What job makes you a millionaire?

Any high income job has the ability to make you a millionaire. However, income alone will not make you rich. Millionaires understand how to keep and grow their money. Poor people know how to spend money.

Having a high income job is only one of the pieces of the puzzle. In order to get rich, you need to know how to save and invest your money.

However, imagine having a job that made saving money easy. You make enough money that you didn’t have to work 30-40 years until retirement. What if you could quit your job by 40 or 50 years old?

Luckily for you, I’m going to show you which jobs can help you get rich quickly through high income. I’ll also show you how to use your high income to reach your first million dollars.

This article may contain affiliate links which pays a commission and supports this blog! Thank you for your support!

What job makes you a millionaire?

Any job which makes you $70,000 per year or more is enough to make you a millionaire. The average family in the United States makes $63k per year. Therefore, you could invest $7,000 per year and be a millionaire in 35 years while living an average life.

Yes, it is still possible to become a millionaire with less money. However, it becomes easier to save and invest money after $70,000 per year.

Obviously, lifestyle factors would apply. Someone who lives in a lower cost of living area would save one million dollars quickly. Higher cost of living areas are much harder to live in.

So which jobs pay at least $70,000 per year? Any job with a high income (e.g. doctors, physicians). Examples include:

- Engineers

- Lawyers

- Doctors

- Physicians

- Nurse Anesthetist

- Pediatricians

- Software Developers

- Mathematicians

- Material Scientists

- Physicists

- Investment Banker

- Stock traders

Becoming a millionaire takes more than just income. You also need to know how to keep and grow your money through investments. Millionaires are great planners when it comes to their money. So how do you become a millionaire?

What jobs make you happy and rich?

Careers which focus on science, technology, engineering, and math (S.T.E.M) are reported to be low stress and high paying. However, most S.T.E.M jobs require a college degree. Trade careers, such as Pipe fitter and Millwright, can be fun jobs that make you rich.

Four Pillar Freedom wrote an article on how jobs relate to stress levels. The article contains an interactive chart which can help you find a fun career at your desired pay and stress level.

How to become a millionaire

Savings rate is what determines when you become a millionaire. You will build wealth faster with the more money you invest on a consistent basis. Therefore, focus on saving and investing as much of your paycheck as possible.

For example, someone who earns $100,000 and saves $10,000 has a savings rate of 10%. Another person who earns $50,000 but saves $25,000 has a savings rate of 50%. The $50k per year earner will reach millionaire status much faster because they are being smart with their money.

Just because someone is a doctor does not make them wealthy. Often, high income earners adjust their lifestyle to match their income. As a result, most high income earners have little savings.

So what steps can you take to become a millionaire?

1. Plan your money

Budgeting is the best thing anyone can do for their finances. Everyone should have a budget, not just millionaires. It’s hard to keep your money if you don’t have a budget.

A budget is a plan for your money. You’ll earn $500,000 over 10 years if you make $50,000 per year. Most people who don’t budget will spend every single dollar. How would you like to make half a million dollars and have nothing to show for it?

Every dollar you earn should be accounted for in your budget. You need to know where your money is going. Otherwise, you’ll end up spending $700 on groceries without knowing it.

Most millionaires spend at least an hour a week budgeting.

2. Focus on high income and building income sources

Millionaires understand that earning a high income is the best way to build wealth. With investing, your money works for you. The more money you can invest the harder your money works. Therefore, you need a high income to invest more.

You should also focus on building income streams. The goal is to have multiple streams of income paying you for owning an asset. Millionaires are always looking to add an income stream.

What income streams can you start adding? You can buy websites, invest in dividend stocks, start a side hustle, buy real estate, and so many more options!

3. Keep your expenses low

Millionaires are very frugal with their money. It takes a lot of effort to build so much wealth, so why spend it? You’ll have more money to invest if you don’t spend it on much.

Again, saving money comes down to your saving rate. How much money you earn versus how much you spend. However, most people can only reduce expenses so much.

For example, you could cut out cable tv, subscriptions, and extra expenses. However, you still need money for rent and utilities. Slashing expenses can only take you so far. Therefore, growing your income is more important.

4. Invest

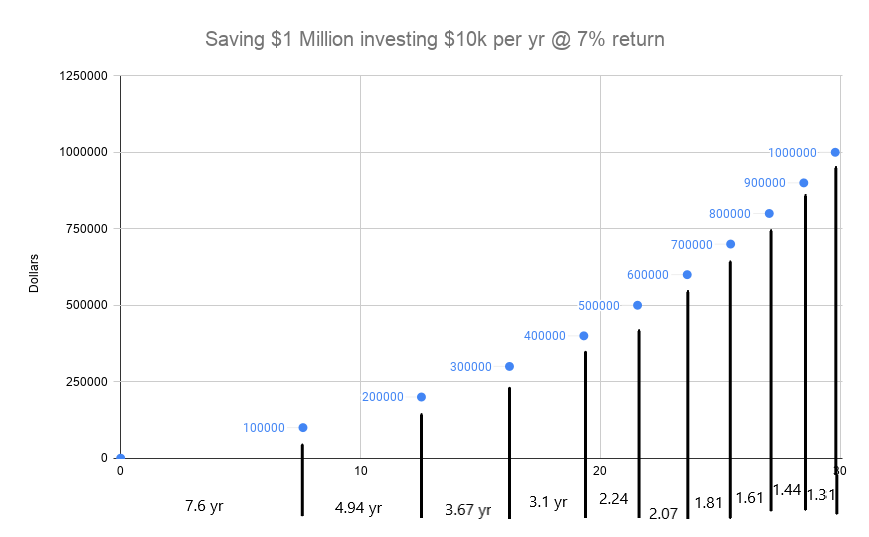

Investing is the only way to build true wealth. Saving your way to one million dollars is hard. Investing puts your money to work for you through compounding interest.

Compounding interest is the concept that our returns will start to make us more money as time goes on. Essentially, the rich get richer because of compounding interest.

As you get more money invested, your investments begin to do more of the heavy lifting. Eventually, your investments will earn you more money than what you contribute. Interest earned on $1 million is way more than you earn with only $10,000 invested.

In the example above, it takes 7.6 years to save your first 100,000. Your next 100k only takes 5 more years. Therefore, reaching 200k represents half of the time to make your first million.

Millionaires understand the importance of investing. Imagine having one million dollars invested in dividend paying stocks or exchange trade funds. At a three percent dividend, your investments would pay you $30,000 yearly in cash!

Summary: What job makes you a millionaire?

As you can see, any job that makes a salary of $70,000 or more can make you a millionaire. Therefore, you have a lot of career options to help you reach millionaire status.

Becoming a millionaire is all about your savings rate. You need to focus on building the gap between income and expenses. Make money and invest it while keeping your expenses low.

Millionaires follow a simple strategy for making that much money. They plan their money, focus on growing income, keep expenses low, and invest the rest.

Everyone wants to talk about Mark Zuckerberg. Yes, he made millions building Facebook, but he’s not the normal. Every day millionaires are like you and me. They show up to work, work hard, and invest their money.

The key is to find a fun job that makes you rich. Most well paying jobs require a degree. However, you can still find high paying jobs without college.