What is the best way to invest a $200,000 lump sum inheritance or windfall?

The best way to invest $200k is in a long-term growth or cash-flowing investment. The S&P 500 is one of the most reliable investments for long-term success. You can choose to invest the lump sum at once or use down cost averaging to average into the market.

Imagine safely investing a lump sum inheritance and aligning it with your retirement strategy. Investing a lump sum can give your investments a big kickstart.

You just need to know how you’re going to invest.

Luckily, I will show you different ways to invest a large lump sum of $200k or more. I’ll show you how to invest in growth, income, or real estate. You just have to determine which strategy works best for you.

Key Takeaways

- $200k is a lot of money at 3-4 times the average household income. Investing a $200k lump sum can significantly reduce the number of working years until retirement.

- The best way to invest $200k is through growth or income investments. Consider investing in stocks or ETFs for Growth, High Dividend Yield, Covered Calls, Business Development companies, REITs, and Real Estate.

- Always do your due diligence before investing. Consider investments that protect your capital, pay a yield, appreciate, and receive preferential tax treatment.

- Investing a lump sum is best done with a long-term outlook. Down cost averaging is best if the stock market declines, while investing all at once is best if the stock market rises.

- You will typically earn 10% or $20,000 on a $200,000 investment on an annualized basis.

This article may contain affiliate links which pay a commission and supports this blog. Thank you for your support!

Is $200k a lot of money?

A $200k lump sum is considered a lot of money. $200k is 3-4 times the average household income in the United States. The average person at retirement age has around $200k in retirement savings despite higher recommended savings. Investing $200k can significantly reduce your time to retirement.

The typical household income in the United States is around $63,000. Therefore, the average American household has to work 3.2 years to earn $200k before taxes.

Getting a windfall of $200k doesn’t just reduce your working career by 3.2 years. You can retire early by investing your lump sum. Now, your invested money makes you money faster through compounding interest.

For example, let’s assume you’re 30 years old without retirement savings. You want to retire on $1,000,000. Contributing $675 monthly at an 8% return on investment would yield you $1,000,000 in 30 years.

Now, assume you’re 30 years old and invest your $200k lump sum and contribute $675 per month. You can now retire with $1,000,000 in 17 years, retiring 13 years sooner because of your initial investment!

$200k can be a significant financial boost. Most retirees only have around $200k saved for retirement. Investing a lump sum now can ensure you have more money at retirement age.

Click to Tweet! Please Share!Click To Tweet

Considerations for investing $200k

You can invest $200k for growth, income generation, or a mix of both. The longer your investment timeline, the longer your money will have to compound. You can invest your lump sum all at once or average into the market via down-cost averaging.

The key to investing your $200k is to invest it for the long-term.

At 8% ROI, the future value of $200k is $444k in 10 years, $985k in 20 years, and nearly $2.2 million in 30 years. You could easily become a millionaire by investing your lump sum.

Remember, it may be beneficial to consult a financial advisor to discuss your financial goals and investment options if you’re not comfortable with self-directed investing.

Evaluating your first investment

There are four things I like to consider before putting any money into an investment. Consider the following before investing your hard-earned money:

- Potential for capital appreciation

- Yield

- Capital protection from losses

- Tax advantages

I like to ask myself if an investment meets all four criteria as a litmus test for a good investment. My investment doesn’t have to meet all four criteria, but it should meet the majority.

Capital appreciation

Capital appreciation is the value of an investment increasing over time. Growth stocks are an example of capital appreciation because investors believe the share price will increase as the company becomes more profitable.

For example, you buy a share for $100, which might be $200 in seven years.

Dividend yield

My preference when investing is that the investment pays a yield or some sort of dividend. You get paid for being an owner of a company or an asset that pays you.

Investments have a wide variety of growth and yield. Typically, companies with more considerable capital appreciation pay little to no dividend. Other companies have a smaller capital appreciation but produce higher dividend yields.

The key is to figure out your investment style. Do you want to own shares in a company where:

- The share price is flat, but you get an 8-10% annual dividend yield (e.g., $8-$10 for every $100 invested)

- Share price snowballs, but you get paid a 0.5% dividend yield (e.g., $0.50 for every $100 invested)

- Moderate share price growth but a 2-5% dividend yield (e.g., $2-$5 for every $100 invested)

I like to have a mix in my investments. I want a good paying yield, but I also like the share price and yield to increase over time.

Capital Protection

Capital protection means investing in an asset you’re confident you won’t lose money. As an investor, you should make capital protection your top priority.

You can break down most of capital protection into risk management.

Sure, you could throw a lump sum of money into a crypto coin your nephew told you about, but nobody else knows. However, it’s probably not the smartest thing to do with your money because you know nothing about the investment.

Sadly, many people lose money because they gamble away their savings.

A few Don’ts of investing include:

- Not doing your research

- Investing in something you don’t understand

- Investing in something because a friend or the news said it’s the next big thing.

- Putting all your money into one investment

- Investing in penny stocks

The list isn’t meant to be all-inclusive because there are thousands of ways to lose money.

Use your common sense, do your research, and fully understand an investment before placing any money into it.

One of my favorite things to do when choosing individual stocks is to look at previous performance during past economic hardships. For example, look at how companies performed during stock market crashes in 2001, 2008, and 2020.

Tax advantages

Tax-advantaged investments can help protect your money from the government, which always wants its portion.

One of the most common ways of shielding your investments from taxes is choosing the proper investment account. For example:

- 401(k) plans are popular retirement investment accounts. You put money into a 401(k) with pre-tax dollars, and the money is taxed upon withdrawal in retirement.

- Individual Retirement Accounts (IRA) allow growth of your contributions to be tax-free until withdrawing in retirement.

The benefit of the 401(k) and IRA is that your money isn’t taxed upfront. Should you earn and invest $100, you get the growth on the $100.

Other investments like a Roth IRA are taxed up front, but the capital gains are withdrawn tax-free. For example, you might earn $100, but after taxes, you have $90. You can then invest your $90 and pull out the money in retirement tax-free.

You should also consider income investments in which dividends are paid as qualified dividends instead of ordinary income.

- Qualified dividends are taxed as capital gains tax. You have to pay capital gains tax on income over $80k.

- Some dividends may be paid as ordinary income, meaning the payment is added to your earned income at tax time following your tax bracket.

Some dividends may be paid as a Return of Capital, which means your investment principal is being paid back to you. Return of Capital is not taxed.

Asset mix

Growth investors are looking for the price of the asset to increase. You might buy a share of stock at $100 today, which could be worth $200 in seven years. Growth investing is popular among young investors looking to maximize returns.

Income investors are looking to generate cash flow. The stock price could go up or down, but the company pays a dividend consistently. Income investing is typically ideal for those looking to receive a steady paycheck without selling their investments.

Some investors have a healthy mix of both growth and income investments. Mixing your assets can help protect against volatile market conditions. For example, growth stocks might be down, but your income investments continue to pay dividends.

You may also want to consider your age and risk tolerance for investing. Your asset allocation may start primarily in stocks but gradually shift towards bonds as you get older.

Investing lump sum all at once vs. down cost averaging

A long-term outlook is the best approach to investing $200k. A long-term mindset will allow you to invest your lump sum all at once because you’re not concerned with daily market fluctuations. Over time, the market should go up, which means your $200k should also.

However, some people would prefer to down cost average. Down cost averaging divides your $200k into equal sums to invest over time.

For example, here’s a hypothetical example of the difference between down-cost averaging and lump sum investing.

| Price of the Market | Value of your $200k lump sum investment (investing all at once) | Value of investing $200k over 12 months (Investing $16,667 per month) |

| $100 | $200k | $16,667 |

| $90 | $180k | $31,667 |

| $80 | $160k | $44,815 |

| $75 | $150k | $58,681 |

| $85 | $170k | $83,172 |

| $110 | $220k | $124,302 |

| $105 | $210k | $135,319 |

| $103 | $206k | $149,408 |

| $107 | $214k | $171,878 |

| $115 | $230k | $201,395 |

| $110 | $220k | $209,306 |

| $118 | $236 | $241,195 |

As you can see, the result in this scenario is relatively similar. The down cost averager was able to buy shares cheaper when the market dropped, but they also bought high as the market rose in price.

The lump sum investor would have come out ahead if the market shot straight up in price. However, a dropping market would cause the down cost averager to buy at a lower price. You can’t predict what the market will do, so choose the strategy that works for you.

How to invest $200k for growth

Investing $200k for growth is best done through low-cost index funds like the S&P 500. The S&P 500 has been a reliable investment with an average annualized return of around 10%. Alternatively, you can invest in a total stock market ETF or growth funds in small, mid, or large cap.

I recommend sticking with Vanguard ETFs or mutual funds because of the low-expense ratio. Expense ratio is the fee you’ll be charged for investing in each fund. It’ll be hard to find anything else that can compete with the cost.

S&P 500 ETF or Mutual Fund

Most beginners would do well investing in the S&P 500 ETF like VOO. The S&P 500 is the top 500 companies in the United States, so you know you’re getting a quality group of companies. As stated, the S&P 500 has continued to produce positive returns and is seen as reliable.

Total Stock Market ETF or Mutual Fund

You can also choose to invest in a total stock market ETF, like VTI. A total stock market ETF invests in the overall stock market but is usually weighted based on market cap. Therefore, most of your funds will be S&P 500, plus many other companies making a small portion.

Growth ETFs or Mutual Funds

Some investors will invest in small, mid, or large-cap specific growth funds. Small-cap are smaller companies, while large-cap are big companies like Johnson and Johnson. For example, you could invest ⅓ of your funds in VBK (small cap), ⅓ in VOT (mid-cap), and ⅓ in VV (large cap).

Precious Metals

Depending on your investment goals, some investors like the idea of investing in precious metals like physical gold. Precious metals have low volatility, so the price doesn’t change substantially. However, precious metals tend to do best when the stock market is in a downturn which makes them a good inflation hedge.

Where to invest $200k now for income

The best places to invest for income include:

- Covered Call ETFs

- Business Development Companies (BDCs)

- High Dividend Yield ETFs

Other noteworthy places to invest for income include:

- Municipal Bonds

- Corporate Bonds

- High-Yield Savings Account

Investing for income often means sacrificing capital gains. However, dividend investing can be an excellent way to reduce volatility in the market.

Investing for income can be seen as riskier than investing for growth to some people. You’re giving up share price growth for a set income return as an income investor.

For example, the S&P 500 could go up 20% this year, but your income investment might only pay you 10%.

Covered Call ETFs

Covered call ETFs are income investments where a fund manager writes options against an underlying index, like the S&P 500. QYLD, RYLD, XYLD, NUSI, and JEPI are all examples of covered call ETFs. The price remains relatively stable because the funds are 100% options, so they’re all yield and no gains.

Alternatively, you could invest in something like QYLG or XYLG, where only 50% of the fund is in options. Therefore, half of your money is income generating while the other half sees capital gains.

Business Development Companies

Business development companies like ARCC or MAIN invest in businesses. BDCs loan money to companies too big for individual investors but not big enough to be listed on the stock market. BDCs are required to return the majority of the profits to investors as a dividend.

High Dividend Yield ETFs

Alternatively, you can invest in High Dividend Yield ETFs, like VYM. Dividend ETFs typically pay a dividend yield between 3-5% and see good growth.

Municipal Bonds

A government entity issues a municipal bond to fund financial projects like bridges, highways, and other infrastructure projects. Municipal bond investments are less volatile than stocks but still a great way to generate consistent income and diversify your investment portfolio. The main reason for investing in municipal bonds is they are often tax-exempt for Federal income tax and possibly for State or Local taxes.

Corporate Bonds

Corporations issue corporate bonds to fund different business needs, from acquisitions to expansions. Bonds generally don’t provide a high rate of return, but these financial products offer consistent income and a high return compared to other fixed-income securities.

The main difference between a corporate and municipal bond, besides the issuing party, is corporate bonds are subject to Federal income tax.

High-Yield Savings Account

A high-yield savings account is a federally insured account that offers higher interest rates than your standard bank account. These accounts are one of the best short-term investments for parking your money, with most financial institutions offering around 1.5% APY. High-yield savings accounts are not a good idea for the long run because inflation will outpace your returns.

Investing for growth and income

We can invest for growth and income in a few different ways. Personally, investing for both growth and income is one of my favorites. Not only do you get a steady income, but you also benefit from your assets growing over time.

Different ways to invest for growth and income include:

- Dividend stocks or ETFs with historical growth

- Investing in growth stocks or ETFs and selling covered calls

- Starting an online business

Investing in growing dividend stocks or ETFs

You can find individual companies or exchange-traded funds that pay dividends and have a long growth history. While past performance isn’t a guarantee of future performance, past performance can be a good starting point.

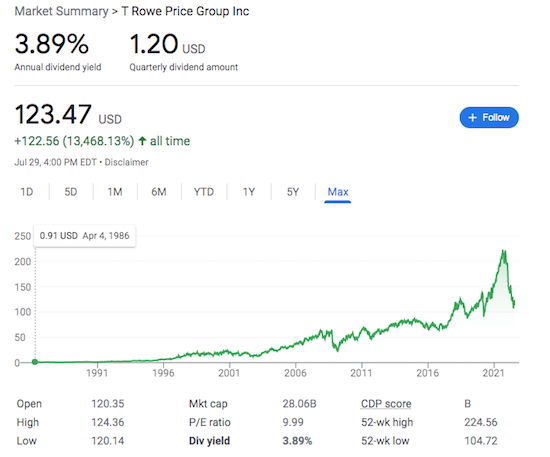

Look at T Rowe Price Group Inc, Stock ticker $TROW.

The price of TROW has steadily been climbing since 1986. I would feel comfortable investing in TROW because they’ve got a good track record of steady growth.

Every year, ideally, the price is going to appreciate as well as the income you’re going to receive from the dividend payment. However, we still need to investigate the dividend stability.

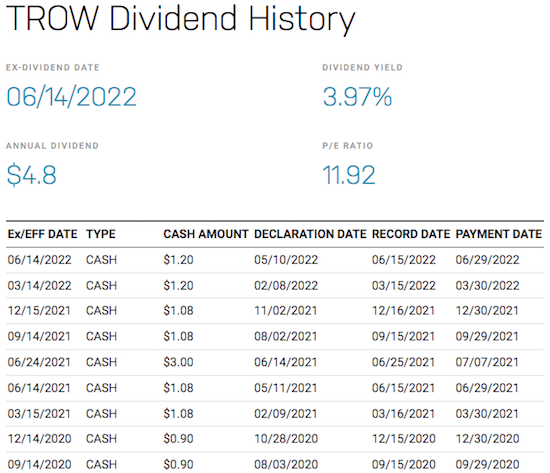

TROW currently pays a dividend of $1.2 per quarter (four times per year) with earnings per share (EPS) of $12.36. Over one year, I would earn $4.8 per share ($1.2 x 4) just for being an owner of the company.

The payout ratio estimates how much a company pays investors out of their earnings. TROW has a payout ratio of 39% ($4.8/$12.36 x 100), meaning TROW is paying out 39% of profits back to investors.

I can then look at TROW’s dividend history on the NASDAQ’s website.

TROW has consistently paid a dividend since December of 1988. Even better, the dividend has been increasing over time, which means you should earn more every year of owning TROW.

Buying companies with consistent dividend growth is considered dividend growth investing.

Investing in growth stocks or ETFs and selling covered calls

Did you know you can generate cash from owning your favorite growth stock or exchange-traded fund?

Selling covered call options is a strategy to make additional money on your favorite stocks. The more volatile the stock is, the more money you stand to make.

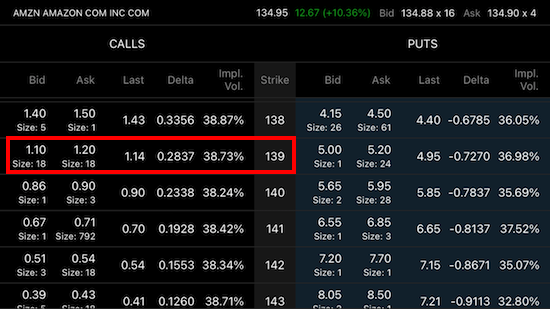

Let’s look at a hypothetical example of selling covered calls on Amazon: stock ticker $AMZN.

The first thing you need to do is own 100 shares of Amazon. Options contracts are sold on a 100-share basis. The current price of Amazon is $135, which means you would have to invest $13,500.

Looking at the weekly call options, the current Bid is $1.10, and the Ask is $1.20 for a $139 strike price, which is at a 0.2838 delta. Typically, you want to sell call options between a delta of 0.2-0.3.

So what does this mean?

If I sell a call option against my 100 shares of Amazon, I am giving someone else the right to buy my shares for $139 within the next week. Assuming the price never reaches $139, the contract would expire worthless.

Assuming a midpoint between the Bid and Ask, you get an option premium of $1.15 per share. Because options contracts are in 100 shares, you earn $115, which you keep regardless.

Online business

$200k is plenty of money to start an online business and join many of the small business owners earning an income online. Most internet businesses are inexpensive to start and there are various ways to make income including:

- Consulting

- Blogger

- YouTuber

- Web Designer

- Flipping domain names

You can even find different options for buying existing online businesses.

For example, Flippa is a website specializing in buying and selling websites. You may be able to find a good deal on a website selling for $20k, but currently earns $800 per month. You can then continue to grow the website while earning a nice income.

How to invest $200k in real estate

You can invest $200k in real estate by buying property or investing in Real Estate Investment Trusts (REITs). Investing in property can be time-consuming, so investors might need a property manager. REITs are ideal because you’re buying shares of companies that invest in real estate.

Rental properties

Buying your rental property can be very profitable, but it can also be a headache.

Long term physical real estate investments can lead to higher returns. An investment property might be good for you depending on your financial situation, risk tolerance, and willingness to manage property.

A few reasons why rental properties are one of the best investments include:

- You receive rental income

- The rent covers your mortgage payments which helps you build equity

- Home price appreciation (Property’s value increases over time)

- There are many tax benefits to owning property

- You can even use someone else’s money to build your portfolio.

But investing in real estate isn’t passive income. Toilets are going to break, a tenant might start a fire, and you may even receive phone calls at two in the morning. You can hire a property manager, but it will cost a price.

You are also subject to the local real estate market and any economic downturns. You’ll typically see a lot of vacant single-family homes and apartment buildings should the job market tank in your area. Therefore, it’s important to maintain a lower-risk investment strategy with real estate with diversification and to have an emergency fund.

Real Estate Investment Trusts (REITs)

Some people love investing in physical real estate they own. I would rather own a real estate investment trust.

REITs are one of my favorite long-term investments. A REIT trades like a stock in your brokerage account, but these companies invest in real estate specifically. A REIT investment is a great option for additional income because REITs are required to pay out 90% of their taxable income to investors.

Examples of properties REITs invest in include:

- Commercial Properties (Office Buildings, Shopping Malls, Hospitals)

- Apartments

- Cell phone towers

- Single and Multi-Family Homes

These companies know real estate and are more than willing to deal with the hard work of broken toilets. You get a smaller return on investment than owning your property, but it requires much less work.

REITs are purchased on a stock exchange, so you’ll need a brokerage to acquire them. When buying a REIT:

- Make sure the company is steadily growing over time.

- The company pays a dividend that grows over time.

- Ideally, the company has been around for more than ten years.

- The company isn’t paying out more in dividends than it’s earning.

You can find a complete list of REITs on REIT.com.

How long can you live on 200k?

According to the Trinity study, you should be able to withdraw 4% of your investment principal each year for living expenses. Therefore, a growth investor should be able to live on an $8k salary with $200k invested, which isn’t much. An income investor can be paid $20k annually with a 10% dividend yield investment.

Dividend investing is one of the best strategies for living on your investments. You don’t have to worry if the market is up or down, but you get paid for owning companies. A $200k investment in QYLD currently pays nearly 12% ROI or $24k per year.

As you can imagine, $24,000 yearly doesn’t seem like a lot. However, you can take advantage of location arbitrage and have more than enough money.

Location Arbitrage is the practice of living in a lower cost of living area so that your money goes further. Imagine earning money in the United States but spending money in Mexico or Thailand.

Simply put, you get more bang for your buck in other countries.

Individuals can live comfortably in countries such as Portugal or Thailand for between $1,000 and $1,700 monthly, depending on their lifestyle. Assuming a comfortably monthly income of $1,500, your annual spending would be $18,000.

How much interest will $200,000 earn in a year?

The S&P 500 has an average annualized return of 10%. Therefore, the interest of $200k invested in an S&P 500 fund would yield around $20k per year.

Let’s assume you invest your $200k lump sum and earn an 8% return on investment. Your investment would grow to one million dollars in about 21 years.

Click to Tweet! Please Share!Click To Tweet

Summary: Invest a $200k lump sum (e.g., Inheritance or Windfall)

As you can see, there are plenty of ways to invest your $200k lump sum. You can invest in growth or dividend-paying assets. Investments can be made all at once, or you can average into the market through down-cost averaging.

The first step is to choose your asset mix. Will you prefer to invest for growth potential or income investing? Growth has the potential for better returns over a long period of time, but income provides a steady paycheck.

Growth investors should look into the S&P 500 or a total stock market fund. You can even get growth funds depending on company size (e.g., small, mid, or large-cap). Typically, the S&P 500 has been a reliable source of investing for most investors.

Dividend investors can invest in covered call ETFs, BDCs, or high dividend yield ETFs. You can try picking your dividend stocks, but it’s not recommended for beginners.

As a growth investor, you can expect a salary of around $8k per year with a $200k investment. A dividend investor can make a 10% ROI with covered calls and earn $20k annually.