How much car can you afford on a $50,000 salary?

Generally, it is best to spend no more than 10% of your gross salary ($5,000) on a vehicle. Dave Ramsey recommends spending no more than half your gross salary ($25,000) on a new vehicle. Spending too much money on cars leads to missed opportunity cost or financial strain.

Imagine, being able to drive off in a new vehicle without sacrificing your finances. You may not be getting a Lamborghini, but you’ll have more money at the end of the day.

Car shopping is dangerous. It’s so easy to want the fancy, top of the line, new vehicles.

Unfortunately, most families take on significant debt to finance cars they can’t afford. This one purchase can set a person back on retirement for years!

Luckily for you, I’m going to show you how much car you can afford. You don’t have to listen to me, but at least you can make an informed decision. Only you can decide if the cost of a vehicle is worth the impact to your finances.

Key Takeaways

- A person with a $50k salary can afford up to a $25k car.

- It is recommended that you don’t spend more than $5,000 or 10% of your gross salary on annual car expenses. Car expenses include gas, car loans, and maintenance.

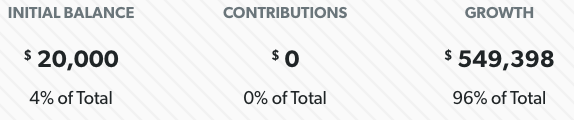

- Buying a new car comes with missed opportunity costs. Investing $20k at age 25 would result in $550,000 at the age of 67 with 8% return on investment. Car loans will increase your overall cost of the car.

- It’s ok to finance a car if the payments fit within your budget. Keep in mind, new cars depreciate fast which makes it easy to end up owing more on the car than it’s worth. You should also factor in the car payments into your emergency fund in the event you lose your job. You should also weigh the opportunity cost of financing.

- The best time to buy a new car is the last quarter of the year when dealers are making room for new inventory.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

How much car can I afford on a $50,000 salary?

On a $50,000 salary, it is recommended you don’t spend more than $5,000 (10%) on a car. Dave Ramsey recommends spending no more than half your gross annual income ($50k) on a new car. However, the cost of a car really includes purchase price, opportunity cost of investments, or loan interest.

Start by making a budget if you don’t already have one. You’ll need to understand how much free cash you actually have. You also need to decide if you’re going to take out a car loan, which is not recommended.

Paying in cash is always preferred, but not always possible.

So let’s take a look at a couple scenarios, assuming you’re a new college graduate with a $50k salary. Most college graduates make the mistake of taking their savings and purchasing a new car.

Click to Tweet! Please Share!Click To Tweet

Evaluating the opportunity cost of a new car

You have two choices, buy a $5,000 or a $25,000 car. Let’s assume you’ve got $25,000 on hand to make this purchase.

Unfortunately, you went with buying a new car for $25k. You could have invested the $20k difference. Using an investment calculator, your $20k would have grown to $570k from age 25 to 67 at 8% return.

Now, let’s assume you only had $5,000 to spend on a new car. Assuming you want the new car, you’ll need a car loan.

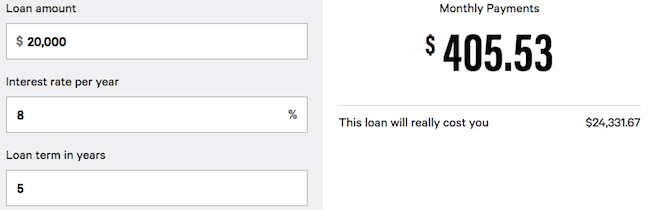

According to Bankrate, your interest rate on an auto loan will be anywhere from3.65%-17.74%! Loan terms are expected between two and seven years!

As a college graduate, your credit score is most likely low. Assuming an 8% interest rate and a five year term, we can estimate the true cost of your loan. Your monthly payments would be $405.53, costing you a total of $24,331.67!

So not only are you spending an extra $4.3k, but you’re also missing out on potential investment returns. Cars also tend to depreciate in value over time, so your car makes you lose money.

How much is too much for a car payment?

Generally, paying more than 10% of your income for a used car or 50% for a new car is considered too much. Ultimately, the deciding factor should be your overall financial situation to guide your car payments. You should be able to afford your expenses, savings goals, and use leftover cash for a car payment.

Remember, personal finance is personal. Only you know how your money will benefit your life the best. If you can meet your financial responsibilities then you can splurge on cars.

My only recommendation is that you consider the opportunity cost. Transportation is one of the biggest expenses you’ll face. Debt, such as a car payment, does not help you build wealth.

As previously mentioned, start with your budget. You should have a plan for your income to plan your monthly expenses, emergencies, and still be on track for retirement.

Once your budget is completed, is there any spare money left over? You can use this for a car payment provided no better alternatives exist.

So let’s say you’re comfortable spending $300 per month on a car payment. You visit the dealer, but the payments come out to $350. What do you do?

You can either revisit your budget and see if you can find an extra $50 per month. However, it’s probably best just to save up for down payment on your new car. With a substantial down payment, you can greatly reduce your monthly payments.

Is it ok to finance a car?

Your personal finance situation will dictate if it is okay for you to finance a car. Keep in mind, your car will depreciate in value while you are making payments. New cars depreciate 20 to 30% in the first year. Therefore, your car may be worth less than you owe on the car.

Again, this will all come down to your personal budget if you can make the payments. Personally, I would avoid taking on additional debt. What would happen if you lost your job tomorrow?

You should also factor in the cost of your car payments when building your emergency fund. Remember, losing your job is hard, but it is even harder when you have a car payment. Failure to repay your car loan may result in repossession of your car.

Your car tends to depreciate in value very rapidly. The more you drive your car, the further away from the original value your car gets. Your car loses value quicker, the newer it is.

Imagine, purchasing a car from a dealer for $25,000. You’ve been driving the car for one year and lost your job. You’ve decided that you cannot make the payments and want to sell your car.

Unfortunately for you, cars depreciate 20 to 30% in the first year. You owe the bank $24,000, but the car is now only worth $18,000. It’s a bad situation to be in, but it happens all the time.

I need a new car but can’t afford one

One of the biggest struggles people face is needing a new car, but not being able to afford one. Most individuals can’t afford a car payment, but also struggle to keep their current car running.

These are the steps that I would take if I found myself needing a new car, but couldn’t afford to buy one.

1. Evaluate your budget

The first thing I would do is evaluate my budget. If you don’t have a budget, then you should start making one.

A budget is going to help us do a few different things:

- You will be able to see where your money is going and identify bad spending.

- Your budget will help you identify areas of overspending, so you can take corrective action.

- You’ll be able to see how much money you’re earning versus spending. If you are spending more than you’re earning, then you can develop an action plan to spend less than you earn.

You don’t need to get too fancy with your budget. All you need is Google Sheets and to log into your online banking to see where the transactions are happening.

A lot of banks will allow you to export your transactions into a spreadsheet or you can just copy and paste the transactions into Google Sheets.

Break down each transaction into different budgeting categories. Budgeting categories are different areas of spending, such as food, utilities, rent, and transportation.

A basic budget on a $50,000 salary might look something like this:

- Monthly Income: $3,333

- Savings: $500

- Food: $500

- Rent: $850

- Utilities: $200

- Transportation: $350

- Medical and Health: $50

- Insurance: $100

- Entertainment: $75

- Free Spending: $150

- Random Spending $100

- Debt repayment: $485

Keep in mind this is only an example. I would expect your budget to look something completely different.

Look for areas in your budget that you can reduce your spending on. You should also look for areas that you are currently overspending on.

For example, when I first did my budget I realized I was spending way too much money on eating out. Limiting myself to eating out once per week significantly cut down on how much I was spending.

2. Eliminate your bad debt

You absolutely do not want a car payment when you have other bad debt. The more debt you have, the harder it is to pay off. The only way to pay off your debt is to increase the gap between your spending and your earning.

In the budget example we use above, the person was spending $485 on repaying their debt every month.

The average monthly car payment is $712 per month.

Taking on a car payment would mean that someone earning $50,000 per year is spending a third of their money ($1,197 = $485 + $712) on debt repayment.

Therefore, your first focus before taking on any more debt, if you choose to take on any more debt, is to pay off your remaining debt.

Personally, I would use your budget to identify extra money for paying off debt. Once your debt was paid off, I would then use the money you were using for debt repayment for saving towards a car.

3. Increase your income

As of right now, your goal is to pay off all your bad debt and then save for a used car. Increasing your income is one of the best ways to get ahead in life while making significant progress towards debt repayment.

Look at it this way. Increase in your income from $50,000 to $60,000 gives you an extra $10,000 per year. $10,000 is a 20% pay increase on a $50,000 per year salary.

In the short-term, you should consider finding a part-time job while you focus on paying down your debt or saving for a car.

In the long-term, $50,000 per year is rapidly becoming a bad salary. Inflation is rapidly increasing the cost of living which is making $50,000 hard to live on.

In addition, according to the US Census Bureau the median household income is around $67,000.

Making $50,000 per year puts you behind when compared to all households in the United States. Therefore, you should be on the lookout for higher-paying jobs as part of your long-term income strategy.

4. Fix up your car

Chances are that you are driving a beat-up old car. You desperately need a new car and you’re wondering how long your car is going to last. Unfortunately, we need to find a way to start fixing your car until you have enough money for a replacement.

Think about who you know. Do you know anybody that is mechanically inclined that can help you fix your car with free labor?

Parts will still cost you money, but friends will often be willing to help.

You can also try to learn how to repair the issues yourself by watching YouTube videos. I’ll admit, fixing your own car can be frustrating but it is a valuable skill to have.

I have saved myself thousands of dollars by fixing problems myself and watching YouTube videos. Sometimes, the fixes are really simple. However, the simple fixes can often cost thousands of dollars at a repair shop.

Another option is to get help from your local church. There are plenty of church members that feel the calling to do good in the community and often that looks like car repair.

The first step would be to talk to the local Pastor to see if there’s anything that the church can do. The Pastor can then reach out to the church members or they may even have funds available to help you fix your car.

5. Sell your unused items

You may also have a lot of items around your house which you aren’t using. Consider selling these items on Craigslist or Facebook Marketplace to generate extra cash. Use this extra cash to pay off your debt or save for your new car.

6. Save enough for a used car

Once your debt is completely paid off you’re ready to start saving for a used car. Keep using the strategies listed above to increase your income and build savings.

Now is also a good time to start looking around on Craigslist to see what cars are available in your price range. I understand not everyone likes to drive a used car, but you can find reliable cars for a fraction of the price than you can buy them new.

7. Avoid car payments

You should try to avoid car payments if you’ve worked so hard to pay off your debt and save for your car. The last thing you want to do is to get back into debt and start making payments again.

When’s the best time to buy a car?

The last three month of the year (October, November, and December) are the best time to buy a car. Dealerships are trying to clear out room for the new models and they’re trying to meet sales quotas.

Essentially, January is the worst time of year to buy a car. The closer you get to December the better your chances of getting a good deal.

Click to Tweet! Please Share!Click To Tweet

FAQ: Affording a car

The following are some of the most frequently asked questions about affording a car.

Is a $50k car expensive?

A $50k car is considered expensive. Buying a $50k car causes you to miss out on substantial opportunity costs of investing the money instead. Someone making $100k per year can afford a $50k car, but should consider buying a cheaper car.

How much car can I afford based on salary?

A typical rule of thumb is to spend no more than 10% of your gross income on transportation expenses and 50% of your income on a new car. Based on this, someone making $70,000 per year should spend no more than $35,000 on a new car.

Summary: How much car can I afford on $50k salary

As you can see, you probably shouldn’t spend more than 10% of your $50,000 salary on a used car. Dave Ramsey recommends no more than half of your gross salary for a new car. However, you need to consider the opportunity cost when buying a car.

You can earn more money investing the cost of a car. Cars tend to depreciate in value and lose money over time. Most people make the mistake of buying high end cars, which has a significant impact on their finances.

Auto loans should also play a factor in your decision. Your $25k car would end up costing you much more in interest. Your car will depreciate in value, meaning you’re going to owe more than the car is worth.

Before you buy a car, it’s important to have a budget in place. A good budget allows you to understand how much money you really have for a car.

My personal recommendation is to avoid financing a car. Pay in cash when you can. Avoid buying expensive cars, because investing will lead to more money later down the road.