What are the best cash flow business ideas and investments?

The best cash flow ideas and investments allow you to generate recurring income with minimal upkeep. Invest in or create a cash flow business and continue to get paid years later. Cash flow business ideas include internet marketing, dividend investing, real estate or vending machines.

Imagine, getting paid for work you did five years ago. You only work a couple hours per week, but you’re still earning more than a full-time income.

Cash flow businesses make early retirement possible.

Luckily for you, I’m going to show you the best cash flow businesses to create or invest in. I’ll show you why cash flow is so important, how you can create it, and where to invest. With enough cash flow, you’ll be able to quit your 9-5!

This article may contain affiliate links which pays a commission and supports this blog! Thank you for your support!

How do you create a cash flow business?

To create a cash flow business, identify your business model and go all in. Focus on growing your income in a way that separates your time from money. Invest your profits into income producing assets.

The first step is to identify your business and who your customer is going to be. Are you going to be a blogger who helps people lose weight? Or, are you going to be a vending machine owner who serves your community?

It’s important to understand your business and how you’re going to get paid. You’ll need to focus your efforts on one business model.

Too many entrepreneurs don’t make money because they can’t focus on the one task which drives the majority of results. You can’t make money if you’re distracted by every detail or chasing the next big thing.

Once you’ve decided on your business model, take consistent effort on the one task which brings results.

Ideally, you can find a way to separate your time from income. Most of us are used to exchanging time for money, but doing so puts a cap on your earnings. Your earning potential is unlimited if you can separate your time from money.

When you do start earning a profit, invest your income into cash producing assets or growing your business. Income producing assets, like dividend stocks or REITs, will increase your cash flow.

Click to Tweet! Please Share!Click To TweetWhy is cash flow important?

Cash flow is important because having cash on hand allows you to pay expenses and reinvest. Building cash flow is easier than saving a large sum of money, making it easier to retire. When reinvested, cash flow can be used to purchase more cash flow.

Cash flow is easier to make than saving a large sum up for retirement. For example, you could make a $1,000 per month cash flow business in less than a year. Using the 4% withdrawal rule for retirement, that’s the equivalent to having a stock portfolio worth $300k.

For most of us, it takes multiple years to build a $300k portfolio.

Maybe you only need $5,000 per month to retire early. $5k per month can be achieved in a couple years with the right strategy. Two years of building a cash flow asset is way more achievable than building a $1.5 million portfolio.

Cash flow simply speeds up the retirement process.

At a basic level, all you need to do is cover your living expenses with cash flow to retire. Cash flow allows you to get a paycheck, even if you’re not doing much ‘work’.

The cash you earn can be invested to earn even more cash. Essentially, you’re getting money and buying income. Over time, using your cash flow to buy more cash flow builds a massive income snowball.

What are the best cash flow businesses and investments?

The best cash flow businesses and investments include internet marketing, dividend investing, real estate or vending machines. Each investment or business can be started with minimal upfront cost but continue to provide cash payments over time.

Blogging

Blogging is a cash flow business that is difficult to master, but can lead to long term profits. Every single article is a mini-digital asset that works passively to earn you income.

Ad revenue is the most common way bloggers can earn money. Whenever someone visits your site, you’re earning money from ads. However, bloggers earn money in other ways such as selling products or sponsored content.

For every 1,000 pageviews, display ads can earn websites an average of $15. Ad revenue varies between $7-30 per thousand pageviews (RPM). Therefore, a site with 100k pageviews could be earning between $700 and $3,000 per month passively.

Blogging takes advantage of compounding growth. The work you did years ago can continue to earn money.

For example, you might write 100 posts the first year which bring in 300 pageviews each per month. Cool, you now have 30k pageviews per month or $450 per month at $15 RPM.

Next year, you write another 100 posts, but your average monthly pageviews are now 450. Now, you’ve got a blog with 90k pageviews per month and making $1,350 in ad revenue!

You can then supplement your passive income by adding a paid product or using affiliate marketing.

Once you’ve mastered your first website, it’s easy to invest in another. You can start to outsource your content creation and scale even faster.

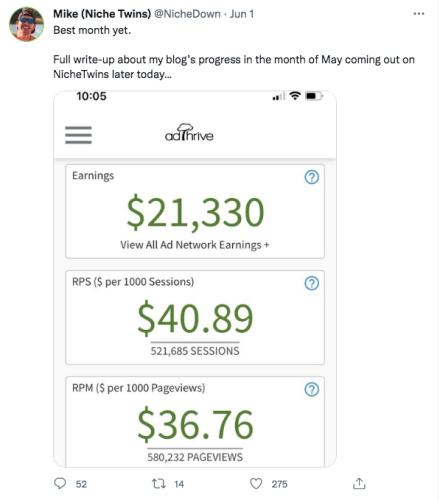

Case Study: Mike Donovan – Niche Twins

Mike Donovan (@NicheDown) is a blogger making over $20,000 per month with his blog. Mike primarily monetizes his blog through AdThrive, an Ad Network which requires 100,000 pageviews per month.

However, Mike didn’t start out making $20k per month instantly. Instead, Mike has built his blog to $20k per month over the course of 2.5 years.

As Mike discusses in his income report, the income starts to build up slowly over time. Here’s a glimpse into Mike’s income progress:

- The first six months of his website, Mike earned $4.34. Mike had earned nothing in the first five months.

- Subsequently, Mike was earning around $50 per month after six more months.

- Mike began earning around $700 per month after an additional six months.

- Amazingly, Mike was earning $16,000 per month at the two year mark.

- Four months later, Mike had broken $20k per month and his income is still climbing.

Surprisingly, Mike writes all his content himself. He credits writing quality content and spending the majority of time on keyword research to his success.

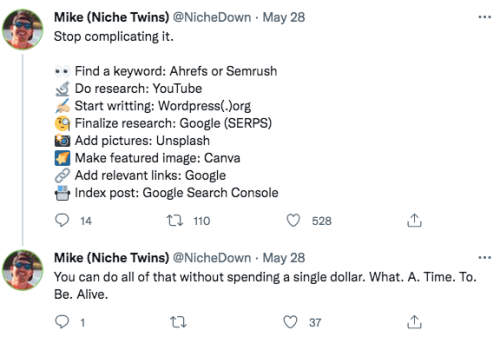

Mike’s steps for creating a successful blog are as follows:

As you can see, Mike has crushed online marketing and out paced his 9-5 income. He’s had so much success that he was featured on Spencer Haws (@nichepursuits) Niche Pursuits podcast with host Jared Bauman (@jaredbauman).

You can watch the full interview to see Mike discussing how he built his online business.

YouTube

YouTube is similar to blogging, but you’re creating video content. Most YouTubers earn a good portion of their revenue through ads, but others sell products or sponsorships.

Every video you produce is an asset which works 24/7 to earn money while you sleep. The more people watch your videos the more you’ll earn in ad revenue or product sales.

As with blogging, consistency is key. You will need to set up a consistent publishing schedule and build a loyal following. The more videos you produce, the more likely people are going to find your channel and subscribe.

Hiring people to produce video content is more challenging than writing, but it’s still possible. Should your main channel make enough money, you could hire someone to create a second YouTube channel.

Real Estate

Real Estate has been a cash flow business for a long time. Your goal as the landlord is to collect more in rent than you have to pay in mortgage fees and expenses.

Typically, you’ll need to have a down payment as part of your initial investment. However, a rental property can pay you with cash flow and appreciate in value. In addition, there are many tax incentives for investing with Real Estate.

Real Estate is a leveraged investment, which means you can borrow money to make money. Typically, banks will loan you the purchase price of the property if you pay a 20% down payment.

For example, if you found a property for $100k your down payment would be $20k. Your loan might be for $650 per month, but the property rents out for $850.

In this example, you might budget $100 per month for repairs. Therefore, your cash flow nets you $100 per month!

Affiliate Marketing

Affiliate marketing is a great cash flow business if you know how to sell products. Essentially, you are selling someone else’s product in exchange for a commission.

Imagine, building a twitter following around a specific topic, let’s say weight loss. People love your tweets and you’ve got good engagement.

You stumble across a blogger’s product for dropping 10 pounds naturally. Deep down, you know this product is a good fit for your audience. The course creator sells this product for $25 and gives you a $10 commission for every sale.

Next time you tweet, you link to this product and 1% of your 20k followers buy it. You just made $2,000 for one tweet!

That’s the power of affiliate marketing.

Digital Course Creator

Digital course creating is the opposite of affiliate marketing, but has amazing cash flow potential. As a digital course creator, you need to be really good about creating useful courses customers would love.

For example, you could create a digital course focused on weight loss. You need sales, which you can make or you can find affiliate marketers to promote your product. The easiest path to cash flow is finding affiliate marketers.

Imagine, having a course that sells for $50. You offer people a 50% commission if they make a sale and refer business. Therefore, you and your partners both make $25 for each sale.

Let’s assume you get 100 people to sign up as your affiliate. If each person could refer two sales every month (some more than others), you’d make 200 sales per month.

200 sales per month means you’re making $5,000 on autopilot. All you had to do was make the course and get other people to sell it for you.

Laundromats

Laundromats are another cash flow business that are more difficult to start, but profitable. You’ll also need to find a good location, because not every area needs laundromat services. People will always need to do laundry, so you’ll always have customers.

Dividend Investing

Dividends are another good source of cash flow for investing your business profits or income. Simply buy the stock or ETF once and continue to get paid for as long as the company maintains a dividend payment.

For example, AT&T ($T) is currently trading for $28.54 and pays a 7.29% dividend yield. A $1,000 investment would give you an annual cash flow of $72.90.

You can choose individual stocks for cash flow or invest in a dividend exchange traded fund (ETF). An ETF is a collection of stocks offered for one low-price. Some ETFs, like VYM, focus on high dividend yield.

So if you’re not interested in keeping up with individual stocks, ETF investing might be for you.

REIT Investing

REITs are similar to dividend paying stocks, but they focus on Real Estate. You can buy REITs just like you’re buying a dividend stock, with a brokerage account. As you can expect, ETFs exist for REIT investing like VNQ.

Vending Machines

Vending machines are cash cows if you know what you’re doing. Simply buy a vending machine online for $150 and find local businesses that will let you have some space. Depending on a variety of factors, each machine can make between $25-75 per month.

Literally, in the worst case scenario, a vending machine pays itself off in less than a year. Obviously, you’re going to have to do the leg work of getting a good location and keeping it stocked.

Click to Tweet! Please Share!Click To TweetNiche Website Investments

Niche websites are worth their return on investment, especially if you invest in a handful of websites and manage them accordingly. You can maintain a steady cash flow from a niche website with little effort.

The key is to find a topic not covered by the larger corporate websites so that your niche website can rank easier in Google through Search Engine Optimization (SEO).

Once you find a topic worth building a website around, purchase a domain name, hosting, install WordPress, and start adding quality content. Use SEO key terms to boost your searchability on Google.

Niche website investments aren’t immediate cash flow opportunities, but if you are patient and supply quality content to the website, they can earn up to five or six figures by the end of a year or even sooner.

You can also invest in hyper niche websites that cover a specific topic – for example, great white sharks instead of just ocean creatures – but these can be trickier to provide a revenue stream.

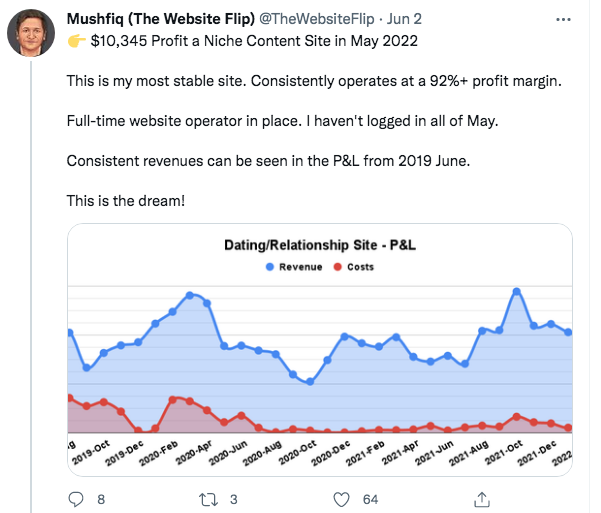

Case Study: Mushfiq – The Website Flip

Mushfiq (@TheWebsiteFlip) is a website flipper who has flipped over 200 websites for profit. In otherwords, he’s buying, holding, and selling websites as an investment.

Here is an example of one of his websites in his portfolio generating around $10,000 per month.

This website is passive income that he doesn’t even have to manage. Mushfiq has hired a website operator who does all the work for him.

Mushfiq buys his websites on marketplaces like Flippa, Empire Flippers, or Motion Invest. Each website is thoroughly vetted to ensure it was built with good practices in mind and can be flipped for profit.

Here is an example of one website Mushfiq bought, made a quick tweak, and can now sell the website for more than 5x what he bought it for:

As you would expect, website flipping isn’t easy to start. However, once you get better at flipping websites then you can seek out great deals with little effort.

Covered Call ETFs

Covered call ETFs are great for those looking to invest in exchange-traded funds for cash flow. Certain funds sell options against an underlying index which generates higher income. You’ll get a cash payment, but sacrifice growth potential in the process.

Covered call ETFs typically come in a 50/50 growth/covered call strategy or a 100% covered call strategy. The 50/50 covered call strategy invests 50% of the funds into the underlying index and writes 50% covered calls on the other half. The 100% covered call strategy writes covered calls on 100% of the funds.

As a result, 100% covered call ETFs will generate you the most cash flow, but usually offers zero growth. 50% covered calls will offer half the yield of a 100% ETF, but it should grow in value over time.

For example, stock ticker $QQQ tracks the Nasdaq 100. $QYLD offers a 100% covered call strategy against $QQQ, while $QYLG offers a 50% covered call strategy.

Here is how each ETF performed from January 1, 2021 to January 1, 2022 assuming $10k invested:

- QQQ had a total return of $29.25% and you would have been paid around $54 in dividends.

- QYLG had a total return of 25.73% and you would have been paid around $1644 in dividends.

- QYLD had a total return of 10.96% and you would have been paid around $1,256 in dividends.

Using this system for investing also offers protection in a volatile market. Your losses won’t be as significant as investing using other methods. Covered call ETFs act as a kind of insurance against major crashes.

Selling Options

Selling options is a great way to turn a profit, even if it can be risky should the market flip not go in the direction you hoped. By selling options, you give the buyer a certain period of time to purchase your stock at a premium price regardless of what the market does.

You can either sell a call option or a put option:

- Selling a covered call option requires you to have 100 shares of a company or ETF. You give a buyer the right to buy your shares at a certain price point within a time frame, for a premium fee.

- Selling a put option, you receive a premium fee but are agreeing to buy 100 shares of a stock at the strike price within a time frame. Therefore, you need to have cash on hand to buy the shares if the buyer exercises their option.

In both cases, the most ideal scenario is that the option expires worthless and you keep the premium fee.

Call Options Example

You’re looking at a plot of land valued at $100,000 and are considering developing a house on it. However, you’re unsure of how the surrounding area will be zoned, so you decide to buy a call option on the land in the next five years. You now have the right to buy the land, but you are not obligated.

The developer sells you the call option, but in exchange he takes a premium fee in exchange for the right to buy the land. Let’s assume you pay him $10,000 for this right.

Two things will either happen, the land value will increase or decrease.

Assuming the land get’s favorably zoned, the value of the land would increase substantially. The land value may now be worth $200,000. However, your option will now give you the right to buy the land at $100k, immediately profiting $90k ($100k minus $10k premium).

However, the land could be zoned unfavorably, such as if a waste treatment facility was zoned next to your plot of land. Your plot of land is now only worth $25,000, making your option worthless.

Case Study: Stephen Wealthy

Stephen (@StephenWealthy_) makes $15k per month between mining crypto, buying shares of QQQ, and then selling covered calls on QQQ.

Selling covered calls requires you to have 100 shares of a company or index fund. As of right now, QQQ is trading around $300 per share, meaning you’d have to have $30,000 invested for 100 shares.

As you can see, $30,000 is a lot of money and most beginners won’t have $30k laying around. However, Stephen has overcome the initial investment barrier by using crypto mining to generate cash flow for stock purchases.

His passive income is buying more passive income, creating a passive income snowball.

As a note, you don’t have to sell QQQ call options. Call options can be sold on many other different stocks and index funds, but QQQ is a popular choice. Therefore, you can find cheaper options to start selling call options on.

Alternatively, other individuals like Decade Investor have made premium income selling cash secured puts. In otherwords, he has the cash on hand in the event he is required to buy shares from his put option.

Amazon FBA

If you have products to sell for your business, there is a way to lighten your workload and capture a wider customer pool. You can use the Amazon FBA program to distribute your goods via Amazon.

Amazon will store and ship your products for a low monthly fee, freeing up your time to create the goods for sale or focus on other projects.

You won’t have to worry about the hassle of shipping, especially for smaller products that can be costly to ship despite their weight.

One of the biggest bonuses of creating an Amazon FBA account is your exposure to more customers. Everyone goes to Amazon for everything. It will be easier for someone to stumble across your product on Amazon than find your website.

Amazon FBA is a great way to increase your cash flow and free up your time if you’re a creator or have a business selling goods.

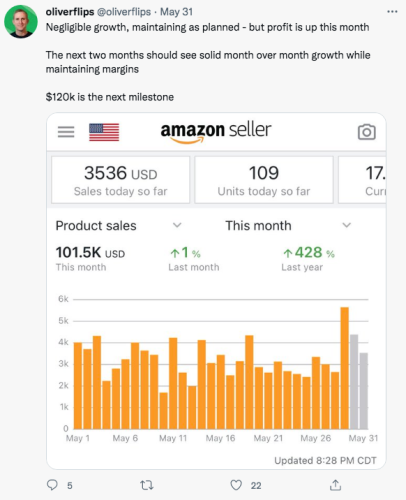

Case Study: Oliver Flips – Amazon FBA

Oliver (@oliverflips) is known for flipping products he finds online through Amazon FBA. He is currently making over $100,000 per month through Amazon FBA.

Oliver started small, starting his business during the 2020 coronavirus pandemic. He worked his way up slowly, buying products, sending them to Amazon, and repeating almost daily.

Oliver is focused on building systems, removing himself from the equation as much as possible. Systems allow his business to work, even when he isn’t. For example, Oliver takes advantage of:

- Virtual Assistants. VA’s are often running his cash flow business for him, sourcing products via Tactical Arbitrage and filtering products via Keepa.

- Testing small amounts of products before going all in. Oliver always makes sure a product will sell quickly by sending in a few items. Once he gets an idea of how fast an item sells, he buys more and scales.

- He keeps a leads list at all times, so he knows what to buy when product levels get low.

- Prep centers will package and ship his products to Amazon warehouses.

- Seller Candy manages his account health, ensuring his business stays in Amazon’s good graces.

Ebooks

Ebooks are a great way to make passive income after a one-time input of work and energy. There is a large community of readers who occupy the digital space for all you writers out there.

It can be challenging to publish and find a retailer to sell your book, which can also make decent passive income but has a lot of legwork. With ebooks, you can self-publish and reach a large audience.

Venues such as Amazon’s Kindle and Barnes and Noble’s Nook are great places to sell your ebook because they have a large pool of readers and offer a decent percent of royalties.

You can earn 65-70% of the sales from your ebook by publishing with either of these sites. Alternatively, you could keep 100% of the sales if you sell it yourself, which may require more work trying to get yourself noticed.

Ebooks are far cheaper than paper books, and you can write about any topic imaginable without a publisher dictating what to write.

Your next great American novel or the silly stories about your dog could earn you a passive income of a couple hundred to thousands per month.

SaaS Websites

Having a SaaS platform is an easy way for software developers to make passive income and continue creating marketable content for the public.

SaaS websites allow you to create a software platform that you can offer subscription-based access to for your followers. You will need to keep up with the content and update features.

However, once the initial creation of the software is complete, maintenance and updates should be minor. You can let that platform earn income while moving to another SaaS website.

Eventually, you can build several ongoing SaaS platforms and create a substantial revenue stream by putting in little work or even hiring someone to manage them, so you are genuinely making passive income.

SaaS website sales are very high, earning an average salary of $80,000 per year, and top earners make well over $100,000 annually.

Business Development Companies

A business development company (BDC) is an excellent way to earn a substantial return on investment without putting in too much time and effort. BDC’s are similar to REITs as they are both required to pay 90% of their taxable income to shareholders as dividends.

As a result of paying out 90% of their taxable income, BDCs will typically have higher dividend yields. Most BDCs pay yields between 6-10%.

However, BDC’s invest in businesses that are too small for the stock market and to big for other financing options.

Examples of business development companies include:

- Ares Capital Corporation (ARCC)

- FS KKR Capital Corporation (FSK)

- Main Street Capital Corp (MAIN)

Storage Units

Self-storage units that require low maintenance and no onsite staffing are a great way to make passive income. The best way to start your storage unit business is to acquire established storage units.

Car Wash

A car wash can be a great way to earn passive income, but a large initial investment can go into it. You need to purchase the land and building for a car wash and all of the equipment.

In the long run, a fully automatic car wash will earn you the most money, but it will also be the most expensive to purchase outright because of all of the equipment.

Most car wash businesses earn around $50,000 in their first year and then hit six figures quickly in subsequent years.

Purchase Royalties

Purchasing royalties is a different method of investing than buying, trading, and selling stocks. The return on investment may not be as high as risky trading, but it can provide a steady income.

As long as you pick a predictably stable company to purchase royalties from, this low-risk method can earn you a steady stream of income for as long as the company is turning a profit.

Purchasing royalties means you will earn a percentage of profit based on how well the company is doing.

Some of the best royalties to purchase are those in the entertainment industry. You can invest in books, music, movies, and more. As long as it’s turning a profit, so are you. You can purchase royalties on websites like Royalty Exchange.

If you get in on the ground floor of new intellectual property, you could be making passive income on the next Harry Potter or Beatles White album.

Turo and Hyrecar

You may have heard of earning money using your car by giving people rides with Uber or Lyft or delivering food or groceries with Instacart or Doordash, but there’s an even easier way to earn cash.

You don’t even have to drive your car to have it earn money for you. With services like Turo and Hyrecar, you can rent out your car. This is a great way to pay off your car bill, especially if you don’t use your car all the time.

If your car sits in your driveway for long periods of time, Hyrecar and Turo are awesome ways to have your car make money for you. You just need to make sure you have the right insurance on it, and you can earn passive income while someone else drives your car.

This is also a great way to purchase the car of your dreams and pay it off much quicker than normal. If you purchase a newer car and rent it out, but still keep driving your older car yourself, you can make enough income to pay for the new car.

Automated Airbnb

Airbnb is another viable option for earning passive income. There are many different avenues for earning money through Airbnb. The most obvious revenue is by renting out your home, extra property, or a room in your house.

IGMS put together a guide on how to automate your Airbnb. Methods for automating your Airbnb include:

- Automating guest communication.

- Using dynamic pricing tools.

- Automating check-in using lockboxes, electronic locks, or smart locks.

- Automating cleanings by hiring subcontractors or cleaning services.

- Using vacation rental software.

When done right, Airbnb can be completely hands off while generating you thousands of dollars per month.

There are other ways to make money from Airbnb, though. You can co-host a rental property and share the workload and profits. You can host an Airbnb experience which has become more popular in recent years and, if done right, can mean less work for you.

You can support other Airbnbs by starting a cleaning service or becoming a consultant and helping people set up their Airbnbs. Any way you slice it, Airbnb is a great way to earn passive income, especially if you have an extra property sitting around collecting dust.

By putting your property up for rent through Airbnb, you are also afforded the protective services of Airbnb plus their advertisement and a customer pool that is already established and growing exponentially.

You need to make sure that your rental residence is cleaned between guests, but you don’t need to do the hard work yourself if you hire a cleaning crew. Airbnb is a great way to keep that vacation home and make money.

Summary: The best cash flow business ideas and investments

As you can see, there are many cash flow business ideas and investments just waiting for you to start. You need to figure out which business you’re going to start and go all in. Focus on the one task that brings the majority of results and crush it!

Cash flow is important because it allows you to pay for expenses, including early retirement. You can live off of cash flow, which is easier to create than save.

Examples of cash flow businesses include blogging, youtube, Real Estate, affiliate marketing, digital courses, laundromats, dividends, REITs, and vending machines. Some businesses or investments are more passive cash flow models than others.