plan to spend your money wisely so that you can meet your financial goals. I’ve even created a free course to help you budget and save more money each month.

Budgeting is the number one tool that will help you go from broke to financially woke!

Decrease your expenses

We all become accustomed to a certain lifestyle. Sadly, you may be spending money on things when you could be using that money to better your situation.

Don’t get me wrong. We need to spend money on things each month for our own sanity. You just need to ensure that you’re minimizing your excess spending so that you can save more money.

Look over your household budget and see if there is anything you can reduce your spending on. For example, can you spend $500 a month on groceries rather than $700? Can you spend less money on your hobbies or give up a bad habit?

Often times, the stuff we buy is what keeps us broke. Most people don’t take the time to budget so they don’t really know what their monthly expenses are.

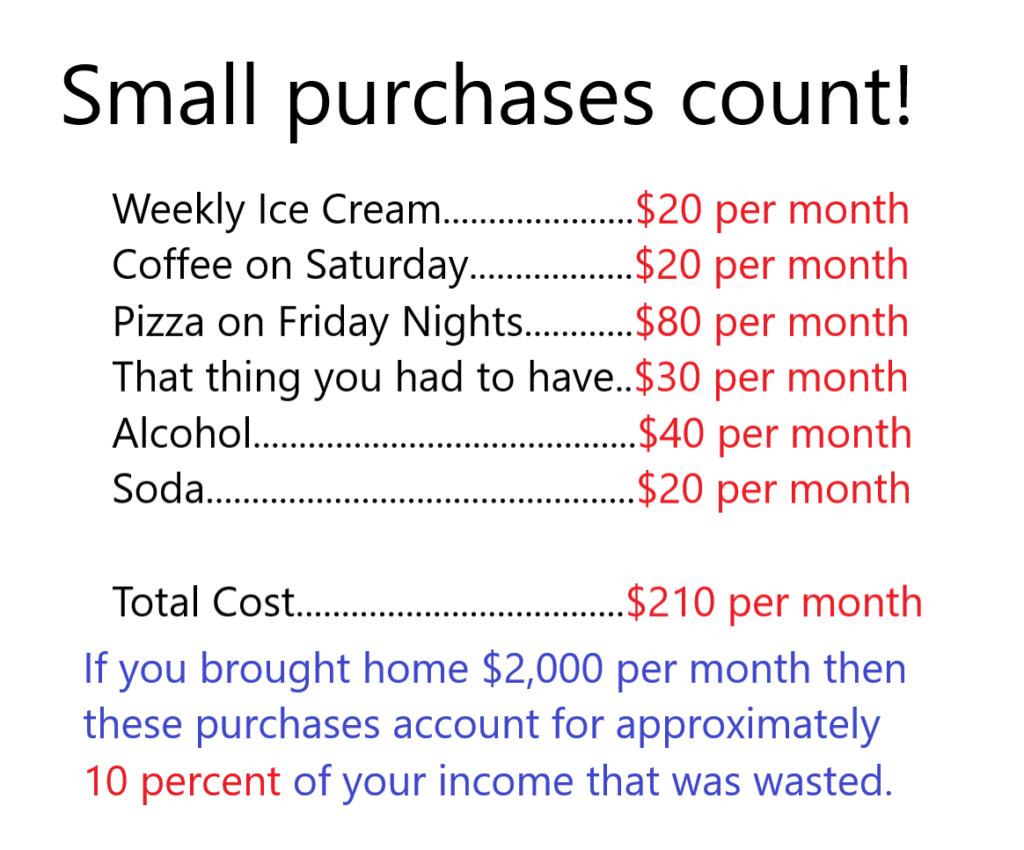

Frequently treating yourself causes financial harm if not managed. Treating yourself to ice cream one night, a pizza the next, and coffee on Saturday starts to add up. The little $5 purchases here and there can really start to add up.

Pay off any debt

Debt is going to drag you down financially. Think about it like you’re running a marathon with a weight strapped to your leg. The marathon was already hard enough, why would I want to carry the extra weight?

You cannot stop being broke if you still have mountains of debt. Focus on destroying your debt before it destroys your family and finances.

How much money are you paying each month towards debt? Imagine having that money every month without having to pay it towards debt. Think of what you could do with all that extra money!

That extra money can be your leverage once your debt is paid off. What do I mean by leverage? If you are paying $500 each month towards debt, you can use that money towards investing once the debt is repaid.

Do you want extra money at the end of this month to pay off your debt? Try a no spend challenge and use the money you save towards your debt.

Stop eating your paycheck

What’s the first thing on my mind after a long day at work? Food. What’s the last thing I want to do after a long day at work? Cooking!

When I first met my wife, I might have accidentally spent $700ish on eating out. Food isn’t only one of my weaknesses, it’s also one most Americans struggle with.

Our society has us working so many long hours that cooking has become an inconvenience. My job has me working 12.5 hours a day, five days a week. Why would I want to use my two hours to myself before bed for cooking?

I understand where you’re coming from! Eating out is the costly solution. The more cost-effective solution is careful meal planning for convenient, homemade meals.

I struggled with eating out and consequently, it was keeping me broke. I recognized the problem, made corrective action, and the savings started taking care of itself.

Have a plan for your saved money

So you just saved a bunch of money by increasing your income, budgeting, and reducing your expenses. What are you going to do with all this extra money? What’s your plan?

If you’re like most Americans, the money will get spent on something frivolous. Don’t be like most Americans. Instead, what can you do with the money that is going to better your situation?

Not having a plan is going to keep you broke!

Should you pay off debt, save for a down payment on a house, invest more money every month?

I highly recommend automating your savings. Put your house payment, investment deposits, bill pay, and any extra savings on auto pay or auto deposit. Ignore the money you are trying to save and live off of the rest.

Remember, your money is your leverage. The more money you have saved the better you can change your current situation.

If you’re looking for more ways to save money consider taking our free course, budgeting and saving money. The course is full of budgeting and save money tips designed to save your family money.